Bitcoin

Only ‘half-way to the top’ Bitcoin can hit $200K by 2025-end – Analyst

Credit : ambcrypto.com

- Bitcoin might double its worth and attain $200,000 by the top of the 12 months

- Technical and inner indicators pointed to enough space for progress

Regardless of being briefly caught within the $90,000 to $100,000 vary, Bitcoin [BTC] might double its worth to $200,000 by the top of 2025. This was a projection made by a pseudonymous market analyst – Stockmoney Lizards.

A part of his evaluation read,

“We’re solely midway to the highest…We have not reached the highest of the canal but; No RSI-based high sign has been given both and the value continues to be effectively above the blue channel after a brief retest. Last objective: $200,000.”

Supply:

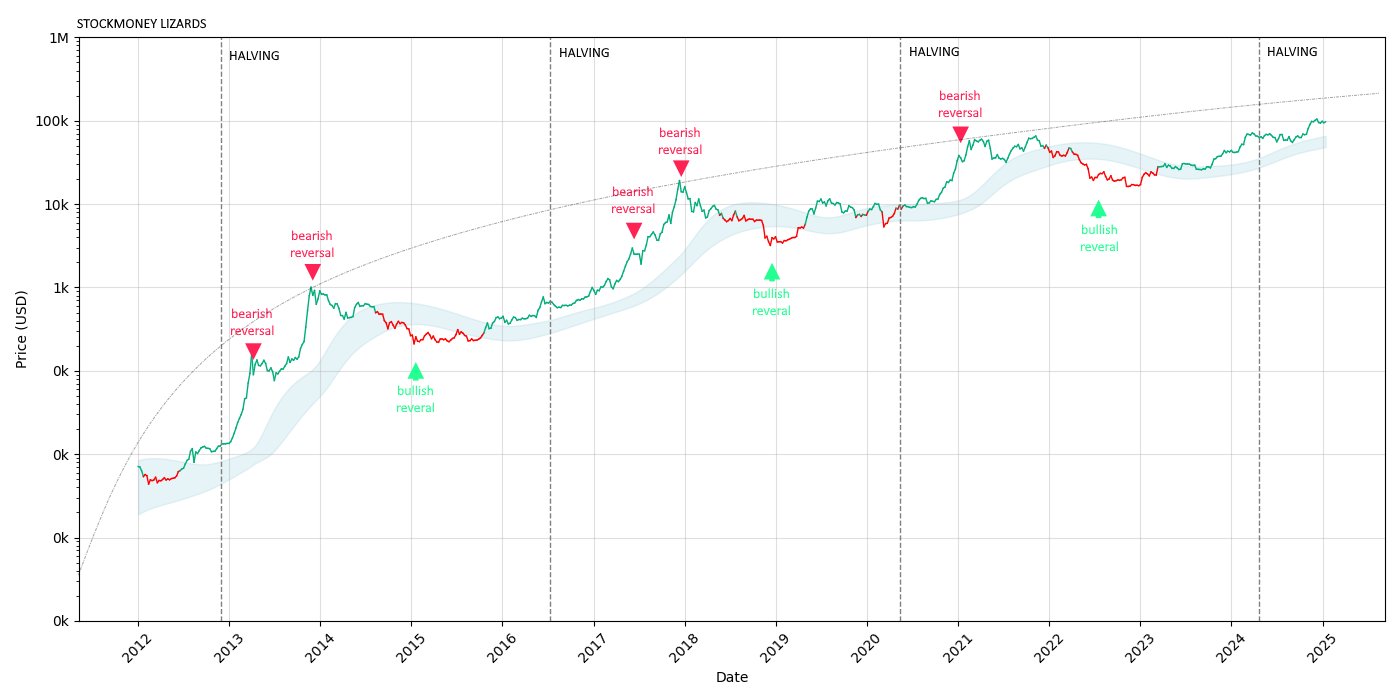

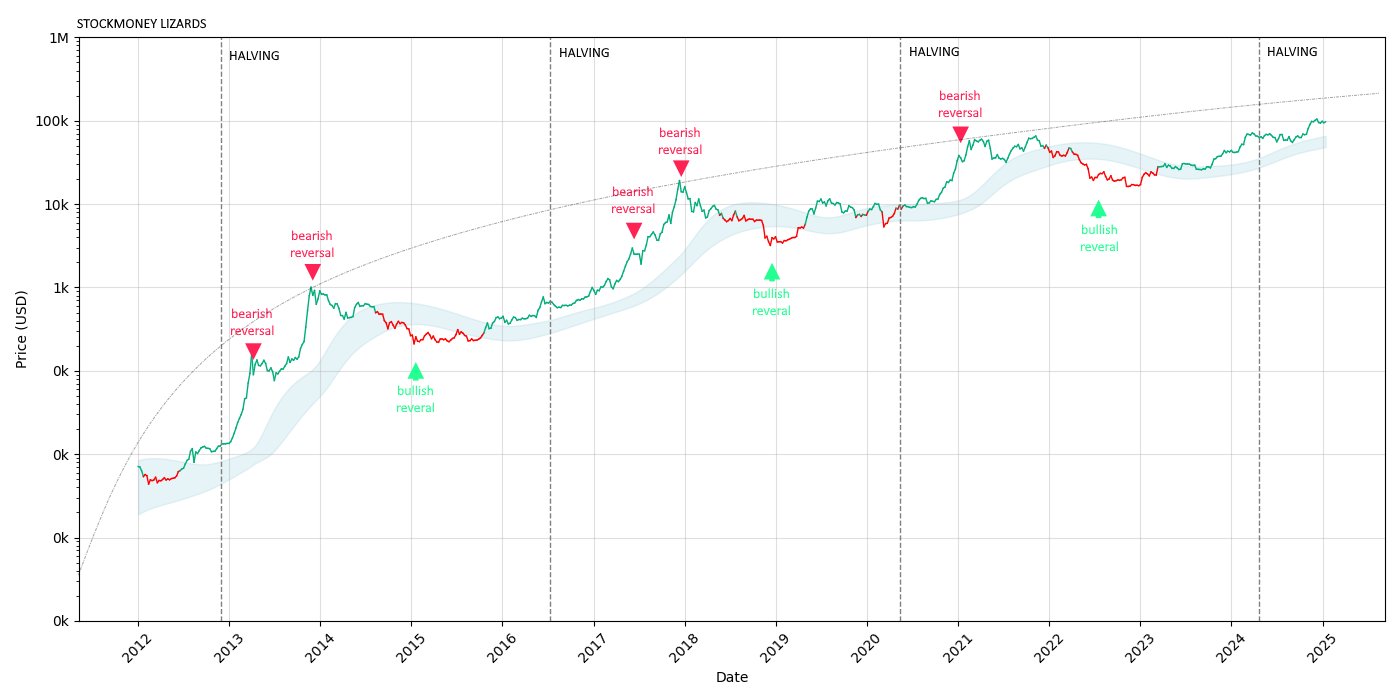

The accompanying chart highlighted historic RSI ranges (crimson/inexperienced arrows), which point out overbought (bearish reversal) and oversold (bullish reversal) situations correlated with earlier BTC cycle tops/bottoms).

Primarily based on this, the RSI had not issued a brand new bearish reversal sign (crimson) – an indication that BTC could also be removed from reaching its peak.

Extra room for progress?

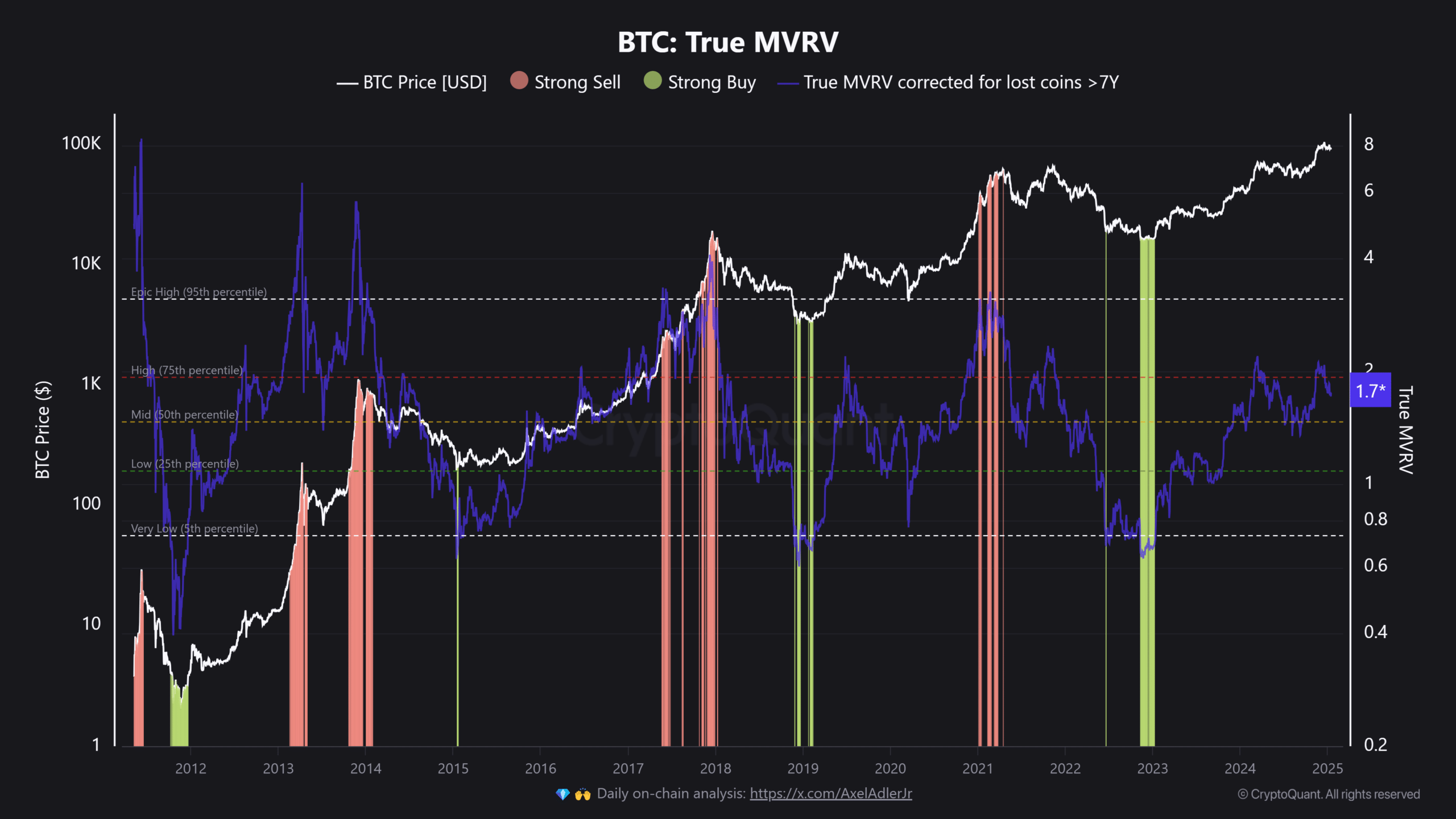

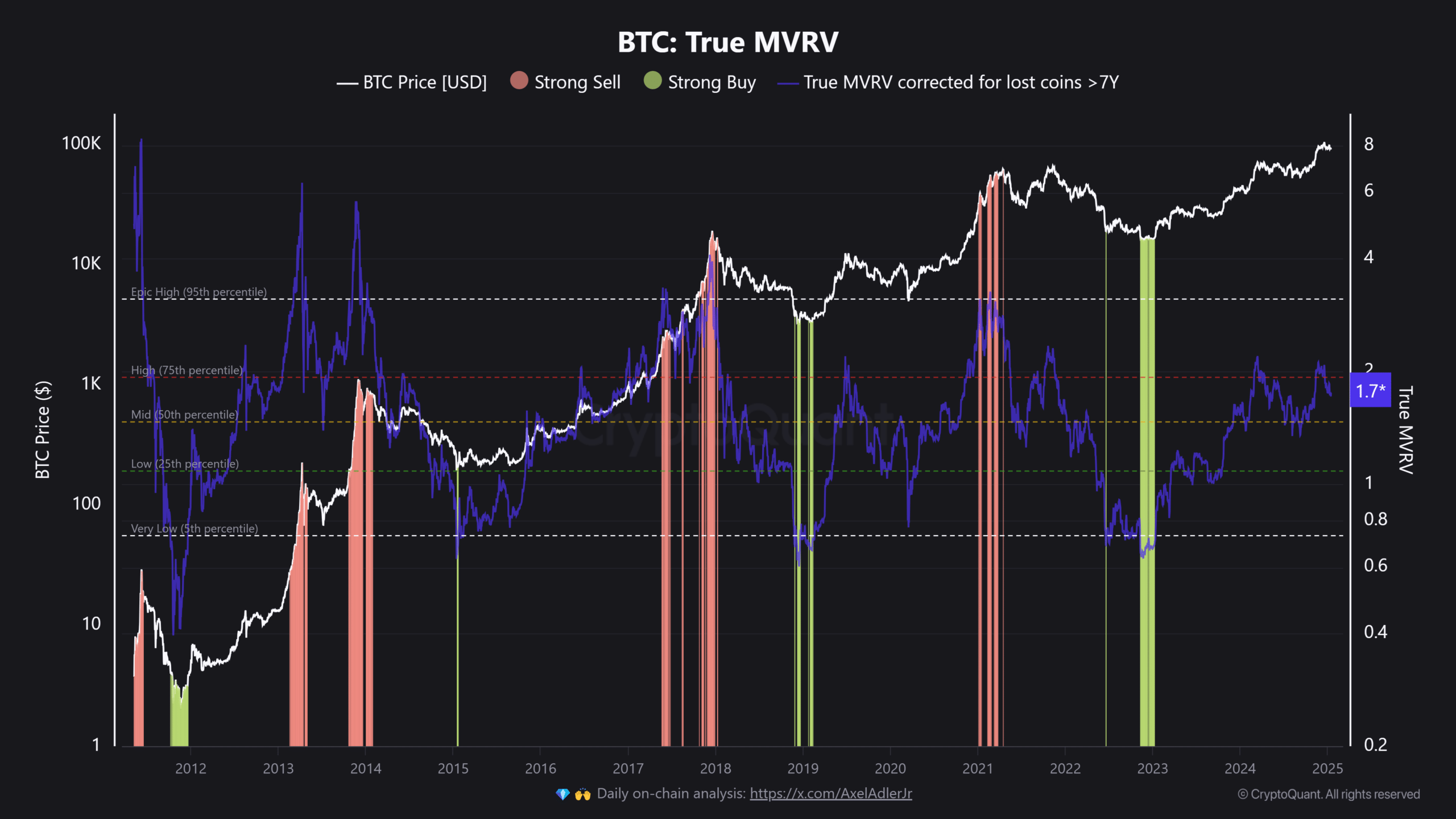

By extension, the aforementioned evaluation implied that Bitcoin was undervalued at press time. One other valuation mannequin, the True MVRV (Market Worth to Realized Worth) ratio, confirmed this concept.

Traditionally, a True MVRV worth of two marks native peaks, whereas a price of 4 and above marks cycle peaks.

In March and December 2024, BTC’s native highs coincided with an MVRV of two. On the time of writing, the MVRV had fallen to 1.7, indicating that there’s loads of room for BTC to develop on the value charts.

Supply: CryptoQuant

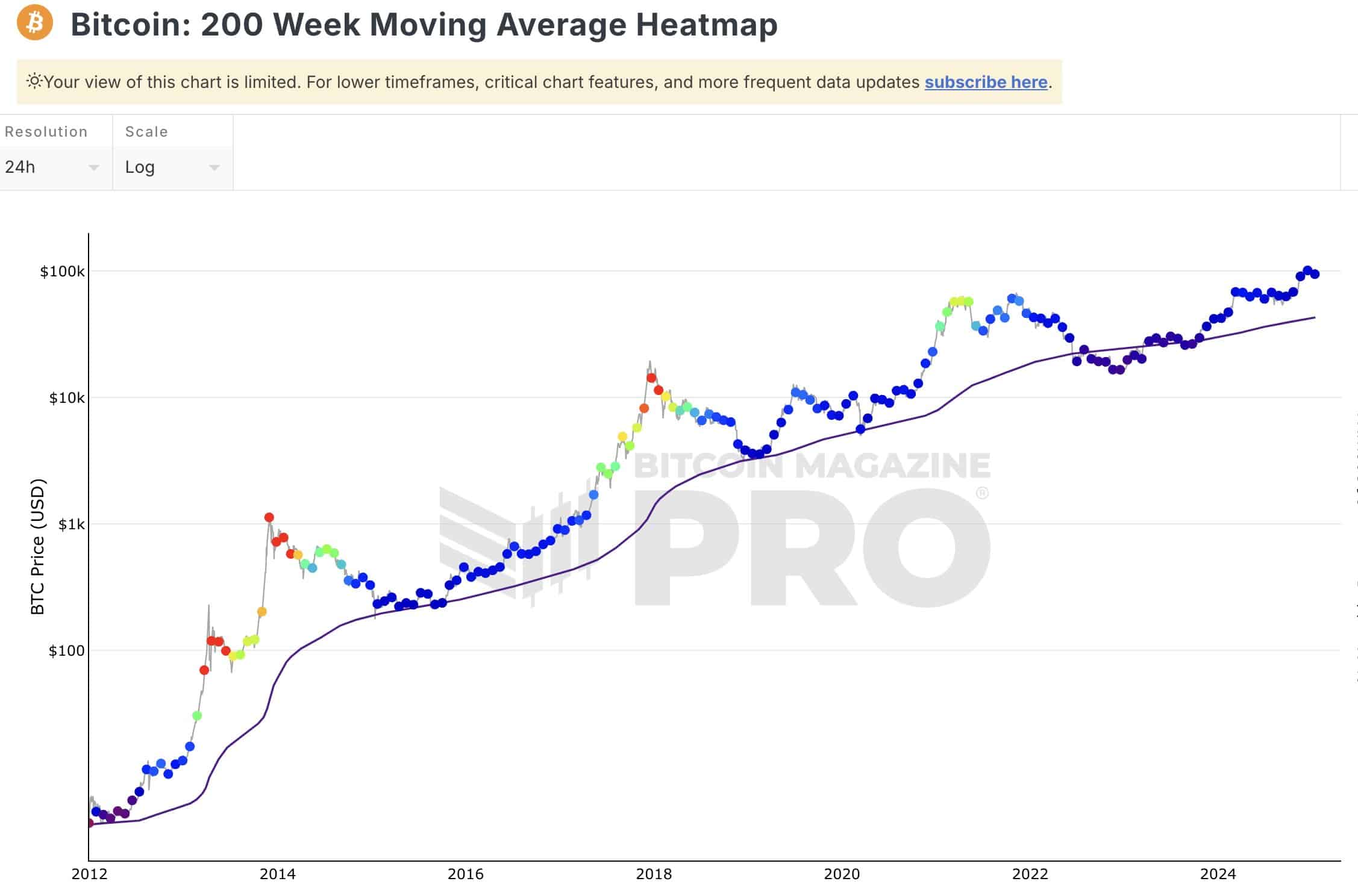

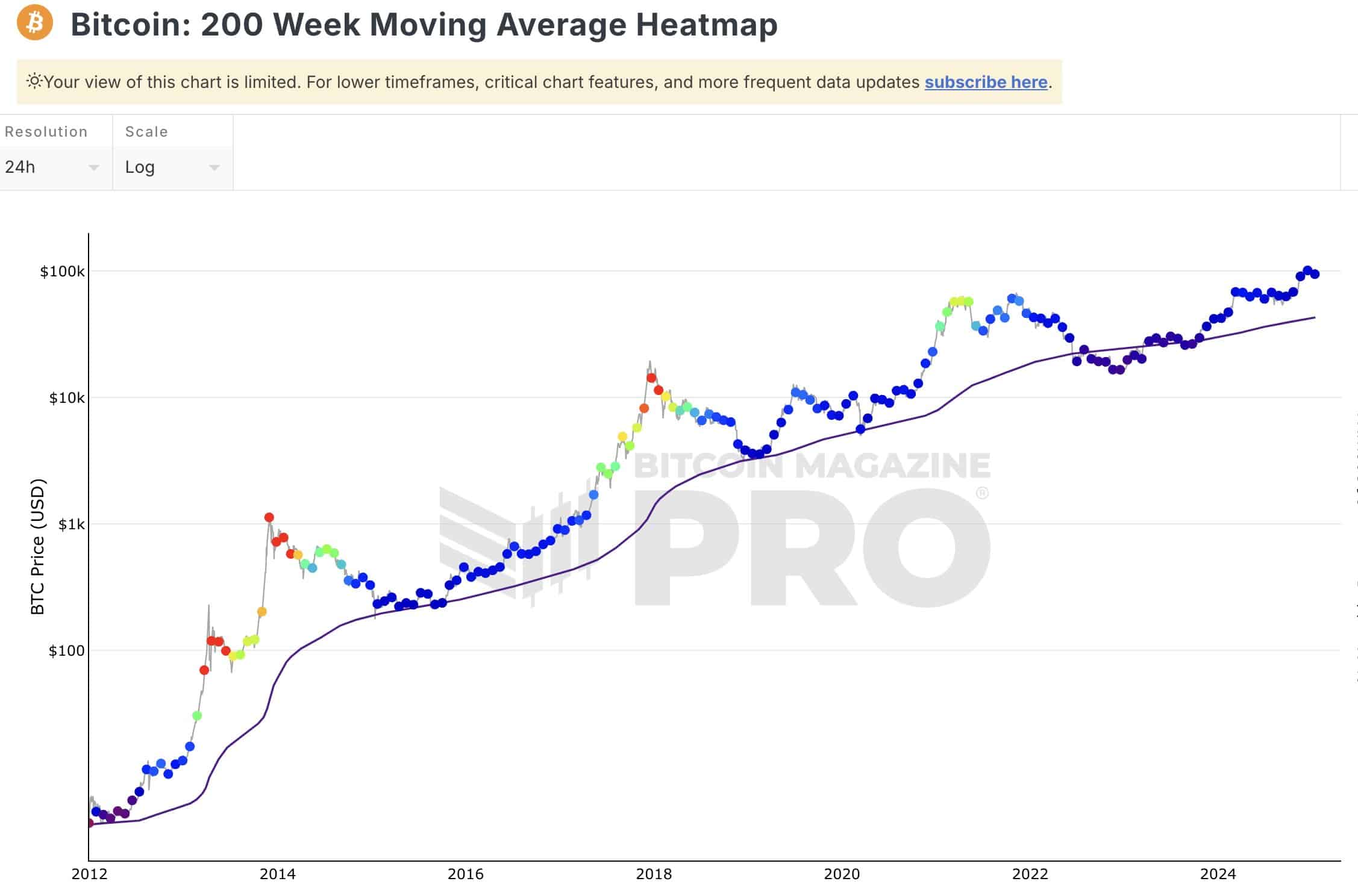

Equally, the 200-week MA (shifting common), sometimes marking the underside of the BTC cycle, rose to $43,000. Merely put, the following bear part might attain above $40,000 earlier than a brand new bull run part is triggered.

Supply:

Nonetheless, it’s value mentioning that the king coin nonetheless faces some short-term dangers. In response to crypto buying and selling agency QCP Capital, Donald Trump’s presidential inauguration and gradual expectations of Fed fee cuts might expose BTC to awkward strikes.

A number of the each day market commentary shared on Telegram read,

“Count on elevated volatility earlier than and after the inauguration as markets digest and regulate to a brand new time period below Trump. We stay cautious on the draw back because the $90k degree in BTC has been examined a number of instances.”

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024