Bitcoin

Bitcoin’s market steps back from ‘extreme greed’ – A positive sign?

Credit : ambcrypto.com

- Bitcoin left the zone of ‘excessive greed’ and will promote sustainable progress

- MVRV and Pi Cycle Prime indicators confirmed that BTC nonetheless had room for upside potential

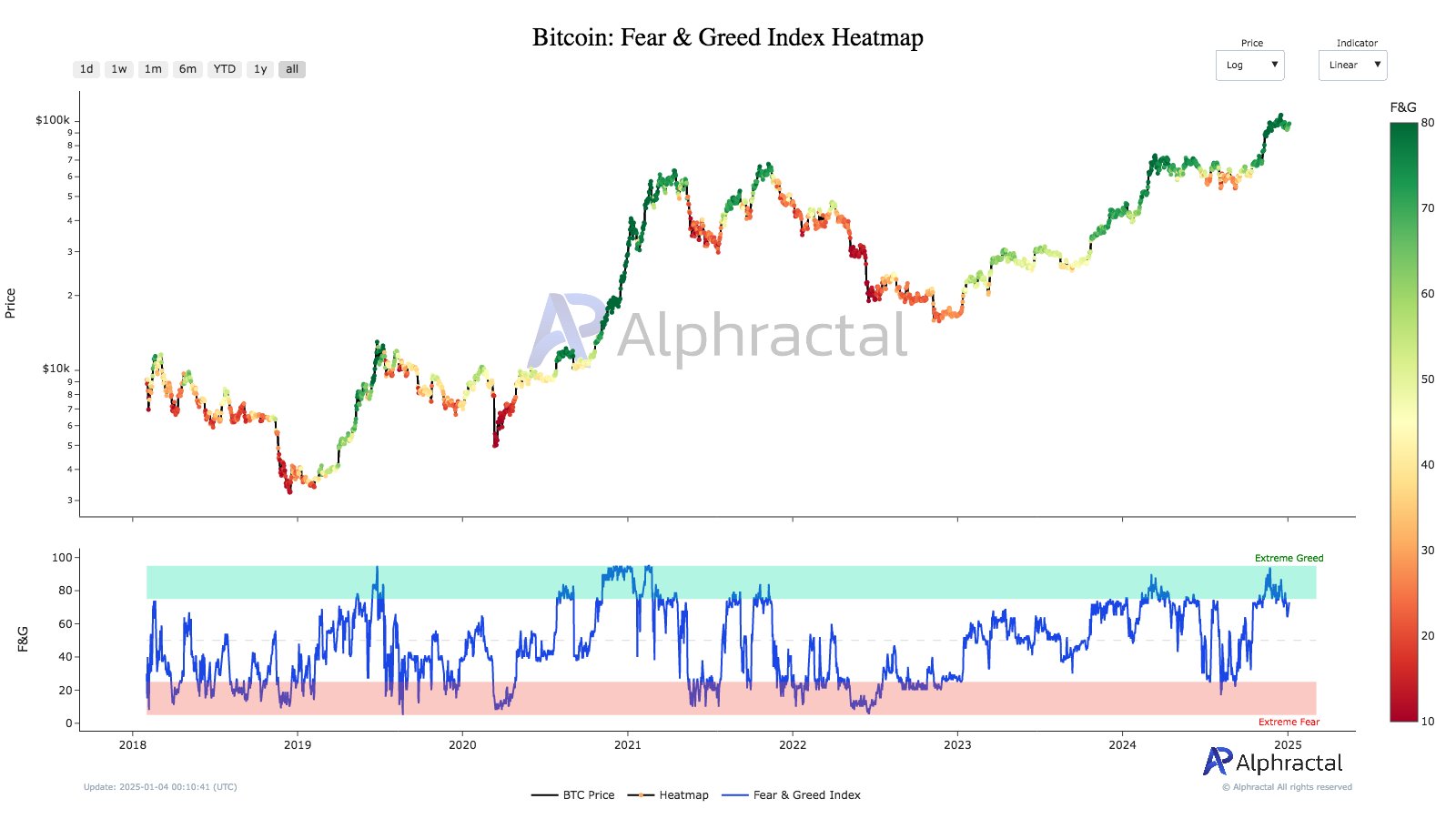

Bitcoins [BTC] Market sentiment has left the “excessive greed” zone for the primary time for the reason that Trump pump commerce started in November. This might present BTC with much-needed progress house.

So stated the pseudonymous on-chain analyst Dark Fostmarked the part of ‘excessive greed’ an overheated market and a possible pullback. In keeping with Fost, this led to the cryptocurrency’s drop from $108,000 to nearly $90,000.

Supply: Alpharactal

A setup for a sustained BTC rally?

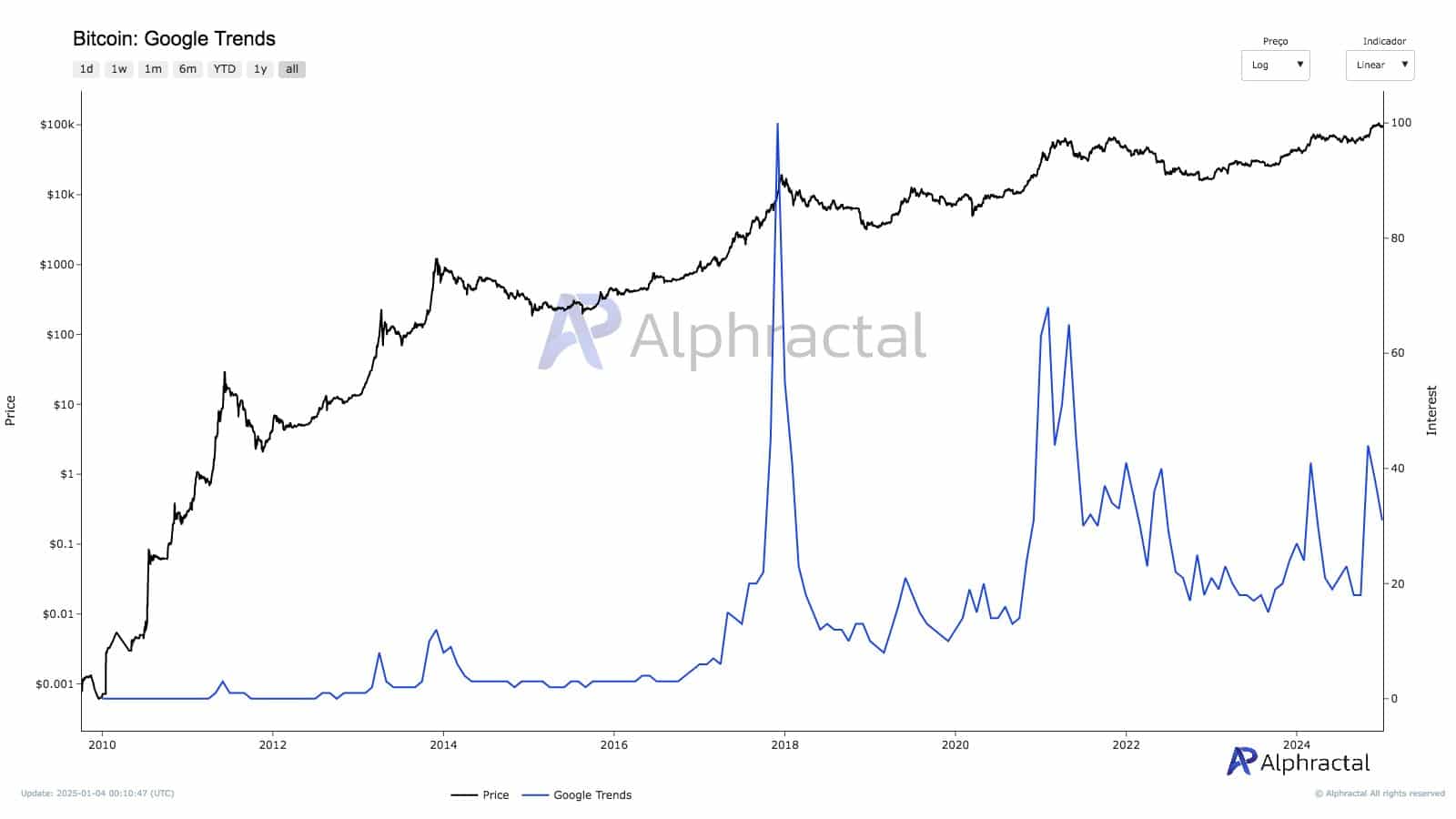

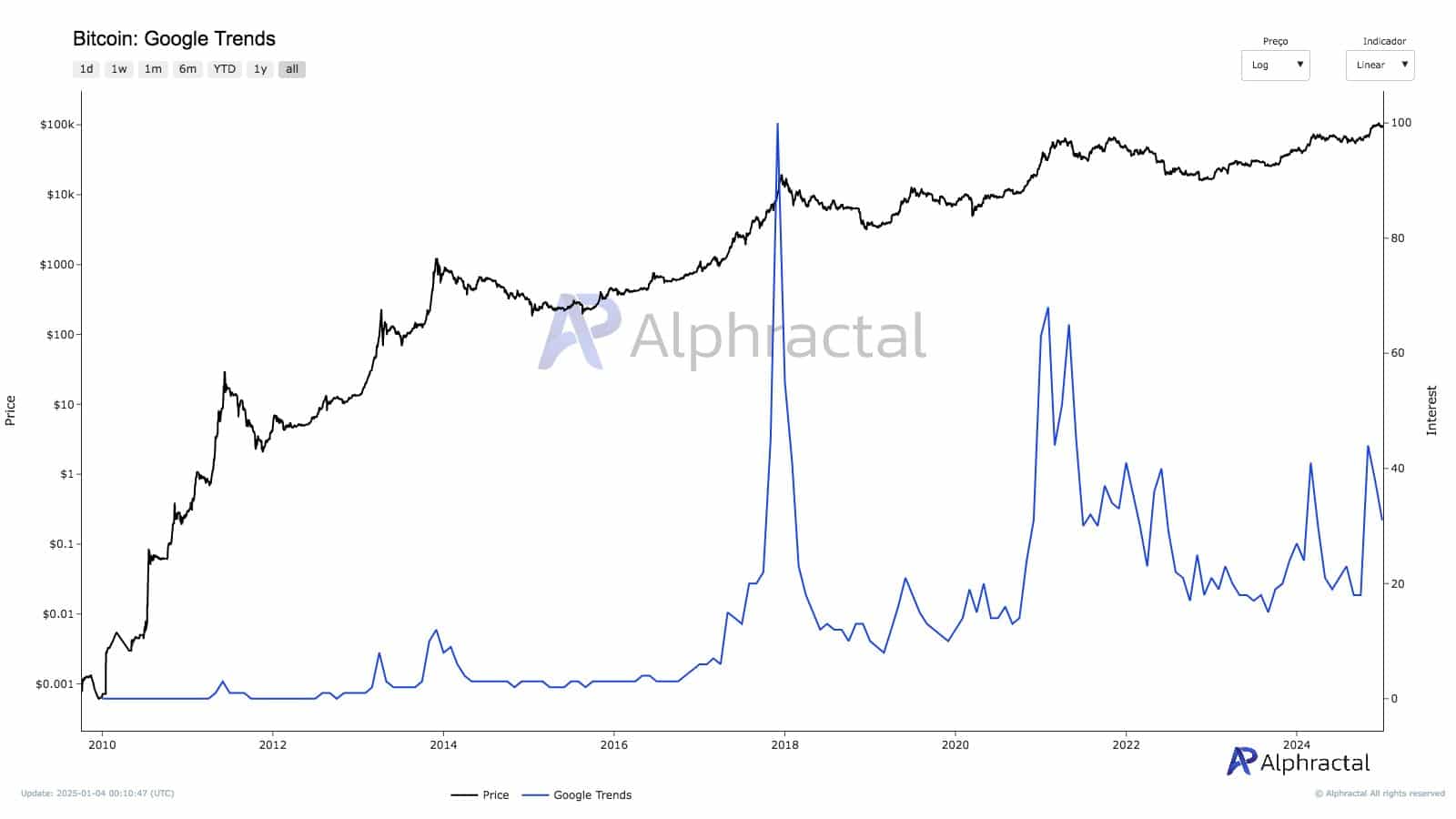

Moreover, new market curiosity in Bitcoin, as tracked by Google Tendencies, dropped considerably when the asset fell beneath the $100,000 mark.

Traditionally, an increase in Google Tendencies has all the time been related to euphoria and potential market corrections or tops.

Supply: CryptoQuant

All issues thought of, Darkish Fost famous that the above tendencies imply that BTC has extra room for progress within the close to time period. He acknowledged,

“Total sentiment stays constructive, however curiosity from potential newcomers stays comparatively low. This might result in a continuation of the bullish part within the medium time period.”

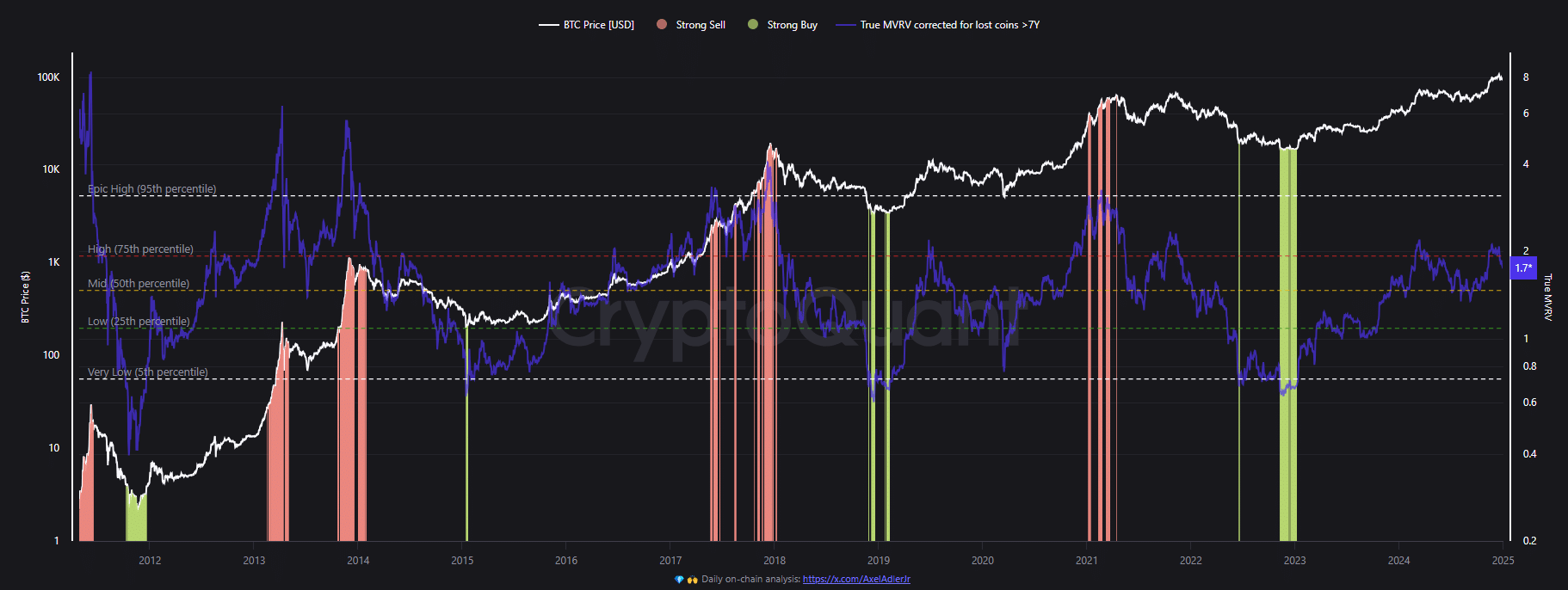

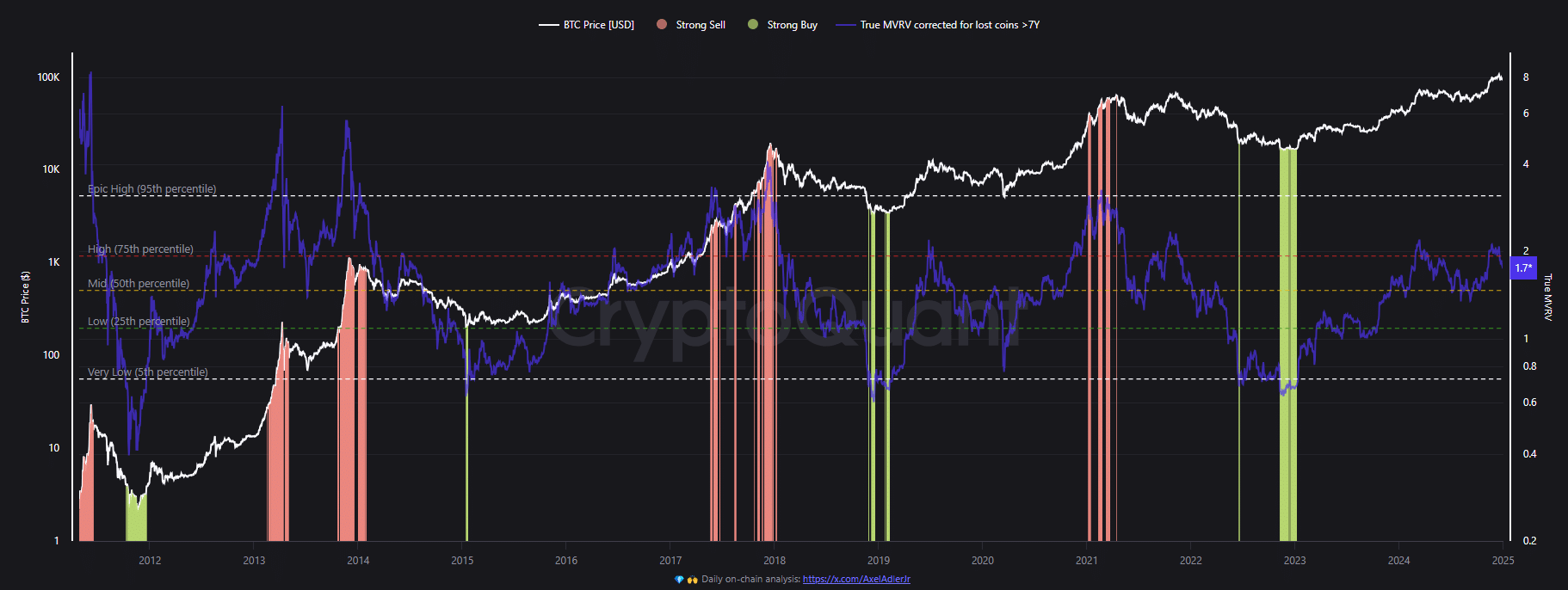

His statement was echoed by the True MVRV (Market Worth to Realized Worth) – a metric used to measure whether or not BTC is overvalued and to trace the market cycle.

Supply: CryptoQuant

The metric precisely displays earlier native and market cycle tops. In reality, the March and December highs of 2024 have been triggered when the benchmark ticked 2. Generally, a rise to 4 marked a cycle prime.

On the time of writing, the worth had fallen again to 1.7 and was removed from 4, indicating that BTC’s cycle prime is just not but shut.

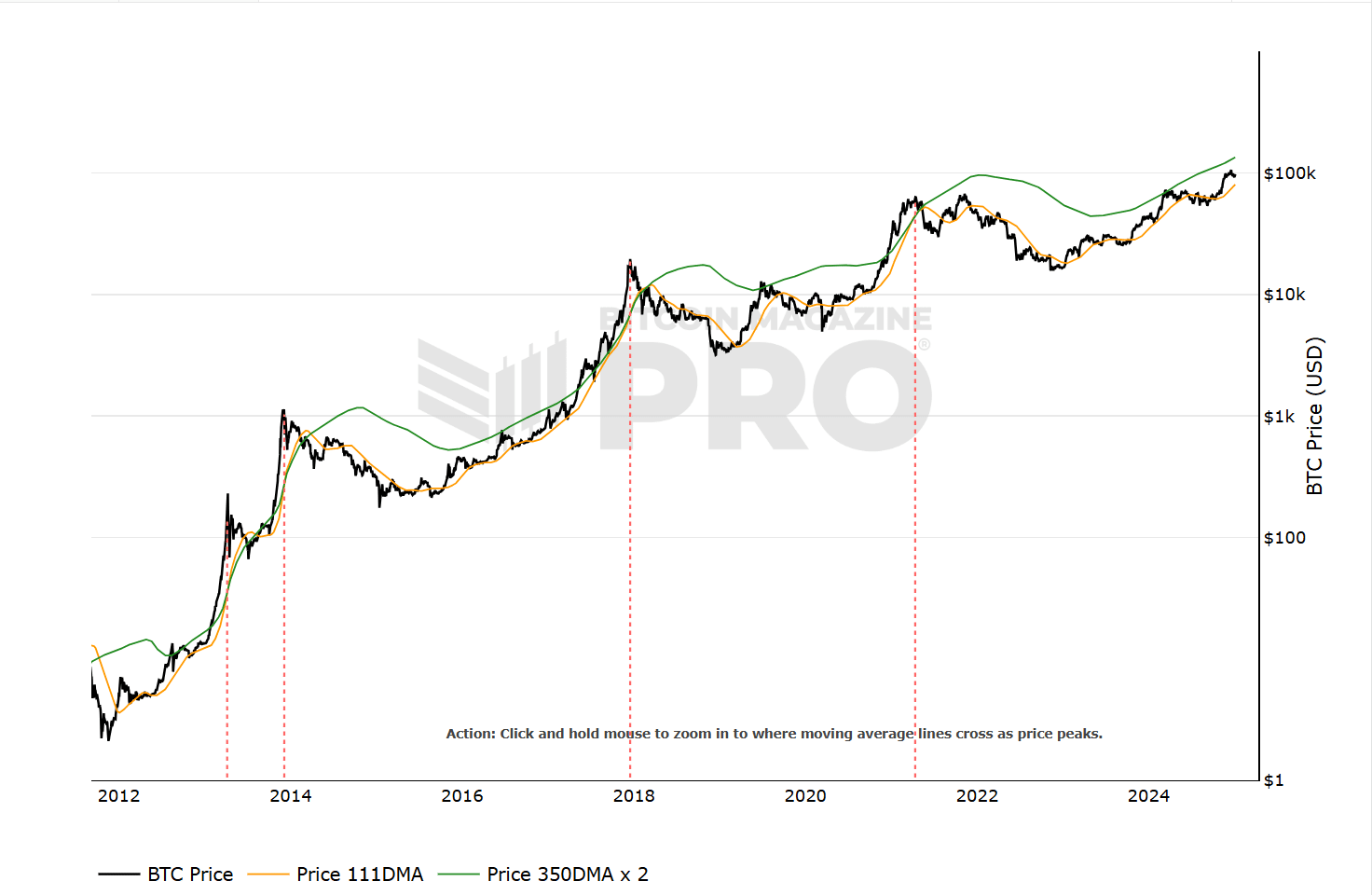

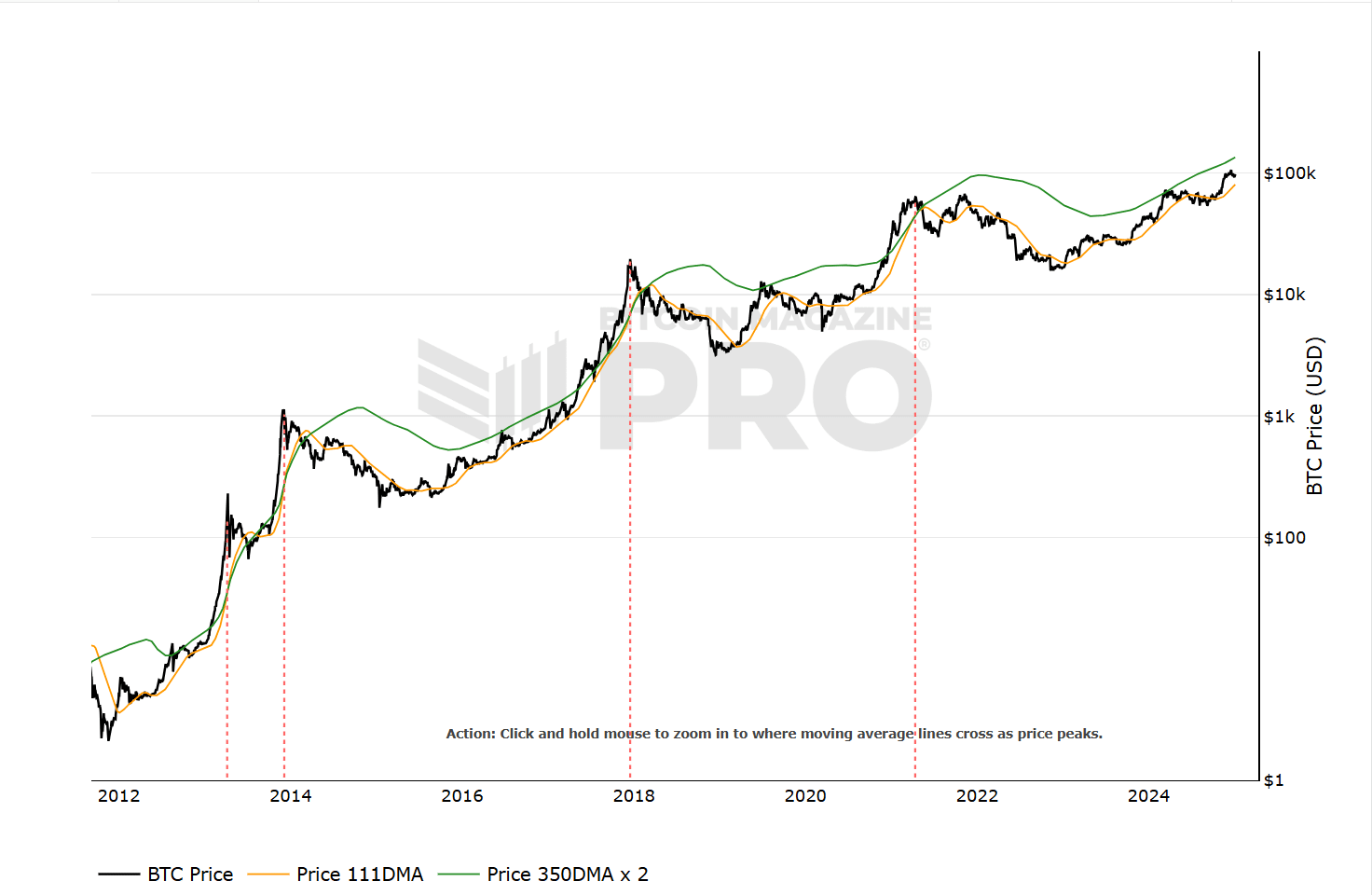

One other cycle prime indicator, the Pi Cycle prime, was removed from the set off for this market peak. The metric marked earlier market peaks when the 111-day transferring common crossed the adjusted 350-day transferring common and the adjusted cycle.

Learn Bitcoin [BTC] Value prediction 2025-2026

Supply: Bitbo

In abstract, BTC’s retreat from “excessive greed” could be seen as a welcome reduction for prolonged and sustainable progress over the medium time period. The potential for upside was additional illustrated by key market cycle prime indicators which have but to set off a possible peak for the cryptocurrency.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September