Adoption

Mark Moss on Bitcoin adoption, freedom, and $1M Bitcoin

Credit : cryptoslate.com

The next is a visitor put up by Christina Comben.

I first met Mark Moss on the entrance to the media heart close to the primary stage Bitcoin MENA in Abu Dhabi, the primary official Bitcoin convention on this a part of the world. We’ve not met earlier than, however due to his acquainted drawl, infectious character and his volumes of insightful content material (together with a YouTube channel and best-selling guide The Uncommunist Manifesto), I really feel like I already know him.

Mark has been championing the advantages of Bitcoin to anybody who will hear since 2016 and was a serial entrepreneur lengthy earlier than that.

“I began an organization in 1999, on the top of the dot-com increase. That crashed. I began one other firm in 2001, an e-commerce firm, which was not straightforward,” he laments. “It was horrible timing. Everybody laughed at me and mentioned, nobody would ever purchase something on-line. I constructed that up and had an amazing end result with it.

From Orange County to Abu Dhabi

What brings him all the way in which from his dwelling in Orange County to Bitcoin MENA within the opulent capital of the UAE?

“I’m a trainer and content material creator,” he says. “I’m additionally a accomplice at a Bitcoin Enterprise Capital fundso we put money into the businesses that construct on and across the Bitcoin ecosystem. I even have a brand new firm that simply went public in Canada referred to as Matador that’s making a Microstrategy play with Bitcoin as a stability sheet asset and investing by way of the Bitcoin Layer 2 house. So I am actively educating and investing within the house to attempt to construct the world I need to see.

What sort of world is that? For Mark it’s clearly Bitcoin, and never crypto. He is been on the altcoin rollercoaster, however would not see some other cryptocurrencies with long-term endurance. “I definitely made some huge cash,” he says, “a lot of cash,” he repeats with additional emphasis. I am ready for him to inform the standard cautionary story about preserving his inventory at zero or getting tough on the sh**coin on line casino, however he says:

“In 2017 and 2018 we competed for Layer 1s. Ethereum, Cardano, Litecoin, NEO… properly, Bitcoin gained that one. So then the crypto story went to DeFi and that every one fell aside, then crypto went to NFTs, and that every one fell aside, and now it is meme cash. Nobody is saying it is a world-changing expertise.”

He admits that meme cash (and altcoins generally) could serve some function as a “gateway drug” to convey individuals to Bitcoin. “Individuals come for the cash and so they keep for the liberty,” as they start their Bitcoin journey and uncover why they want permissionless, censorship-resistant cash within the first place.

“I feel that is what stablecoins result in as properly,” he says, “ultimately individuals get used to having a pockets and transferring digital belongings, however then they marvel why their US greenback stablecoins supply them fewer items and providers purchase, and why Bitcoin buys them extra. , and I feel it is going to all cross ultimately.

The flawed Fiat system and the magical cash printer

Mark says the largest drawback with fiat is that it has no capital prices.

“Once you begin to perceive cash, you perceive that if printing cash makes individuals wealthy, why do not we simply print much more? Cash will need to have an actual value of capital. So for instance, gold I’ve to purchase land and tools and spend power and capital to get the gold. With Bitcoin, new cash are solely launched for those who spend the cash and do the work to get them. So the capital will need to have actual prices. You’ll be able to’t simply print cash out of skinny air, in any other case we would all be wealthy.”

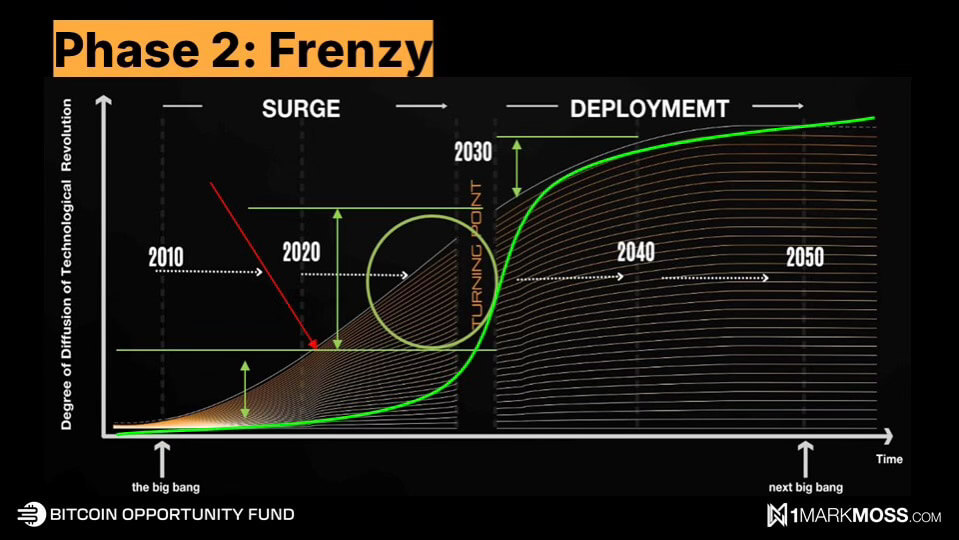

He factors to the S-curve model for measuring Bitcoin adoption.

“The way in which an S-curve works is that the time it takes to achieve 10% adoption is similar because it takes to achieve 80-90%. So you possibly can see that on this second part [between 2020 and 2030] is the place we obtain essentially the most development. We had a retail adoption that delivered that [Bitcoin] to $1.2 trillion between 2010 and 2020, after which with institutional adoption the 90% will come.”

What does a world with 90% Bitcoin adoption seem like? Is there an inevitable collapse of the fiat system and Armageddon on the streets? Mark pauses and shakes his head.

“I feel an enormous false impression is that individuals suppose Bitcoin has to achieve $1 million [something Mark envisions cerca 2030] or $10 million per coin, then which means fiat is nugatory and now it’s $1 million for a gallon of gasoline, however that’s completely not true.”

A reallocation of priceless belongings

Evaluating Bitcoin adoption to market disruptors corresponding to Uber and Airbnb, he says:

“Airbnb takes a bit of bit from the accommodations. It doesn’t suggest that accommodations will disappear, simply as Uber is getting an increasing number of out of taxis. Bitcoin doesn’t take something away from the greenback. Bitcoin is shifting away from different priceless belongings, corresponding to gold, shares, bonds and actual property.”

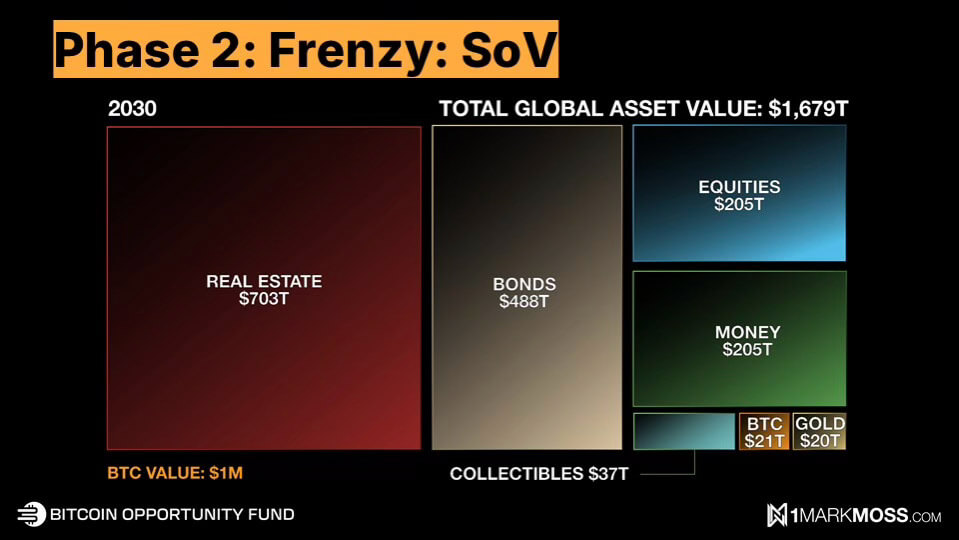

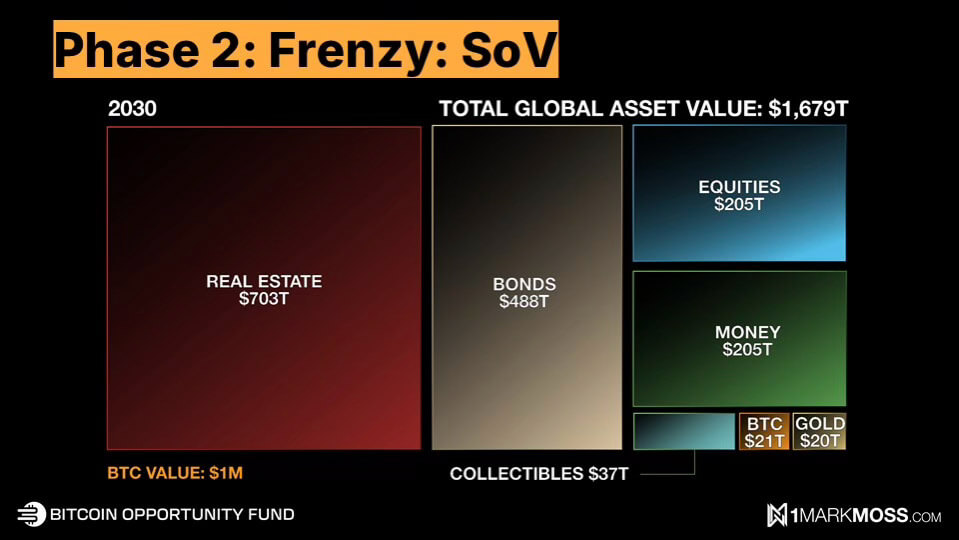

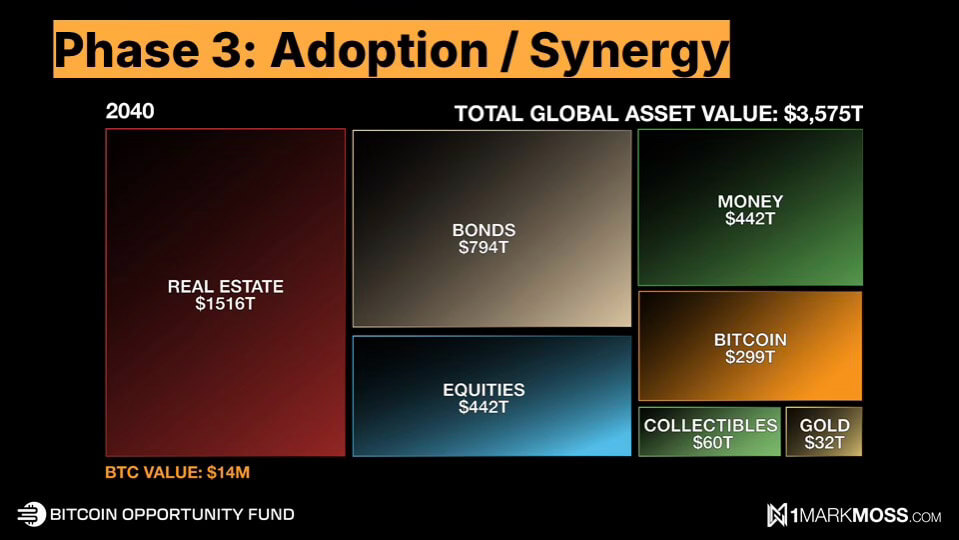

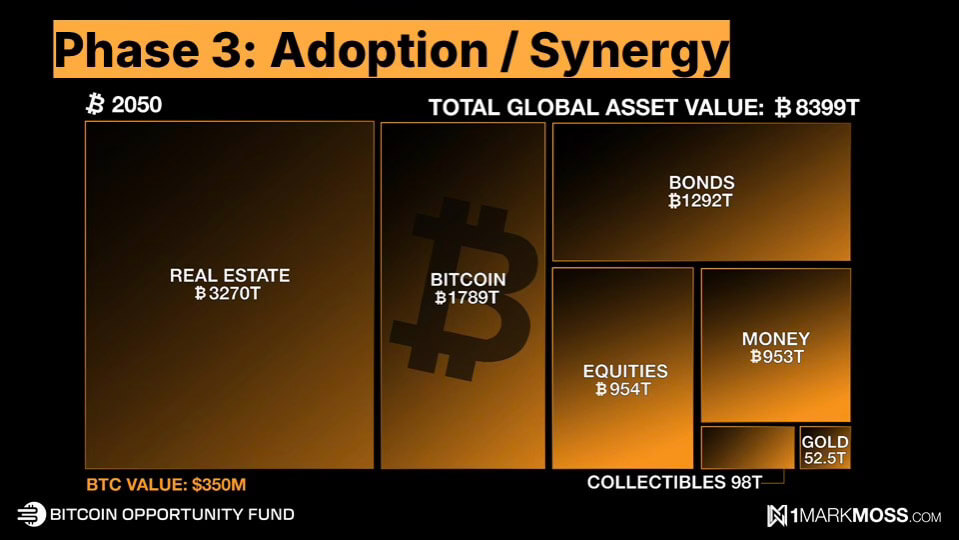

He pulls out three charts evaluating Bitcoin to shops of worth as its value, dimension and market capitalization enhance.

“Bitcoin may develop to $21 trillion by 2030, which suggests $1 million per Bitcoin, however that does not imply all these different belongings disappear. It’s much like gold. It takes a bit of little bit of bonds, a bit of bit of cash and a bit of little bit of shares.”

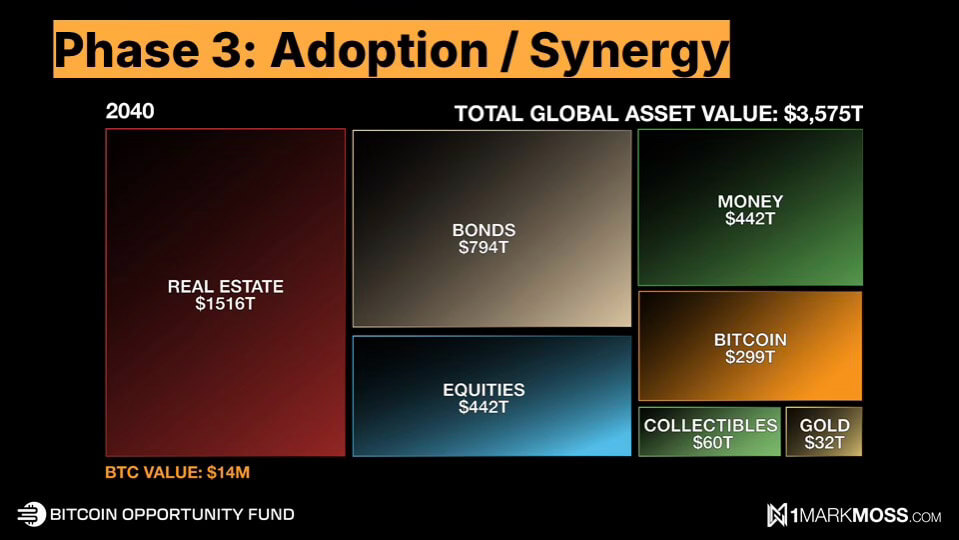

“Quick ahead to 2050, Bitcoin will develop into the second largest asset class, however that does not imply the opposite asset lessons will disappear… By 2050, I imagine all store-of-value belongings will likely be priced in Bitcoin moderately than US. {dollars}, after which one Bitcoin will likely be value one Bitcoin, as an alternative of $100,000 or $1 million.”

He brings up Gresham’s law in his plea for the greenback’s survival.

“Gresham’s Legislation states that dangerous cash drives out good cash. An instance of that is that in the US till 1965, quarters and dimes have been manufactured from pure silver. After ’65 they began making them out of junk metallic. You’ll be able to’t discover a pre-65 quarter and dime in circulation anymore, and for those who did, you would not spend it as a result of it is value about $4. So you’ll make it. The dangerous cash drove out the great cash, pushing out the pre-65s. So I’ll at all times need to use fiat and retailer my Bitcoin.”

‘Good occasions’ forward for Bitcoin

The incoming president’s son, Eric Trump, delivered a keynote on the occasion, stating:absolutely love Bitcoin”, through which he congratulated Bitcoiners for his or her imaginative and prescient, declaring that “America should lead a digital revolution”, and describing the second he referred to as his father at 6 a.m. on the day Bitcoin reached $100,000, which led to the now notorious “You are welcome” put up on Fact Social. So does Mark anticipate a golden age for Bitcoin in the US? Will we see a resurgence in innovation and a return of the expertise that bled out to different jurisdictions throughout earlier administrations?

“The brand new authorities will definitely be optimistic in regards to the sector,” he says. “It is not likely that Bitcoin that was on the poll. What was actually on the poll was freedom. The liberty to decide on the way you need to retailer your cash and the way you need to deal with your cash.”

He sees Trump making a “a lot friendlier” surroundings for companies, however he doesn’t foresee an enormous return of the businesses that left. “When you’re gone, you are sort of gone. Why would you come again?” he asks. “However possibly we’ll decelerate the businesses that depart and possibly much more will keep.”

What a few nationwide strategic reserve in Bitcoin fueling the worldwide Bitcoin sport idea? He estimates the prospect at 80%.

“I imply, RFK mentioned he would do it and he is now within the Trump administration. Trump mentioned he would. We’ve a crimson Republican Home, a Senate, and a Pink Presidency, and we have already got the invoice launched by Senator Lummis. It simply must be authorized. Possibly it is going to fail and they’ll resubmit it, however I’d say that may occur within the subsequent 24 months.”

One other prediction Mark has for the following 24 months is that US banking establishments will begin escrowing Bitcoin, promoting Bitcoin, and providing Bitcoin merchandise.

“Final yr, the banks tried to undo an SEC rule referred to as SAV21, which prevents banks from taking Bitcoin into custody. It obtained to President Biden and he vetoed it. So we all know that is what they need. They already tried to overturn it and Biden vetoed it. I believe that when Trump takes over, they are going to resubmit it and it will likely be authorized… these are good occasions,” he says, beaming, “I’m optimistic. I’m very optimistic.”

To listen to extra about Mark’s views on Bitcoin and the levels of worldwide adoption, observe him on Xcatch his main note from Bitcoin MENA, or watch his instructional movies at his YouTube channel.

Talked about on this article

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now