Altcoin

Bitcoin’s demand for short transactions has skyrocketed in recent days

Credit : ambcrypto.com

- BTC is up 4.16% up to now 24 hours.

- Rising open curiosity and falling funding charges point out excessive demand for Bitcoin quick buying and selling.

Over the previous 24 hours, Bitcoin [BTC] noticed small beneficial properties as markets bought into the Christmas spirit. On the time of writing, Bitcoin was buying and selling at $98,056. This represented a rise of 4.16% in comparison with the day prior to this.

On Christmas Eve, Bitcoin rose from a low of $93,461 to a excessive of $99,419. This surge over the previous day has led analysts to speak about BTC’s post-Christmas efficiency.

To this extent, Cryptoquant analyst Merchants Oasis has prompt that BTC will transfer sideways throughout the Christmas week, adopted by distribution motion as demand for brief positions will increase.

Bitcoin’s demand for brief positions is skyrocketing

In keeping with Traders oasisBitcoin has undergone a correction in current weeks as a result of lack of institutional demand.

Supply: Cryptoquant

In his evaluation, he acknowledged that the Coinbase premium index didn’t accompany the worth improve, resulting in a backlash. Nevertheless, the analyst expects the market to proceed its rise because the index has entered adverse territory.

Supply: Cryptoquant

In keeping with him, the continuation of the potential improve is supported by financing charges and open curiosity.

As such, funding charges have fallen, which is a optimistic signal for a bull market, whereas open charges have soared in current days.

Supply: Cryptoquant

When the financing charge falls whereas the open curiosity rises, it signifies that traders are opening quick gross sales. As traders open quick trades, this means that they count on costs to fall.

Nevertheless, the elevated demand for brief gross sales may lead to a brief squeeze as shopping for stress will increase. This spike attracts extra patrons, making a self-reinforcing rally.

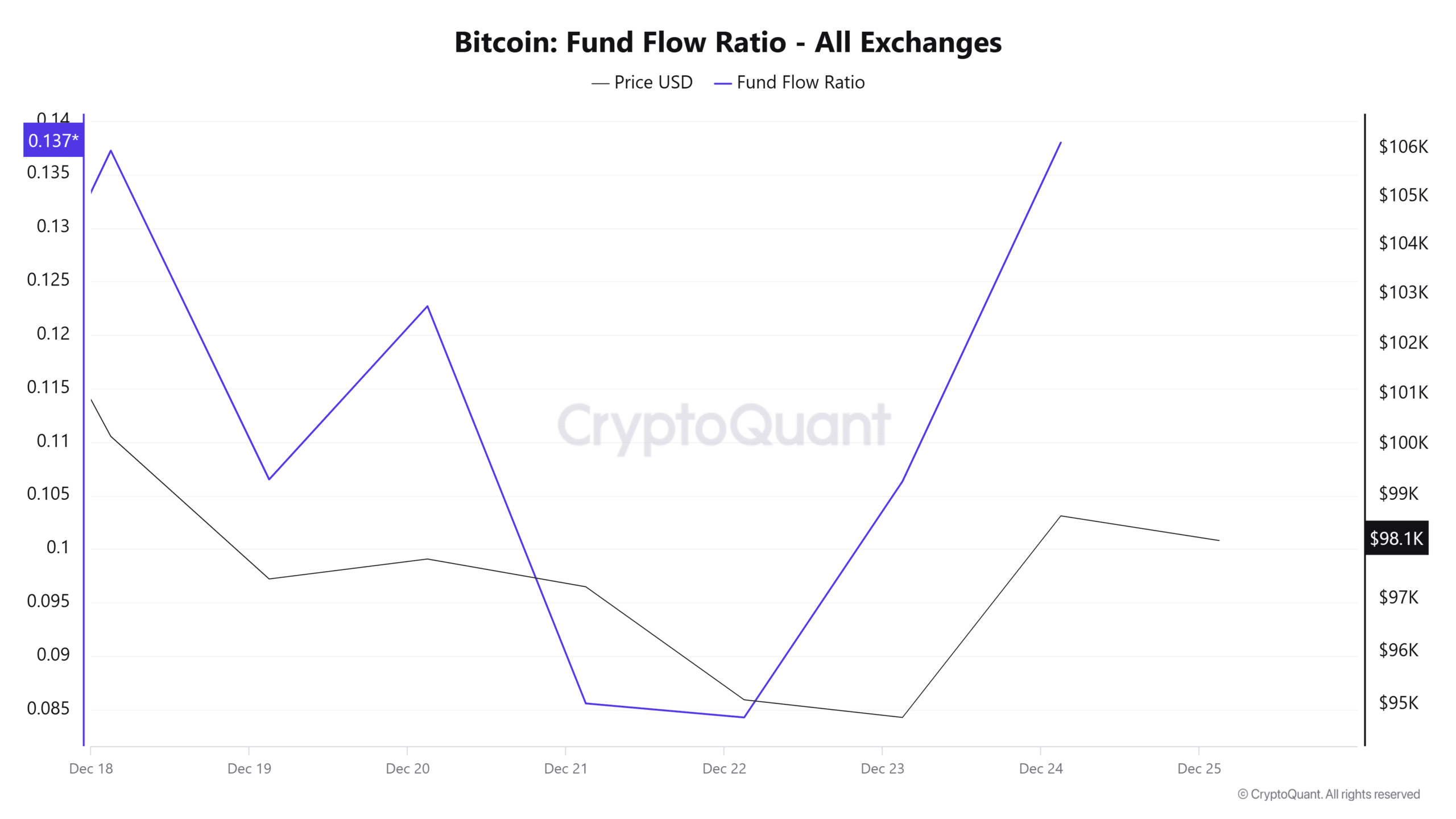

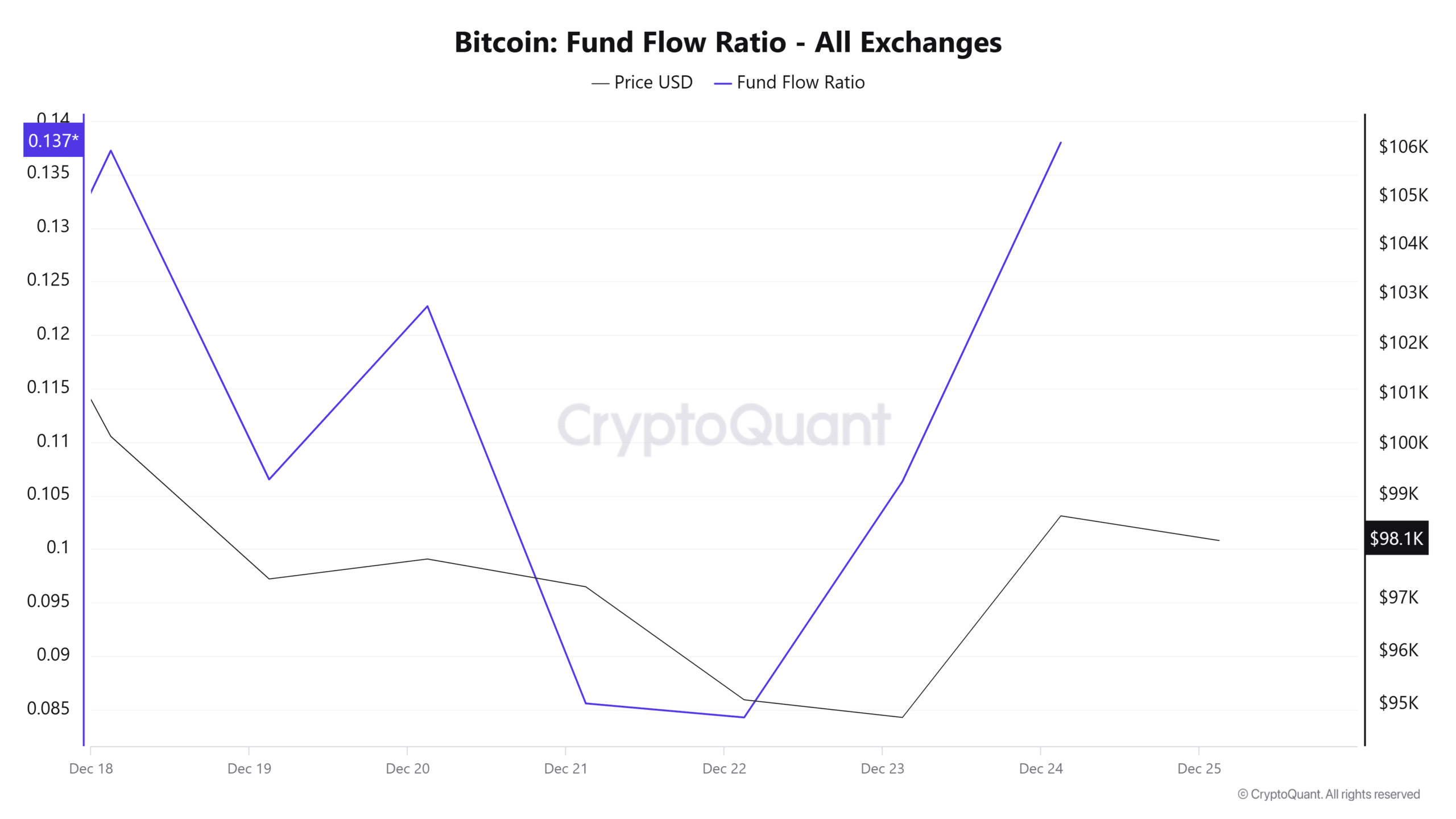

We will see this demand for Bitcoin within the final three days. Throughout this era, the BTC fund movement ratio elevated from 0.084 to 0.137.

Supply: Cryptoquant

When the fund movement ratio will increase, it means extra money is invested in Bitcoin. Such a pattern is a bullish sign indicating that traders are keen to allocate extra capital to BTC. This results in rising costs resulting from elevated buying stress.

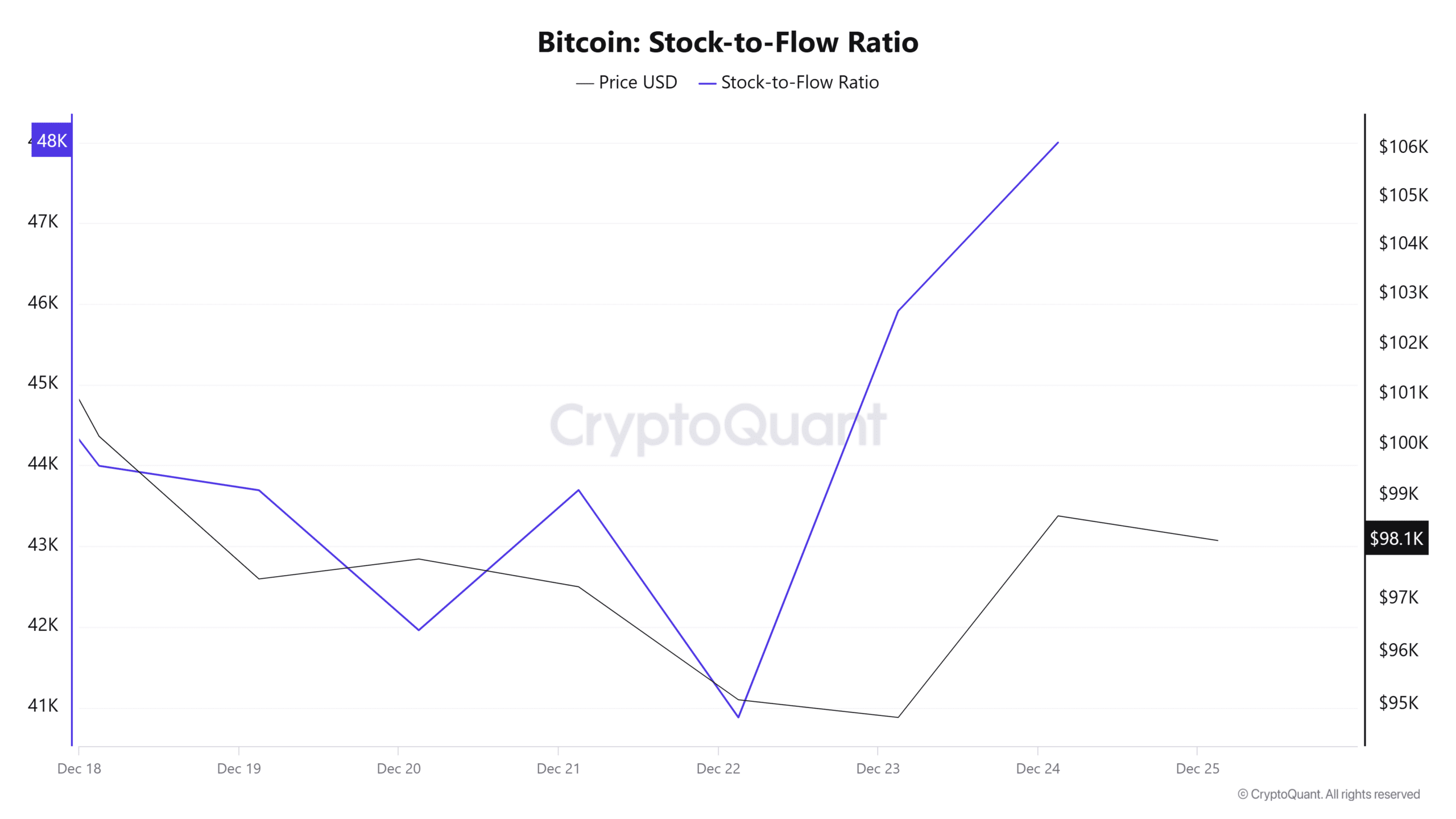

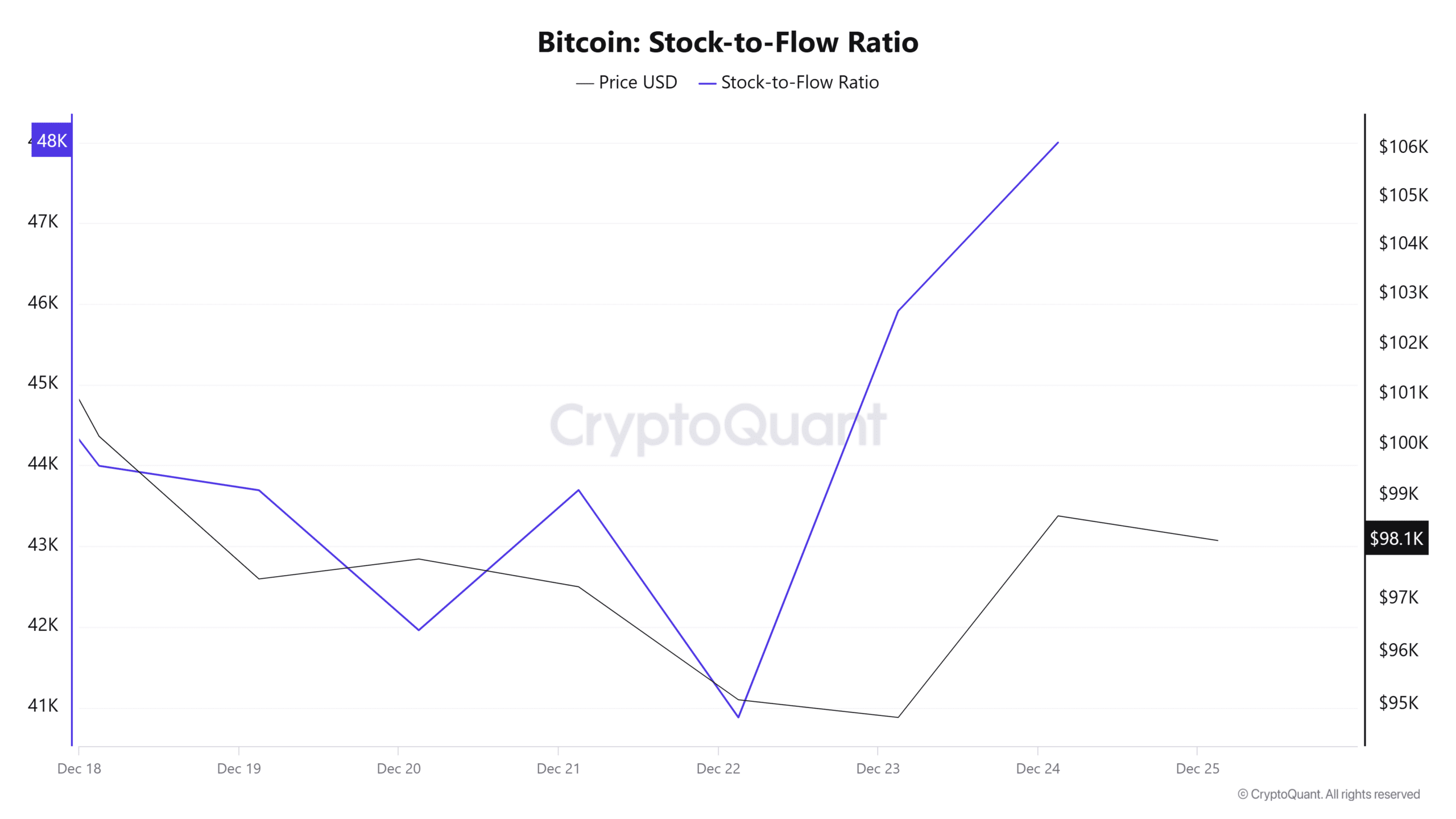

Supply: Cryptoquant

Moreover, the elevated influx implies that extra BTC leaves the exchanges, rising shortage. As an increasing number of merchants purchase cryptocurrency, it’s now changing into scarce, as evidenced by the rising stock-to-flow ratio.

When Bitcoin turns into scarcer, costs rise as a result of increased demand with low provide results in increased costs.

Learn Bitcoin’s [BTC] Value forecast 2024-25

What’s subsequent for BTC?

As investor demand for brief trades will increase, it seems that these merchants could expertise a brief squeeze. That is when the demand for many who are shorting causes the other response from the market, inflicting costs to rise.

Subsequently, if demand stays fixed whereas provide falls, as noticed, we may see Bitcoin regain the $100,000 resistance after Christmas. Nevertheless, if the crypto continues to commerce sideways, it may drop to $96,600.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024