Bitcoin

Bitcoin’s road to $68K – Traders, watch out for these ongoing trends!

Credit : ambcrypto.com

- BTC’s NVT ratio indicated that it was undervalued on the charts

- A variety of numbers had been bearish, indicating a decline in the direction of $57k

Bitcoin [BTC] Traders had a blast on the time of writing because the king of cryptos’ value motion turned bullish as soon as once more. BTC’s newest value surge additionally pushed a key indicator into the bull zone. Subsequently, it’s price taking a more in-depth take a look at the present state of the cryptocurrency to see how lengthy bulls can maintain this new uptrend.

Bitcoin turns bullish once more

Bitcoin breached the $61,000 degree on August 23 and sentiment across the coin has been bullish ever since. In actual fact, the crypto was rapidly approaching $65,000. In line with CoinMarketCapFor instance, the value has elevated by greater than 5% within the final 24 hours.

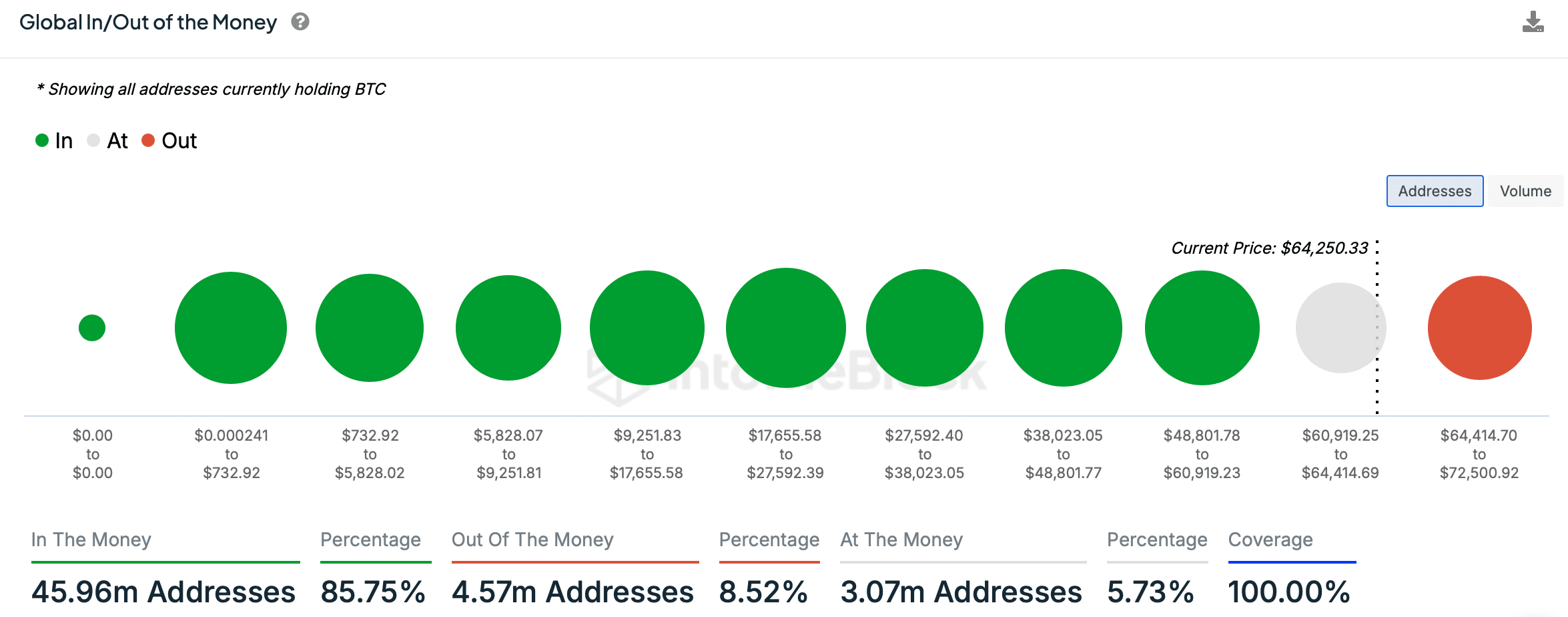

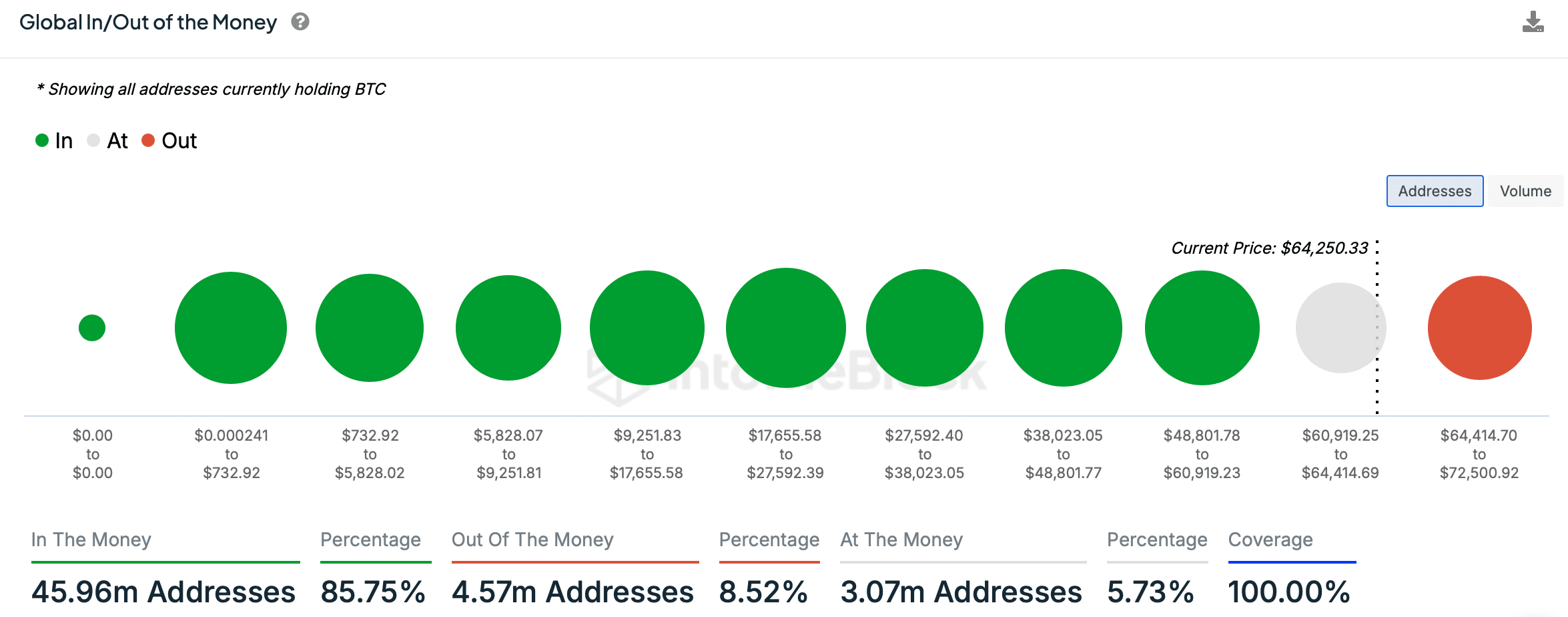

On the time of writing, BTC was buying and selling at $64,276.61 with a market cap of over $1.26 trillion. Due to this value enhance, virtually 86% of BTC traders made a revenue.

Supply: IntoTheBlock

Nonetheless, that is not all.

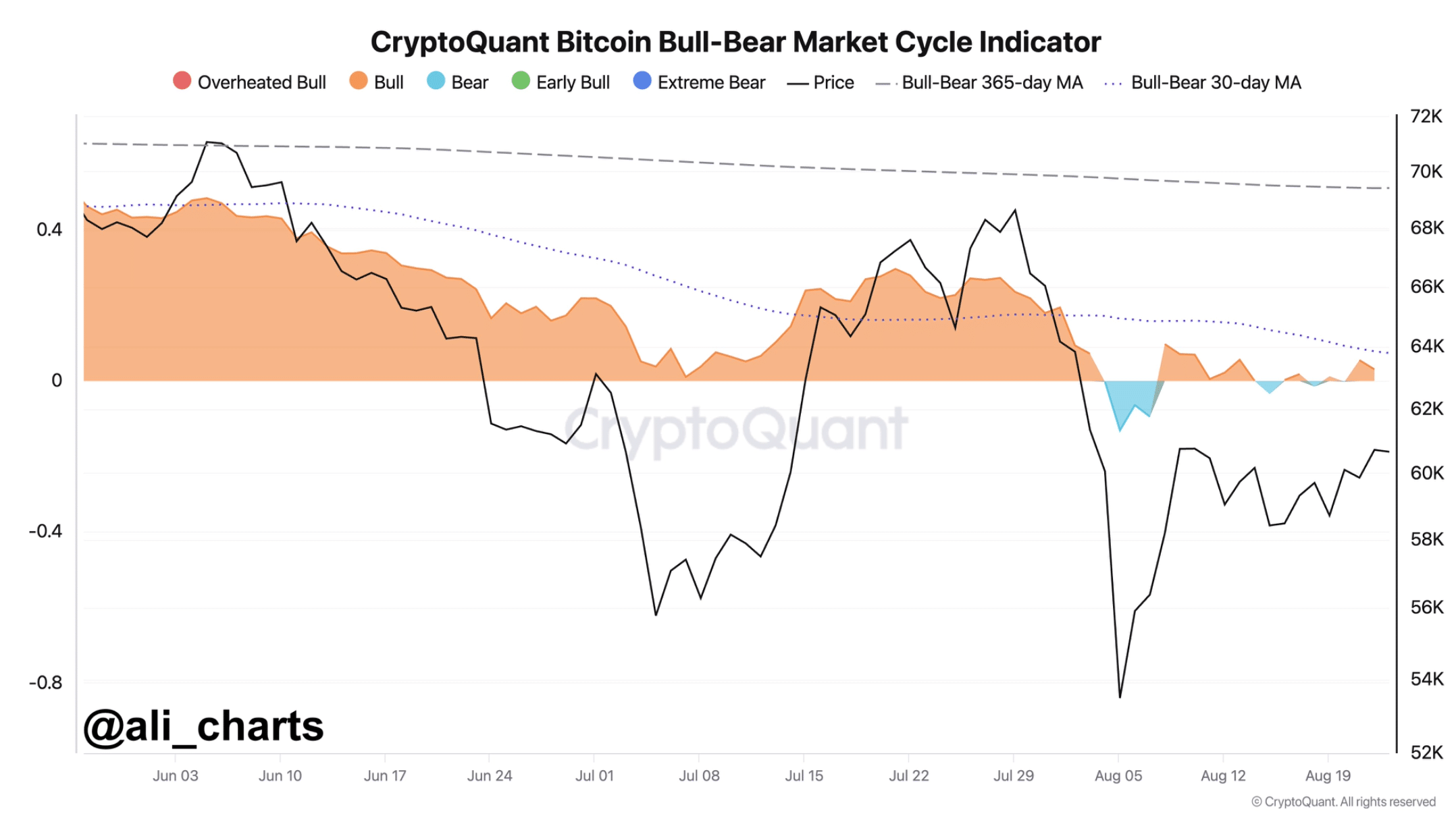

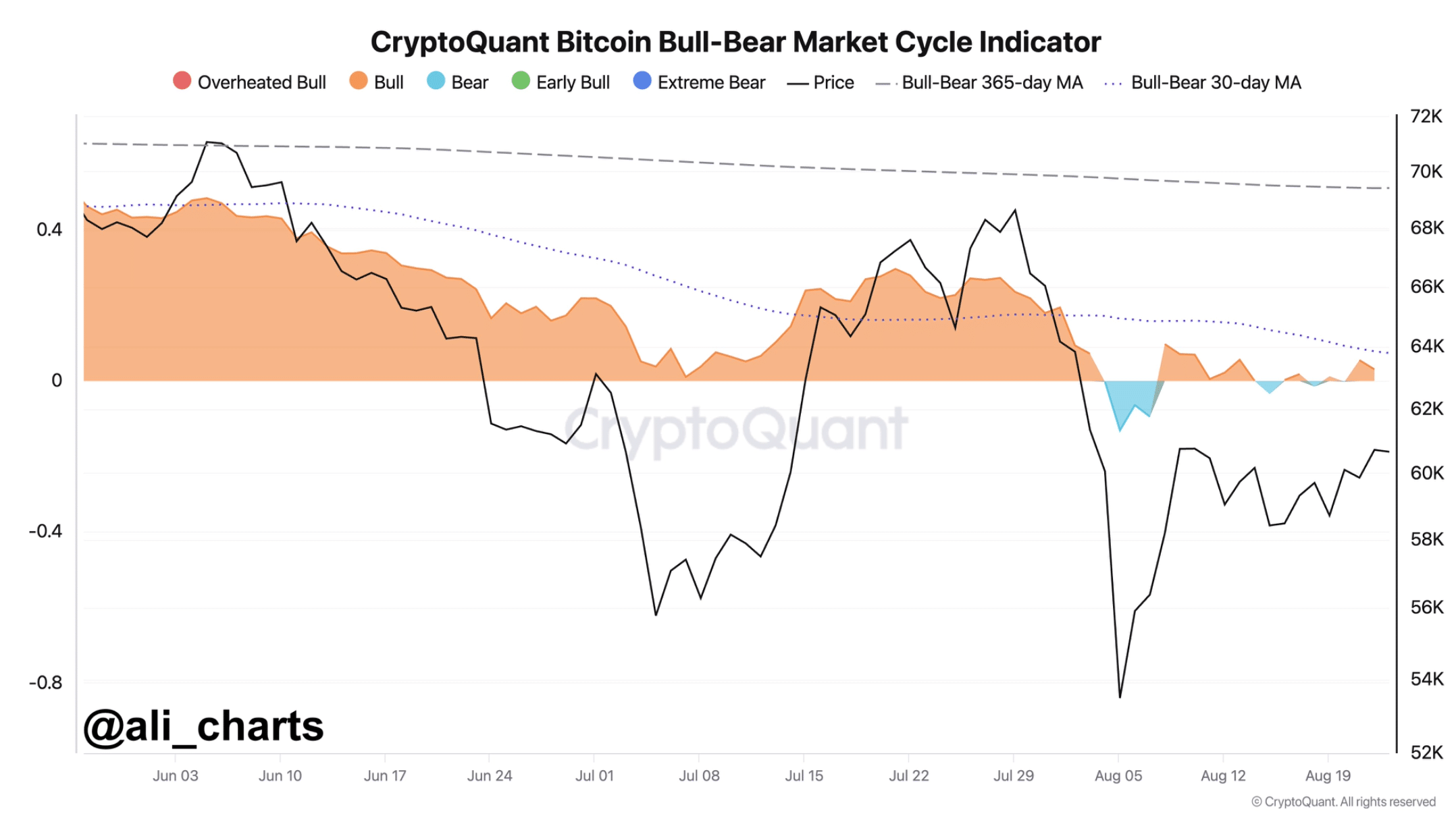

Ali, a well-liked crypto analyst, just lately shared one tweet which exhibits a bullish improvement. In line with the identical info, BTC’s bull-bear market indicator has been fluctuating between bearish and bullish since early August. Now the value has turn out to be bullish once more.

Which means BTC’s newest upswing might proceed.

Supply:

BTC’s upcoming aims

Because the aforementioned indicator turned bullish, AMBCrypto checked different information units to learn how probably the King Coin is to stay bullish.

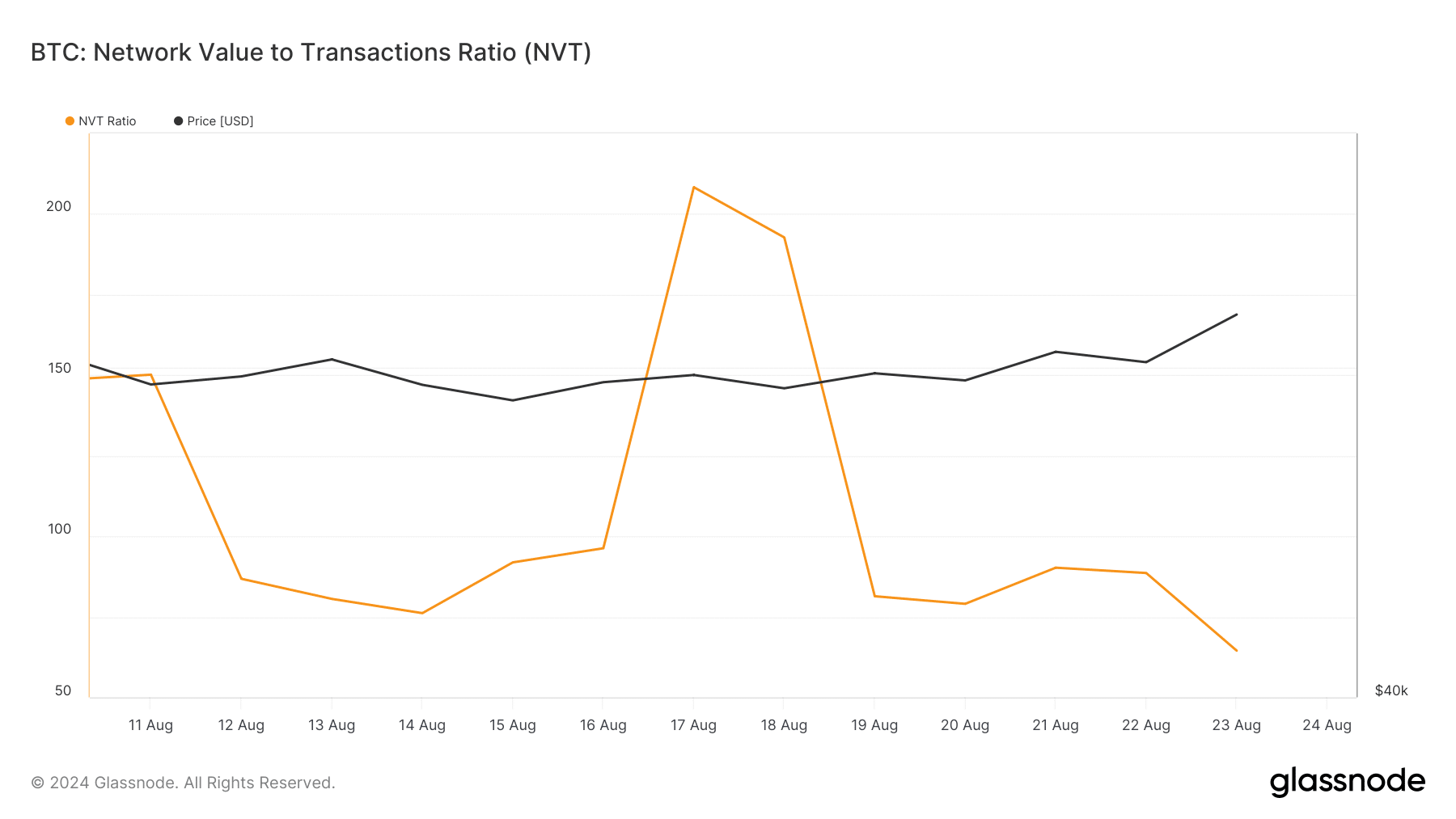

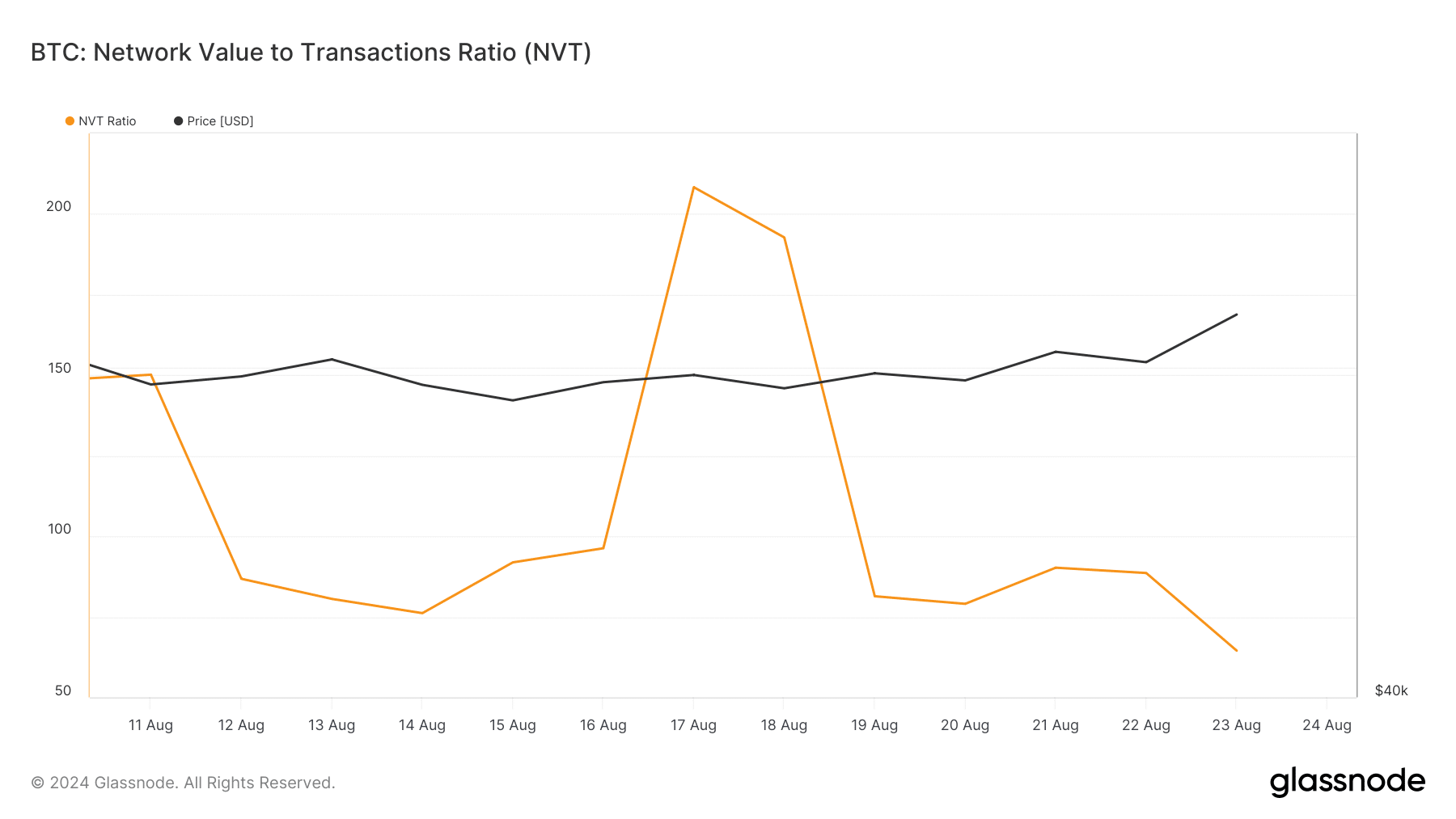

Our evaluation of Glassnode’s information confirmed that BTC’s NVT ratio registered a pointy decline. A decline on this measure means an asset is undervalued, indicating a value enhance on the horizon.

Supply: Glassnode

Moreover, in line with CryptoQuant’s factsBTC’s internet deposits on the exchanges had been low in comparison with the typical of the previous seven days, indicating a drop in promoting stress. Aside from this, AMBCrypto reported earlier that the NASDAQ shaped a bearish divergence sample. Which means a revival of promoting stress might see liquidity circulation from shares to Bitcoin.

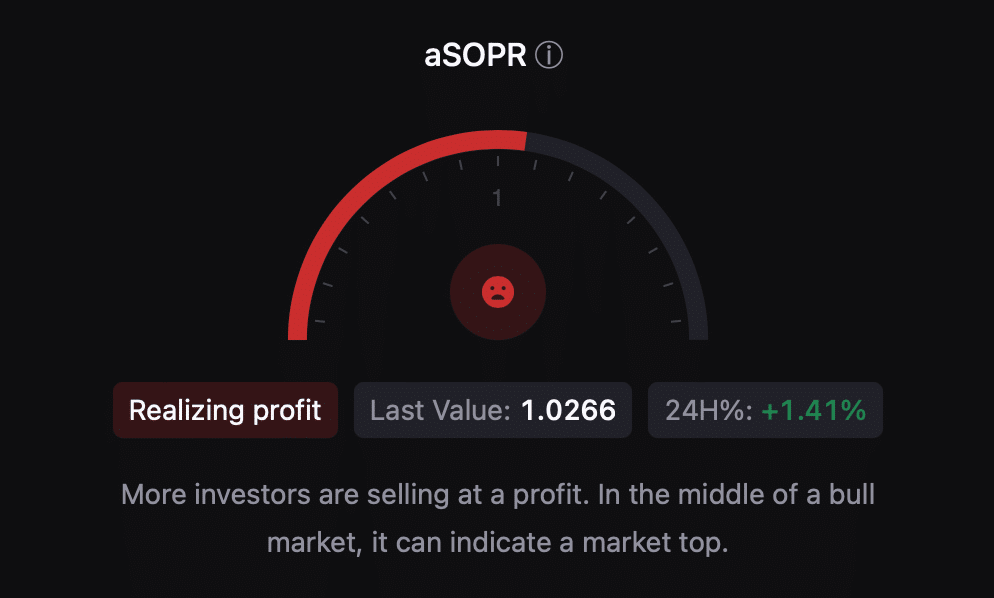

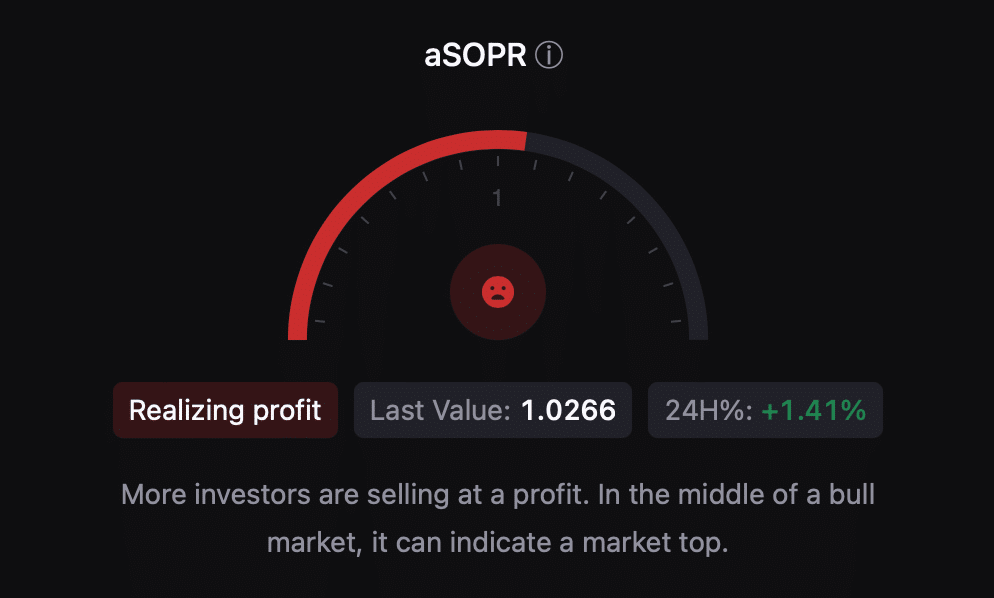

Nonetheless, some numbers turned bearish. For instance, the aSORP was crimson, that means extra traders had been promoting at a revenue. In the course of a bull market, this might point out a market high.

Additionally, the NULP identified that traders are in a religion section the place they’re presently in a state of excessive unrealized good points.

Supply: CryptoQuant

Subsequently, AMBCrypto checked the each day chart of BTC to raised perceive whether or not it will possibly preserve the bull momentum. The technical indicator MACD confirmed a bullish crossover. The Chaikin Cash Stream (CMF) additionally registered a revival.

Learn Bitcoins [BTC] Worth prediction 2024-25

If the bull rally continues, BTC might quickly transfer above the $65.2k resistance after which strategy $68k. Nonetheless, within the occasion of a bearish takeover, Bitcoin might fall again to $57,000.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024