Bitcoin

Can Bitcoin’s price drop again despite $90K support holding firm?

Credit : ambcrypto.com

- Bitcoin’s $90,000 assist stays robust after December’s sell-off, pointing to underlying market resilience

- Institutional profit-taking has cooled, with Bitcoin ETF inflows falling from $14 billion to $6.6 billion per thirty days

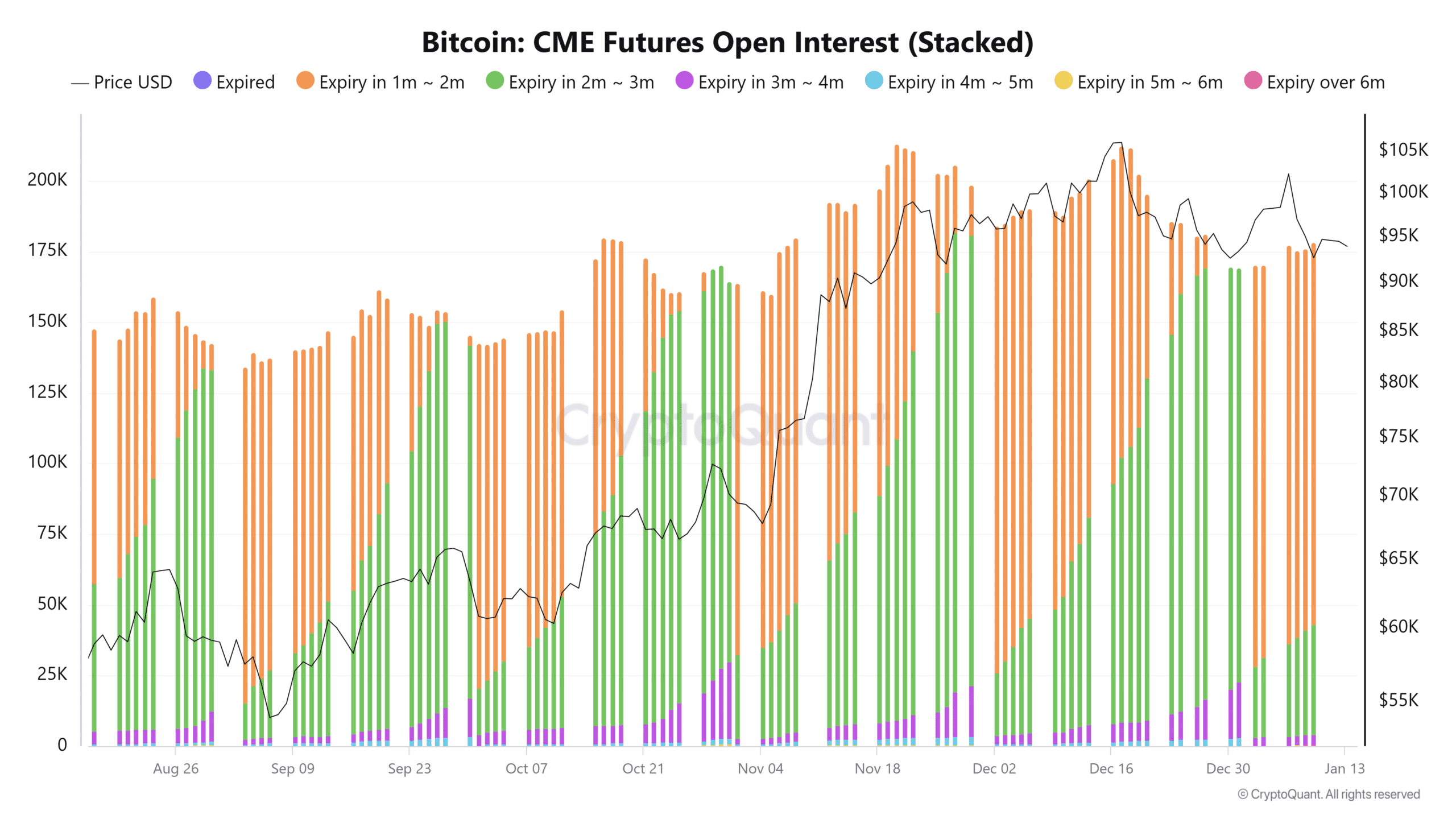

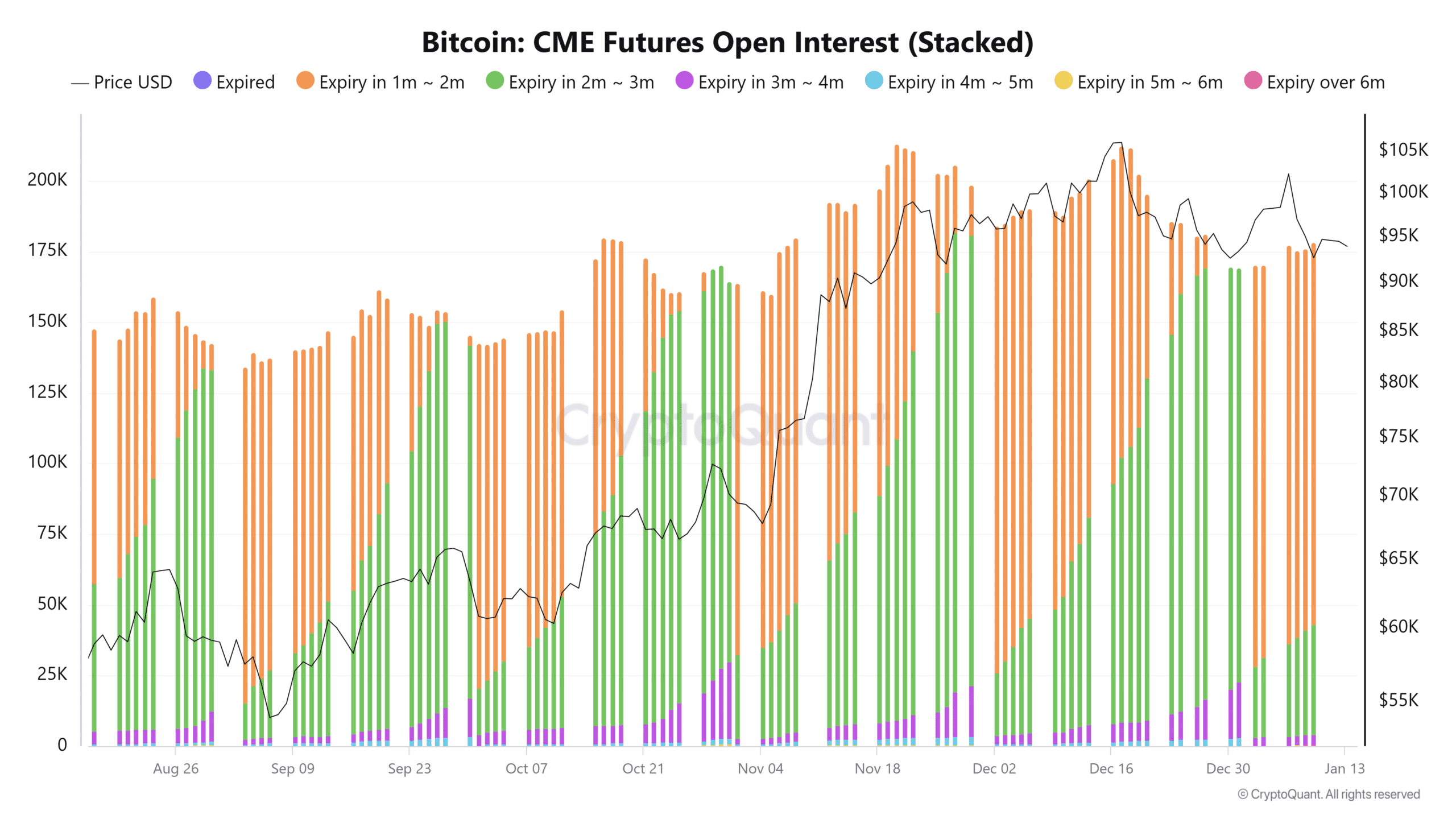

Seasonality has by no means been sort to Bitcoin [BTC] finish of December. The sell-side avalanche tends to spill over into January, and 2025 is not any exception. Institutional profit-taking has taken its toll, with open curiosity on CME contracts falling 13%. ETFs have additionally seen their web inflows cool, from $14 billion a month to $6.6 billion, as establishments lock of their earnings.

Regardless of this, Bitcoin has held regular across the vital assist at $90,000. The heavy promoting stress of December – $200 million in every day outflows – has subsided, leaving January caught on the impartial line. The resilience alerts underlying energy, however is it sufficient for Bitcoin to defy the percentages?

The $90,000 assist is holding

After a risky December marked by relentless sell-side stress and every day outflows peaking at $200 million, the market entered January with renewed stability. The vital assist degree at $90,000, fashioned by institutional inflows, is now an indication of resilience amid declining volatility.

Supply: Cryptoquant

On the time of writing, Open Curiosity, which has fallen 13% since its peak in November, highlighted a wave of profit-taking amongst institutional buyers. The sharp decline within the variety of contracts nearing expiration on the finish of December correlated with the sell-off, indicating danger aversion as market uncertainty escalated.

Furthermore, the unwinding of longer-dated futures indicated cautious sentiment past the short-term horizon. This contraction in exercise meant establishments hedged their positions, moderately than aggressively participating in upside bets.

Bitcoin’s value steered that the $90,000 degree has grow to be a psychological anchor. A break under this threshold might spark renewed momentum on the promote facet, however present resilience alerts assist from each institutional hedgers and retail contributors. Whereas outflows have slowed, the cautious optimism has but to translate into vital upside momentum, leaving the market in a fragile stability.

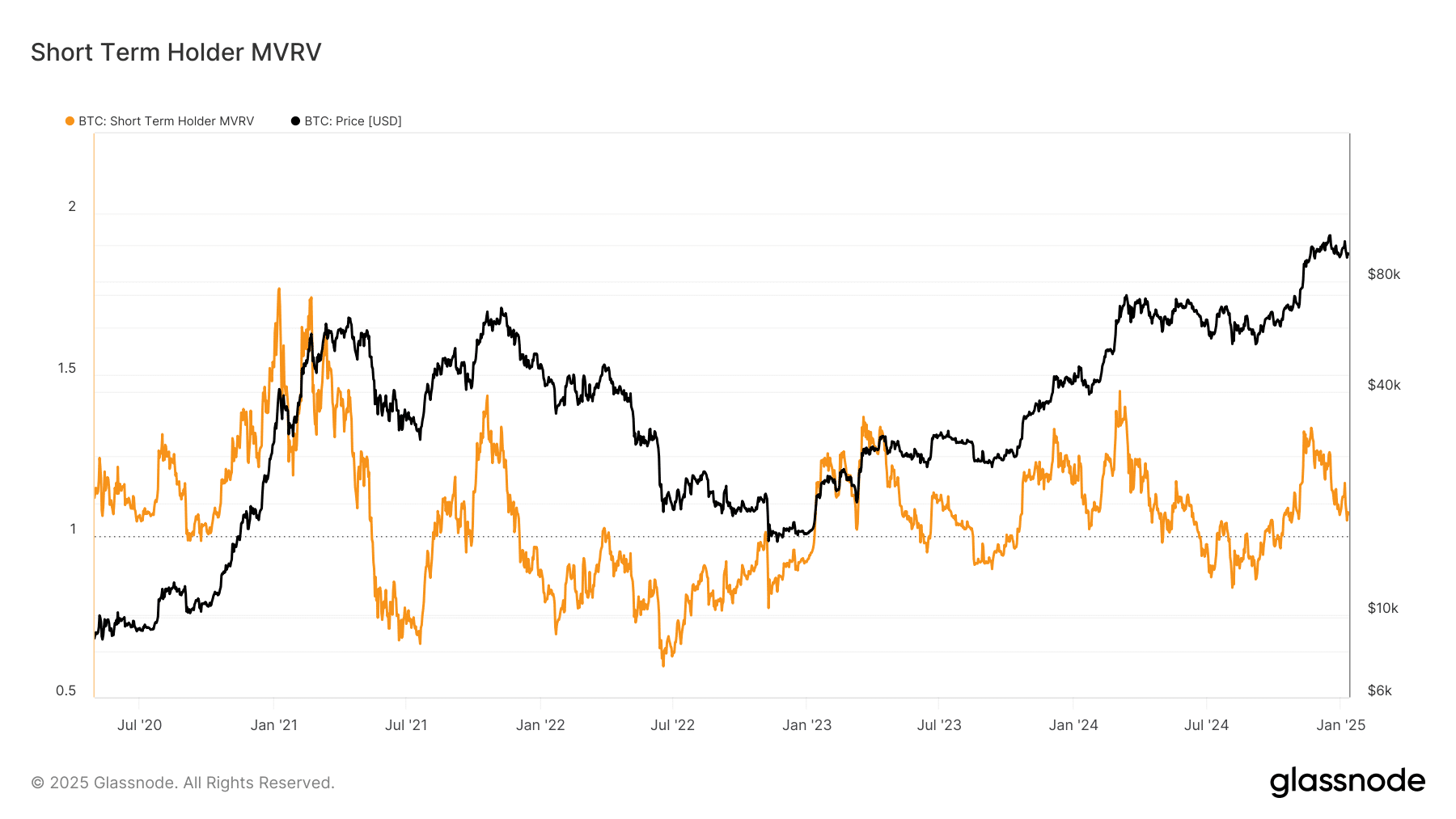

Key indicators: MVRV and sell-side danger ratio

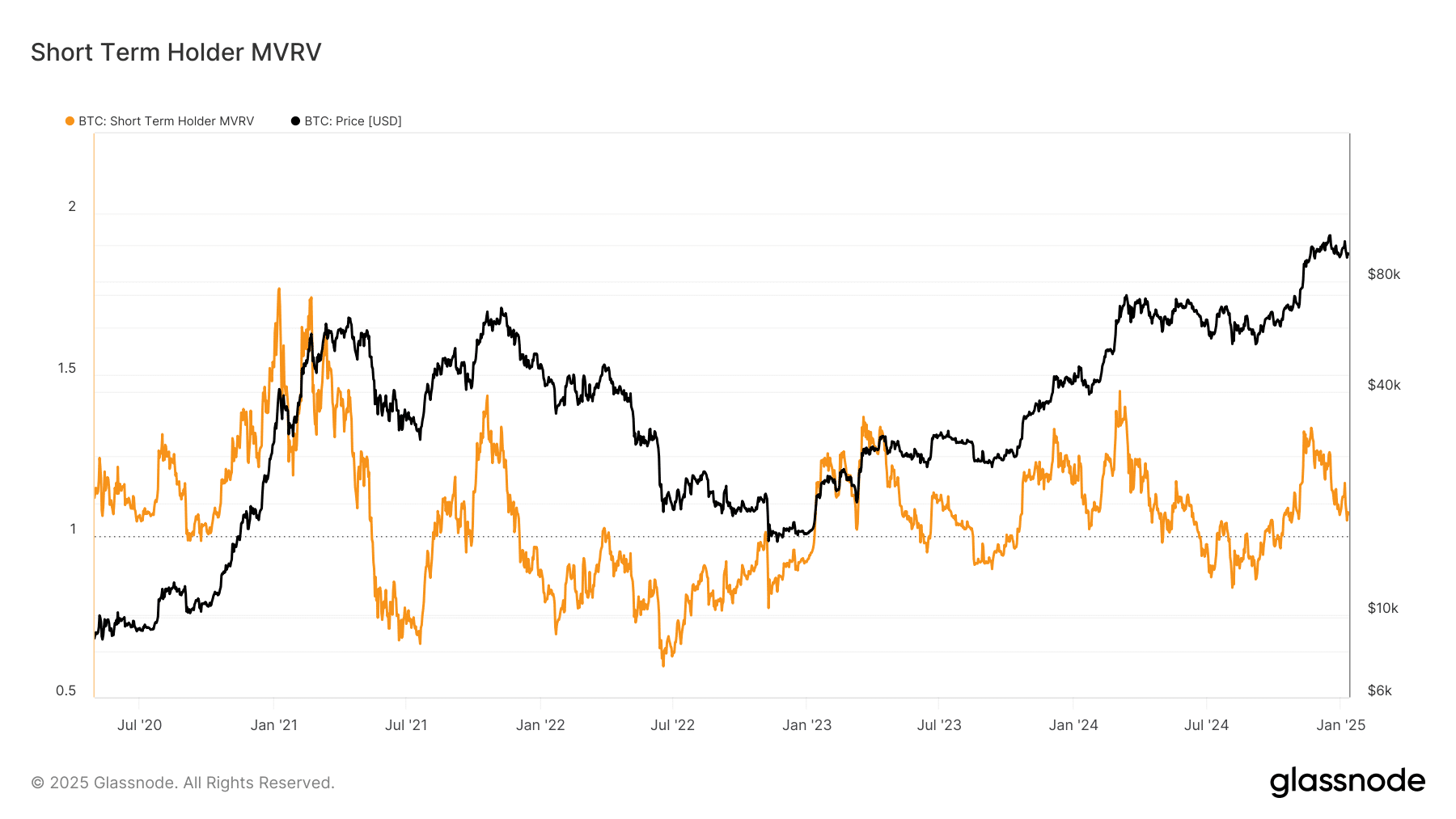

Supply: Glassnode

The STH MVRV ratio revealed an intriguing dynamic. Brief-term holders, whose prices common round $88,000, have but to really feel the pinch of uncontrollable losses.

Nonetheless, the hole between 1.08 and 1 displays a fragile stability – one that would flip bearish if Bitcoin have been to interrupt its $90,000 assist. Quite the opposite, closing this hole might act as a springboard for upward momentum.

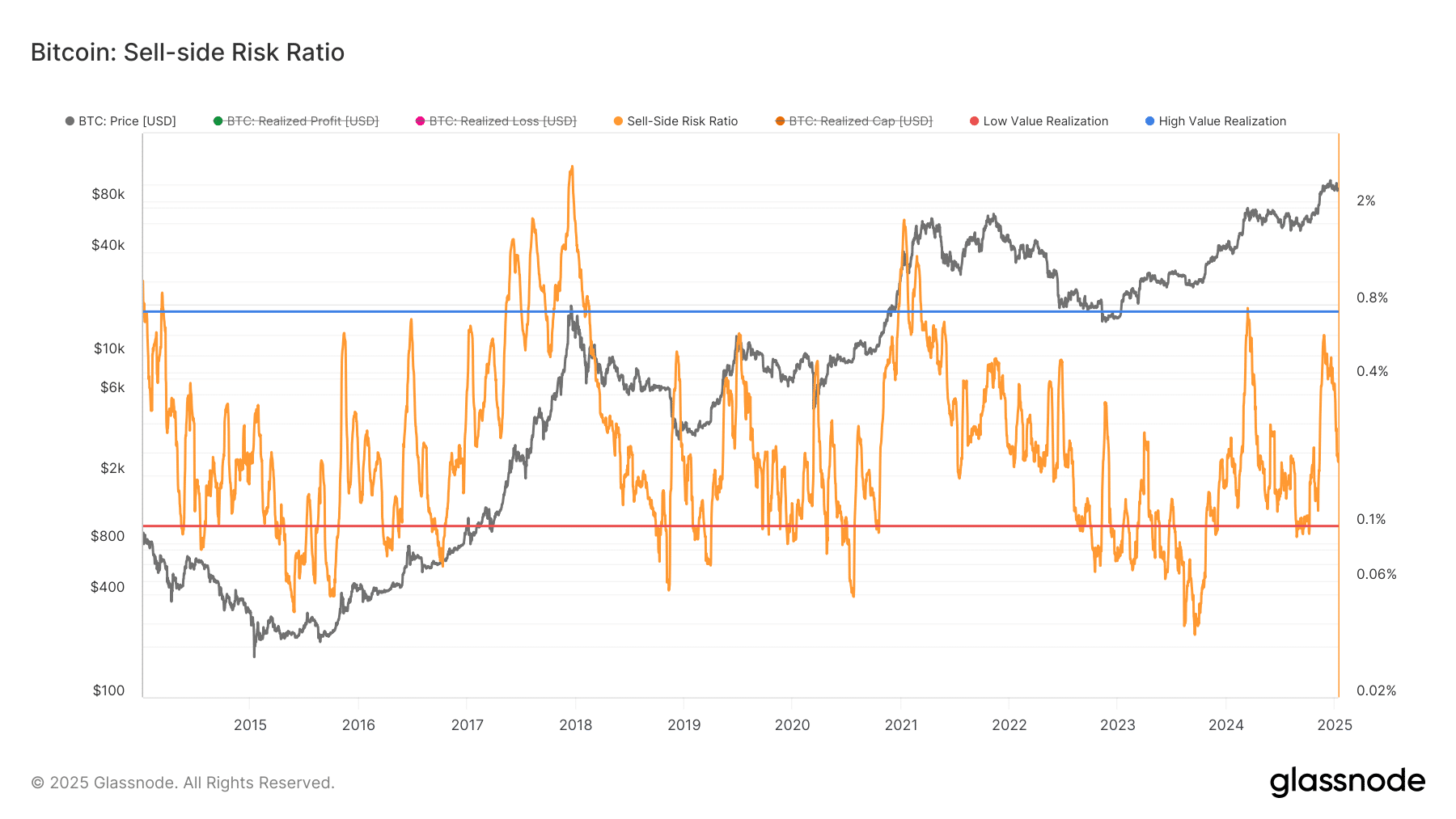

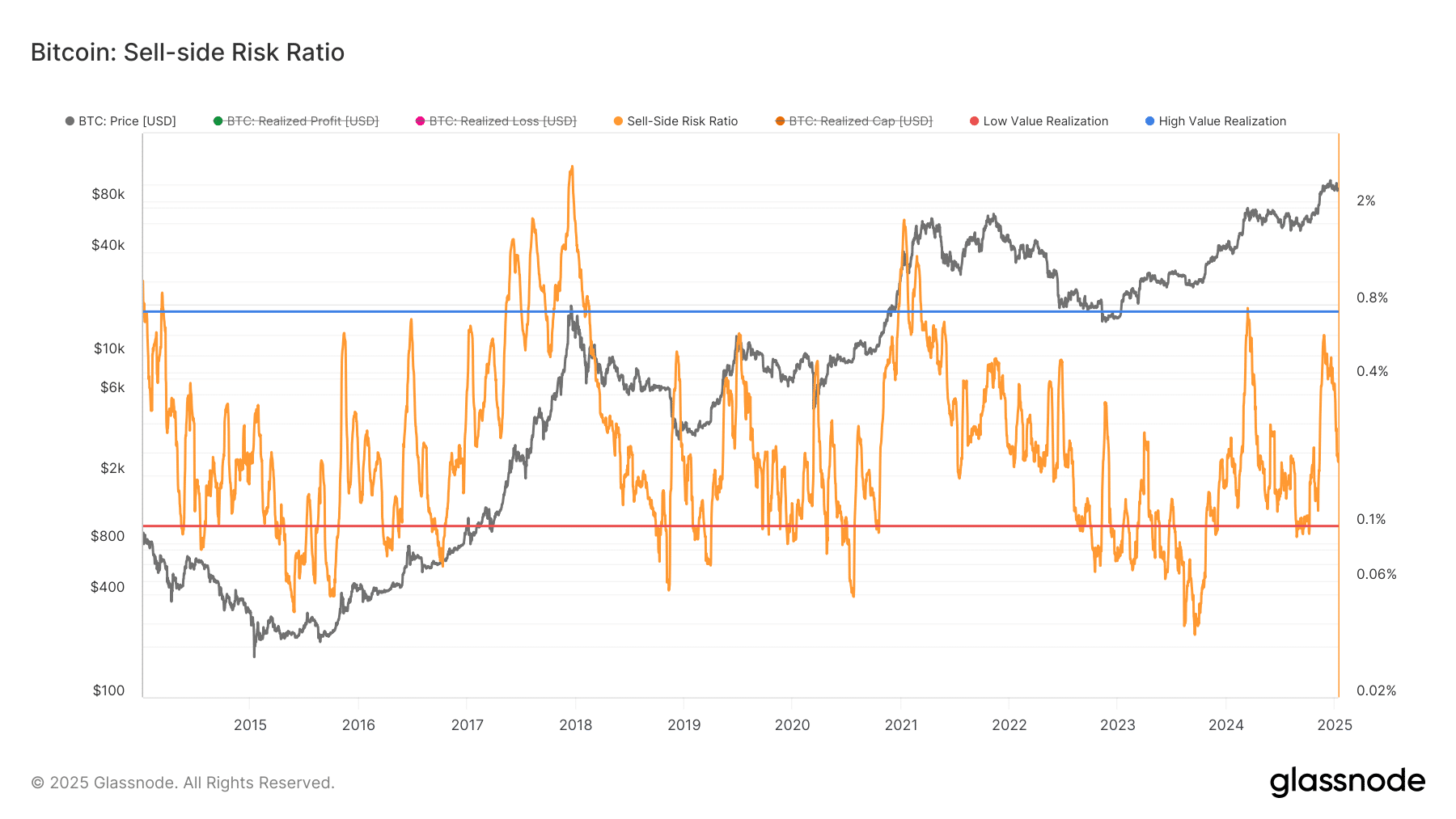

Supply: Glassnode

The Promote-side Danger Ratio chart bolstered Bitcoin’s precarious positioning. Traditionally, elevated promote danger has been correlated with elevated volatility and bearish sentiment, particularly in periods of institutional revenue taking. The current decline within the ratio is according to the declining outflows noticed in January – an indication of easing promoting stress.

Nonetheless, the proximity to the decrease threshold highlighted Bitcoin’s sensitivity to additional draw back stress if the $90,000 assist weakens. Conversely, continued resilience might immediate renewed bullish exercise, pushed by short-term bonds closing their value foundation hole.

Is Bitcoin Ready for a Catalyst?

Bitcoin seems to be in a holding sample, with assist stretching out in anticipation of a decisive push. Macro catalysts – similar to financial knowledge, financial coverage modifications or institutional bulletins – might dictate the following step.

The STH MVRV ratio hinted that short-term holders are near their value foundation, leaving room for a bullish catalyst to push Bitcoin above $90,000. In the meantime, the sell-side danger ratio steered that promoting stress is easing. But Bitcoin stays susceptible if demand doesn’t materialize quickly.

Investor habits stays cautiously optimistic. Forex inflows and outflows hovering round $12 billion every day present a basis for liquidity, however Spot ETFs lack the momentum to make a breakthrough.

For now, Bitcoin is strolling a effective line. Whether or not it dips in direction of $88,000 to reset market sentiment or finds new demand to scale additional, the approaching weeks can be vital in figuring out its route.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024