Altcoin

How can BNB traders take advantage of the short-term price fluctuations?

Credit : ambcrypto.com

- BNB has turned its long-term trendline resistance into help

- Derivatives information confirmed a bullish upside as the worth consolidated above the important thing EMAs

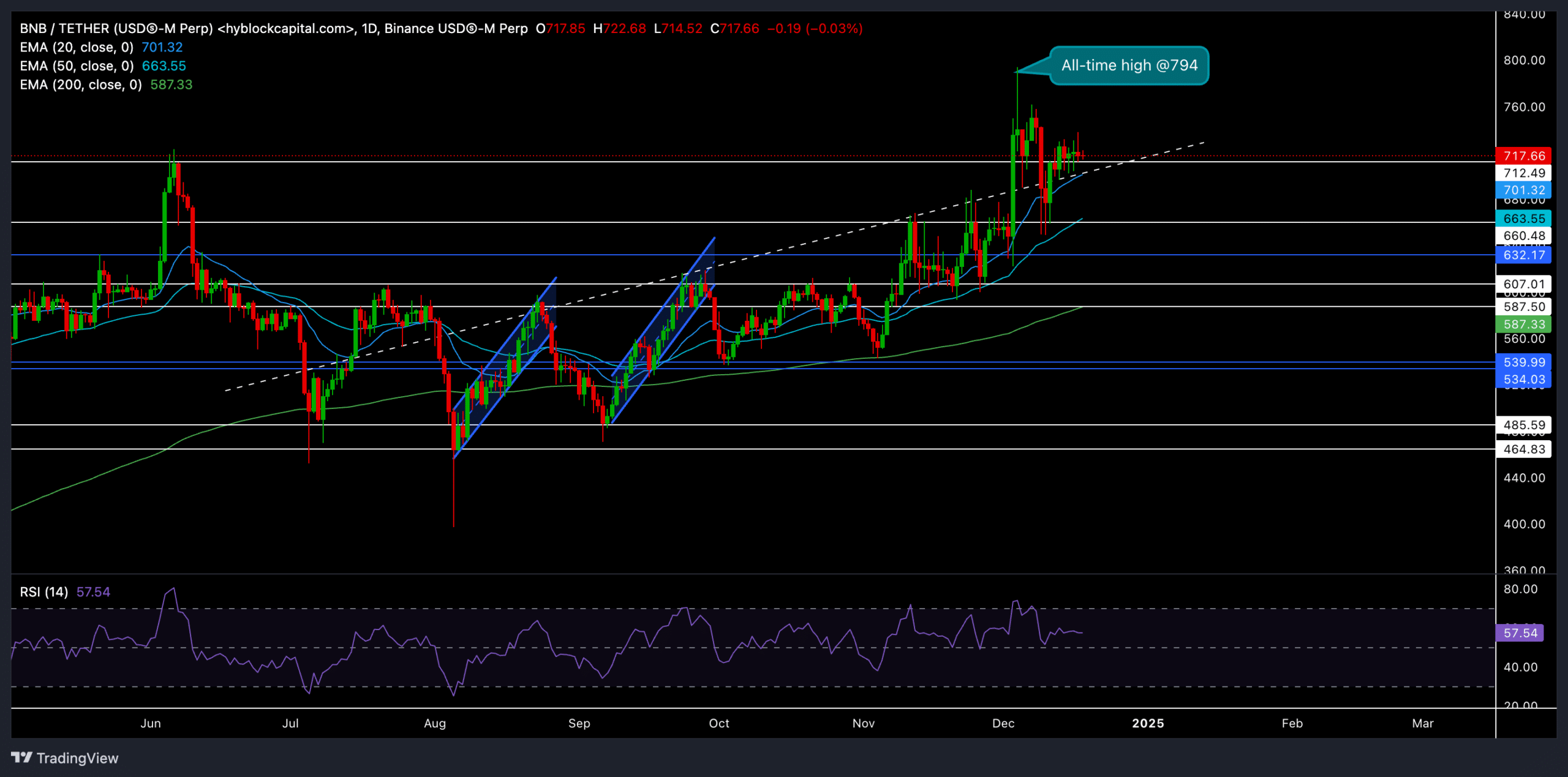

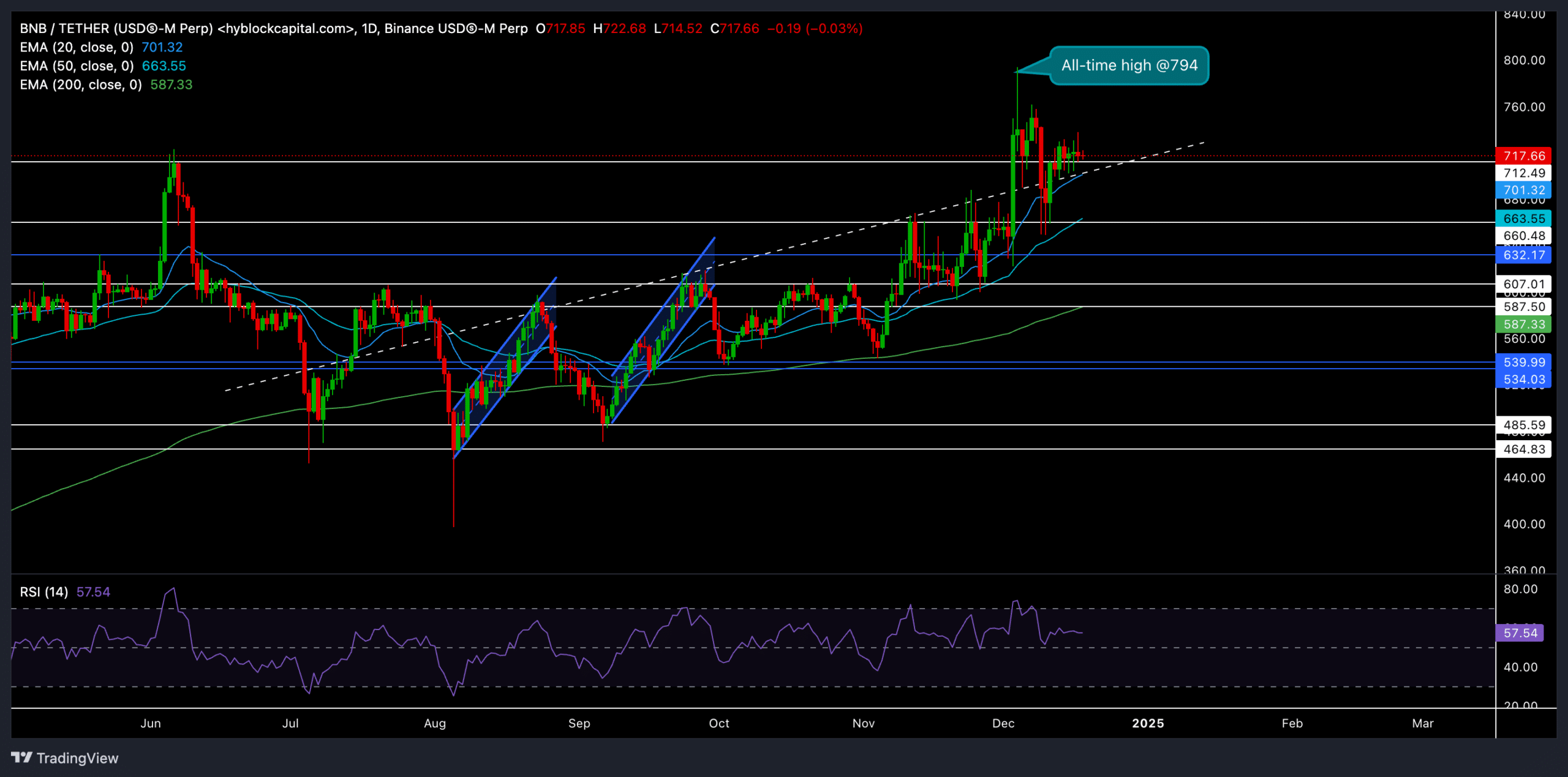

After breaking down its long-term trendline resistance, Binance Coin [BNB] reached a brand new all-time excessive (ATH) on December 4 at $794. This enhance was fueled by broader bullish sentiment within the crypto market, particularly Bitcoin [BTC] latest HIKE.

On the time of writing, BNB was buying and selling at $715.86 and consolidating close to its vital help zones.

BNB is consolidating at key factors of help

Supply: TradingView, BNB/USDT

BNB’s worth motion on the day by day chart mirrored sturdy bullish resilience because it maintained ranges above the 20-day, 50-day and 200-day EMAs. After lately touching its new ATH, worth motion consolidated in latest days.

A decisive shut under the $712 help may expose BNB to a pullback in the direction of the 50-day EMA at $663, which may act as sturdy dynamic help.

The Relative Power Index (RSI) stood at 57, nicely under the overbought zone. This prompt room for additional upside if broader market sentiment turns within the bulls’ favor.

The $712 help degree now supplied essential short-term help. If the bulls defend this degree, a attainable retest of the $750-$760 resistance zone may observe. An in depth above this zone may put BNB right into a worth discovery part.

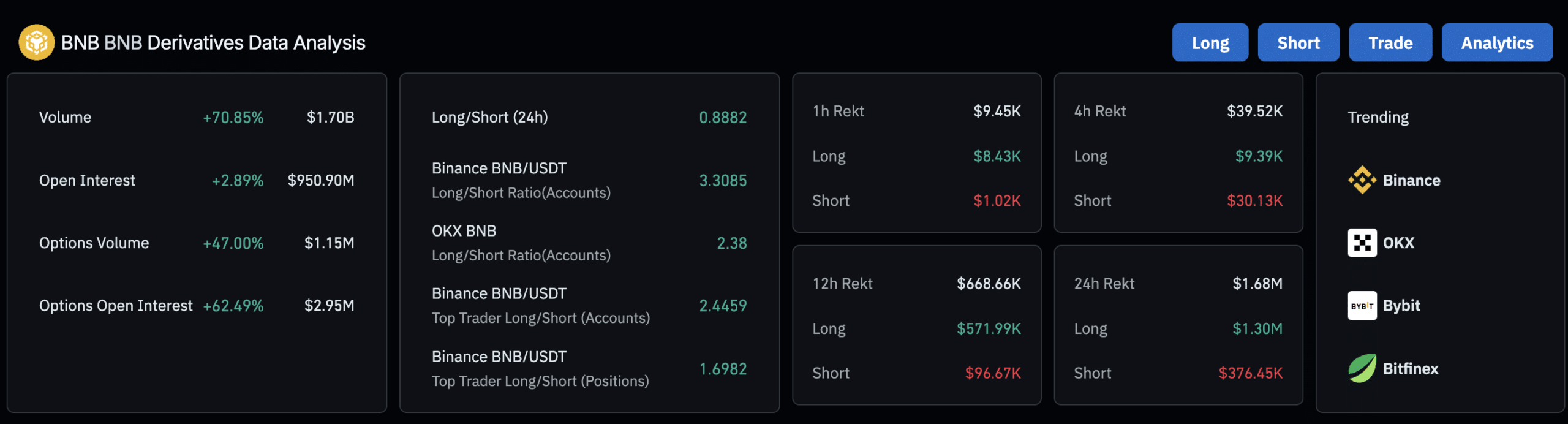

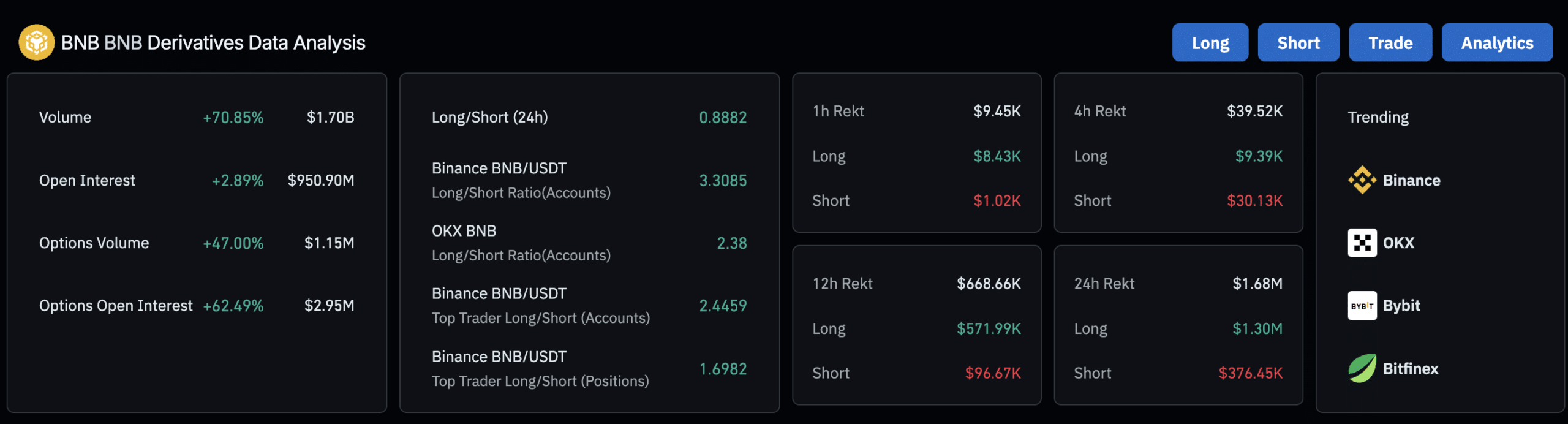

Derivatives information signifies bullish sentiment

Supply: HyblockCapital

BNB’s derivatives market information mirrored rising curiosity from merchants. Quantity rose 70.85% to $1.7 billion, exhibiting rather more exercise after the latest uptrend. Open Curiosity additionally rose 2.89% to $950.9 million, indicating new positions are getting into the market. Right here it’s price noting that Choices Open Curiosity can be up 62.49%.

Apparently, the lengthy/quick ratio (over the past 24 hours) was 0.8882, indicating considerably cautious sentiment general. Nevertheless, merchants on Binance are feeling fairly bullish, as evidenced by their lengthy/quick ratio of three.3085. Furthermore, prime merchants maintained a robust lengthy bias with a ratio round 2.4.

BNB’s consolidation close to vital help indicated a possible rebound alternative for bulls. Whereas broader market sentiment, particularly BTC’s trajectory, will stay essential, merchants can search for a rebound within the short-term EMAs to gauge a sustained uptrend.

Then again, a decline under $712 may negate the bullish setup and set off a retest of the 50-day EMA.

Merchants ought to intently monitor Bitcoin’s momentum and BNB’s worth motion round key ranges earlier than making buying and selling selections.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024