Bitcoin

Bitcoin bulls watch $97K: Can Fed’s $400B liquidity injection help BTC?

Credit : ambcrypto.com

- The Fed injected $400 billion of liquidity into the US market on January 1.

- However the brutal sell-off of long-term holders has been absorbed by STH (short-term holders).

The US Federal Reserve (Fed) may flip away from quantitative tightening (QT), a transfer that would inject extra liquidity into the market and hit dangerous property like Bitcoin [BTC].

On January 1, one of many components used to measure the Fed’s QT was: Reverse Repo Facilityprinted $400 billion. This meant injecting $400 billion into the US financial system, growing market liquidity.

Will US Liquidity Injection Pump BTC?

Supply:

Traditionally, a pointy enhance within the Repo Facility has correlated with a powerful uptrend of BTC in 2021. Thus, BTC may anticipate upward momentum if the pattern repeats and the Fed’s liquidity injection continues.

Pseudonymous macro and crypto analyst Rooster Genius had beforehand acknowledged that the Fed’s QT would finish within the first quarter of 2025. said,

“Forecast: Quantitative Tightening (QT) Ends This Quarter.”

Lengthy-term holders are dumping Bitcoin

Regardless of the constructive replace on the macro entrance, BTC holders are long-term [LTH] have been to sell ruthless.

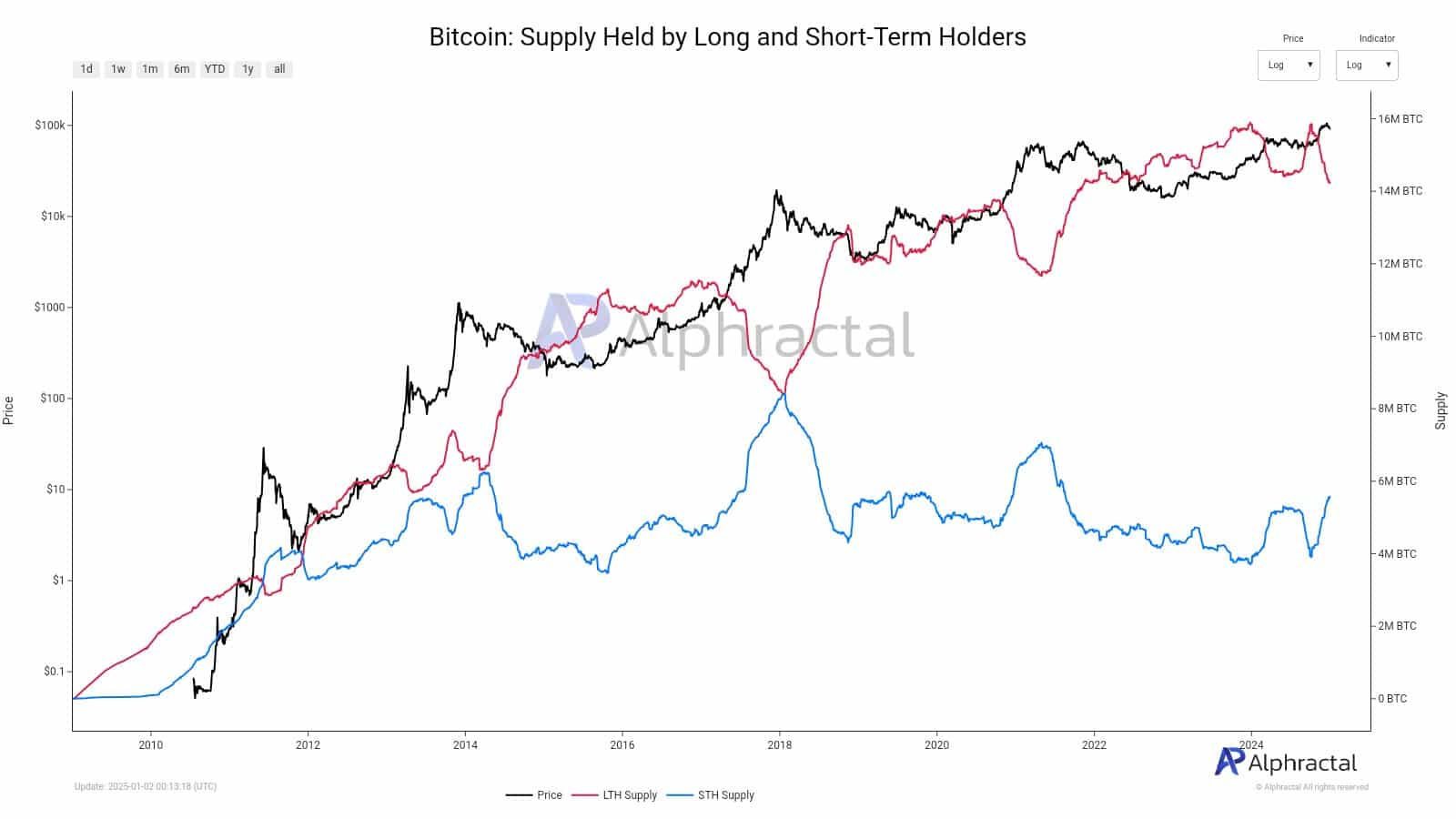

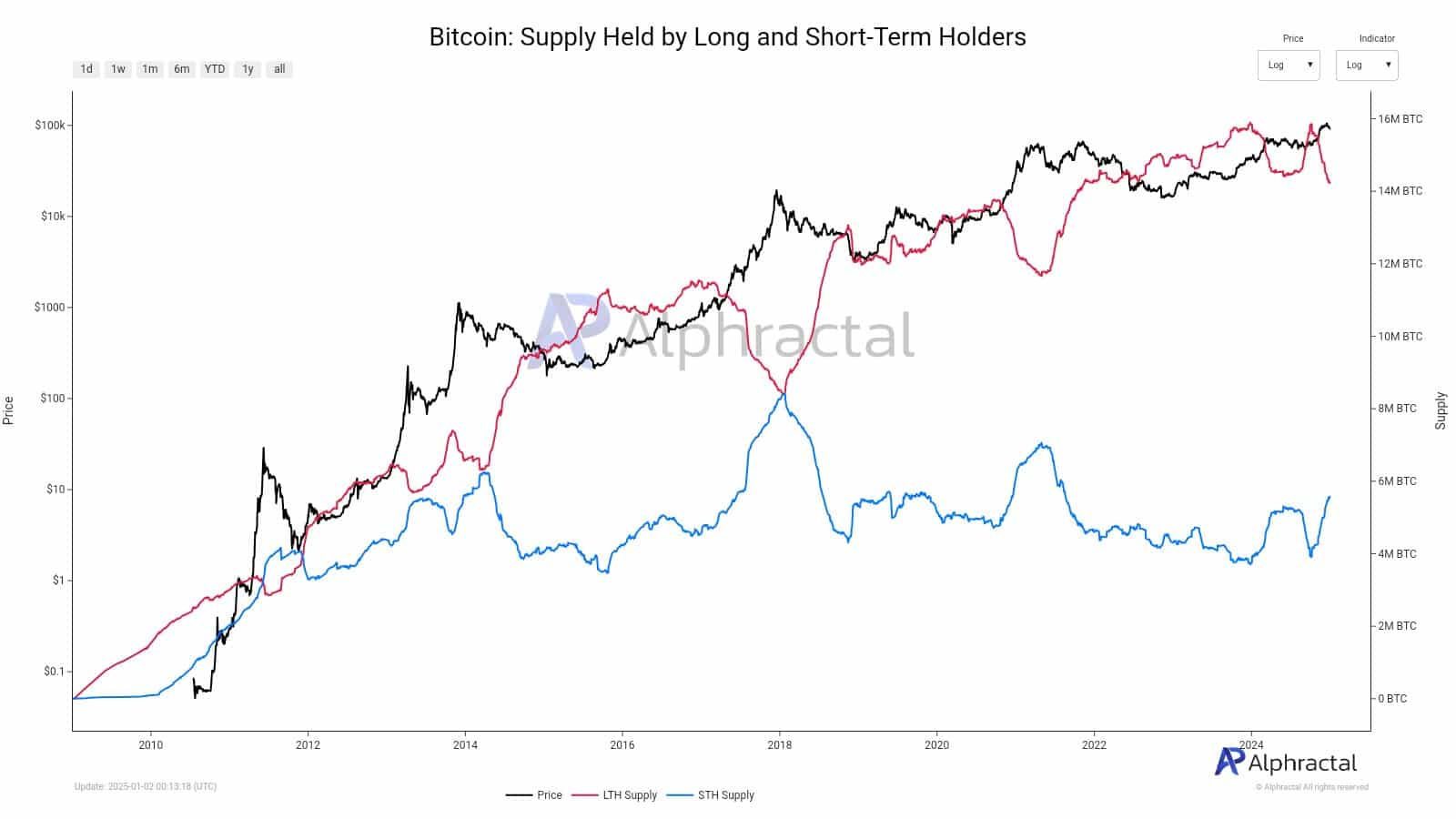

Supply: Alpharactal

Since mid-September 2024, LTH provide has shrunk from 14.2 million to nearly 13.1 million in early January 2025. In brief, they’ve bought greater than 1 million BTC cash in three months.

Nevertheless, short-term holders have absorbed nearly all the LTH sell-off. Throughout the identical interval, STH provide elevated from 2.5 million to three.8 million BTC.

Learn Bitcoin [BTC] Worth forecast 2025-2026

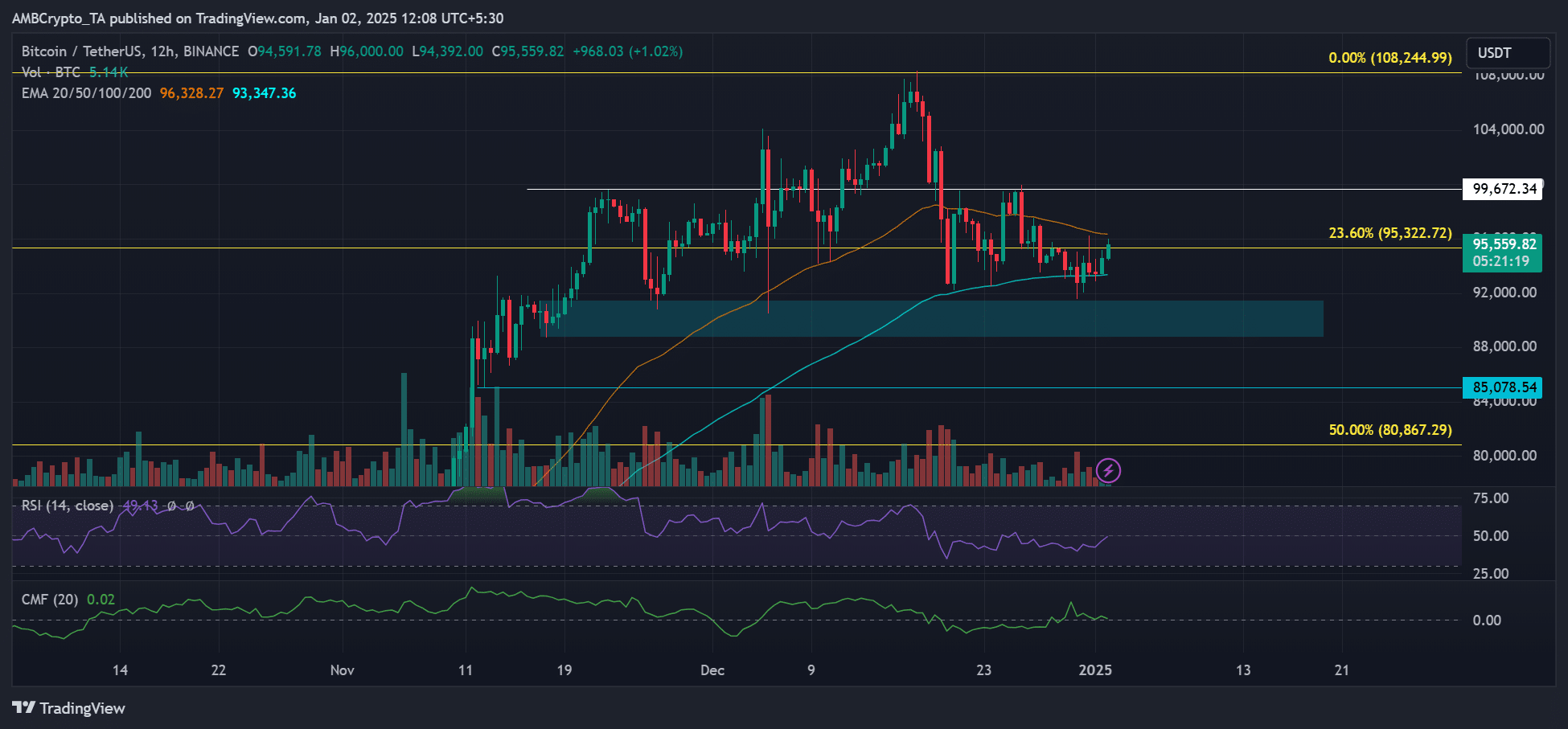

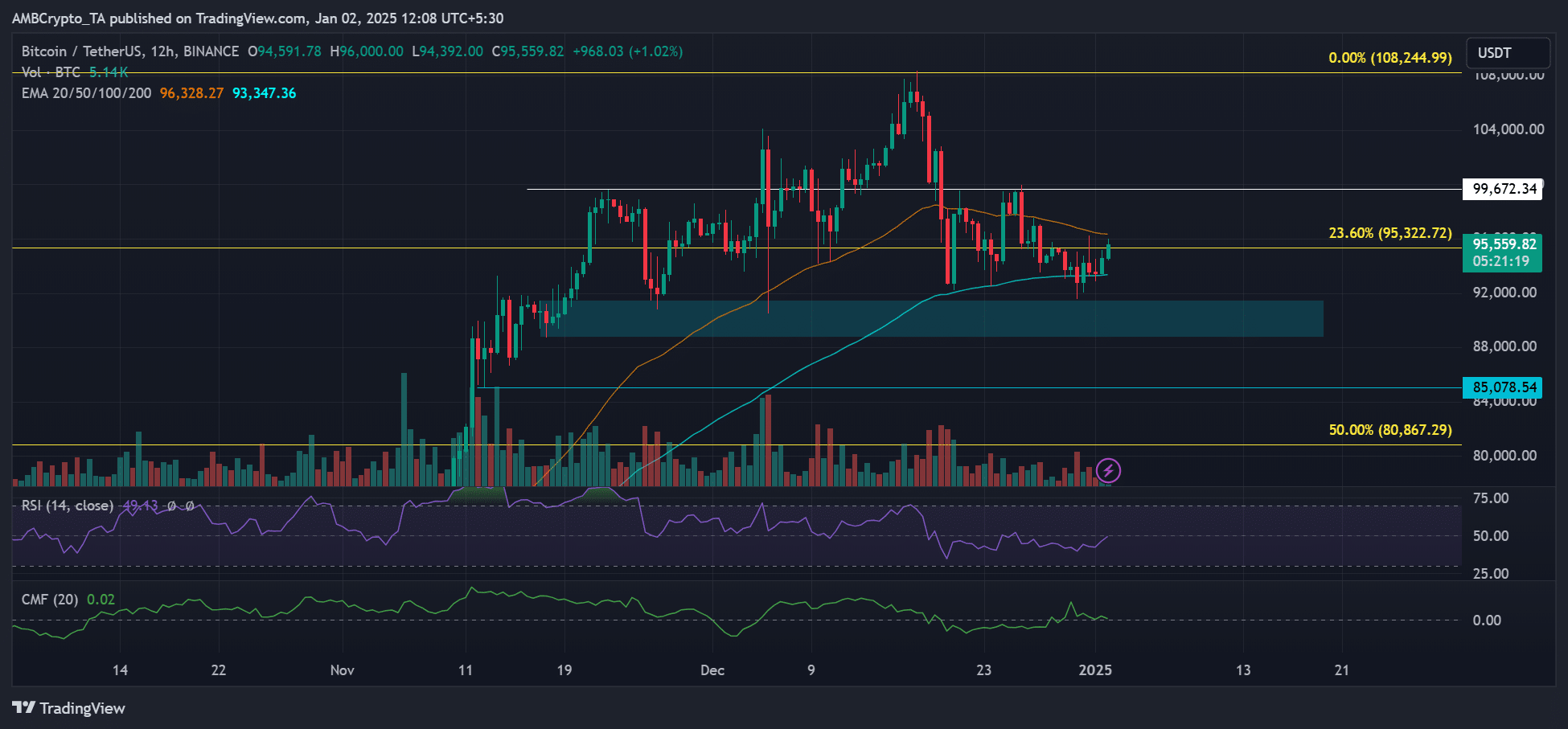

That mentioned, the cryptocurrency was trying to recuperate $95K on the time of writing. The upper timeframe market construction may flip bullish if it definitively closes above $97K and key transferring averages.

Supply: BTC/USDT, TradingView

Nevertheless, one other worth rejection at $97,000 may drag the worth in direction of the 100-day EMA of $93,000 or the asking help of $90,000 (cyan).

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now