Ethereum

Here’s how EIGEN is driving the future of Ethereum staking solutions

Credit : ambcrypto.com

- EigenLayer’s deal with progress highlighted rising adoption with a 148.61% improve in new addresses

- Market sentiment stabilized as improvement exercise and MVRV ratios pointed to balanced buying and selling dynamics

Within the dynamic blockchain house OwnLayer [EIGEN] has seen spectacular community progress, indicating its growing prominence amongst Ethereum staking options. Prior to now week alone, the platform has recorded a rise in new addresses, energetic accounts and total person engagement.

Collectively, these traits spotlight elevated curiosity in EigenLayer’s providing, making it a standout participant within the Ethereum ecosystem. On the time of writing, OWN was buying and selling at $3.69, having fallen barely 1.66% previously 24 hours.

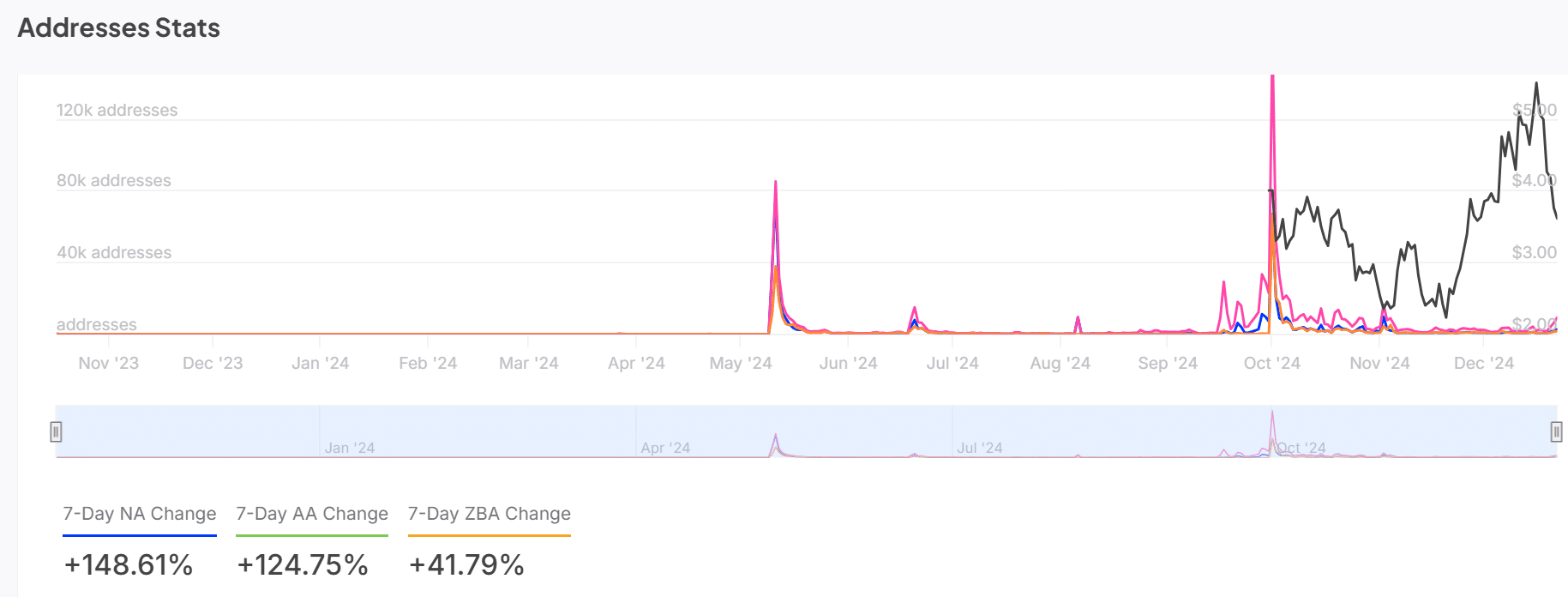

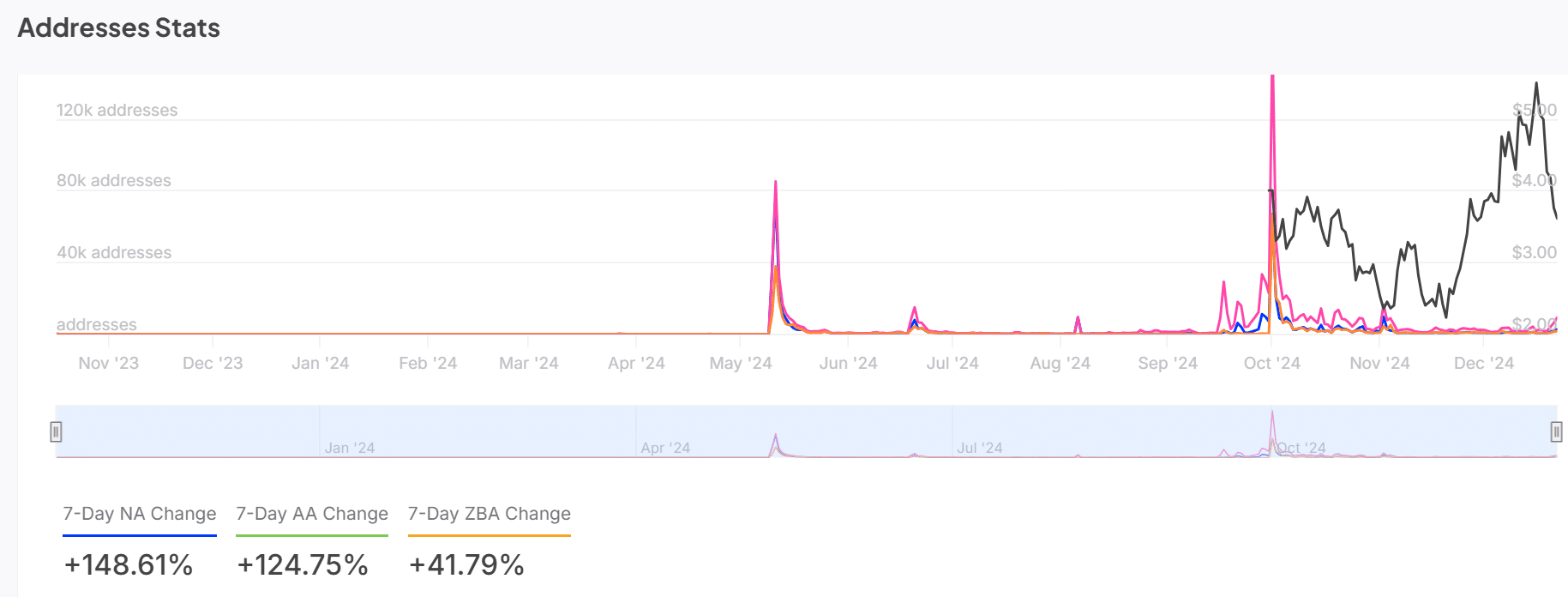

The expansion of the OWN deal with exhibits rising community exercise

EigenLayer’s deal with statistics revealed a community that noticed fast progress and engagement. The 148.61% improve in new addresses mirrored an inflow of recent individuals attracted by the platform’s modern staking options.

Moreover, the 124.75% improve in energetic addresses underlines continued exercise amongst current customers – an indication of sturdy retention. In the meantime, the 41.79% improve within the variety of zero stability accounts indicated rising curiosity from potential buyers seeking to discover the platform.

These mixed statistics may be seen as a reference to EigenLayer’s rising footprint within the Ethereum staking ecosystem.

Supply: IntoTheBlock

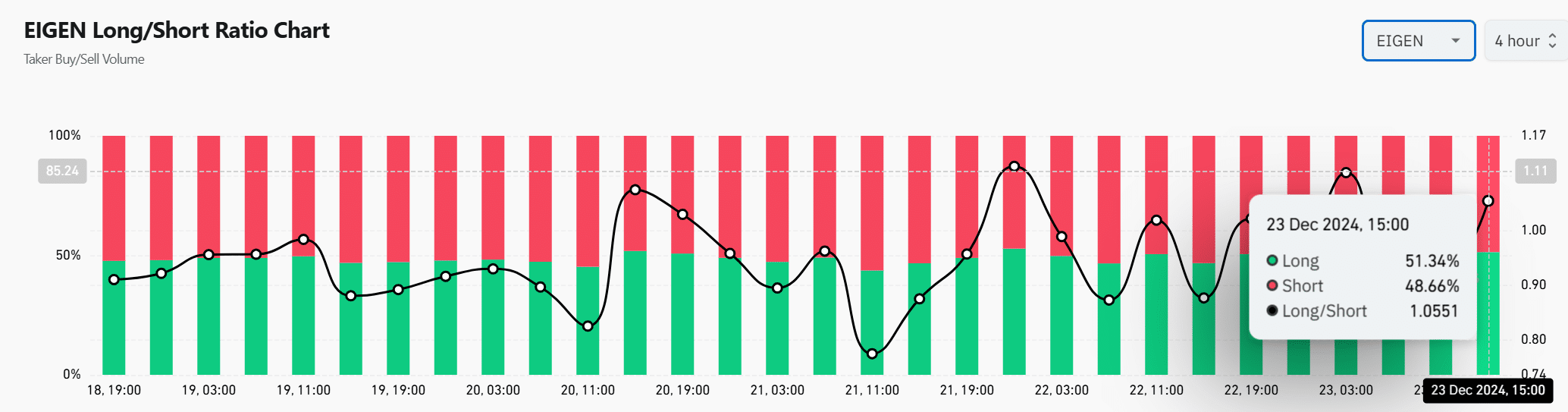

A balanced market sentiment?

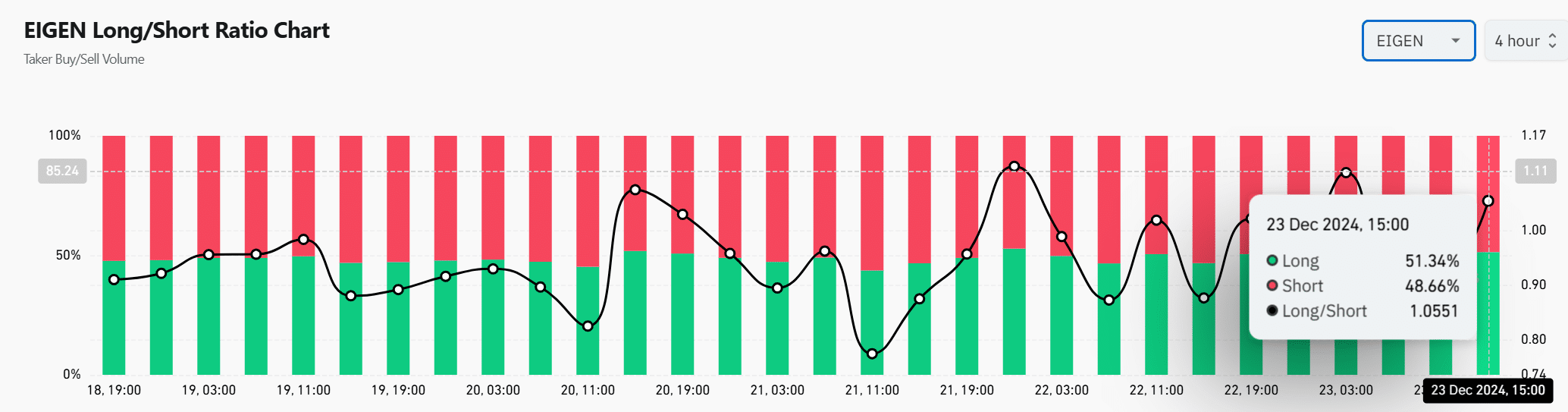

Market sentiment for EIGEN has remained pretty balanced, because the lengthy/brief ratio indicated a virtually even cut up. On the time of writing, 51.34% of positions have been lengthy and 48.66% have been brief. This underlines the cautious but optimistic outlook amongst merchants.

Latest spikes in lengthy positions indicated that some buyers are betting on a doable value restoration regardless of latest volatility.

This equilibrium indicated a market that rigorously weighs dangers and alternatives, with out excessive preferences in both path. Such sentiment usually precedes main strikes, making this an important level to observe.

Supply: Coinglass

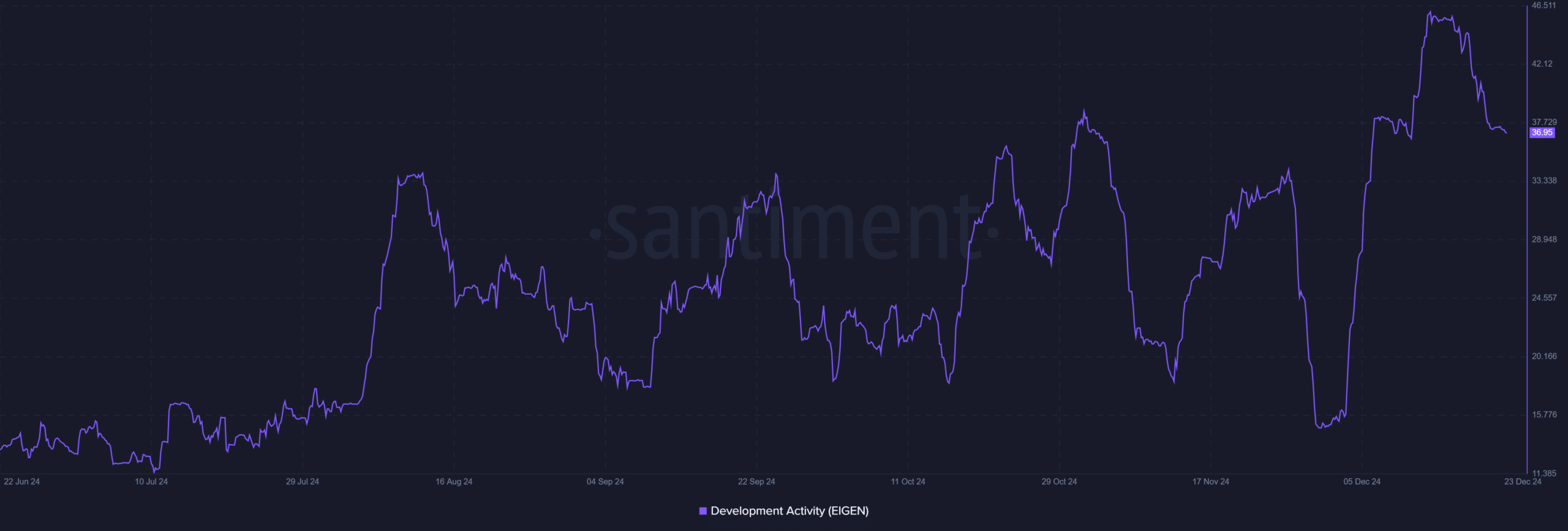

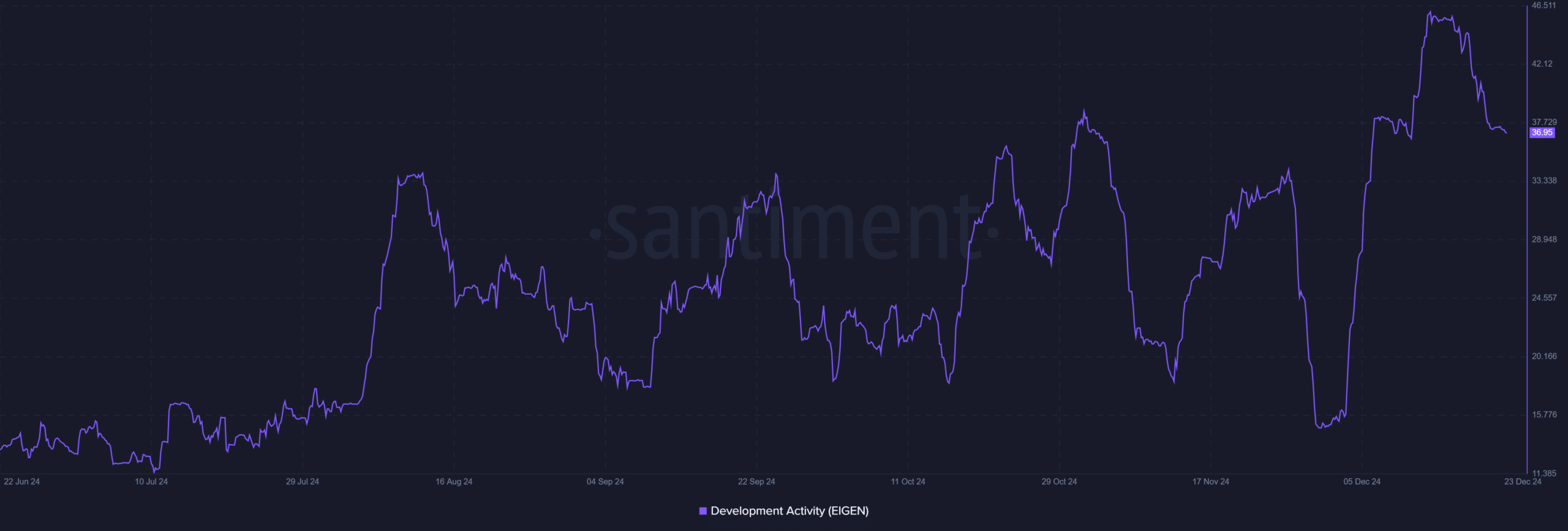

Regular improvement actions strengthen innovation

Improvement exercise on EigenLayer has maintained a gentle tempo, with a press time rating of 36.95. Whereas this degree of exercise will not be but at its peak, it’s a signal of continued enhancements and enhancements to the platform.

Common updates and improvements guarantee customers and buyers’ long-term dedication to the challenge to stay aggressive. Subsequently, EigenLayer’s constant improvement efforts present a strong basis for sustainable progress within the Ethereum staking house.

Supply: Santiment

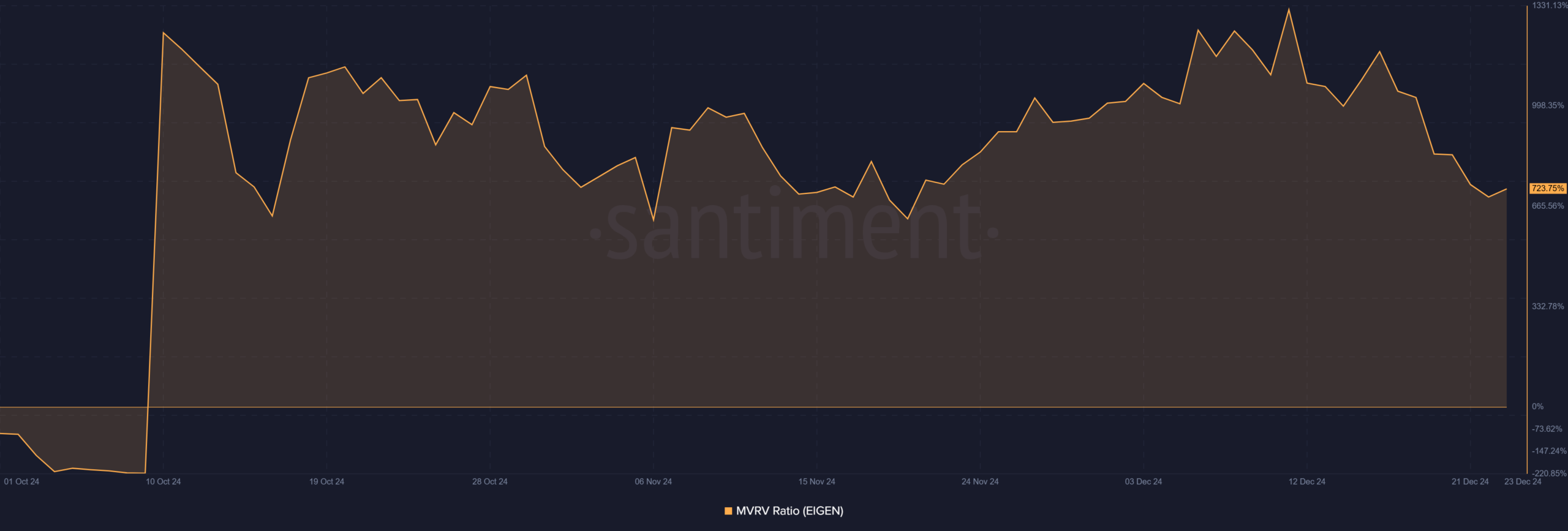

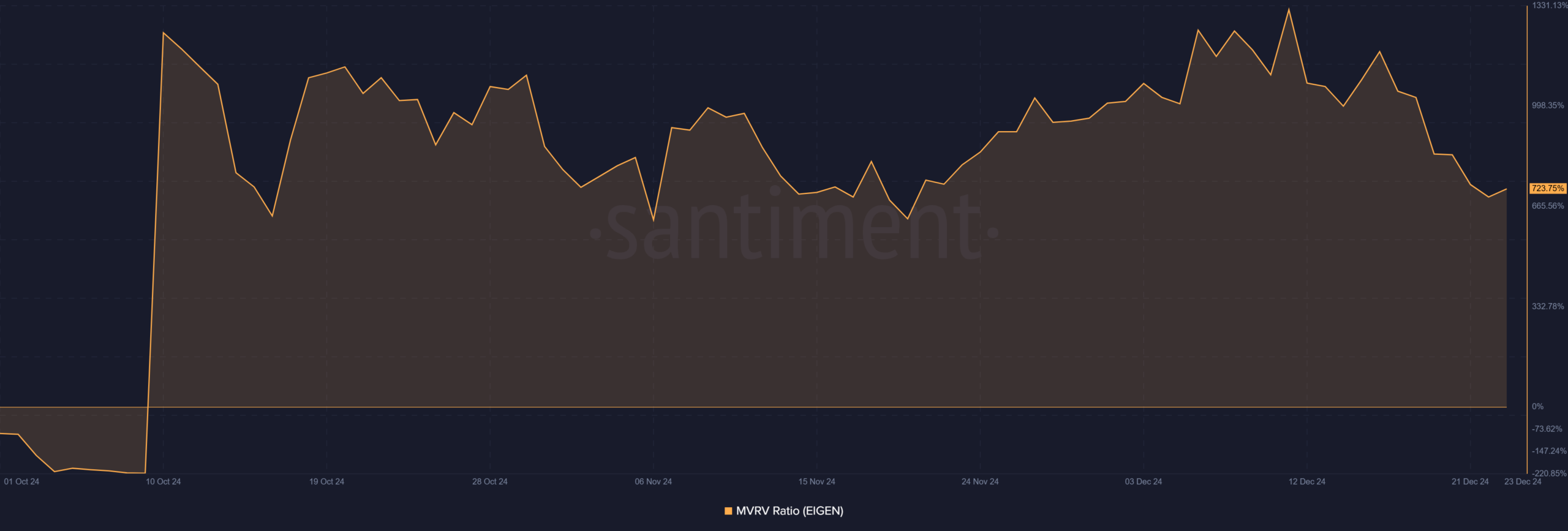

The MVRV ratio signifies potential for profit-taking

The MVRV ratio, which was 723.75%, urged that many early adopters have made vital unrealized beneficial properties. Elevated MVRV ranges usually coincide with higher profit-taking, which may lead to short-term volatility.

Nonetheless, such actions can even present a possibility for brand spanking new buyers to enter at decrease costs. This dynamic between revenue taking and new shopping for may create an fascinating value motion sample within the coming days.

Supply: Santiment

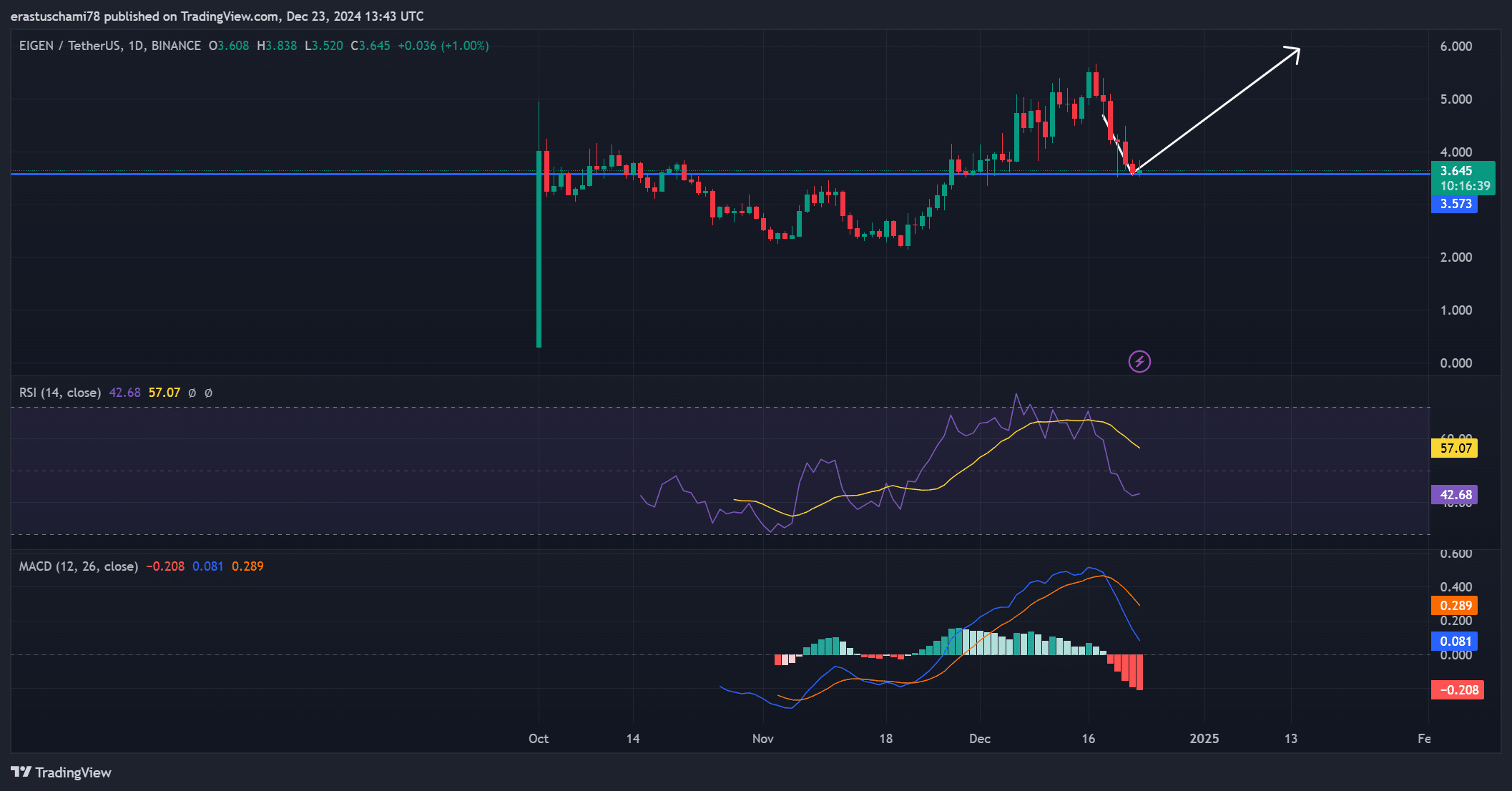

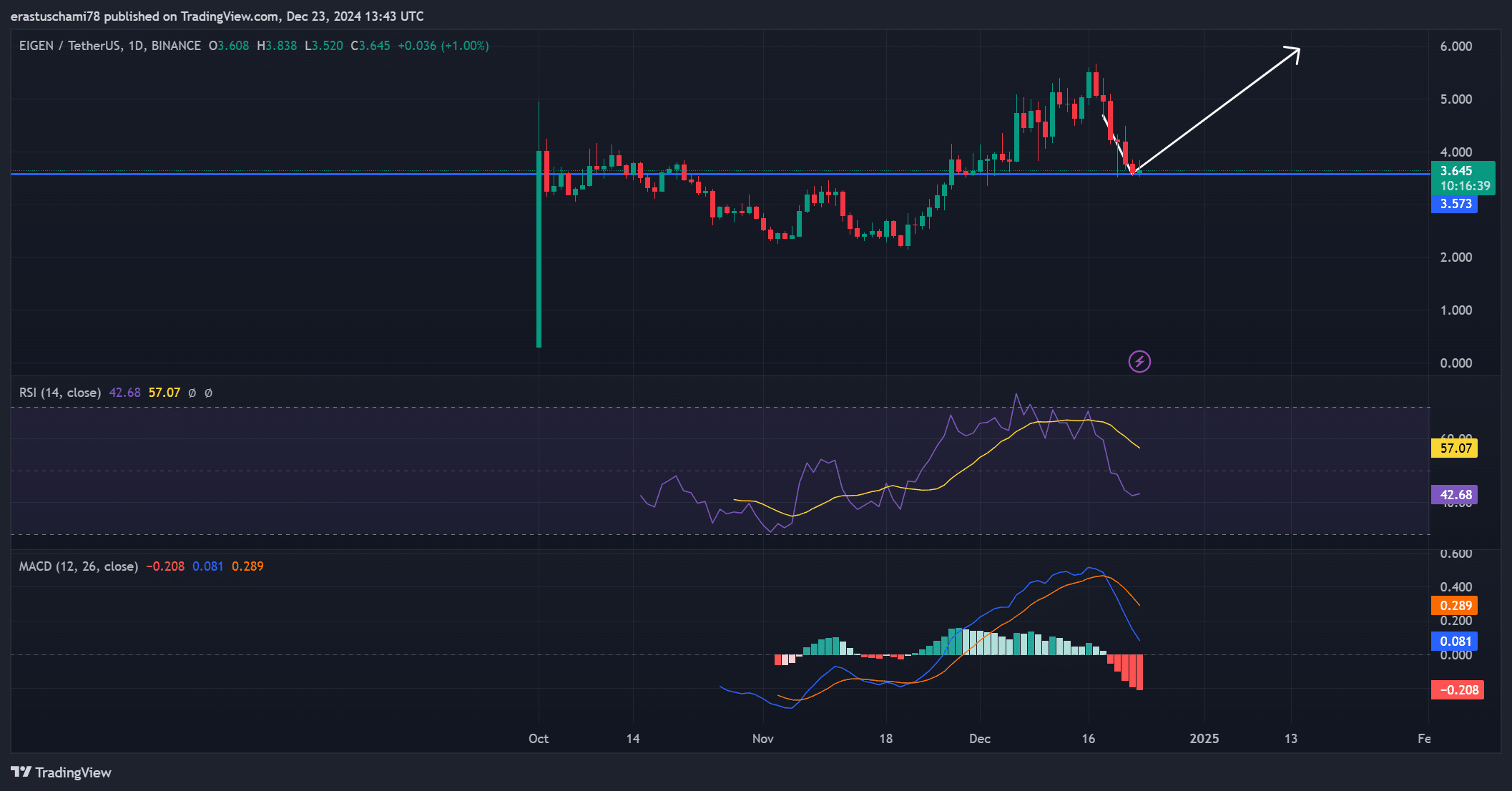

Potential for restoration?

Technical evaluation confirmed blended indicators for EIGEN’s near-term value trajectory. For instance, the RSI at 42.68 urged that the token is approaching oversold territory, which regularly precedes a rebound.

In the meantime, the MACD indicated barely bearish momentum, with a studying of -0.208. Nonetheless, with sturdy assist round $3.57, EIGEN has the potential to stabilize and recuperate if bullish sentiment strengthens. Subsequently, a turnaround in market sentiment may pave the way in which for renewed upward momentum.

Supply: TradingView

Is your portfolio inexperienced? View the OWN Revenue Calculator

EigenLayer’s sturdy deal with metrics, balanced market sentiment, and constant improvement exercise underscore its rising relevance in Ethereum deployment. Whereas near-term pricing challenges stay, the platform’s spectacular numbers imply it’s effectively positioned for sustainable progress.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024