Bitcoin

Bitcoin: Why $148 billion in stablecoin inflows might concern you

Credit : ambcrypto.com

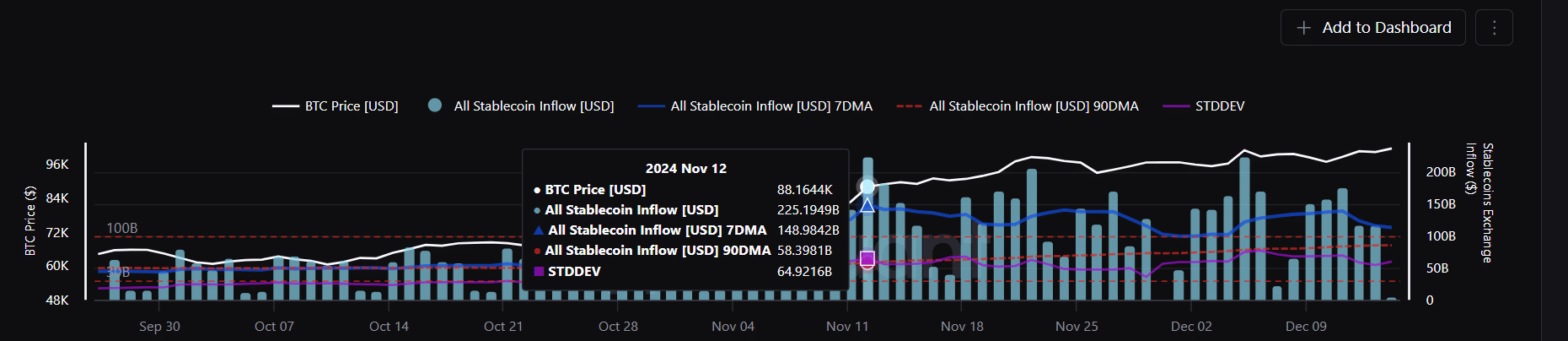

- Bitcoin outflows from the exchanges peaked at $148 billion when it reached $88,000, creating a powerful base of assist.

- Now an much more sturdy basis has emerged, a sign that it’s best to strategy with warning.

With a restricted provide of 21 million, Bitcoins [BTC] The market cap has soared previous $2 trillion, with every BTC value $102,383 on the time of writing. Clearly. the stakes have by no means been larger.

Whereas Bitcoin continues to outpace conventional twentieth century belongings with $450 trillion in bonds and actual property, King Coin’s meteoric leap from $67,000 to $102,000 in simply 40 days indicators a future that is exhausting to disregard is.

However as is commonly the case with fast wins, the short-term outlook for Bitcoin is way from sure.

With $148 billion value of stablecoins flooding the market at a worth of $88,000, these buyers have already made a 15% achieve, making this worth appear to be a golden entry.

As historical past reveals, the temptation to money out at a major revenue might be too nice to withstand. This creates a high-stakes scenario, testing buyers’ danger urge for food because the market braces for a attainable sell-off.

The huge inflow of stablecoins could possibly be a warning signal

When stablecoins flood into exchanges, it often indicators a bullish outlook. Traders are positioning themselves to purchase Bitcoin as soon as market volatility subsides.

This development grew to become particularly evident throughout the elections, when the “Trump pump” introduced in huge liquidity, amounting to $2 billion in USDT. beaten.

Economically, the inflow of stablecoins was instantly linked to a surge in demand for Bitcoin, pushing its worth to $88,000 in lower than every week.

Demand for BTC peaked at this worth level, with $148 billion value of stablecoins, principally ERC-20 tokens, flooding into exchanges.

Clearly, buyers have been assured that BTC would cross $100,000, at the least earlier than the election pump acquired going.

Supply: CryptoQuant

This brings us to some compelling insights: First, these buyers are comfortably in-the-money, able to HODL or money out at a revenue.

Second, because the election pump loses steam, the market desperately wants a brand new catalyst to stop these holders from hitting the promote button.

And third, if gross sales truly choose up, the massive query is whether or not the market has the power to soak up the stress.

Regardless of December already effectively beneath approach, BTC has but to set a brand new all-time excessive, a milestone that was briefly reached over every week in the past when the worth reached $104,000.

Since then, the corporate has been in a holding sample, leaving market observers divided on its subsequent transfer.

Are Bitcoin Traders Dropping Their Danger Urge for food?

The $88,000 restrict has clearly confirmed to be a pretty entry level. This was additionally demonstrated when Bitcoin fell simply over 5% to $90,000, 4 days after it first examined the $99,000 degree.

However earlier than the worth may fall additional, a 4% restoration the subsequent day rapidly introduced the worth again into the inexperienced. Since then, bears have tried twice to push Bitcoin again to that degree, however every try has failed.

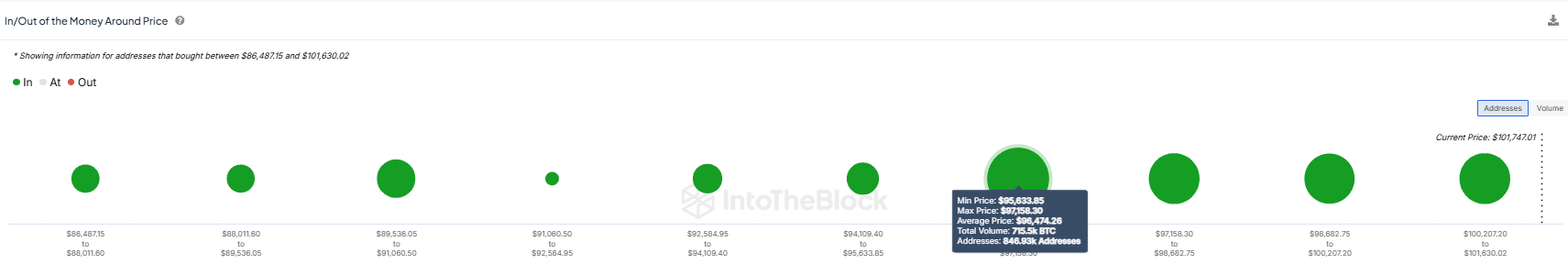

Because of this, a brand new backside has fashioned between $94,000 and $96,000.

Why is that this vital? The chart above reveals a major improve in stablecoin inflows, with $131 billion flowing into exchanges at this worth degree.

Much more telling, greater than 840,000 addresses – marking the best variety of holders at this degree – acquired a complete of 715.5,000 BTC.

Supply: IntoTheBlock

This creates a powerful assist base between $94K and $96K, making it essential for BTC to remain above this vary in case you are “lengthy” on it.

On the one hand, the information means that institutional gamers are stepping in to offset the promoting stress.

Nonetheless, a shift is going down: investor greed is declining. As the worth of BTC rises, many change into extra cautious and discover the worth too excessive to leap in.

Learn Bitcoin’s [BTC] Worth forecast 2024-25

This hesitation signifies that retail buyers could also be ready for a dip earlier than deciding to enter the market. Apparently, the stablecoin market factors to the $96K degree as a pretty entry level.

This could possibly be one thing to keep watch over within the coming days.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now