Ethereum

Mapping Ethereum’s price reaction to December’s CPI data

Credit : ambcrypto.com

- Ethereum is going through elevated volatility following the newest CPI knowledge, prompting market hypothesis

- In mild of the CPI knowledge announcement, ETH Open Curiosity rose to over $6 billion

The latest US Consumer Price Index (CPI) Report. indicated a rise of 0.4% in December, bringing annual inflation to 2.9%. This uptick, primarily pushed by rising power prices, has important implications for monetary markets, together with cryptocurrencies resembling Bitcoin (BTC) and Ethereum (ETH).

Market reactions to CPI knowledge

Following the discharge of the CPI, Bitcoin’s worth rose 4.12% to round $100,510, reflecting investor optimism about potential rate of interest cuts by the Federal Reserve. Ethereum additionally posted features within the newest buying and selling session, with its worth rising greater than 7% to round $3,451.

These strikes advised that cryptocurrencies reply positively to inflation knowledge attributable to their enchantment as various belongings in inflationary environments.

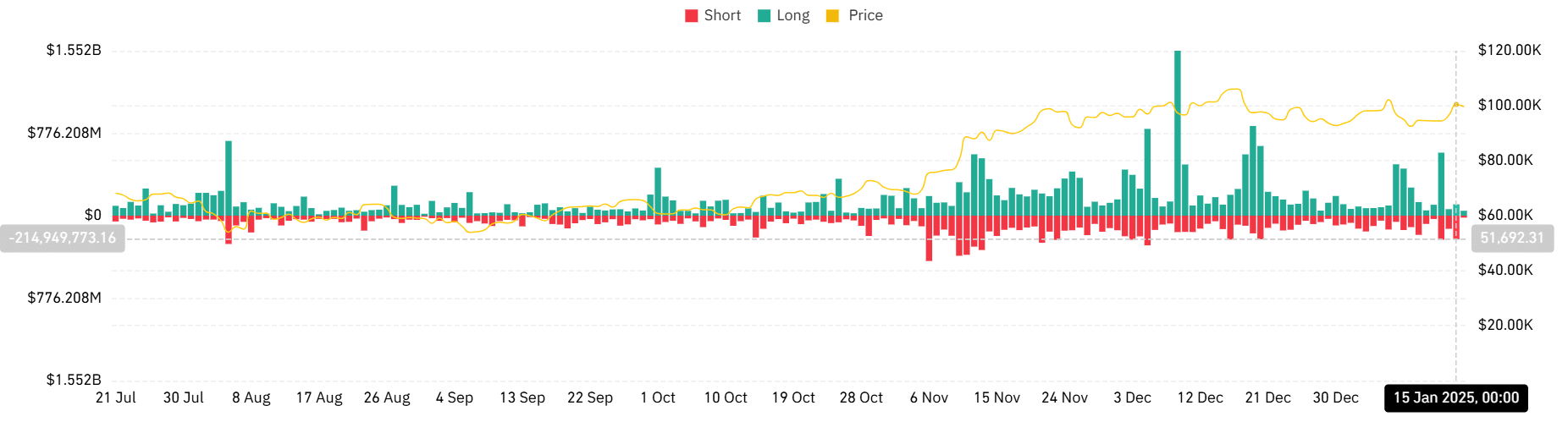

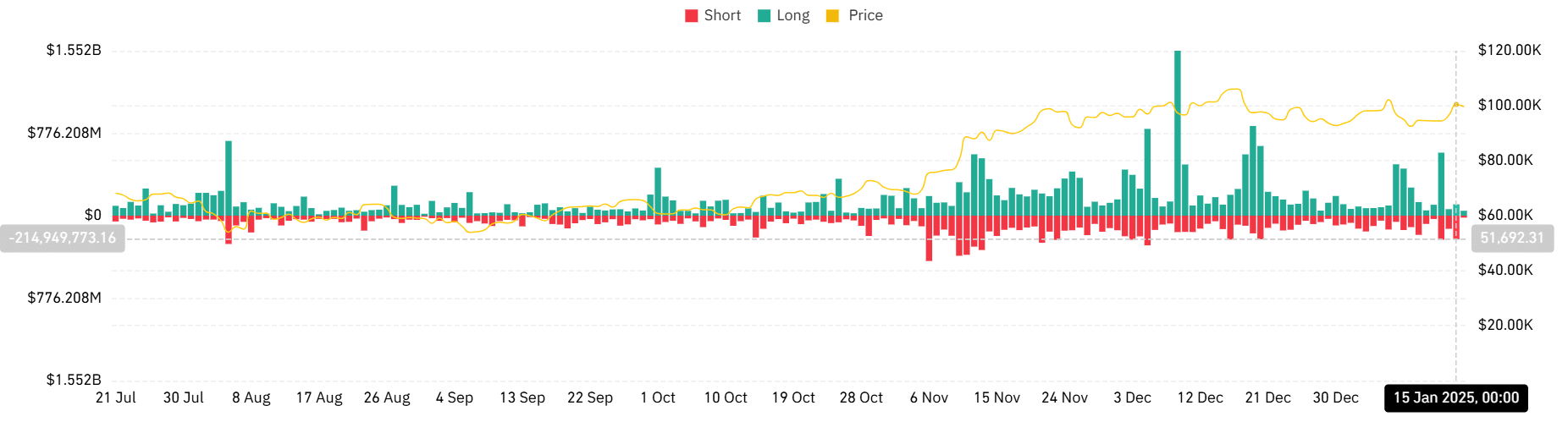

Liquidation dynamics after the CPI launch

The entire liquidation chart from the final buying and selling session revealed a liquidation wave after the CPI announcement. An evaluation of the chart confirmed that liquidations amounted to nearly $330 million.

Ethereum particularly noticed important liquidation exercise – an indication of elevated market volatility and fast shifts in buyers’ positions. Actually, the liquidations have been value greater than $67 million.

Supply: Coinglass

Moreover, the market noticed extra brief liquidations, with recorded quantity exceeding $223 million.

This development underlines the sensitivity of those belongings to macroeconomic indicators and the speculative nature of the market.

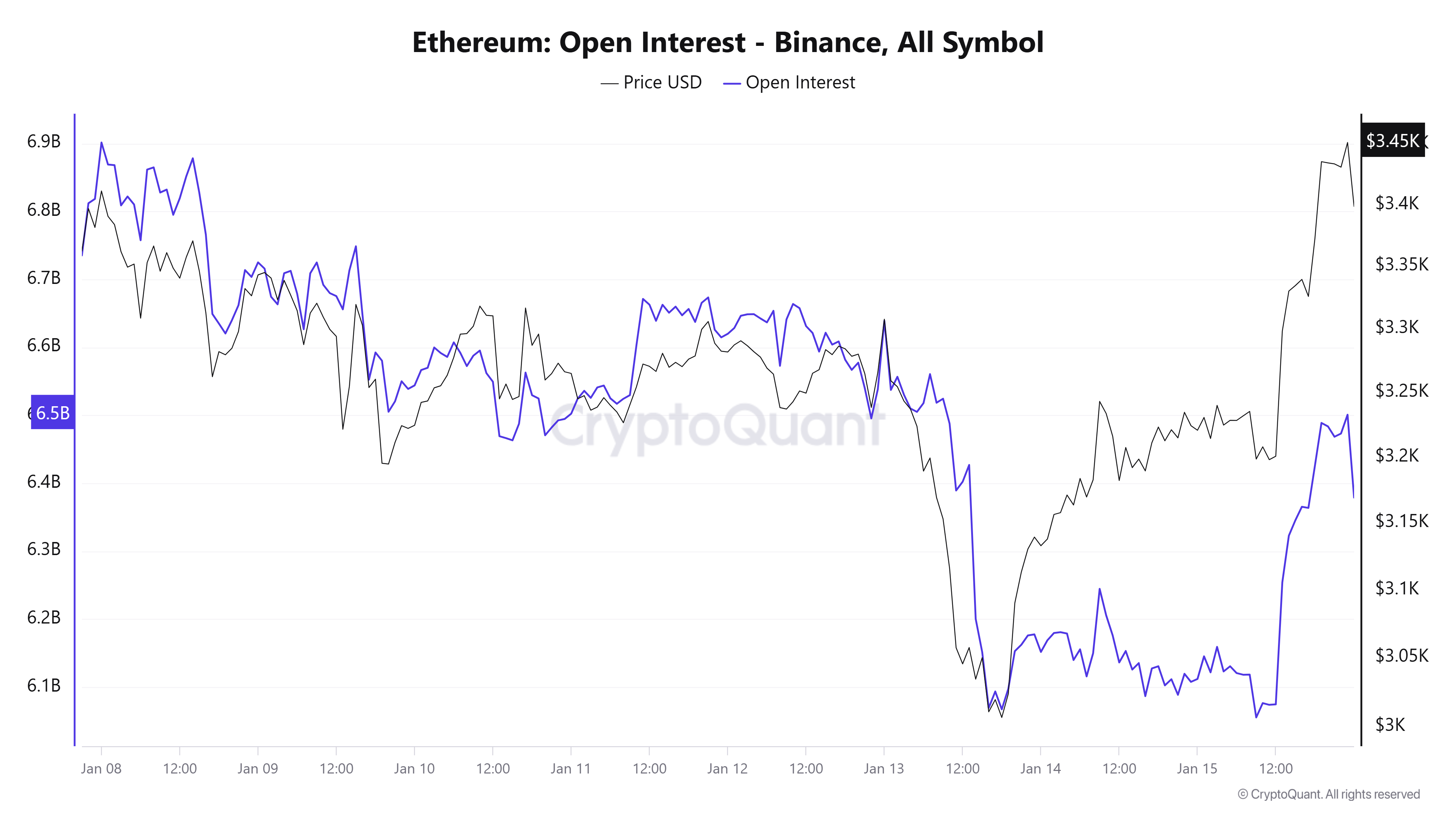

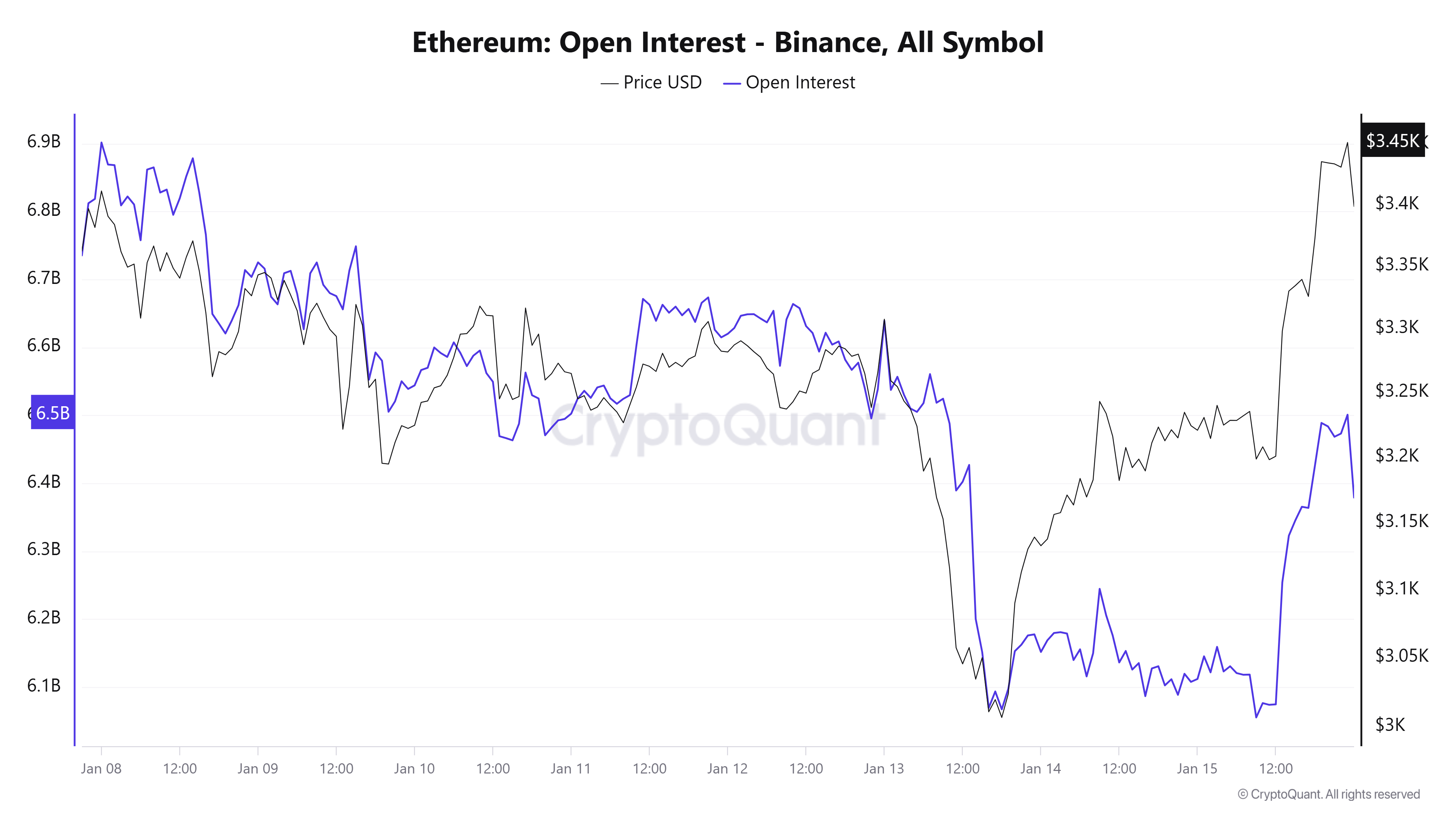

Ethereum Open Curiosity Evaluation

Ethereum’s Open Curiosity (OI) chart highlighted a notable enhance in OI following the discharge of the CPI knowledge. Evaluation of the OI knowledge confirmed that this rose to round $6.5 billion within the final buying and selling session.

Supply: CryptoQuant

This uptick advised that extra capital has entered the ETH futures markets, reflecting rising investor curiosity and potential expectations of future worth actions. Nevertheless, it’s value noting that top OI also can point out increased leverage. This could result in higher volatility.

Ethereum’s worth outlook

Ethereum’s worth motion revealed a compelling technical setup, with the 50-day transferring common at $3,562.47 sustaining a wholesome hole above the 200-day MA at $2,980.39. The MACD indicator values (0.53, -55.72, -56.25) advised that momentum is making an attempt to shift though the present construction stays fairly fragile.

Supply: TradingView

The altcoin’s newest worth transfer, influenced by CPI knowledge displaying a 0.4% enhance in December, has prompted ETH to check important resistance ranges. The important thing help zone at $3,200 is now essential for sustaining the prevailing market construction, whereas the $3,500 zone represents fast resistance.

– Learn Ethereum (ETH) worth forecast 2025-26

Ethereum’s response to those macro catalysts might set the tone for its near-term worth motion. Whereas the derivatives market is displaying indicators of elevated curiosity, the balanced liquidation patterns point out a extra mature market response to financial knowledge, in comparison with earlier cycles.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024