Bitcoin

U.S. Equities Flash Cautionary Signal for Bitcoin

Credit : www.coindesk.com

By Omkar Godbole (All instances ET until indicated in any other case)

It is nonetheless early in 2025, and already we’re seeing a major divergence between bitcoin and the S&P 500.

BTC is trying to safe a foothold above $100,000, and its Deribit-listed choices are indicating a bullish bias. The identical cannot be stated of the S&P 500, which has a historical past of offering risk-on/off cues to danger belongings, together with BTC.

Based on Cboe knowledge, the SPX choices skew now displays better draw back danger than it did a yr in the past.

The defensive positioning in shares maybe stems from considerations that President-elect Donald Trump’s Jan. 20 inauguration might be a “sell-the-news” occasion. Danger-taking has picked up throughout monetary markets up to now two months in anticipation of pro-corporate and pro-economy reforms underneath Trump’s presidency, and profit-taking can’t be dominated out.

“Broadly talking, we see some cracks within the knowledge and suppose that Trump’s inauguration later this month has an honest likelihood of being a ‘promote the information’ occasion after practically three months of unbridled financial optimism throughout most sectors,” Bruce J Clark, head of charges America at Informa Join, stated on LinkedIn.

That raises the query: How will BTC react? In spite of everything, expectations of regulatory readability underneath Trump have already seen the cryptocurrency rally to over $100,000 from $70,000 in simply two months. A Jan. 20 broader market sell-off might pull down the greenback index and the bond yields, doubtlessly supporting BTC.

For now, there are a number of elements supporting BTC. As an example, the $400 billion in liquidity sucked out of the system within the closing two weeks of 2024 is more likely to return, greasing asset costs, based on the LondonCryptoClub publication. Plus, a number of the capital flows from China might discover a residence in cryptocurrencies.

Bitcoin is once more buying and selling at a premium on Coinbase, reflecting stronger Stateside demand whereas miners are anticipated to chop again on gross sales.

“The Internet Unrealized Revenue and Loss (NUPL) for miners stays very constructive, hovering round 0.5, suggesting that miners are nonetheless in a powerful place, with substantial unrealized income and a desire to carry onto their BTC at this stage,” analysts at Bitfinex instructed CoinDesk.

Within the broader market, some merchants are dabbling with December 2025 ETH calls at strikes as excessive as $11,000. Ether is at the moment buying and selling beneath $4,000. Over 70 of the highest 100 cash by market worth have been up on a 24-hour foundation at press time. Want extra proof of risk-on?

That stated, control the bond market rout, which is quick spreading exterior the U.S. Early as we speak, the Japanese 10-year bond yield rose to a 13-year excessive whereas its 30-year British counterpart was on the verge of hitting the best because the late Nineties. That may suck the wind out of danger belongings. Keep alert!

What to Watch

- Crypto

- Jan. 7: Nightfall (DUSK) mainnet launch.

- Jan. 8: Bybit terminates withdrawal and custody companies to nationals or residents of the French Territories.

- Jan. 8: Xterio (XTER) to create and distribute new tokens in token technology occasion.

- Jan. 9, 1:00 a.m.: Cronos (CRO) zkEVM mainnet upgrades to ZKsync’s newest launch.

- Jan. 12, 10:30 p.m.: Binance will halt Fantom token (FTM) deposits and withdrawals and delist all FTM buying and selling pairs. FTM tokens can be swapped for S tokens at a 1:1 ratio.

Jan. 15: Derive (DRV) token technology occasion. - Jan. 15: Mintlayer version 1.0.0 release. The mainnet improve introduces atomic swaps, enabling native BTC cross-chain swaps.

- Jan. 16, 3:00 a.m.: Buying and selling for the Sonic token (S) is ready to begin on Binance, that includes pairs like S/USDT, S/BTC, and S/BNB.

- Macro

- Jan. 7, 8:55 a.m.: U.S. Redbook YoY for the week ended Jan. 4. Prev. 7.1%.

- Jan. 7, 10:00 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November 2024’s Job Openings and Labor Turnover Summary (JOLTS) report.

- Job openings Est. 7.65M vs. Prev. 7.744M.

- Job quits Prev. 3.326M.

- Jan. 8, 8:30 a.m.: Fed Governor Christopher J. Waller is giving a speech, “Financial Outlook,” on the Lectures of the Governor Occasion, Paris, France. Livestream link.

- Jan. 8, 2:00 p.m.: The Fed releases the minutes of the Dec. 17-18 Federal Open Market Committee (FOMC) assembly.

- Jan. 9, 8:30 a.m.: The U.S. Division of Labor releases the Unemployment Insurance coverage Weekly Claims Report for the week ended Jan. 4. Preliminary Jobless Claims Est. 210K vs. Prev. 211K.

- Jan. 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Employment Situation Summary report.

- Nonfarm payrolls Est. 160K vs. Prev. 227K.

- Unemployment fee Est. 4.2% vs Prev. 4.2%.

- Jan. 10, 10:00 a.m.: The College of Michigan releases January’s Michigan Consumer Sentiment (Preliminary). Est. 74.5 vs. Prev. 74.0.

Token Occasions

- Governance votes & calls

- The dYdX DAO voted to wind down its FTM-USD market over the Sonic token migration. Spartan Council is holding the same vote.

- Unlocks

- Jan. 7: Ethereum Title Service to unlock 1.46% of its whole locked provide, value $53.5 million.

- Jan. 8: Flare to unlock 1.61% of its circulating provide, value $47.15 million.

- Jan. 8: Ethena to unlock 0.42% of its ENA circulating provide, value $14.7 million.

- Jan. 8: Optimism to unlock 0.33% of its OP circulating provide, value $9.3 million.

- Token Listings

- Jan. 7: Sonic SVM (SONIC) to be listed on Bitget, KuCoin, and MEXC at 7 a.m.

- Jan. 10: Lava Community (LAVA) to be listed on KuCoin and Bybit at 5 a.m.

- Jan. 10: Bybit to delist FTM (FTM) at 5 a.m..

Conferences:

Token Speak

By Shaurya Malwa

Ethereum co-founder Vitalik Buterin has offloaded a stash of memecoins despatched to him by varied communities to fund a charity, on-chain knowledge exhibits.

Prior to now two days, Buterin has bought $940,900 value of lesser-known memecoins for the USDC stablecoin and ether. The NEIRO, ESTEE, MARVIN, EBULL, MSTR, and TERMINUS tokens introduced in no less than $57,000 value of USDC, whereas different tokens have been bought for lower than $40,000.

Simply over $916,000 was whisked away to a multisign pockets, doubtless tied to the charity Kanro, based on SpotOnChain.

Communities usually ship tokens to Buterin primarily to realize publicity and leverage his affect within the crypto area.

However Buterin’s identified philanthropy additionally performs a job. Communities ship tokens anticipating him to donate them, not directly supporting charity. Again in October, Buterin stated he would donate any tokens despatched to him to charitable causes, although he added that he didn’t help the act.

I admire all of the memecoins that donate parts of their provide on to charity.

(eg. I noticed ebull despatched a bunch to numerous teams final month)

Something that will get despatched to me will get donated to charity too (thanks moodeng! The 10B from as we speak goes to anti-airborne-disease…

— vitalik.eth (@VitalikButerin) October 7, 2024

“Something that will get despatched to me will get donated to charity too (thanks moodeng!), he stated. “The 10B from as we speak goes to anti-airborne-disease tech), although I really desire in the event you guys ship to charity immediately, perhaps even make a DAO and get your neighborhood immediately engaged within the selections and course of.”

Derivatives Positioning

- BTC and ETH foundation on the CME are little modified round 10% and 13%, respectively, with open curiosity ticking up, however staying effectively wanting file highs.

- The broader market perpetual funding charges stay in a spread close to an annualized 10%.

- BTC and ETH calls proceed to commerce pricier than places, however the largest block commerce for the day leaned bearish, involving an extended place within the $100,000 put expiring Jan. 31 financed by promoting the $90,000 put expiring in June.

Market Actions:

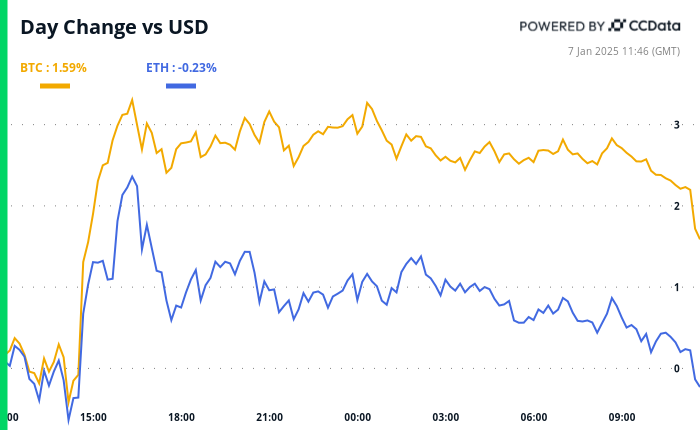

- BTC is down 0.23% from 4 p.m. ET Monday to $101,428.11 (24hrs: +2.72%)

- ETH is down 0.28% at $3,658.61 (24hrs: +0.62%)

- CoinDesk 20 is down 0.34% to three,726.76 (24hrs: +1.95%)

- CESR Composite Ether Staking Price is up 15 bps to three.2%

- BTC funding fee is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.23% at 108.01

- Gold is up 0.63% at $2,655/oz

- Silver is up 1.58% to $30.82/oz

- Nikkei 225 closed +1.97% at 40,083.3

- Cling Seng closed -1.22% at 19,447.58

- FTSE is down 0.22% at 8,231.7

- Euro Stoxx 50 is up 0.45% to five,009.08

- DJIA closed Monday unchanged at 42,706.56

- S&P 500 closed +0.55% at 5,975.38

- Nasdaq closed +1.24% at 19,864.98

- S&P/TSX Composite Index closed -0.29% at 24,999.8

- S&P 40 Latin America closed +2.13% at 2,199.88

- U.S. 10-year Treasury was up 2 bps at 4.618

- E-mini S&P 500 futures are up 0.1% to six,026.5

- E-mini Nasdaq-100 futures are unchanged at 21,761.75

- E-mini Dow Jones Industrial Common Index futures are unchanged at 43,011

Bitcoin Stats:

- BTC Dominance: 57.55%

- Ethereum to bitcoin ratio: 0.036

- Hashrate (seven-day transferring common): 792 EH/s

- Hashprice (spot): $59.4

- Complete Charges: 6.6 BTC/ $665,000

- CME Futures Open Curiosity:495,641 BTC

- BTC priced in gold: 38.5 oz

- BTC vs gold market cap: 10.95%

Basket Efficiency

Technical Evaluation

- The rally in longer-duration bond yields exhibits no indicators of stopping.

- The 30-year Treasury yield has topped the horizontal resistance from the April 2024 excessive.

- Ought to it maintain at that stage, the main target will shift to the 2023 excessive above 5%.

Crypto Equities

- MicroStrategy (MSTR): closed on Monday at $379.09 (+11.61%), unchanged in pre-market.

- Coinbase International (COIN): closed at $287.76 (+6.32%), down 0.91% at $285.09 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$29.83 (+1.32%)

- MARA Holdings (MARA): closed at $20.55 (+4.63%), down 1.75% at $20.19 in pre-market.

- Riot Platforms (RIOT): closed at $12.89 (+4.46%), down 1.47% at $12.70 in pre-market.

- Core Scientific (CORZ): closed at $15.12 (-1.69%), down 0.13% at $15.10 in pre-market.

- CleanSpark (CLSK): closed at $11.43 (+5.83%), down 1.14% at $11.3 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $26.15 (+1.63%), down 0.96% at $25.90 in pre-market.

- Semler Scientific (SMLR): closed at $58.94 (-0.17%), down 1.49% at $58.06 in pre-market.

ETF Flows

Spot BTC ETFs:

- Each day web circulate: $978.6 million

- Cumulative web flows: $36.89 billion

- Complete BTC holdings ~ 1.134 million.

Spot ETH ETFs

- Each day web circulate: $128.7 million

- Cumulative web flows: $2.77 billion

- Complete ETH holdings ~ 3.618 million.

Supply: Farside Investors

In a single day Flows

Chart of the Day

- The chart exhibits ether’s $4,000 name is now the most well-liked possibility on Deribit, with an open curiosity of $336 million.

- Additionally, word the exercise in larger strike calls at $10,000 and $15,000.

Whereas You Had been Sleeping

- Bitcoin Merchants Eye $109K as Trump Anticipation Builds, BTC ETFs Rake in Almost $1B (CoinDesk): Bitcoin rebounded from December lows after surpassing $102,000, with U.S.-listed spot BTC ETFs attracting practically $1 billion in inflows on Monday.

- FTX EU Offered to Backpack Change, Plans Regulated Crypto Derivatives Push Throughout Europe (CoinDesk): Backpack Change introduced the $32.7 million acquisition of FTX E.U., aiming to change into the primary regulated trade within the E.U. to supply perpetual crypto futures.

- Dollar Edges Toward One-Week Low as Market Ponders Trump Tariffs (Reuters): The U.S. greenback index (DXY) eased towards a one-week low amid hypothesis President-elect Donald Trump’s tariffs could also be much less aggressive than promised, regardless of his denials.

- Canada Tilts Right as Inflation Claims Trudeau as Latest Victim (Bloomberg): Justin Trudeau resigned as Canada’s prime minister as inflation, poor financial progress, housing unaffordability and controversial immigration insurance policies eroded public confidence, boosting Conservative prospects of successful the following federal election.

- Bitcoin Miners Stockpile Coins to Ride Out Profit Squeeze (Monetary Instances): Some U.S. bitcoin miners, together with MARA and Riot, are retaining all mined bitcoin for his or her treasury and utilizing raised funds and income to purchase extra whereas diversifying into AI-driven operations to offset rising prices and competitors.

- This Crypto Fund Blew Previous Bitcoin’s 121% Worth Acquire in 2024 (CoinDesk): Pythagoras’ Alpha Lengthy Biased Technique outperformed bitcoin’s 121% acquire in 2024 by combining a core bitcoin place for long-term progress with machine-learning-driven momentum and long-short methods, reaching a 204% return.

Within the Ether

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024