Analysis

What Is Happening With Bitcoin Right Now?

Credit : coinpedia.org

Since Bitcoin crossed the $92,000 mark in late November, the worth has reached this stage a number of occasions. Some contemplate it a market warning about an impending decline in BTC, whereas others assume it strengthens its help right here. Market sentiment is fearful, however traders see it as a possibility. What’s presently taking place with bitcoin? Let’s attempt to discover out.

The Bitcoin Charts

Bitcoin has obtained good help on the $92,300 stage. We are able to see BTC making decrease highs. A pattern line can be discovered working by the lows. On Monday, the worth fell under $90,000 for the primary time since November 18. RSI performed together with the worth for a very long time, however obtained a distraction. When the worth made a decrease excessive round $102k between January 6 and seven, the RSI made the next excessive in opposition to it. The relative energy indicator additionally pointed to oversold.

Belongings want a quiet down after such an occasion. Shifting Common 200 rides above all averages and acts because the strongest resistance. The MA have reversed their positions, with MA 200 on the prime and MA 20 on the backside.

Different statistics

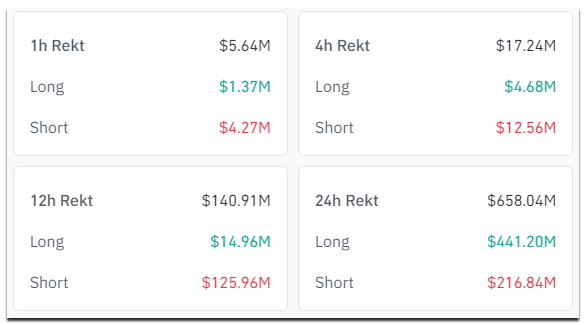

In accordance with Coinglass’ whole liquidation information, greater than 202,800 merchants have been liquidated previously 24 hours. On nearer inspection, we will see that within the first twelve hours it was the lengthy merchants who have been liquidated, however within the final twelve hours the market has shifted gears. The market has seen the liquidation of quick merchants in current hours.

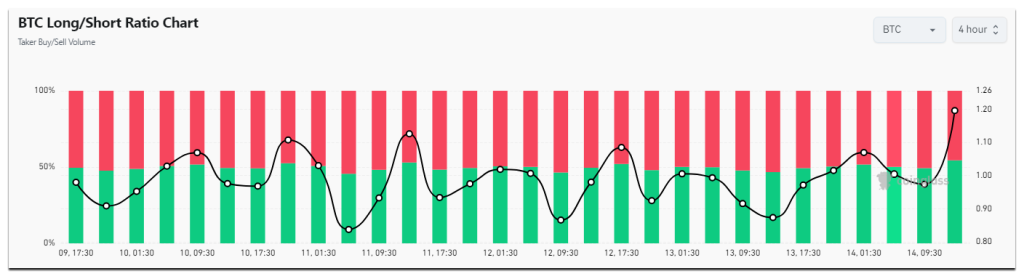

The Bitcoin Lengthy vs. The quick ratio stands at 1.1954, indicating that lengthy merchants are gaining confidence. 54.45% of the entire open futures trades for BTC are longs and 45.55% are quick trades. However this may be an indication of one other impending liquidation because the market just isn’t in a transparent state.

What to anticipate

Market sentiment is considerably fearful because the Worry and Greed Index stands at 46 immediately. Often this causes bears to take over the market. We all know that market sell-offs trigger panic and open doorways of alternative for traders to fill their coffers. Social media is flooded with key phrases like 90k, promoting and shopping for the dip. The market is attempting to go up, however the resistance is deeply hidden. What do you assume will occur out there?

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024