Bitcoin

Bitcoin ETFs consume more BTC than miners produce: What this shift means

Credit : ambcrypto.com

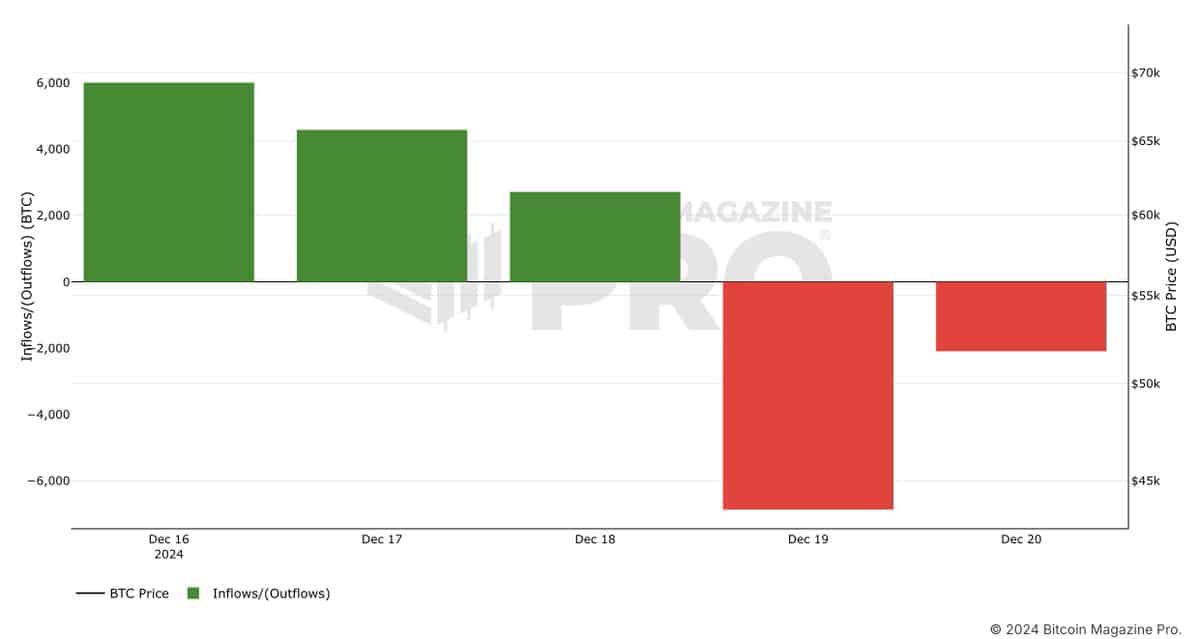

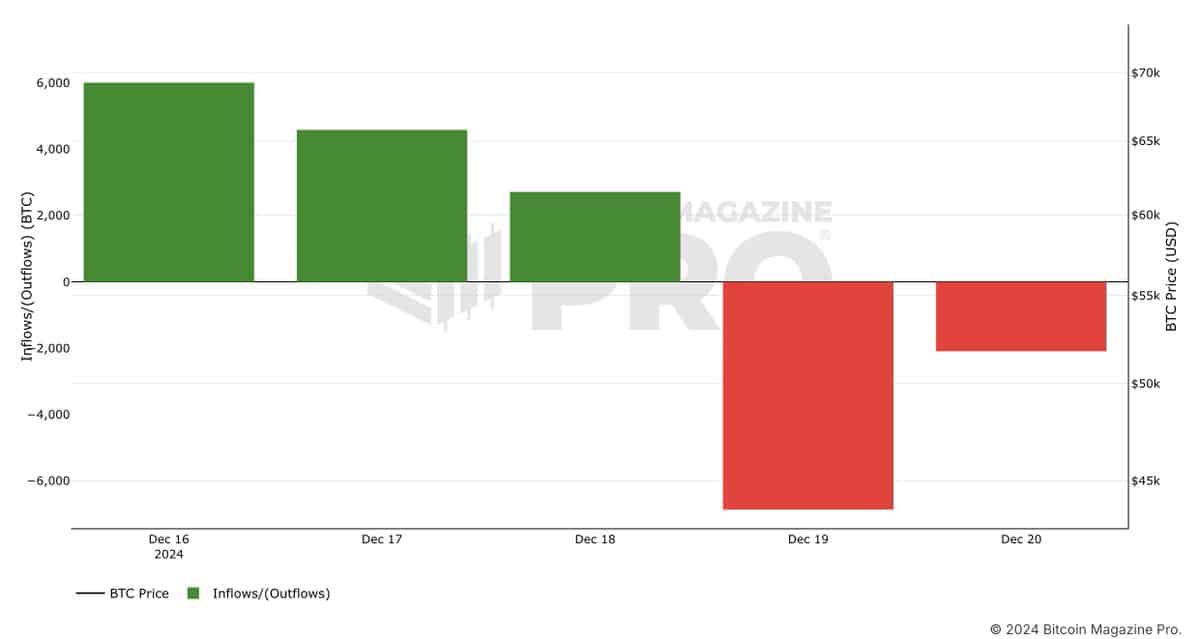

- Spot Bitcoin ETFs absorbed 4,349.7 BTC, far exceeding the availability from miners this week.

- Institutional demand reduces liquidity, growing Bitcoin’s value sensitivity and volatility dangers.

Institutional demand for Bitcoin [BTC] reveals no indicators of abating even with value volatility. Previously week, spot Bitcoin ETFs recorded inflows of 4,349.7 BTC, value $423.6 million – nearly double the two,250 BTC mined throughout the identical interval.

This imbalance highlights the rising dominance of institutional traders in shaping market dynamics and raises essential questions on Bitcoin’s means to satisfy escalating demand.

Bitcoin ETFs soak up liquidity quicker than miners provide it

Place Bitcoin ETFs have emerged as a cornerstone for institutional publicity to Bitcoin, providing a simplified different to direct asset custody. This week’s inflows are an instance of the altering dynamics, with ETFs accumulating extra BTC than miners can produce.

Supply:

The distinction between ETF inflows and miner output displays tighter liquidity in Bitcoin markets. As miners grapple with post-halving challenges, ETFs proceed to soak up a good portion of the circulating provide.

Institutional traders, undeterred by the latest value declines, seem dedicated to Bitcoin as a long-term macroeconomic hedge, reinforcing its attraction past speculative buying and selling.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024