Altcoin

Bitcoin sell-off likely when this value reaches 4%, analyst explains

Credit : www.newsbtc.com

This text is offered in Spanish.

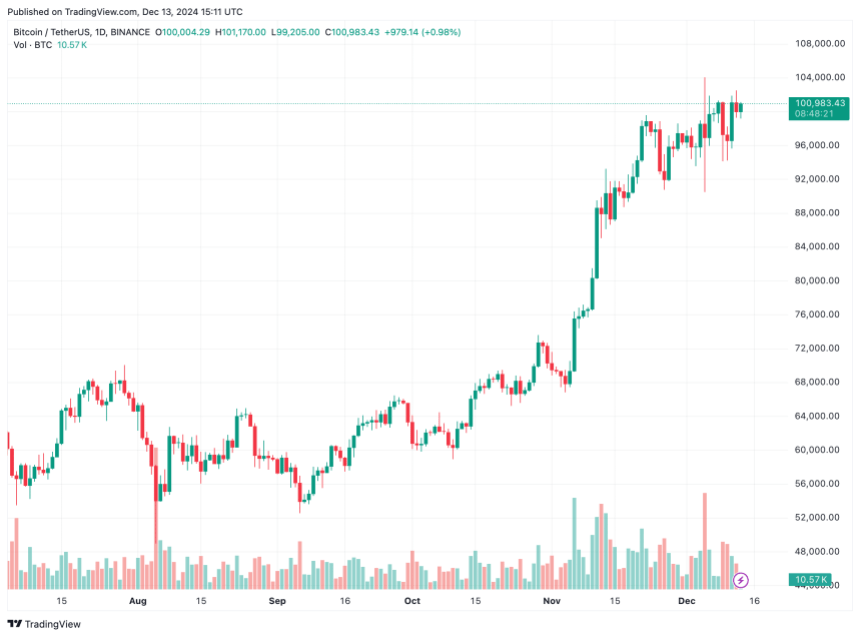

As Bitcoin (BTC) hovers across the crucial $100,000 worth degree, some traders could also be in search of the perfect alternative to take earnings and exit the market. On this context, a CryptoQuant evaluation highlights an necessary BTC metric that may function a useful instrument for constructing an exit technique.

Wish to make a revenue in Bitcoin? Regulate this indicator

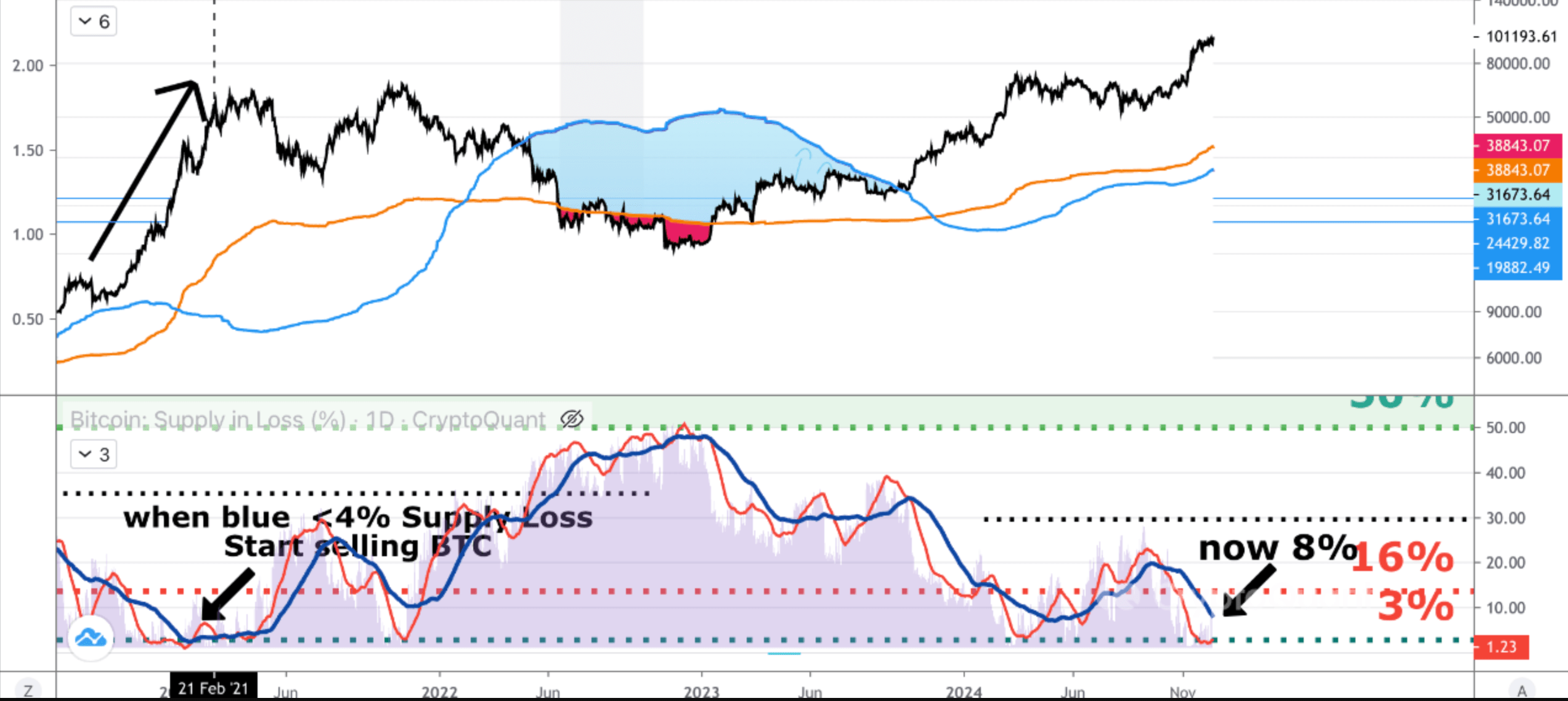

In a Quicktake weblog put up revealed in the present day, CryptoQuant contributor Onchain Edge writes shared perception into the timing of BTC gross sales in the course of the present bull market. The analyst emphasised the significance of Bitcoin provide within the loss metric, noting its potential to point when to exit the market to protect earnings.

Associated studying

For these unfamiliar with Bitcoin, the loss providing measures the proportion of BTC held at a loss primarily based on the final moved worth. Low provide losses usually point out peak market euphoria and function a warning to safe beneficial properties earlier than a bear market correction begins.

In accordance with CryptoQuant evaluation, when the BTC provide falls under 4% at a loss is an efficient time for traders to dollar-cost averaging (DCA) out of their BTC positions and look forward to the following bear market lows . At the moment, the BTC provide at a loss is 8.14%.

DCA is an funding technique wherein traders allocate a hard and fast quantity to an asset at common intervals, no matter its worth. This methodology helps cut back the affect of market volatility and lowers common unit prices over time. The analyst provides:

Why? Under 4% signifies that many individuals are making a revenue. That is the height bull run section. Belief me, you do not wish to be holding baggage since you thought we’ll by no means see one other bear market. Be afraid when others are grasping.

Analysts are assured of additional will increase within the BTC worth

Whereas monitoring BTC provide in loss metrics may help traders safeguard their earnings, latest predictions from crypto analysts recommend that there should still be room for additional upside earlier than this indicator turns into essential.

Associated studying

In accordance with crypto analyst Ali Martinez of BTC varieties a basic cup and deal with sample on the weekly chart. The main cryptocurrency appears poised to interrupt out of the bullish formation, with targets as excessive as $275,000.

Likewise, Donald Trump’s victory has introduced new optimism to the crypto trade. On the just lately concluded Bitcoin MENA convention in Abu Dhabi, former Trump marketing campaign chairman Paul Manafort mentioned famous that BTC traders can anticipate to make “over $100,000” in the course of the ongoing market cycle.

Different forecasts stay equally bullish. Tom Dunleavy, Chief Funding Officer at MV International, initiatives BTC will attain $250,000, whereas Ethereum (ETH) might rise to $12,000 throughout this market cycle. BTC is buying and selling at $100,983 on the time of writing, up a modest 0.1% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024