Policy & Regulation

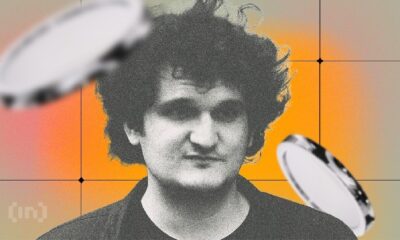

SEC focused on Ripple while ignoring Sam Bankman-Fried – Charles Gasparino

Credit : cryptonews.net

The SEC’s ongoing authorized battle with Ripple over its XRP token is that it goes too far in regulating the crypto house, whereas extra urgent points just like the Sam Bankman-Fried stay. Specializing in Ripple may set a worrying precedent for future digital asset regulation within the US

This battle between the US Securities and Alternate Fee and Ripple Labs is so necessary within the crypto world that many are involved in regards to the US authorities’s rules on its digital property.

SEC’s Deal with Ripple Whereas Overlooking Greater Points

Fox Enterprise Reporter Charles Gasparino was vital of different high-profile circumstances involving Sam Bankman-Fried, however the SEC’s motion in opposition to Ripple and its native cryptocurrency, XRP, acquired consideration.

Gasparino argues that the SEC is specializing in Ripple, which might not be related, particularly since there are larger fish (Sam Bankman) floating round within the monetary world. This case goes nicely past Ripple and can undoubtedly rewrite how the US will proceed to manage its cryptocurrencies any further.

In an interview, he mentioned Ripple Labs and CEO Brad Garlinghouse imagine the SEC has gone too far. They view the case filed in December 2020 as an assault not solely on Ripple, but additionally on the cryptocurrency trade as an entire.

Garlinghouse has additionally criticized the SEC, arguing that the case will set a nasty precedent for all the trade. He additional argued that the SEC doesn’t know tips on how to regulate cryptocurrency and that it doesn’t recognize the excellence between digital property and others.

Ripple vs SEC

Ripple has reportedly expressed frustration over the SEC’s lack of ability to supply clear steerage on what an organization concerned in cryptocurrencies and associated companies ought to do in regulation.

Ripple received partially within the 2023 courtroom ruling, because it dominated that XRP offered on secondary markets can’t be thought-about a safety. The decision separates XRP from different conventional securities transactions and marks a serious win for Ripple.

Nevertheless, the courtroom dominated that the direct gross sales of XRP to institutional buyers are securities transactions, additional highlighting the complexity of the case and the completely different nature through which XRP is utilized in several contexts.

There may be an argument that digital property like XRP ought to be handled in precisely the identical approach as the actual securities inside them, with common causes defending buyers from fraud. Gary Gensler will then be chairman of the SEC. Mr. Gensler claims that the crypto market should comply with securities legal guidelines. For him, XRP has an obligation, amongst different issues, to adjust to securities legal guidelines to guard buyers.

In statements launched by the corporate in 2021, Gensler refers to Bitcoin and Ethereum as commodities, however to many different tokens and cryptocurrencies as seemingly securities and subsequently topic to regulation.

Based on the SEC, Ripple gross sales of XRP ought to be thought-about securities, whether or not institutional or retail gross sales, and subsequently fall throughout the identical gross sales guidelines that apply to shares and bonds.

If that is so, the larger dialog is about how the US authorities ought to regulate cryptocurrency. Critics have identified the aggressive stance the SEC has taken towards Ripple.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now