Bitcoin

CryptoQuant CEO Says Using Strategic Bitcoin Reserve To Offset US Debt Is Feasible, Calls the Approach Practical

Credit : dailyhodl.com

The CEO of digital asset analytics firm CryptoQuant thinks a nationwide strategic Bitcoin (BTC) reserve may offset US debt.

Ki Younger Ju tells In accordance with its 389,600 followers on the social media platform

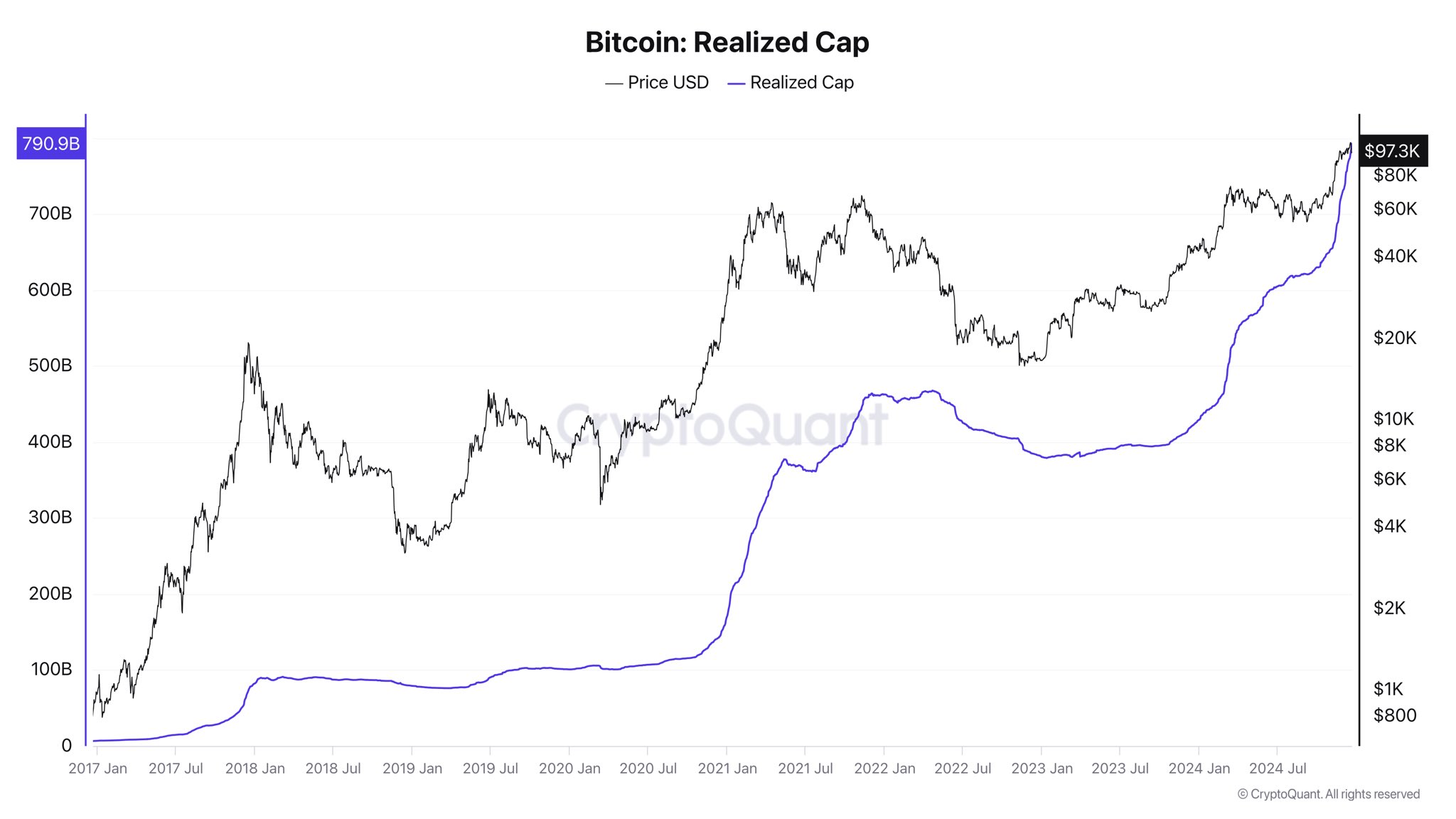

“This yr alone, an influx of $352 billion has added $1 trillion to the market cap.

Nevertheless, utilizing a pumpable asset like Bitcoin to offset dollar-denominated debt – as a substitute of gold or {dollars} – may make it troublesome to achieve consensus amongst collectors. For Bitcoin to attain broader market acceptance, Bitcoin should achieve a world, nationwide authority akin to that of gold. Establishing a Strategic Bitcoin Reserve (SBR) may function a symbolic first step.

With 70% of US debt held domestically, offsetting 36% of that by buying 1 million Bitcoin by 2050 turns into possible if the US authorities designates Bitcoin as a strategic asset.”

CryptoQuant’s CEO provides that the 30% of debt held by overseas entities may resist this method, however he says the technique stays sensible nonetheless.

“If consensus is reached on the standing of Bitcoin, it is vitally attainable to attain this.

The one threat can be previous whales dumping BTC to assault the US. But when governments proceed to build up Bitcoin till 2050 and its value continues to rise, I doubt they may truly dump Bitcoin.”

Matthew Sigel, head of digital asset analysis at exchange-traded fund (ETF) supplier VanEck, initially outlined how a strategic Bitcoin reserve may offset US debt.

“Suppose the US Treasury begins buying a million Bitcoin over a five-year interval at a beginning value of $200,000.

Suppose US debt grows at 5% (in comparison with a compound annual progress charge of 8% over the previous 10 years) and the worth of BTC grows at 25%.

In such a situation, the US Strategic BTC Reserve would maintain property value 36% of debt by 2050.

In that situation, BTC can be $42 million per coin (identical as Michael Saylor’s). goal (coincidentally) and the market capitalization can be 18% of worldwide monetary property.

However even at a compound annual progress charge of 15%, the BTC provide would nonetheless be fairly invaluable.”

Do not miss a beat – Subscribe to obtain e-mail alerts straight to your inbox

Verify value motion

Comply with us additional X, Facebook And Telegram

Surf to the Day by day Hodl combine

Generated picture: Midjourney

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now