Blockchain

Raredex offers rare earth metal exposure for investors on Arbitrum

Credit : cryptonews.net

Raredex is now reside on the Arbittrium blockchain. This marks a big shift within the accessibility of an asset class that has lengthy been the protect of institutional traders.

Raredex is a blockchain-based platform on the Arbitrum community that offers traders entry to uncommon earth metals. Uncommon earth metals, that are wanted for companies starting from expertise improvement to renewable power, have historically been tough to entry for personal traders, hampered by excessive entry prices – usually above $10,000. Raredex solves this by enabling fractional possession utilizing blockchain-based tokenization, the place every token represents one kilogram of bodily metallic.

Louis O’Connor, CEO of Raredex, highlighted the democratization potential, saying that “Early adopters” will now have entry to an asset class that has “usually been reserved for governments” or the “well-connected, rich” people. that traders can now enter the market on a smaller scale, with a lot much less capital required.

You may additionally like: RWA platform Allo secures a $100 million Bitcoin-backed credit score facility

How does Raredex work?

Raredex shops its bodily metals in a bank-grade vault operated by Tradium in Germany for entry to custody and availability. Buyers can confirm the provenance of their tokens as they’re all tagged with intensive provenance information. Utilizing blockchain expertise creates an immutable file of possession, decreasing the danger of fraud and growing transparency.

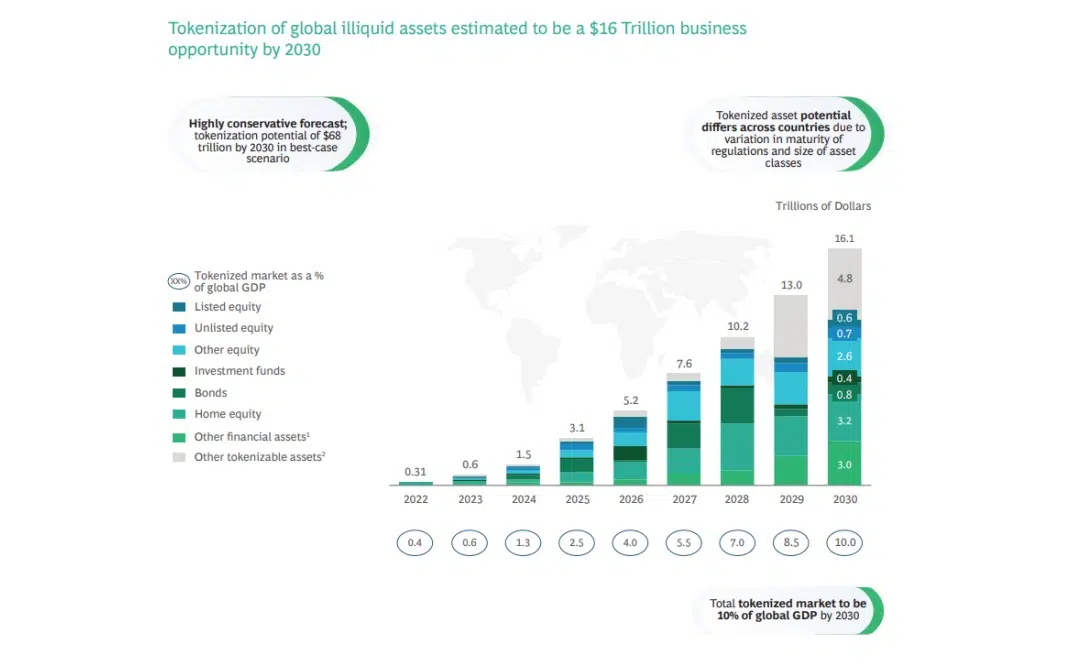

The launch of the platform comes at a time of elevated curiosity in RWA tokenization. This replace comes amid a bigger development to tokenize real-world property. By 2023, the category of RWAs had grown 700%, producing $860 million in income. In accordance with Boston Consulting Group and ADDX, RWAs are anticipated to be a $16 trillion market by 2030. The decentralized, tamper-resistant nature of blockchain will improve transparency and belief, whereas fragmentation opens up new methods to entry and put money into priceless property.

You may additionally like: Digital asset funding merchandise to achieve file $44.2 billion by 2024, says CoinShares

The chart estimates that the tokenization of world illiquid property will attain $16.1 trillion by 2030, representing 10% of world GDP. This reveals that Raredex, working within the RWA class, is prepared for development. Sourced from ADDX by crypto.information.

Different related initiatives embrace UBS Asset Administration’s Ethereum-hosted tokenized funding fund and Archax’s $4.8 billion cash market fund on the XRP Ledger.

As there’s a rising demand for uncommon earths attributable to improvements in expertise and clear power, Raredex’s platform may very well be a mannequin for a broader wave of commodity buying and selling on the blockchain, remodeling how traders work together with bodily property.

Learn extra: Constancy Digital Property: Tokenization, Bitcoin Nation State and Extra in 2025

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024