Bitcoin

How did MicroStrategy’s Bitcoin bet pay off in 2024?

Credit : ambcrypto.com

- MicroStrategy and BTC had been the highest asset gamers on the planet in 2024.

- Will the corporate’s daring BTC technique repay once more in 2025?

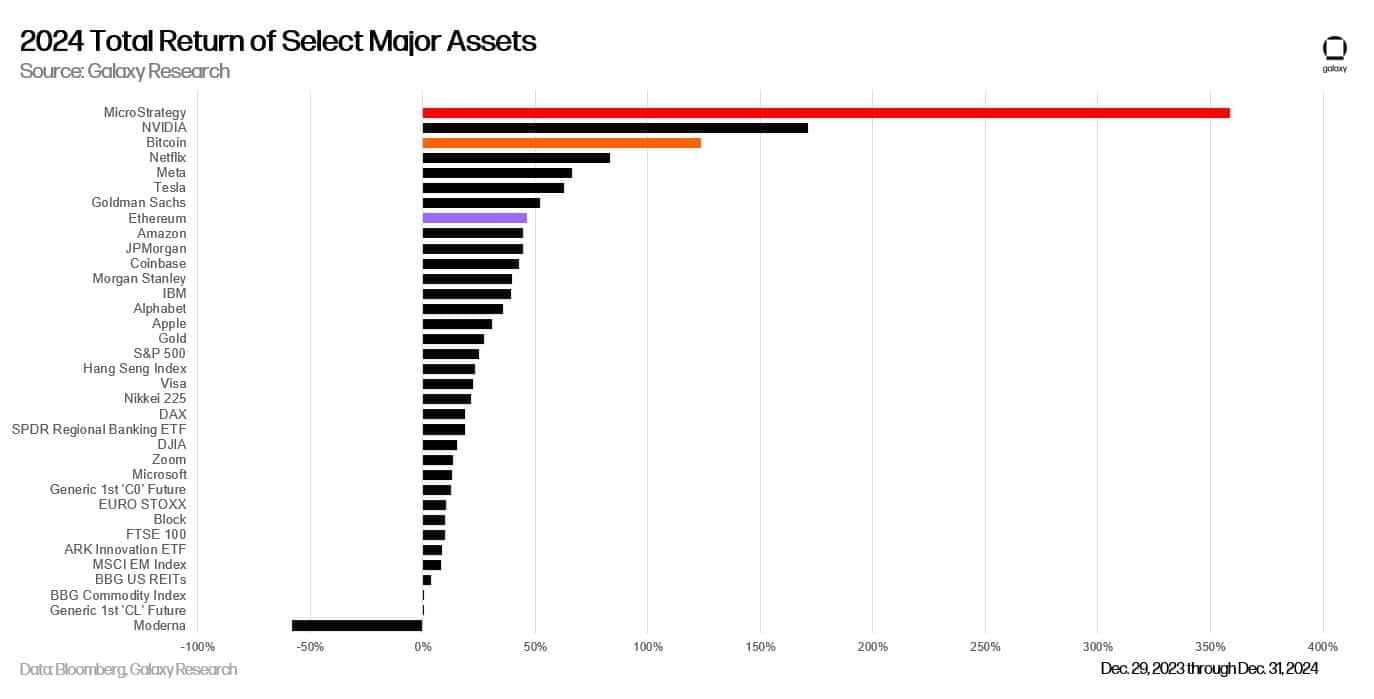

MicroStrategy is aggressive Bitcoin [BTC] The shopping for frenzy in 2024 seems to be paying off. In response to Galaxy Analysis, the corporate’s inventory, MSTR, was the most effective by way of property on the planet in 2024, with an annual achieve of 358%.

Supply: Galaxy Analysis

MSTR shared the highest spot with Palantir Applied sciences [PLTR]a software program firm that additionally affords knowledge analytics options to cryptocurrency corporations.

BTC completed in third place, whereas Nvidia got here in second. Alex Thorn, head of company-wide analysis at Galaxy Digital, famous that the highest two performers had been associated to BTC. He stated,

“Even on a risk-adjusted (sharpe) foundation, MSTR completed first and BTC third. Two of the highest three property in 2024 had been associated to Bitcoin.”

MicroStrategy’s BTC wager

MSTR’s exceptional annual efficiency was no shock. The corporate’s founder and former CEO, Michael Saylor, is a BTC maxi who believes the cryptocurrency will all the time outperform most US shares.

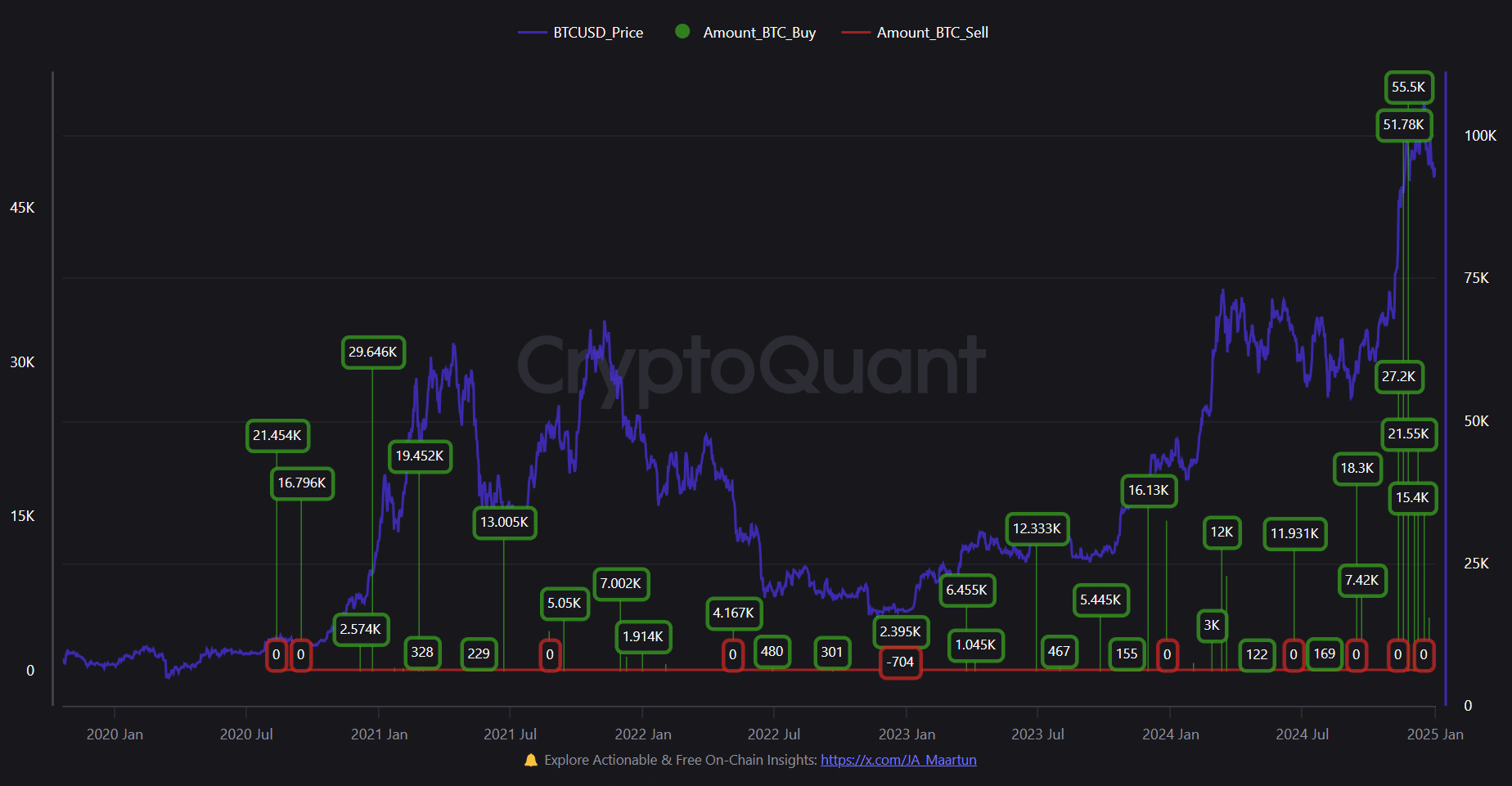

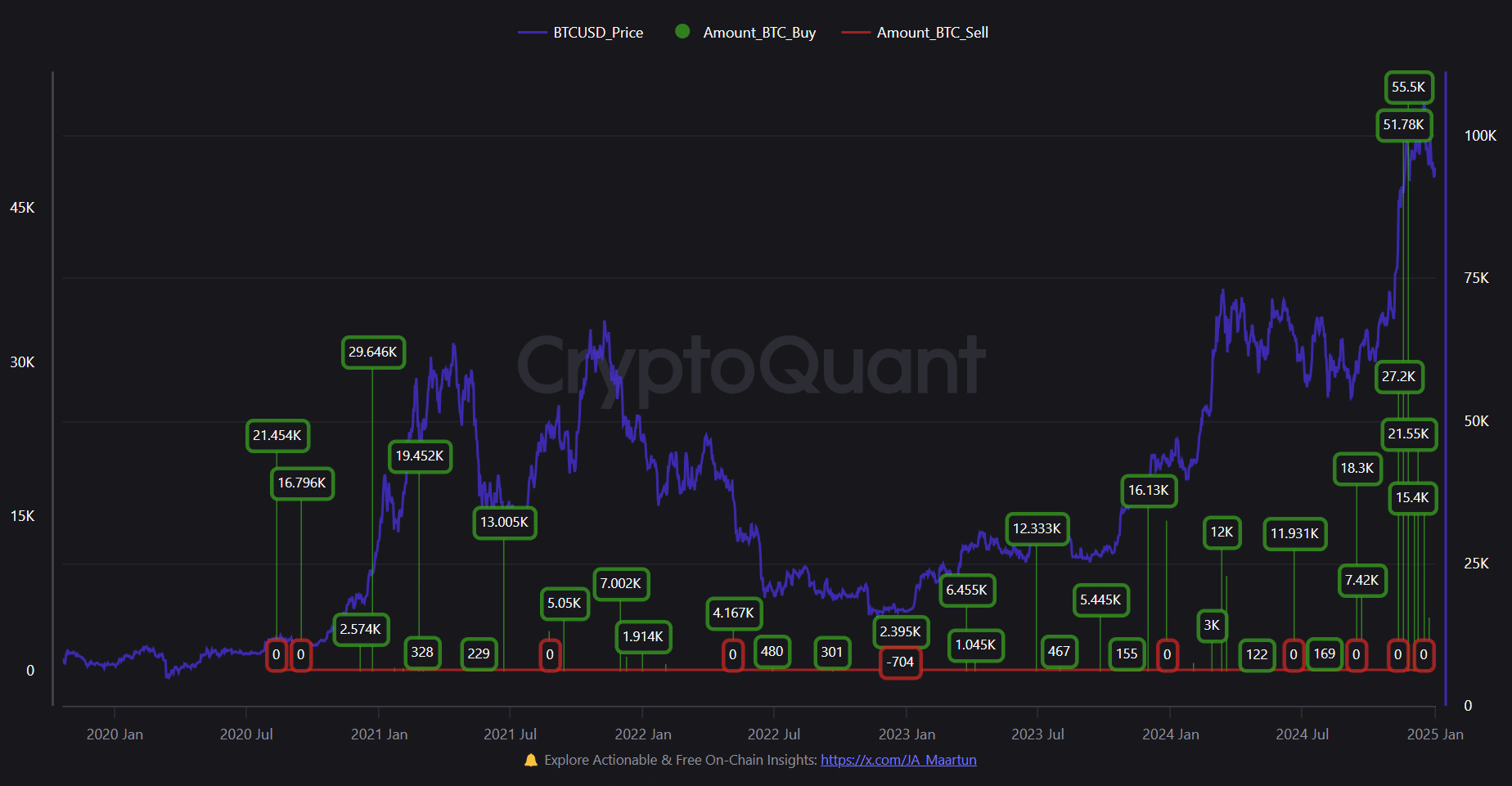

To capitalize on BTC’s progress, the corporate has acquired a good portion of the cryptocurrency (446.4K BTC) and now controls 2.2% of the whole provide as of the tip of 2024.

Curiously, probably the most aggressive shopping for spree occurred within the fourth quarter of 2024. In November alone, the corporate acquired greater than 107,000 BTC in two transactions, value greater than $10 billion.

Supply: CryptoQuant

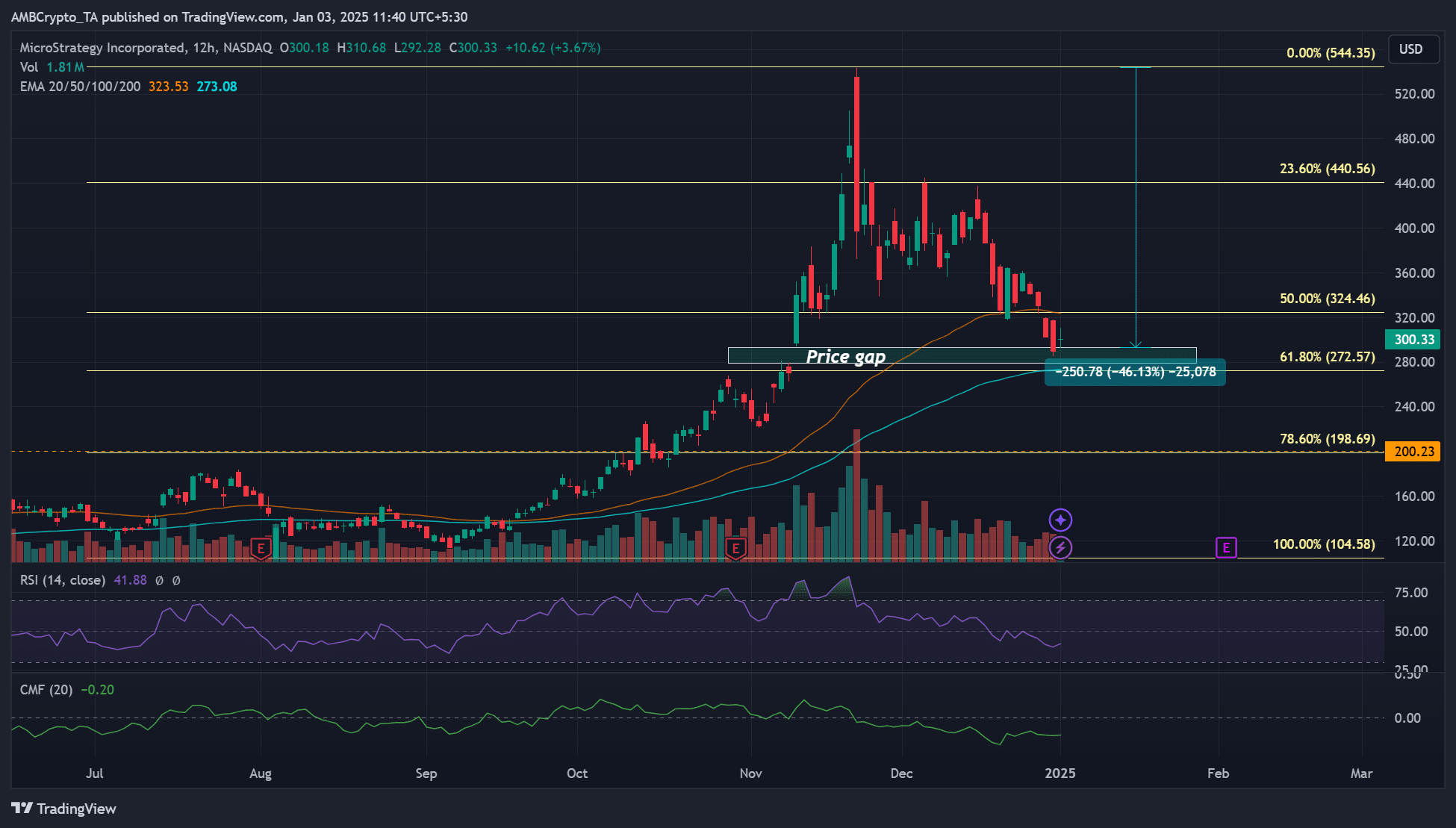

Whereas the tempo of acquisitions slowed in December, the corporate is poised to launch an enormous inventory issuance program to speed up its BTC technique. It is just lately introduced plans to extend the variety of shares of MSTR to greater than 10 billion to realize its objectives.

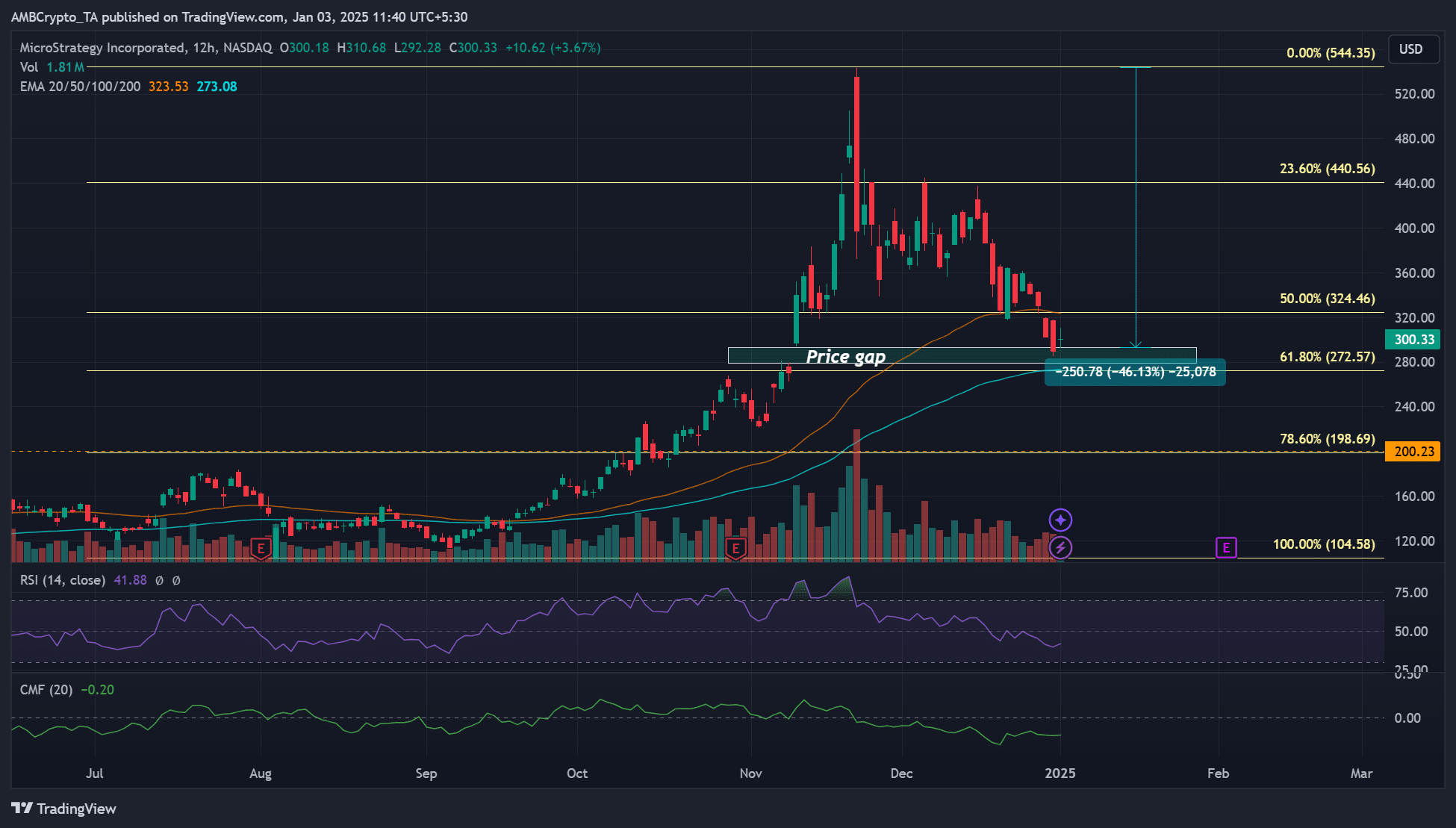

It stays to be seen whether or not MSTR’s daring wager on BTC will repay once more in 2025. In the meantime, the inventory fell 46% after an enormous BTC sell-off through the vacation season.

Supply: MSTR, TradingView

Throughout the identical interval, BTC fell from $108,000 to a low of $92,000 earlier than trying to recuperate to $97,000 in early January.

Nevertheless, the MSTR decline moderated as a result of coincidence of a worth differential and the gold ratio’s Fibonacci degree of 61.8% (close to $300).

Some market commentators consider that the latest low and weak sentiment might present the most effective low cost for purchasing MSTR.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024