Ethereum

Bitcoin, Ethereum hit by ‘trading paralysis,’ but is there a way out of this FUD?

Credit : ambcrypto.com

- Stablecoin reserves rose to 48 billion USDT equal, indicating vital dry powder on the sidelines

- Outflows from Bitcoin exchanges elevated, whereas ETH noticed combined flows

The cryptocurrency market is seeing a major slowdown as capital inflows decline and buying and selling quantity reaches all-time lows – an indication of accelerating investor hesitancy within the present market setting. The truth is, knowledge confirmed a dramatic 56.70% drop in capital inflows, from $134 billion to $58 billion, whereas buying and selling exercise has fallen to ranges not seen since earlier than final 12 months’s US elections.

Buying and selling quantity within the crypto market is reaching pre-election lows

Buying and selling quantity in main crypto sectors, together with memecoins, AI/Large Information initiatives, and Layer 1 and Layer 2 protocols, has reached its lowest level since November 4.

In response to SantimentThis drop in exercise hints at a type of ‘buying and selling paralysis’ as buyers battle to make decisive strikes in prevailing market situations. An evaluation of the chart revealed a constant downward pattern throughout all segments, with notably notable declines in beforehand energetic sectors reminiscent of AI and memecoins.

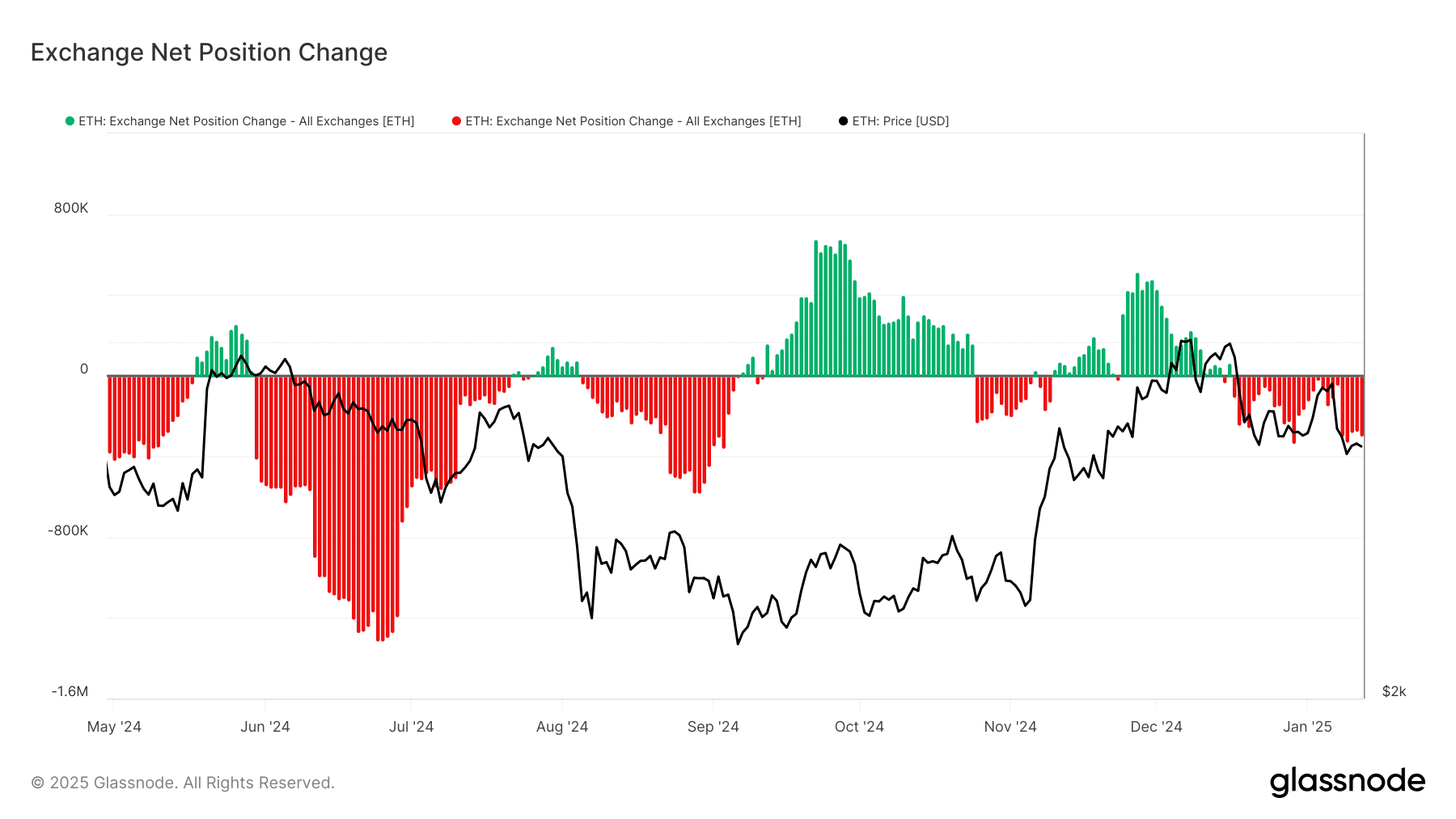

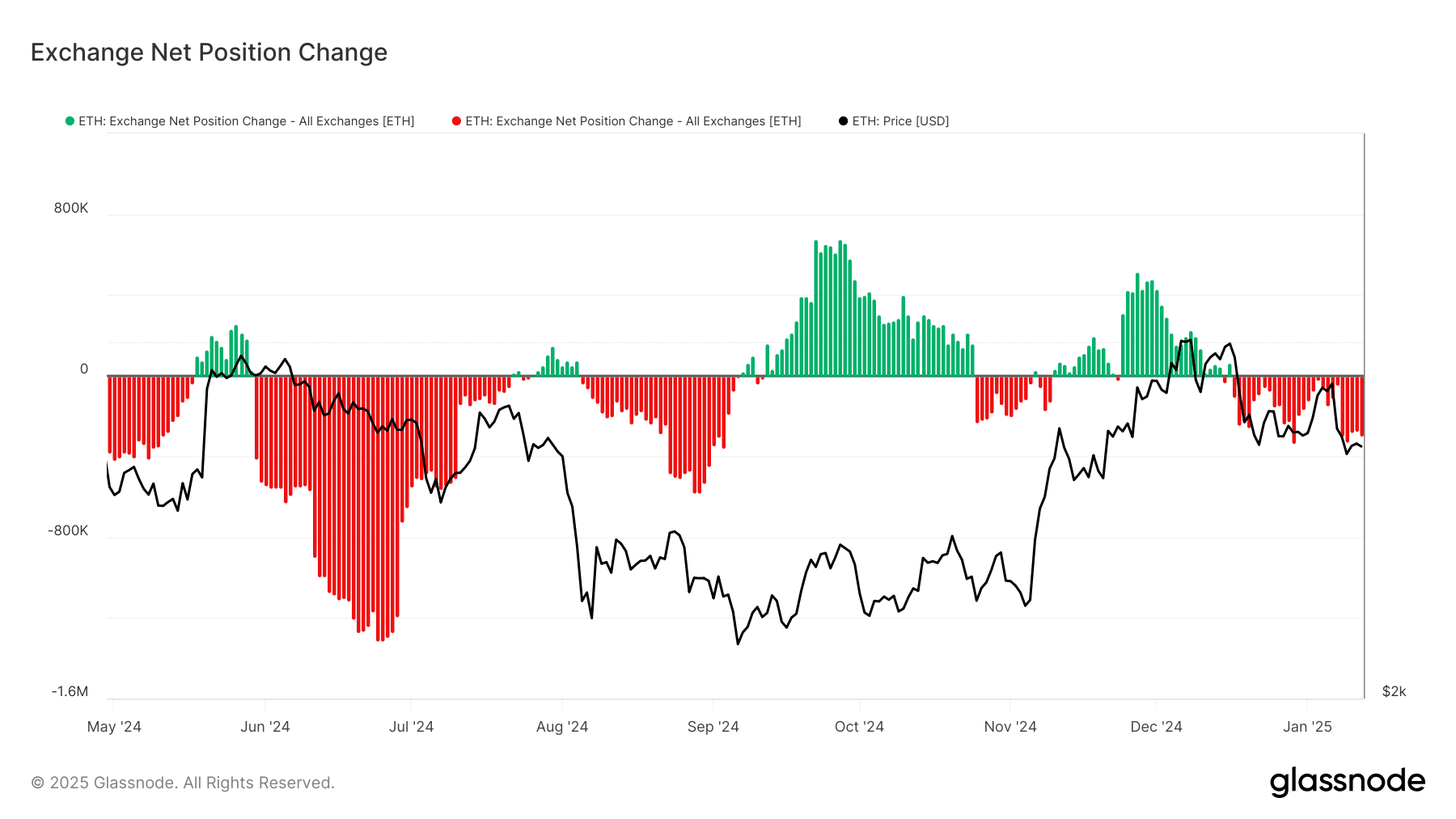

Trade web positions present combined indicators

Alternating present facts highlighted contrasting patterns between Ethereum and Bitcoin all through 2024. Ethereum noticed its largest outflows in July 2024, when roughly 1.6 million ETH left the exchanges, adopted by a notable accumulation part in October when inflows peaked at 700,000 ETH.

In January 2025, Ethereum has seen a damaging web movement of round 400,000 ETH, indicating a return to withdrawal conduct.

Supply: Glassnode

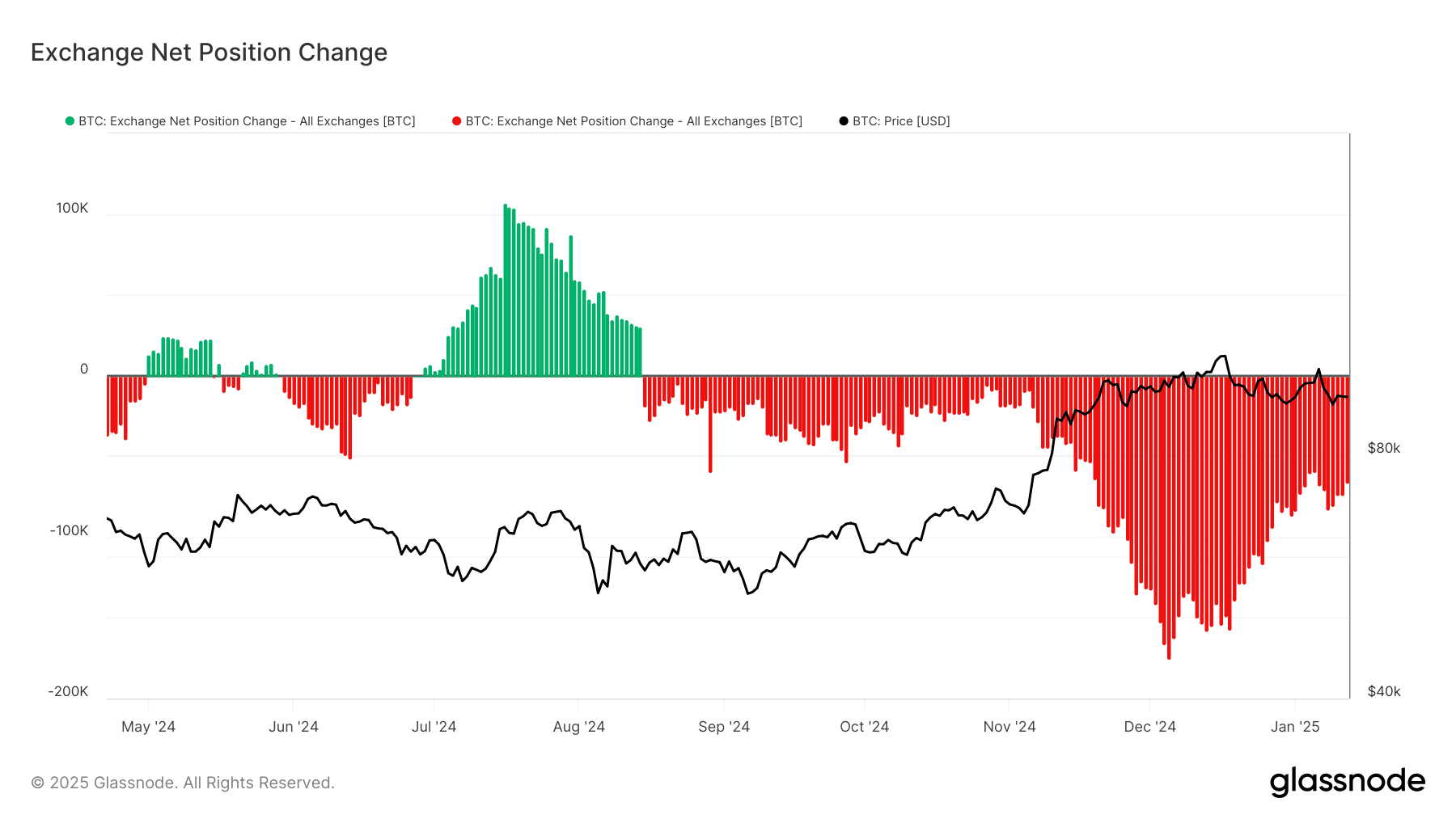

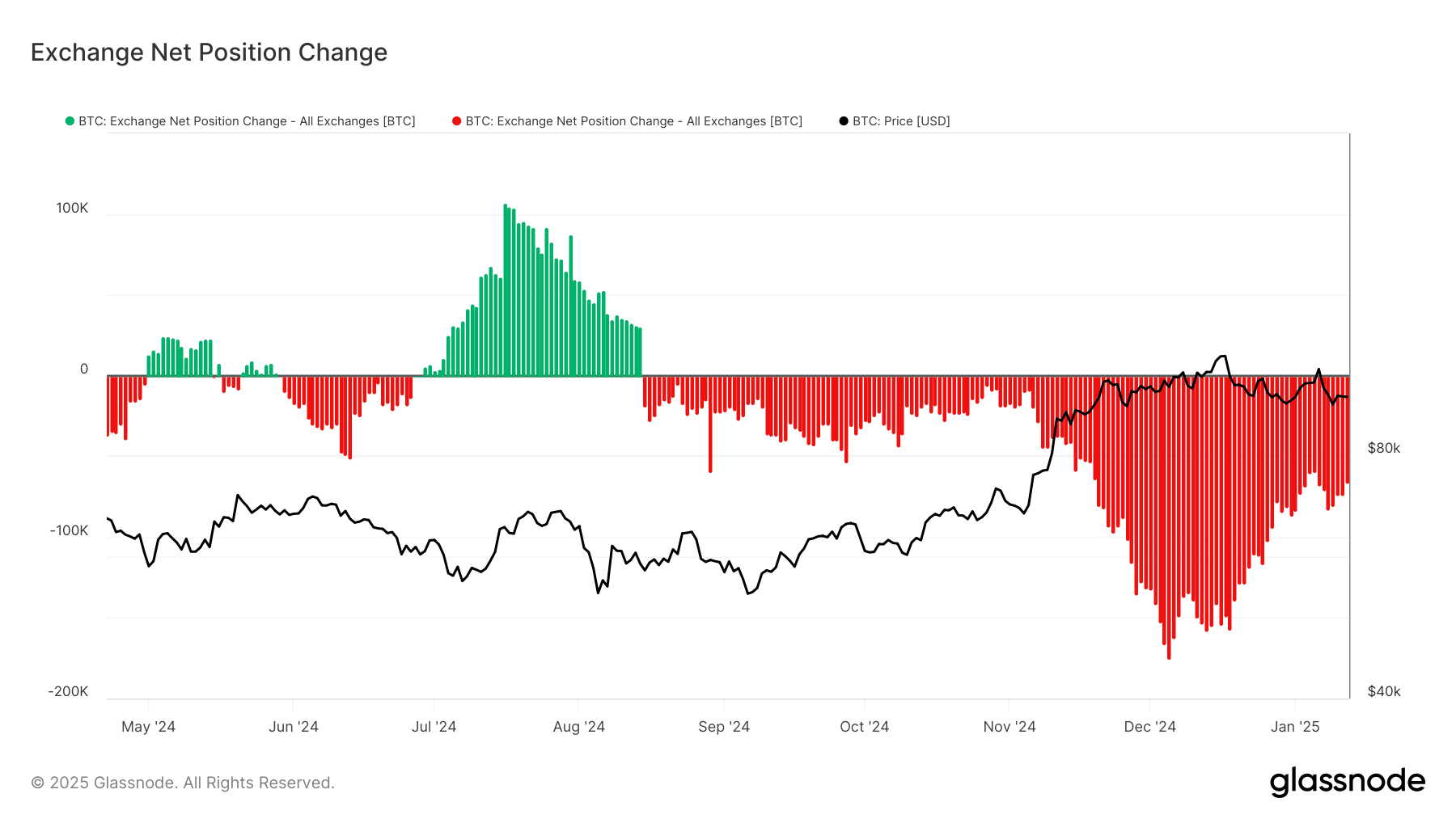

Bitcoin’s alternate positions, nonetheless, confirmed a distinct story.

August 2024 marked peak accumulation with a web influx of 100,000 BTC. Nevertheless, in December 2024, a dramatic shift occurred as outflows elevated to just about 200,000 BTC – the most important withdrawal quantity within the noticed interval. This pattern has continued till early 2025, with continued outflows averaging 80,000 BTC.

Supply: Glassnode

Stablecoin reserves point out untapped potential

The stablecoin panorama has modified considerably since March 2024, with the overall combination provide growing from 16 billion to 48 billion USDT equal.

USDT maintains market dominance, rising from 16 billion to 32 billion, whereas USDC maintains a steady place between 4 and 5 billion all through the interval. Whole provide confirmed specific energy in November 2024, rising from 24 billion to 40 billion – an indication that there’s vital dry powder ready on the sidelines.

Supply: Glassnode

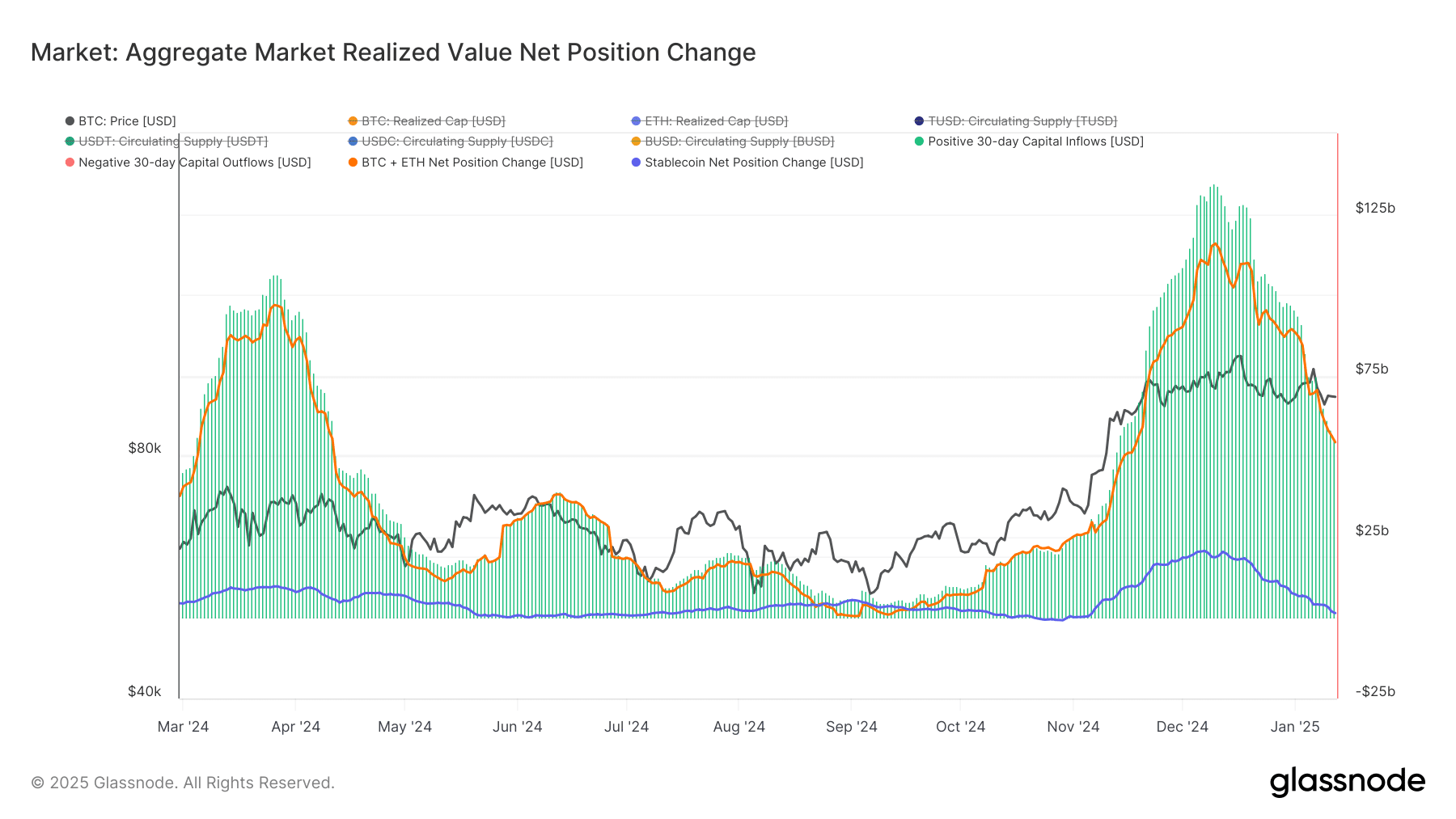

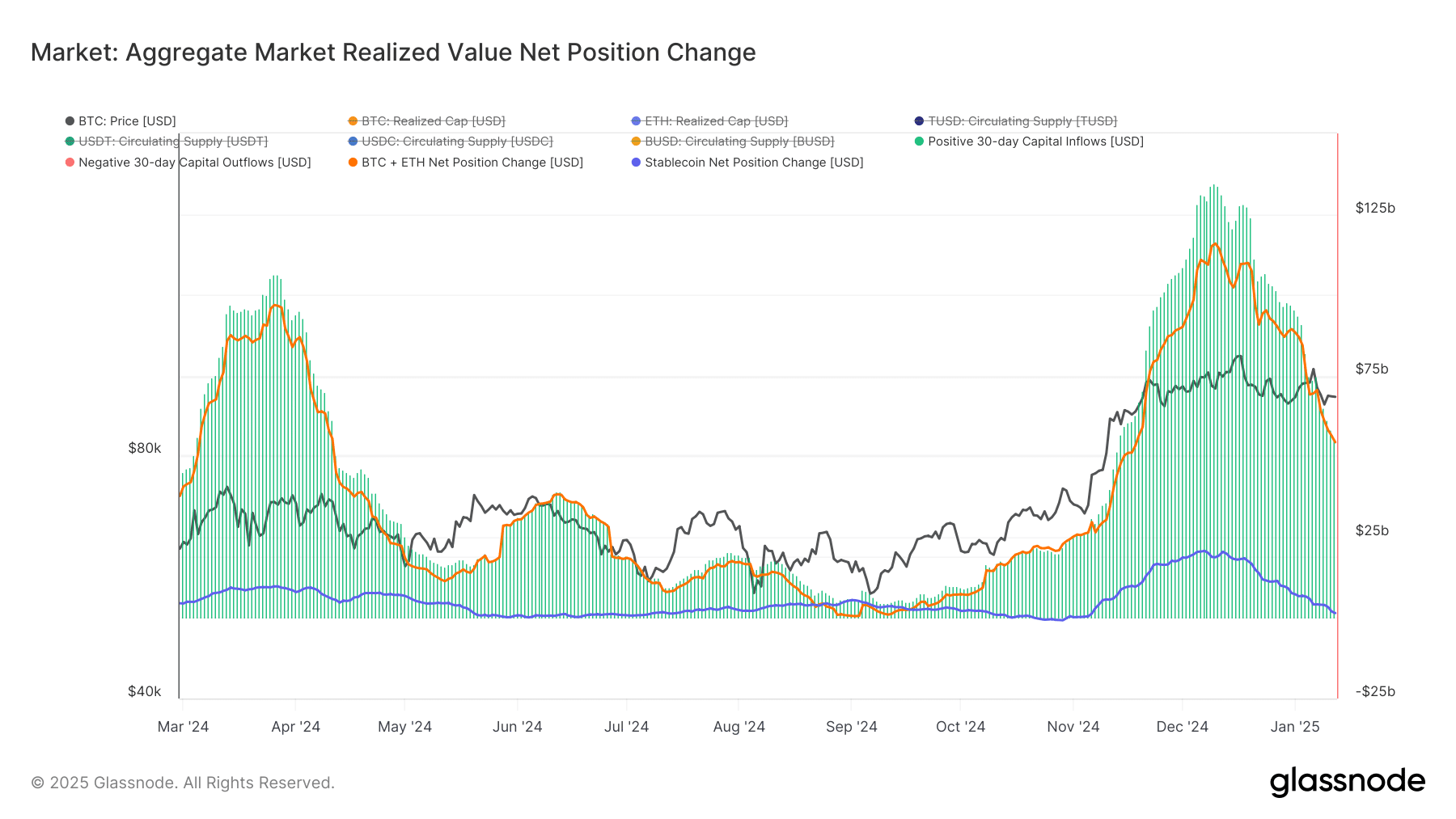

The worth realized by the market reveals declining confidence

Market realized worth confirmed a number of phases in 2024, with capital flows peaking at $100 billion in March-April earlier than getting into a sustained low interval of $25 billion on common from Might by means of September.

There was a pointy restoration in October-November, with inflows reaching $125 billion earlier than the ultimate decline to round $58 billion in early 2025.

Supply: Glassnode

The decline highlighted the weakening of liquidity and decreased danger urge for food, particularly after sturdy market exercise in December. This shift additionally mirrored broader sentiment within the cryptocurrency house, presumably as a result of macroeconomic uncertainty, which deterred new investments.

Between worry and alternative

Whereas present market situations could appear bearish at first look, historic patterns point out that durations of maximum worry and low buying and selling quantity typically precede a major market restoration. The numerous stablecoin reserves on the exchanges, particularly the expansion to 48 billion USDT equal, might present the mandatory gasoline for a restoration as soon as market sentiment improves.

Nevertheless, dangers stay. The continued decline in buying and selling quantity and capital inflows might delay market stagnation if confidence doesn’t return. The sharp decline in realized worth since December 2024, down 56.70% from the November peak, underlines the present market uncertainty.

The convergence of declining inflows, traditionally low buying and selling volumes and rising stablecoin reserves presents a fancy market image. Bitcoin’s substantial withdrawal from exchanges and Ethereum’s fluctuating patterns point out divergent methods amongst completely different teams of holders. In the meantime, the buildup of stablecoin reserves hints at vital potential power for future market actions.

Because the market navigates this era of decreased exercise, the build-up of steady belongings on the exchanges might sign alternatives for these keen to behave as sentiment shifts. The important thing will probably be to observe how these varied metrics evolve over the approaching weeks, from alternate flows to stablecoin deliveries.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024