Ethereum

Ethereum ETFs struggle as Bitcoin ETFs see $252M inflows: Can ETH catch up?

Credit : ambcrypto.com

- Bitcoin ETFs are outperforming Ethereum, with BTC inflows rising, whereas ETH ETFs are scuffling with outflows.

- Bitcoin’s dominance and first-mover benefit strengthen its lead over Ethereum within the ETF market.

Bitcoin [BTC] Change Traded Funds (ETFs) have had a major influence on the crypto market and have demonstrated robust efficiency since their launch.

Bitcoin and Ethereum ETF Evaluation

Based on the most recent replace of Farside InvestorsBTC ETFs recorded internet inflows of $252 million.

Main the best way was BlackRock’s IBIT, with $86.8 million in inflows, adopted by Constancy’s FBTC, which recorded $64 million.

Nonetheless, amid this influx race, Grayscale’s GBTC confronted challenges, recording $35.6 million in outflows on August 23.

Alternatively, Ethereum [ETH] ETFs have been struggling and have primarily skilled outflows since their inception. As of August 23, ETH ETFs recorded outflows of $5.7 million.

Notably, BlackRock’s ETHA noticed no inflows, whereas Constancy’s FETH, Bitwise’s ETHW and VanEck managed to register some inflows.

Nonetheless, Grayscale’s ETHE suffered important outflows, recording a report $9.8 million, surpassing all different nations’ outflows. Ethereum ETFs mixed.

Observe about this: an X deal with with the username – Crypto cradle famous,

“Final week, $ETH spot ETFs had internet outflows of $44 million. $BTC spot ETFs had internet inflows of $506 million.”

Not so stunning!

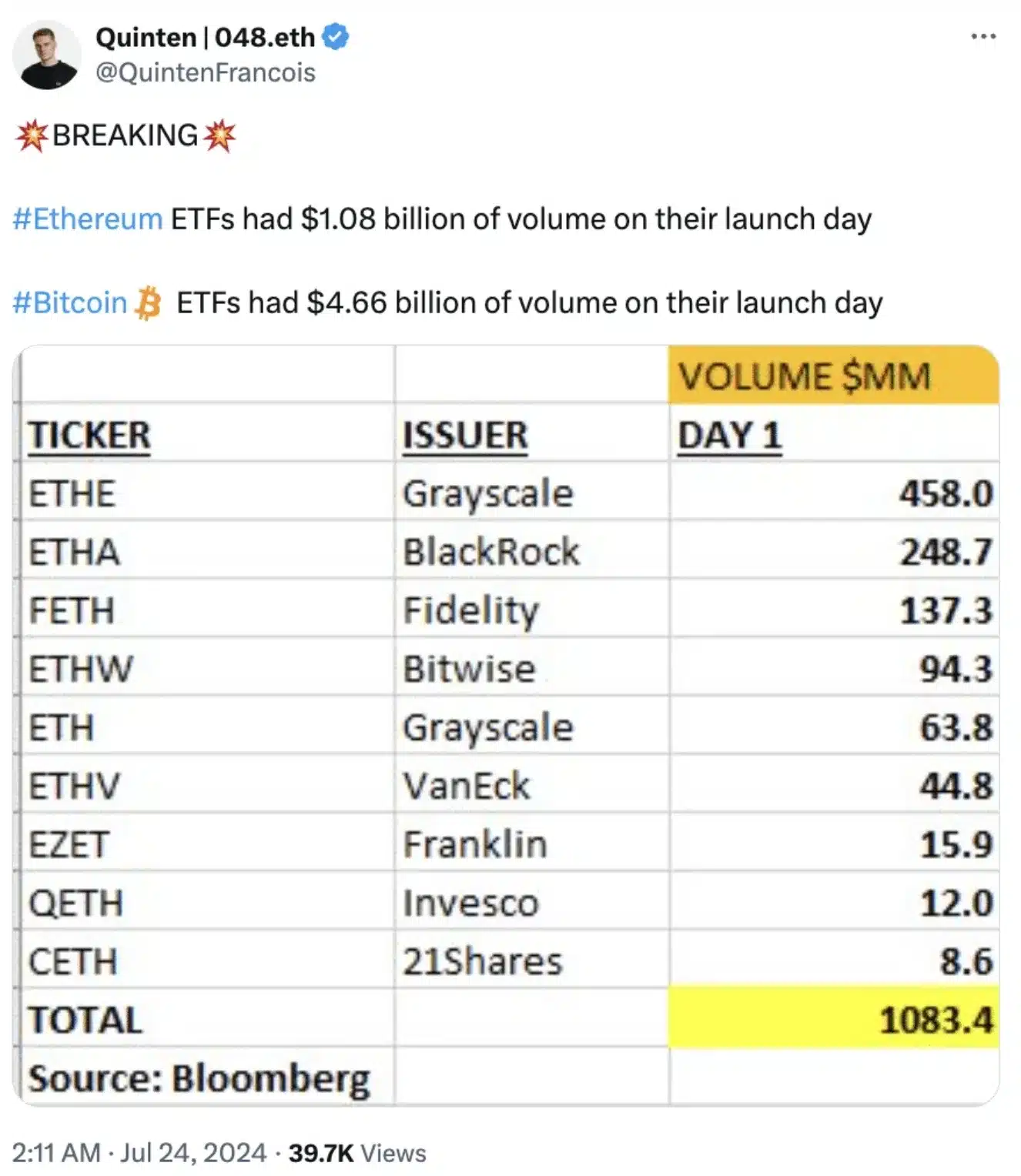

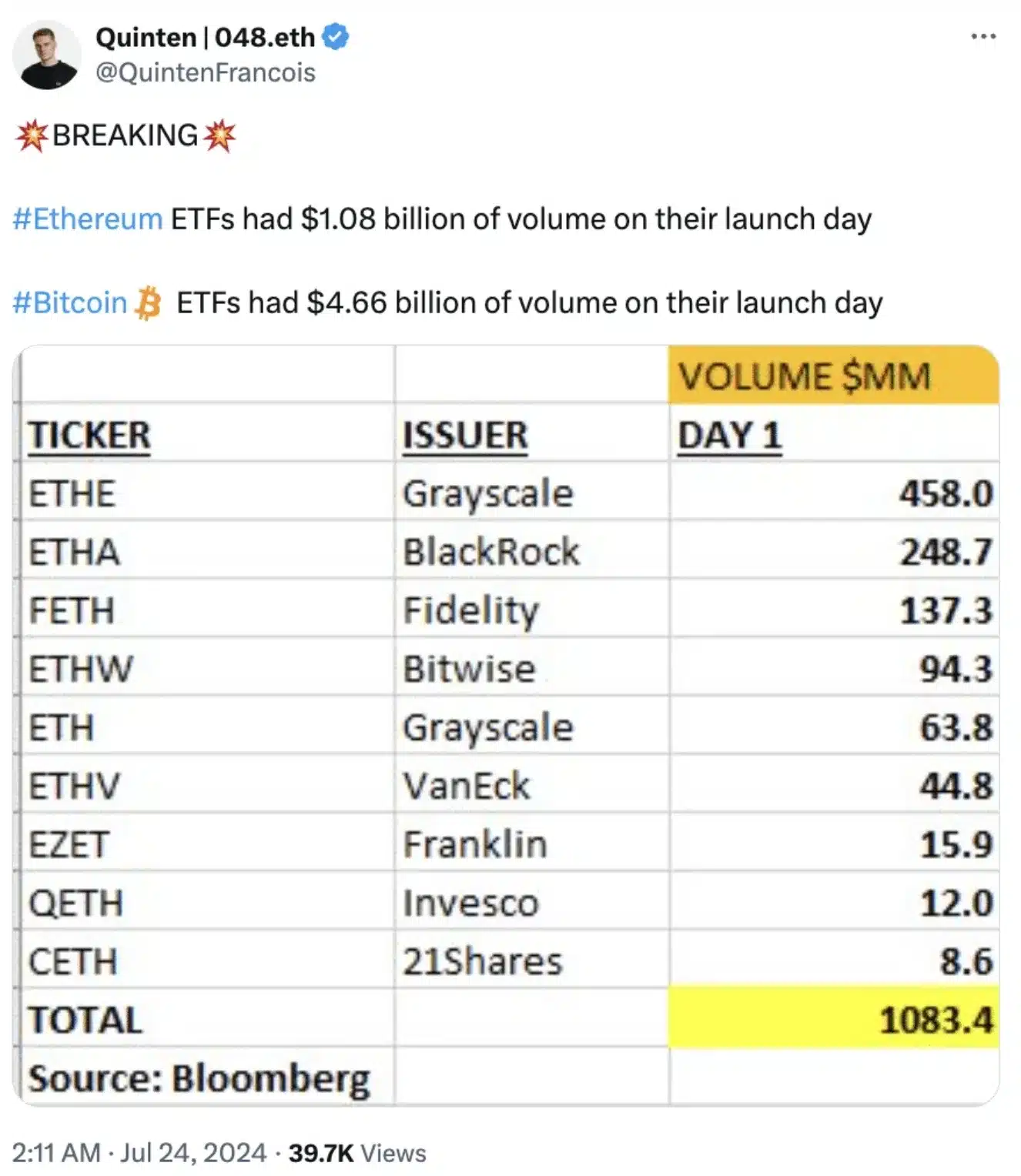

This could come as no shock, nonetheless, as Ethereum ETFs’ buying and selling volumes on their first day have been solely 1 / 4 of what Bitcoin ETFs achieved on their debut.

Supply: Quinten/X

The launch of Spot Bitcoin ETFs created a variety of pleasure available in the market and set a excessive commonplace that Ethereum ETFs have but to match.

Whereas Bitcoin ETFs have seen spectacular buying and selling volumes since their inception, Ethereum ETFs have struggled to generate related curiosity, reflecting a extra muted market response and indicating that they haven’t been in a position to generate the identical enthusiasm.

Influence on token costs

That mentioned, following the launch of Bitcoin ETFs in March, BTC rose to a brand new all-time excessive of $73,000.

Ethereum, however, has confronted challenges and has struggled to cross the $3,000 mark.

Based on the latter CoinMarketCap On the replace, ETH was buying and selling at $2,735, which remained beneath the beforehand anticipated $4K stage.

What’s behind this?

This distinction can be attributed to Bitcoin’s established dominance and its first mover benefit, which has cemented its place as the popular selection for a lot of merchants.

Moreover, Bitcoin’s sturdy proof-of-work system, usually hailed as the head of decentralization, additional strengthens its enchantment in comparison with options equivalent to Ethereum.

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT8 months ago

NFT8 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024