Altcoin

Will NEAR Reach $20 Again? Beware of THESE levels

Credit : ambcrypto.com

- A trendline break positioned NEAR for a comeback from $20 all-time excessive.

- Rising volumes and charges strengthened NEAR’s momentum.

NEAR protocol [NEAR] is shortly rising as a standout participant within the blockchain ecosystem, leaving rivals like Solana behind when it comes to expertise and consumer adoption.

NEAR stands out with groundbreaking improvements equivalent to sharding expertise, making it one of the vital scalable blockchains accessible.

With the total assist of NVIDIA, the third largest firm on the planet, NEAR is positioning itself as a possible “proper hand” of Ethereum. It bridges the hole between scalability, innovation and real-world software.

NEAR is at the moment buying and selling at $6.69, up 3.11% within the final 24 hours, and has a 24-hour quantity of $930.76 million.

Whereas nonetheless 68.08% under the January 2022 all-time excessive of $20.42, the protocol’s progress and market traction point out vital upside potential.

With its rising ecosystem and rising relevance in AI-driven purposes, analysts speculate that NEAR might obtain exponential progress, with returns of as much as 15x as adoption accelerates.

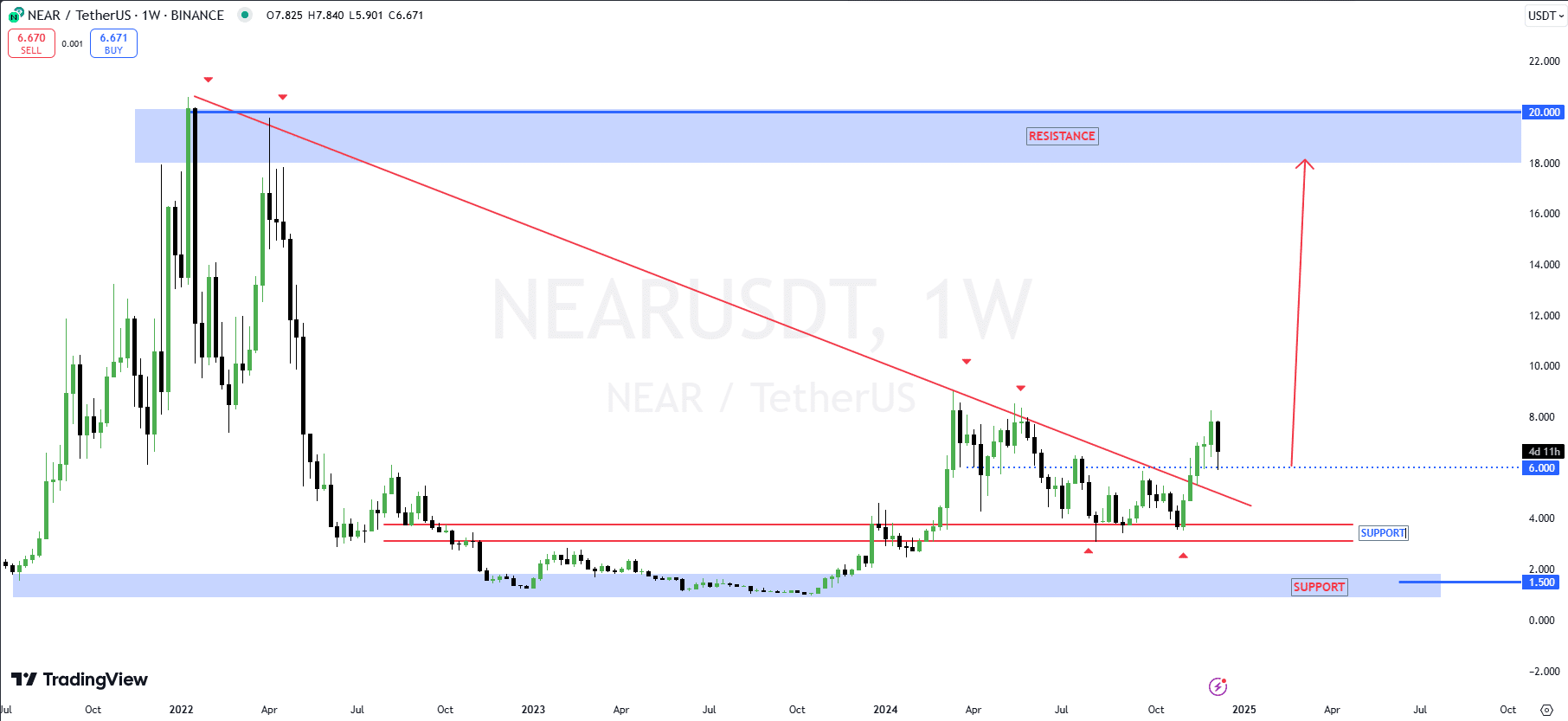

Vital assist and resistance ranges

An AmbCrypto evaluation of NEAR on the weekly timeframe highlights key technical ranges and tendencies. The first resistance zone is $20.00, which matches the earlier all-time excessive in early 2022.

The downtrend line signifies a long-term bearish development that was just lately damaged by NEAR, indicating a shift to bullish momentum.

Nonetheless, the present worth of $6.69 is buying and selling under the speedy resistance zone, close to $8.00. That is per current worth consolidation and promoting strain.

Supply: TradingView

On the draw back, sturdy assist is seen round $6.00, slightly below the present worth. This stage coincides with earlier resistance that changed into assist, and offers an essential foundation for additional bullish strikes.

Under this, further assist exists round $4.00 and a important long-term assist zone round $1.50, which traces up with historic lows.

A profitable break above $8.00 might pave the best way for a retest of $20.00. Failure to carry $6.00 might result in a deeper correction in direction of $4.00 and even $1.50.

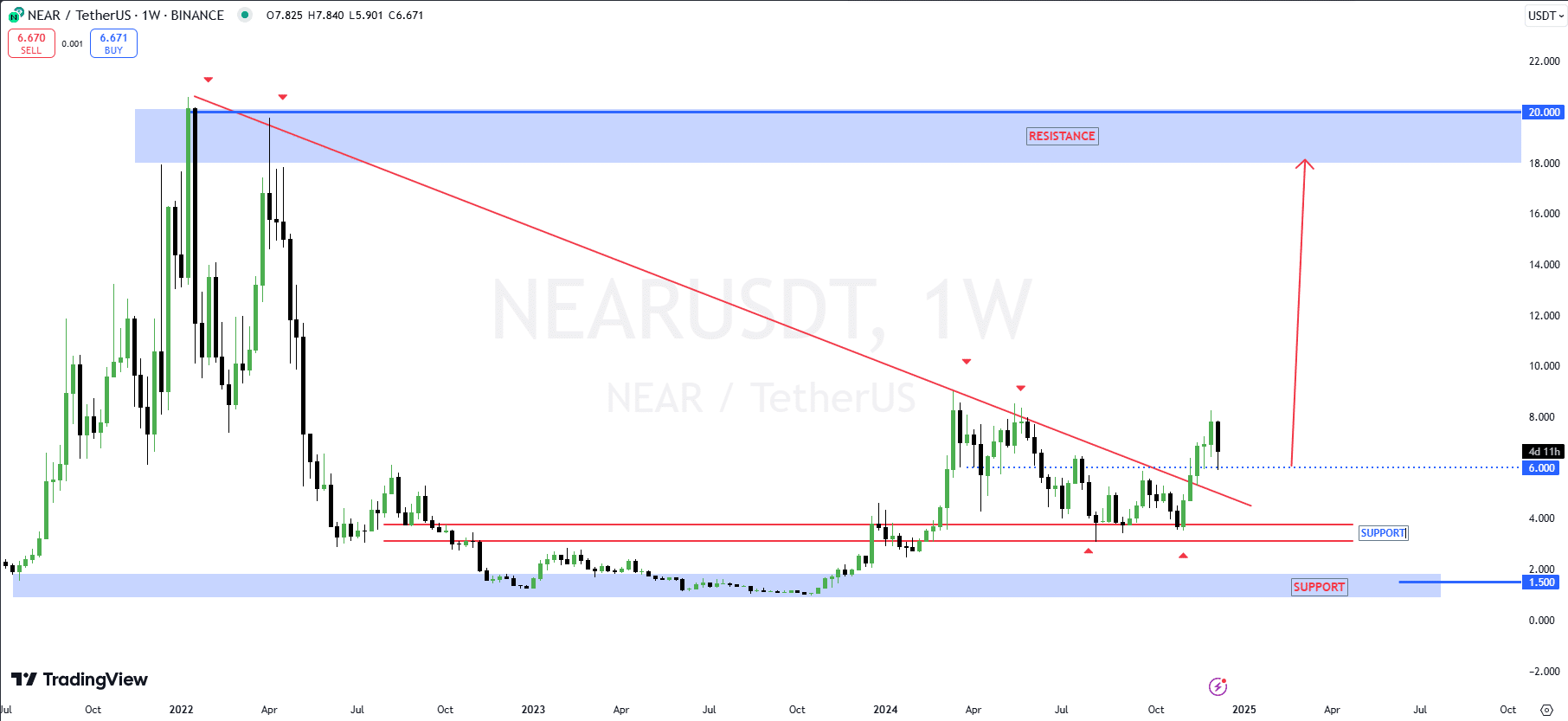

Momentum indicators are signaling a reversal

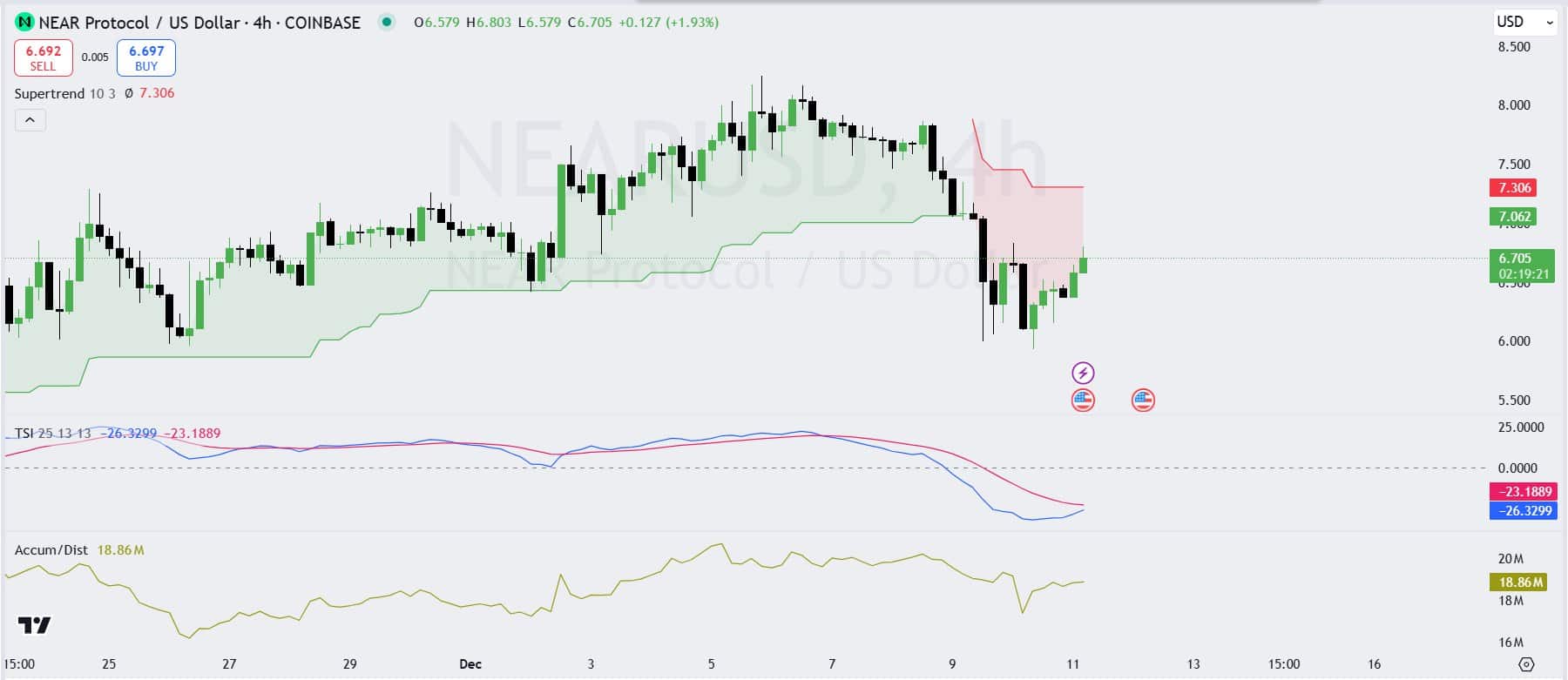

The Supertrend indicator reveals a bearish bias, with resistance at $7,306. The value has just lately bounced again from decrease ranges round $6.57 and is now testing the underside of the bearish Supertrend zone, indicating potential resistance at this stage.

A sustained break above $7,306 might sign a shift in direction of bullish momentum. For now, nevertheless, bearish strain stays.

Supply: TradingView

The True Energy Index stays in adverse territory, with values at -23.18 (sign line) and -26.32 (momentum line). This means continued downward momentum, though the narrowing hole between the traces means that bearish momentum is weakening.

Moreover, the buildup/distribution line stands at 18.86 million, exhibiting delicate accumulation after current declines. This factors to modest shopping for curiosity, which might assist a restoration if confirmed by different indicators.

Enhance within the quantity and prices of NEAR

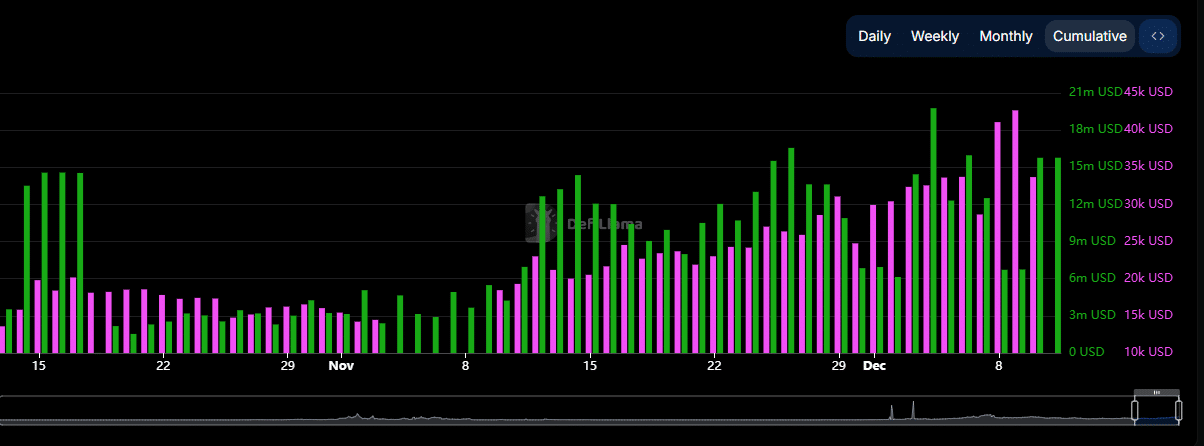

Quantity (inexperienced) began with reasonable exercise in mid-November, however started to extend considerably in direction of the top of the month, peaking in early December.

This upward development displays rising networking exercise, seemingly pushed by elevated curiosity in NEAR’s scalability and ecosystem developments.

Notably, every day quantity reached peaks of over $18 million, demonstrating sturdy adoption and engagement on the platform.

Supply: Defillama

Transaction charges (pink) adopted an identical trajectory, rising steadily together with quantity. This means extra interactions within the chain and a rise in consumer exercise.

The alignment between quantity and charges signifies wholesome community utilization, as charges are immediately associated to transactional demand.

Quick and lengthy liquidations are increase…

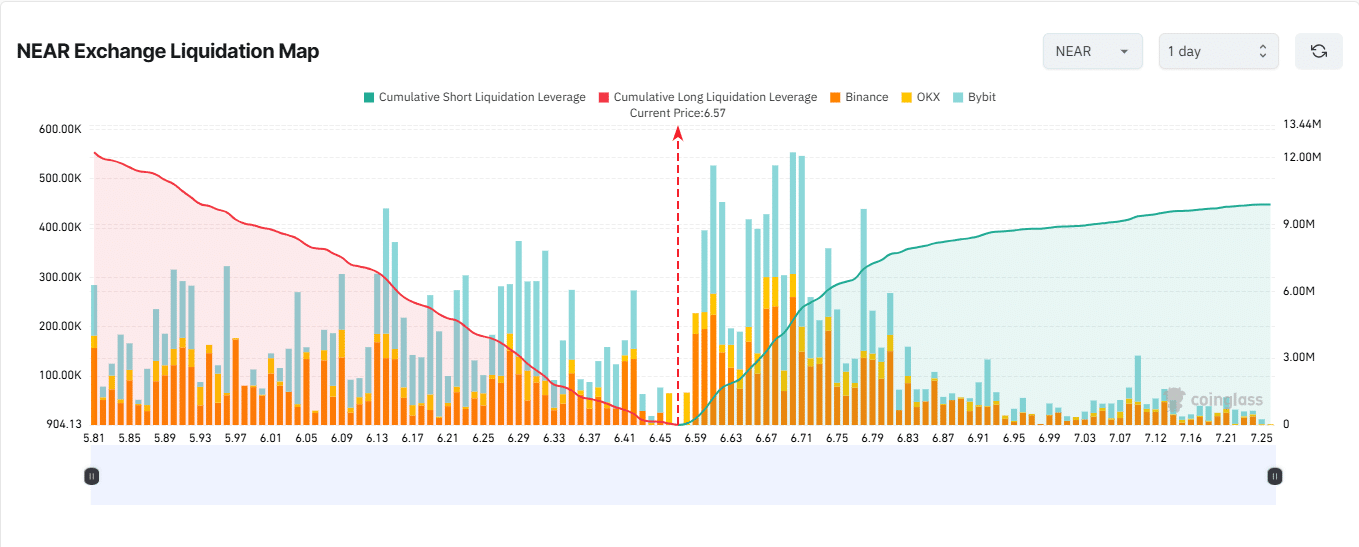

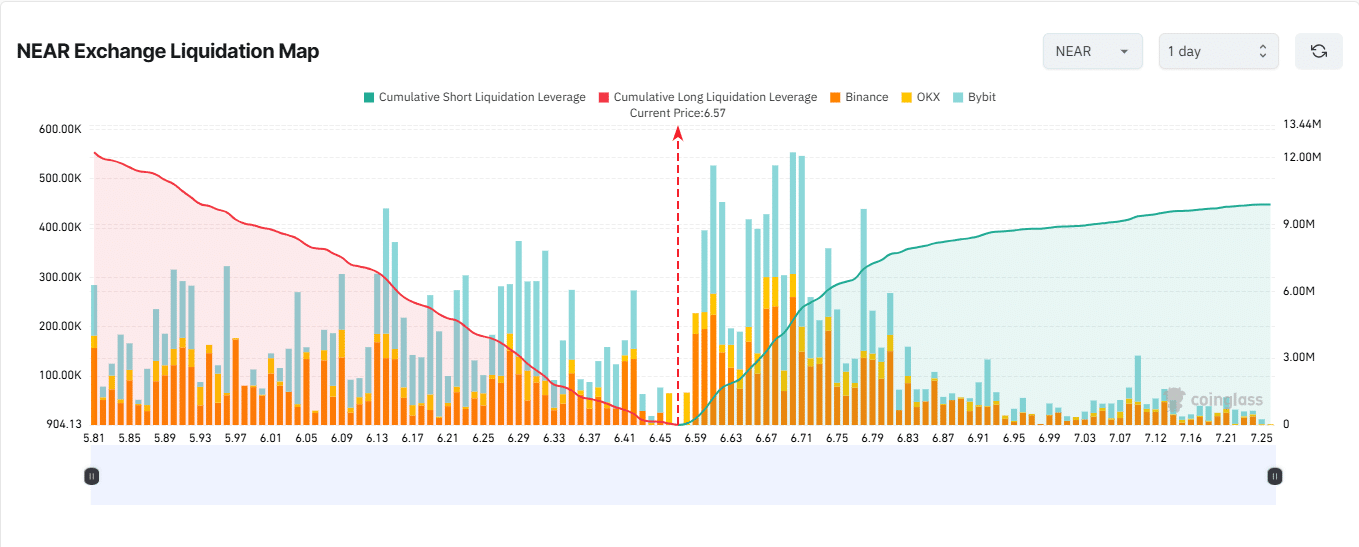

An evaluation of the NEAR liquidation map reveals essential insights into leveraged positions and potential market volatility. Vital ranges of liquidation are concentrated across the present worth, with lengthy positions (inexperienced) exhibiting elevated vulnerability.

Cumulative lengthy liquidations rose sharply from $6.45, peaking at virtually $6.67, with greater than $9 million in worth in danger. This displays a powerful bullish bias, with merchants taking lengthy positions in anticipation of upward momentum.

Supply: Coinglass

On the brief aspect (pink), liquidations fell steadily as costs rose above $6.45, dropping to $6.83. There’s a decrease focus of bearish leveraged positions than lengthy positions.

Learn the NEAR protocol [NEAR] Worth forecast 2024–2025

This dynamic highlights a precarious steadiness between bulls and bears, the place a breakout in both route might set off a cascade of liquidations, resulting in elevated volatility within the brief time period.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024