Bitcoin

Will Bitcoin ETFs Surpass 1 Million BTC Before 2025?

Credit : bitcoinmagazine.com

As Bitcoin continues to mature, probably the most telling indicators of its longevity and integration into the broader monetary ecosystem is the fast development of Bitcoin Alternate-Traded Funds (ETFs). These merchandise – which offer mainstream, regulated publicity to Bitcoin – have attracted important inflows from each institutional and retail buyers since their inception. In accordance with knowledge collected by Bitcoin Journal Professionals Cumulative Bitcoin ETF FlowchartBitcoin ETFs have already accrued over 936,830 BTC, which begs the query: Will these holdings surpass 1 million BTC earlier than 2025?

The #Bitcoin ETFs have already amassed 936,830 #BTC! 🏦

Will this surpass 1,000,000 BTC earlier than 2025? 🪙

Let me know 👇 pic.twitter.com/UojJpJlC4P

— Bitcoin Journal Professional (@BitcoinMagPro) December 16, 2024

The which means of the 1 million BTC signal

Crossing the 1 million BTC threshold could be greater than a symbolic milestone. It will point out deep market maturity and long-term confidence in Bitcoin as a reputable, institutional-quality asset. Such a lot of Bitcoin sitting in ETFs successfully reduces the provision on the open market, paving the way in which for what may very well be a strong catalyst for upward value stress. As fewer cash stay out there on exchanges, the long-term equilibrium of the market shifts, probably elevating Bitcoin’s value flooring and lowering draw back volatility.

The pattern is your pal: document influx

The momentum is simple. November 2024 noticed document inflows into Bitcoin ETFs of over $6.562 billion – over $1 billion greater than the earlier month’s figures. This wave of capital inflows reduces the speed at which new Bitcoins are created. In November alone, solely 13,500 BTC was mined, whereas over 75,000 BTC flowed into ETFs – 5.58 instances the month-to-month provide. Such an imbalance underlines the shortage dynamics at play now. When demand far exceeds provide, the pure response of the market is upward value stress.

A graph of insatiable demand

In a historic second, BlackRock’s Bitcoin ETF not too long ago surpassed the corporate’s personal iShares Gold Belief in whole fund belongings. This second was visually captured within the November difficulty of The Bitcoin Reportexhibiting a transparent shift in investor desire. For many years, gold topped the throne of “secure havens.” At this time, Bitcoin’s rising position as “digital gold” is being validated by its ever-increasing institutional allocations. Demand for Bitcoin-backed ETF merchandise has develop into relentless as seasoned buyers and newcomers alike acknowledge Bitcoin’s potential to function a cornerstone in diversified portfolios.

Lengthy-term holding and provide shock

A key characteristic of Bitcoin ETF inflows is the long-term nature of those investments. Institutional patrons and long-term allocators will commerce much less ceaselessly. As a substitute, they purchase Bitcoin by ETFs and maintain them for longer durations of time – years, if not a long time. As this sample continues, Bitcoin held in ETFs is successfully faraway from circulation. The result’s a gentle trickle of provide leaving the exchanges, pushing the market towards a possible provide shock.

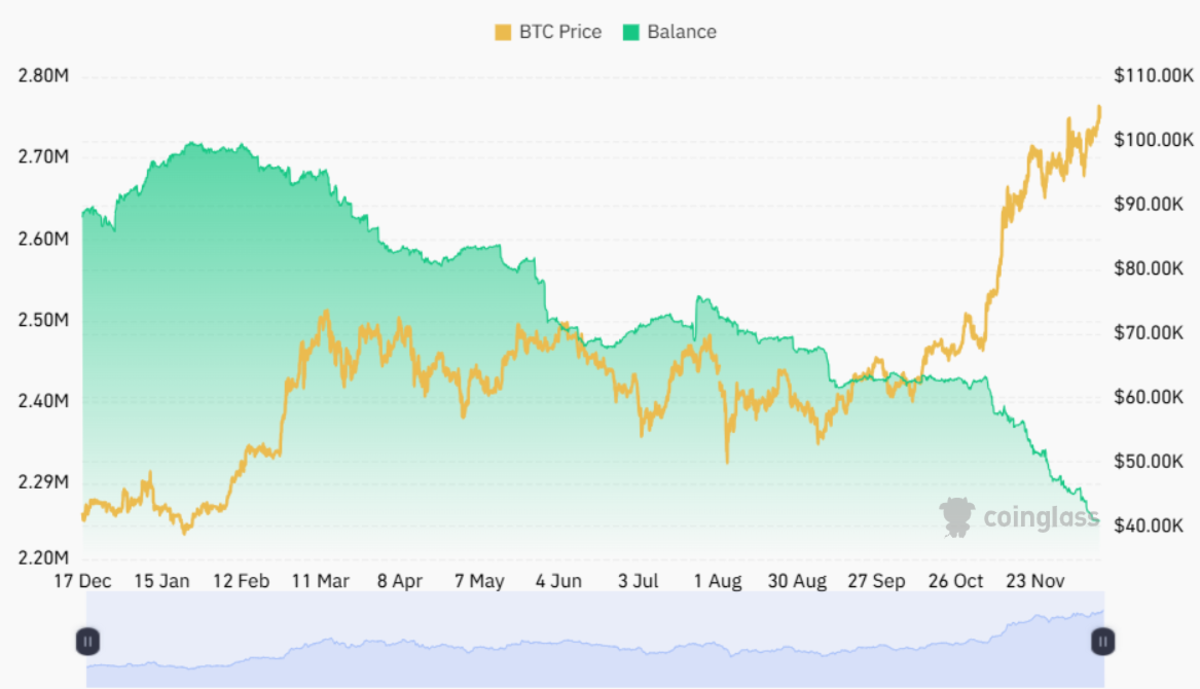

This pattern is clearly illustrated by the most recent knowledge from Mint glass. Solely roughly 2.25 million BTC are at present nonetheless listed on the inventory exchanges, indicating a continued decline within the available provide. The chart beneath reveals a divergence the place Bitcoin’s value continues to rise whereas change charges transfer downward – an irrefutable sign of the shortage dynamics at work.

An ideal Bitcoin Bull Storm and the march in direction of $1 million

This evolving dynamic has already pushed Bitcoin previous the $100,000 mark, and such achievements might quickly really feel like distant recollections. Because the market rationalizes a possible journey to $1 million per BTC, what as soon as appeared like a lofty dream now appears more and more attainable. The “multiplier impact” in market psychology and value modeling suggests that after a significant purchaser comes into play, the ripple results could cause explosive value will increase. As a result of ETFs are continuously rising, every massive buy can set off a cascade of follow-on purchases as buyers worry lacking the subsequent step.

The incoming Trump administration, the Bitcoin Act and a US strategic reserve

As if present developments will not be optimistic sufficient, a brand new and probably transformative situation is brewing on the geopolitical stage. Incoming 2025 President-elect Donald Trump has expressed help for the ‘Bitcoin Act’, a invoice that directs the Treasury Division to determine a strategic Bitcoin reserve. The plan entails promoting a portion of the US authorities’s gold reserves to amass 1 million BTC – about 5% of all at present out there Bitcoin – and maintain it for 20 years. Such a transfer would sign a seismic shift in US financial coverage, placing Bitcoin on par with (and even forward of) gold because the cornerstone of the nation’s wealth retailer.

With ETFs already inflicting shortage, a transfer by the US authorities to safe a big strategic Bitcoin reserve would compound these results. Think about that there are solely 2.25 million BTC out there on exchanges right this moment. Ought to america purpose to amass almost half of that in a comparatively quick time period, the supply-demand imbalances would develop into extraordinary. This situation might unleash a hyper-bullish mania, sending Bitcoin’s value into beforehand unthinkable territory. At that time, even $1 million per BTC may very well be thought-about rational, a pure extension of the asset’s position in international finance and nationwide strategic reserves.

Conclusion: a convergence of bullish forces

From short-term ETF inflows driving new issuance fivefold, to longer-term structural shifts like a possible US Bitcoin reserve, the basics are stacking up in Bitcoin’s favor. The rising shortage, mixed with the multiplier impact of enormous patrons coming into the market, units the stage for an exponential value improve. What was as soon as thought-about unrealistic – a Bitcoin value of $1 million – is now inside the realm of risk, underscored by tangible knowledge and highly effective financial forces at play.

The journey from present ranges to a brand new period of Bitcoin value discovery entails extra than simply hypothesis. It’s supported by tighter provide, unyielding demand, growing institutional acceptance and even the potential imprimatur of the world’s largest financial system. In opposition to this backdrop, surpassing 1 million BTC in ETF holdings earlier than 2025 may very well be only the start of a a lot greater story – one that would reshape international finance and reimagine the idea of a reserve asset.

For the most recent insights on Bitcoin ETF knowledge, month-to-month inflows and evolving market dynamics, discover Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your personal analysis earlier than making any funding choices.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September