Ethereum

Ethereum Price Surges After $17.5M Stake, Institutional Accumulation?

Credit : coinpedia.org

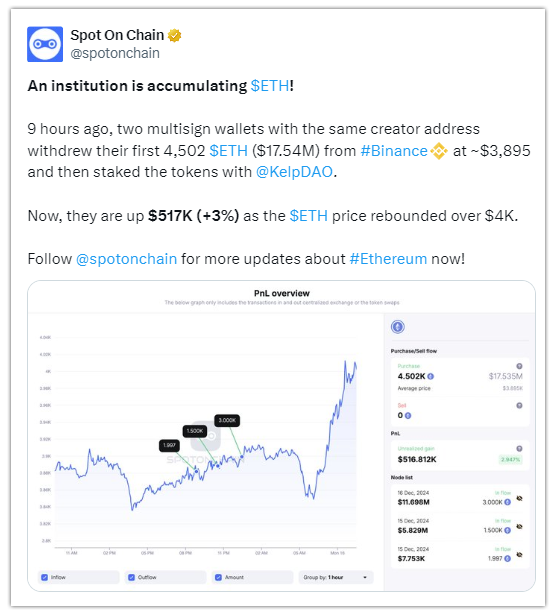

The worth of Ethereum rose once more to $4,000 and that can not be a coincidence. Simply six hours earlier than the worth hike, two multisign wallets with a typical maker deal with withdrew and staked their first ETH. Maybe a brand new establishment has began amassing Ethereum? Their unrealized achieve grew to $517,754 earlier than returning to $157,570 because the ETH value fell to $3,930.

The breakdown

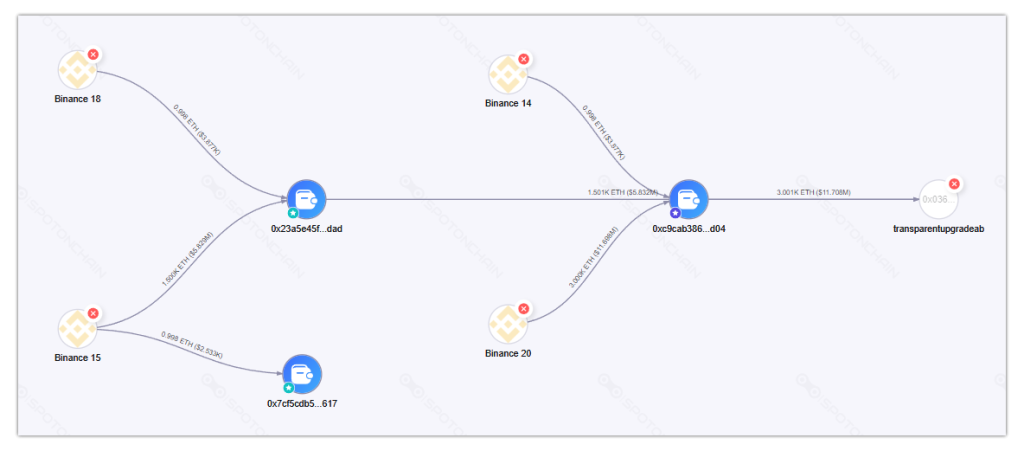

Two multisign wallets 0x23a…dad And 0xc9c…d04 has withdrawn a complete of 4,502 ETH value $17.54 from Binance. This was the primary withdrawal for each wallets. Curiously, each multisign wallets have a typical creation pockets 0x7cf…617. The withdrawals have been made between the ETH value $3,880 and $3,900. These tokens have been then staked on KelpDAO.

Given the quantity and timing of those transactions, it seems that these actions are owned by some establishment. It timed Ethereum’s transfer completely as simply 6 hours later the token reached $4,022. The worth of the staked tokens elevated by 3%, creating an unrealized revenue of $517,000. One factor to remember is that multisign wallets are sometimes utilized by establishments.

The mysterious institute

It could not be potential to obviously point out whether or not this considerations an establishment or a brand new fund. The wallets don’t have any historical past and due to this fact there isn’t a solution to observe them. There are lots of prospects.

These addresses might be from a brand new fund, or from a DAO, and even from a giant investor who’s testing the waters. One of many multisign wallets is 4 days previous and the opposite was created simply 15 hours in the past. Even their maker pockets was created 51 days in the past.

Correlation with ETH value motion

Probably the most fascinating a part of these trades is their timing. Had been the trades based mostly on some evaluation because the time completely aligns with Ethereum’s restoration to $4k. Or was it the opposite means round? Did these trades fill the market with confidence and push the worth larger? Whether or not it is a coincidence or a direct affect, it sends a transparent message that the market is delicate to important trades.

The market motion

On the time of writing, Ethereum is buying and selling at $3,930, down 0.28% up to now 24 hours. Earlier than the token fell, it rose 2.06% to achieve $4,022. The worth is going through rejection from the upper ranges and shifting common is the primary line of protection on the assist stage round $3,940. The RSI is following the worth motion and is right down to 53.19, nonetheless strong. At the moment there isn’t a motive for the market to say no. The 11.26% enhance in buying and selling quantity exhibits that merchants are exhibiting curiosity.

What to anticipate?

Over time, we could uncover who was behind this main ether transaction, however it’s sure that after Bitcoin, establishments can even develop into keen on ETH. The worth is strong close to $4k. The portfolios deploying ETH at this value stage display the arrogance that main buyers have within the crypto. Is that this an establishment, a brand new fund, a DAO or a brand new main participant coming into the market, we’re undecided. What do you assume, tell us.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024