Ethereum

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Credit : www.newsbtc.com

Amid a basic worth decline within the crypto market over the previous week, Ethereum (ETH) recorded a worth correction of over 19.5% and located help at a neighborhood backside of $3,100. Since then, the distinguished altcoin has proven solely slight bounce prior to now two days, rising greater than 5%. Nonetheless, latest knowledge on pockets exercise supplies lots of motive to be optimistic about Ethereum’s long-term future.

Ethereum HODL Addresses Enhance Provide Dominance to 16%

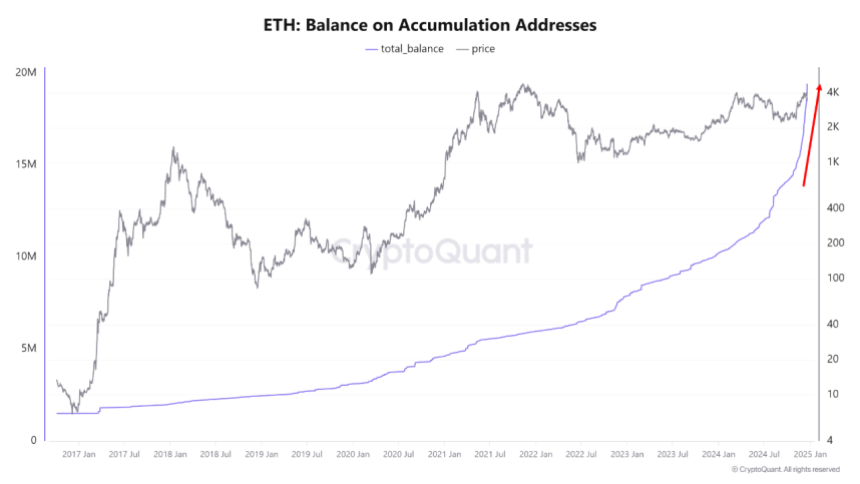

In a latest one QuickTake postCryptoQuant analyst MAC_D shared some constructive insights in regards to the Ethereum market.

The crypto market skilled reviews that the steadiness of Ethereum accumulation addresses elevated by as a lot as 60% between August and December. Throughout this time, these HODL wallets elevated their share of the ETH provide from 10% to 16%, or 19.4 million ETH from 120 million ETH.

To elucidate, the buildup addresses are wallets that maintain Ethereum however hardly ever transfer or promote their property. They’re thought-about a benchmark for long-term funding and belief.

In response to MAC_D, the speedy enhance in possession of those Ethereum HODL wallets is a brand new growth absent in earlier bull cycles. The analyst attributed this enormous accumulation fee to buyers’ optimistic expectations in regards to the incoming administration of Donald Trump within the US.

These expectations embrace extra favorable laws for the DeFi business, which represents a key sector of the Ethereum ecosystem. Subsequently, no matter Ethereum’s present worth motion, these long-holding wallets will possible proceed to extend their holdings in anticipation of future worth progress.

Moreover, MAC_D emphasizes the significance of those accumulation addresses, as Ethereum’s worth has by no means fallen under the realized worth. Subsequently, continued buying by means of these wallets affords nice potential for long-term worth beneficial properties.

What’s subsequent for ETH?

Relating to Ethereum’s rapid transfer, MAC_D warns that macroeconomic elements are more likely to exert a stronger affect on ETH’s worth within the quick time period, as illustrated by the latest worth crash attributable to doable decrease rate of interest cuts in 2025.

On the time of writing, the altcoin is buying and selling at $3,352, having dropped 3.07% prior to now 24 hours. On the identical time, ETH’s day by day buying and selling quantity has fallen by 53.25% and is valued at $31.15 billion.

After the latest worth drops, Ethereum can also be performing negatively on the bigger charts, with losses of 14.74% and 1.05% within the final seven and thirty days respectively. On the plus facet, the asset’s worth remains to be properly above its preliminary worth degree ($2,397) in the beginning of the post-US election worth rally, indicating that longer-term sentiment stays constructive.

With a market cap of $401 billion, Ethereum stays the second largest cryptocurrency and largest altcoin within the digital asset market.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now