Bitcoin

Why are MicroStrategy, MARA, and RIOT stocks up? Details here…

Credit : ambcrypto.com

- MicroStrategy, Mara, and Riot shares noticed their costs rise as BTC reached $107,000.

- BTC demand from new buyers exceeds March demand on the $70,000 stage by 4%.

MicroStrategy has aggressively acquired 15,350 Bitcoins [BTC] at a median value of $100.3K, growing their complete holdings to 439,000 BTC. These have been bought for $27.1 billion at a median of $61,725 every.

This strategic accumulation is mirrored of their reported BTC returns of 46.4% for the quarter and 72.4% year-to-date.

CEO Michael Saylor comments on X (previously Twitter) emphasised a long-term view on digital belongings by evaluating Bitcoin investments to historic Manhattan valuations.

His advocacy for a Digital Property Framework and a Bitcoin Strategic Reserve, alongside MicroStrategy’s inclusion within the Nasdaq 100, highlighted their crucial function in shaping the monetary area.

The MSTR strategy may counsel future traits in company asset allocation and the broader integration of digital belongings into monetary methods.

Different crypto shares rose

Shares of MARA Holdings rose 11% in response to Bitcoin’s rise to a brand new all-time excessive of round $107,000.

This rise in MARA’s inventory value paralleled features in crypto-linked shares, highlighting the market’s growing interdependence with crypto efficiency.

MARA used the proceeds from its zero-coupon convertible bond providing to buy 11,774 BTC. The $1.1 billion acquisition at $96,000 per BTC delivered a return of 12.3% for the quarter and 47.6% for the present 12 months.

MARA’s Bitcoin holdings now stand at 40,435 BTC, price $3.9 billion. The corresponding value motion has the inventory about to hit $45.

Supply: TradingView

Moreover, Riot Blockchain benefited from elevated funding from an elevated issuance of convertible bonds price $594 million, buying 667 BTC at a median worth of $101,135 every.

This strategic transfer expanded Riot’s belongings to 17,429 BTC, price $1.8 billion. All year long, each acquisitions and mining actions contributed to the corporate’s monetary efficiency.

Supply:

Consequently, Riot reported important Bitcoin returns per share, reaching 36.7% for the quarter and 37.2% year-to-date.

This monetary maneuver demonstrates Riot’s strong place in leveraging market dynamics to extend shareholder worth, and highlights its adept technique within the evolving cryptocurrency panorama.

The demand for Bitcoin is growing

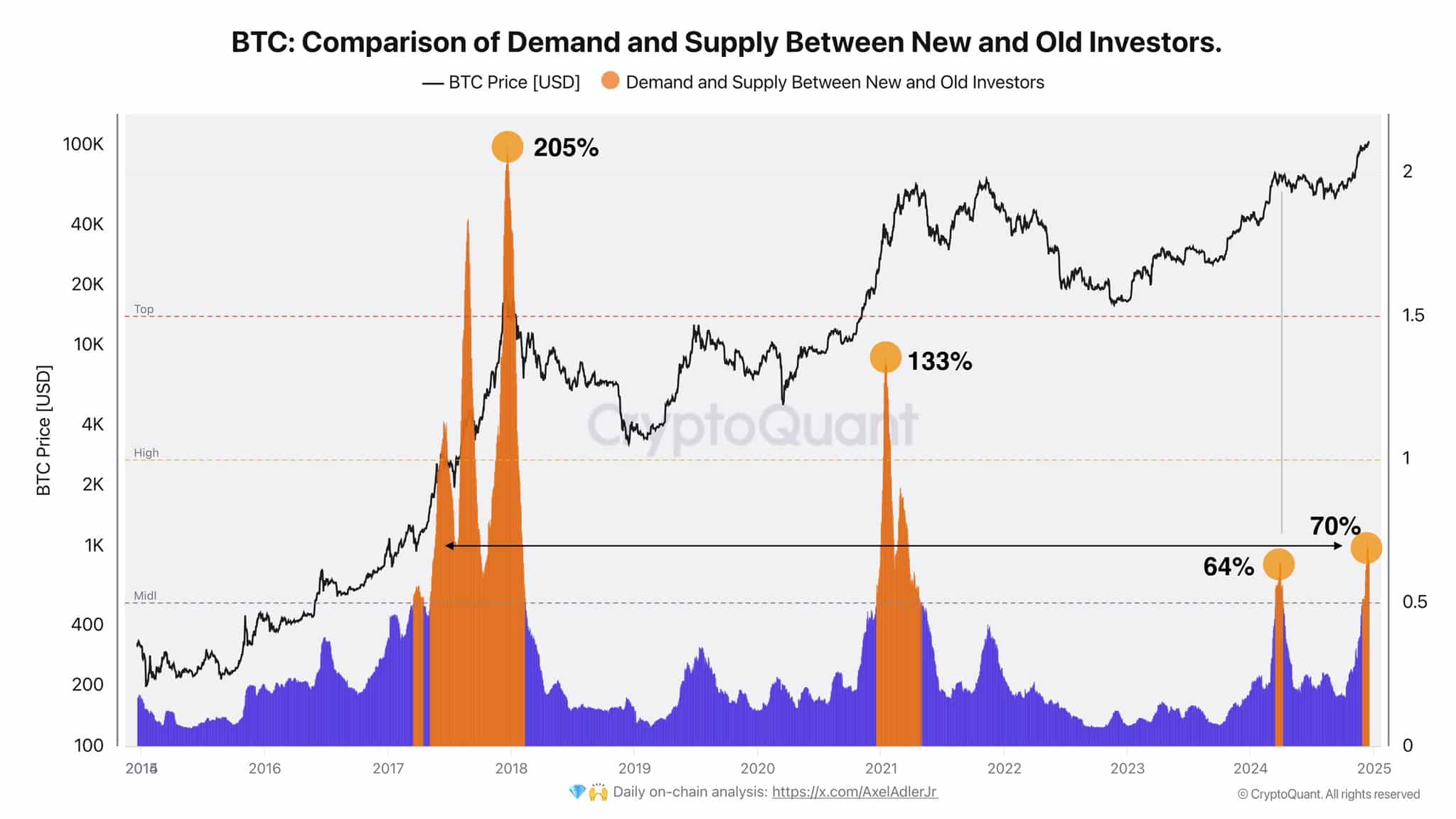

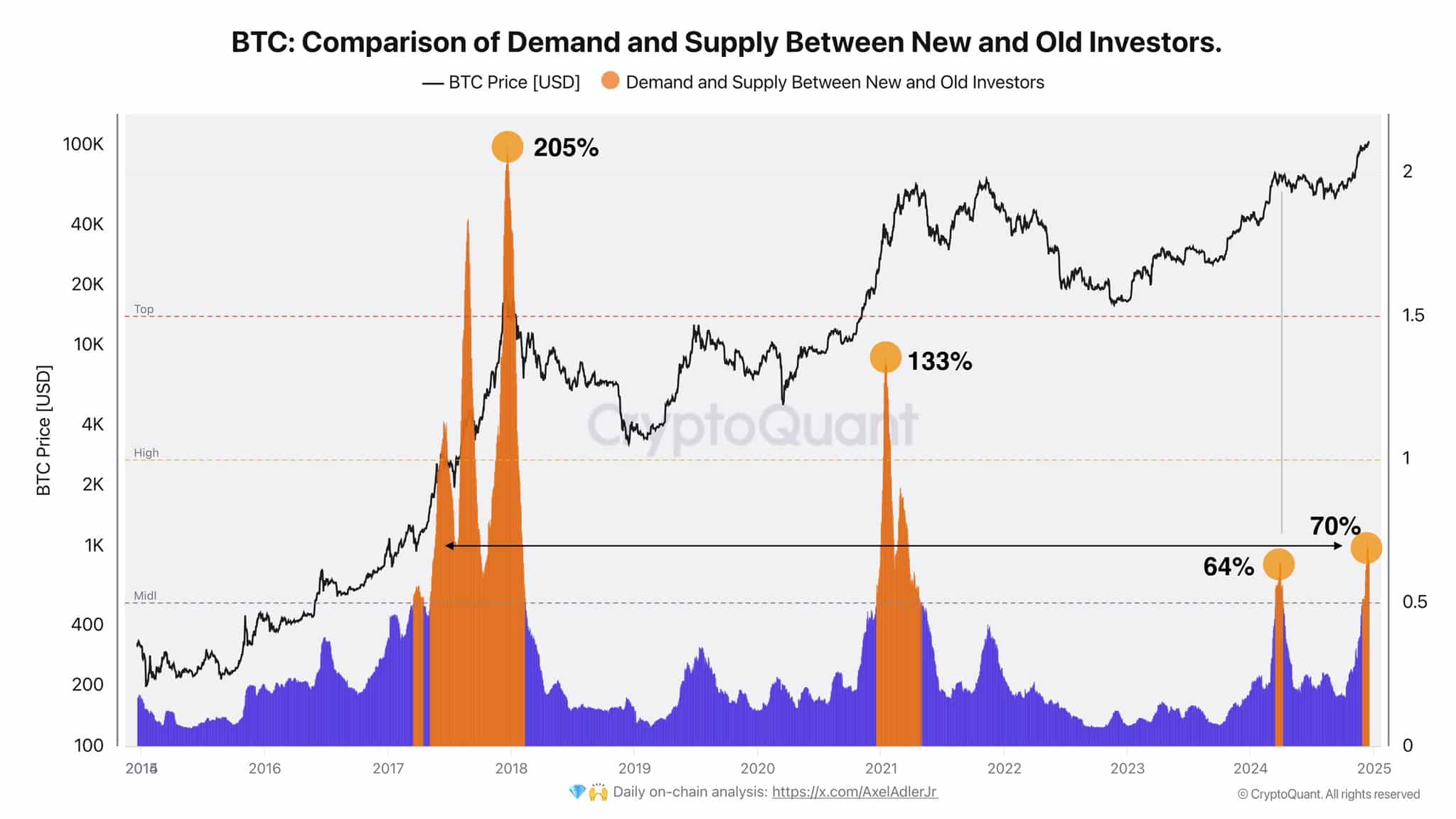

Moreover, demand from new buyers within the present cycle has surpassed the height of March final 12 months, when Bitcoin reached $70,000, by 4%.

Whereas important, this stage of demand is extra muted in comparison with earlier cycles, when demand peaks reached 205% and 133%. This moderation may point out a shift in dynamics or investor sentiment at these costs.

Supply: CryptoQuant

Traditionally, these spikes have typically preceded substantial market actions, suggesting that Bitcoin may endure additional important modifications in valuation.

Learn Bitcoin’s [BTC] Value forecast 2024-25

Anticipating potential volatility or development based mostly on historic patterns has aligned expectations with the conduct of rising markets.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024