Altcoin

Bitcoin Sees Recovery, But Are the Bulls Ready to Push BTC Past $70,000?

Credit : ambcrypto.com

- Bitcoin is up 8.9% and nearing a essential resistance degree at $70,000, with analysts predicting a doable breakout.

- Key metrics corresponding to open curiosity quantity and NVT ratio point out sturdy market curiosity and potential for additional good points.

Bitcoin [BTC] is regularly recovering after a big decline to the $50,000 degree earlier this month on August 5. Presently, the main cryptocurrency is buying and selling at $63,742, marking a rise of 8.9% from the previous week.

This worth motion has sparked discussions amongst crypto analysts about Bitcoin’s doable path within the coming weeks. Considered one of these analysts, Mags, not too long ago shared his insights on X and mentioned Bitcoin’s present worth motion.

Breakout above $70,000 imminent?

Stockroom marked that Bitcoin’s present sideways transfer shouldn’t essentially be considered as bearish. He identified that earlier than any main transfer, Bitcoin sometimes undergoes a interval of consolidation inside a selected vary.

Traditionally, these consolidation phases lasted between 8 and 30 weeks.

Supply: Mags on X

As of now, Bitcoin is 25 weeks into its present consolidation section. Whereas it’s tough to foretell the precise length of this section, Mags emphasised that Bitcoin remains to be in a bull market.

If this sample holds, he advised the eventual breakout might be vital.

As Bitcoin nears the essential resistance degree at $70,000, different analysts are additionally weighing in on the potential for a breakout.

Captain Faibik, one other well-known crypto analyst on X, famous that whereas Bitcoin bulls seem like in management, the true take a look at nonetheless lies forward.

He speculated that Bitcoin may retest the $70,000 resistance this week, however puzzled if the bulls would have the energy to interrupt this key degree.

Supply: Captain Faibik on X

Elementary Indicators: What They Sign for Bitcoin’s Future

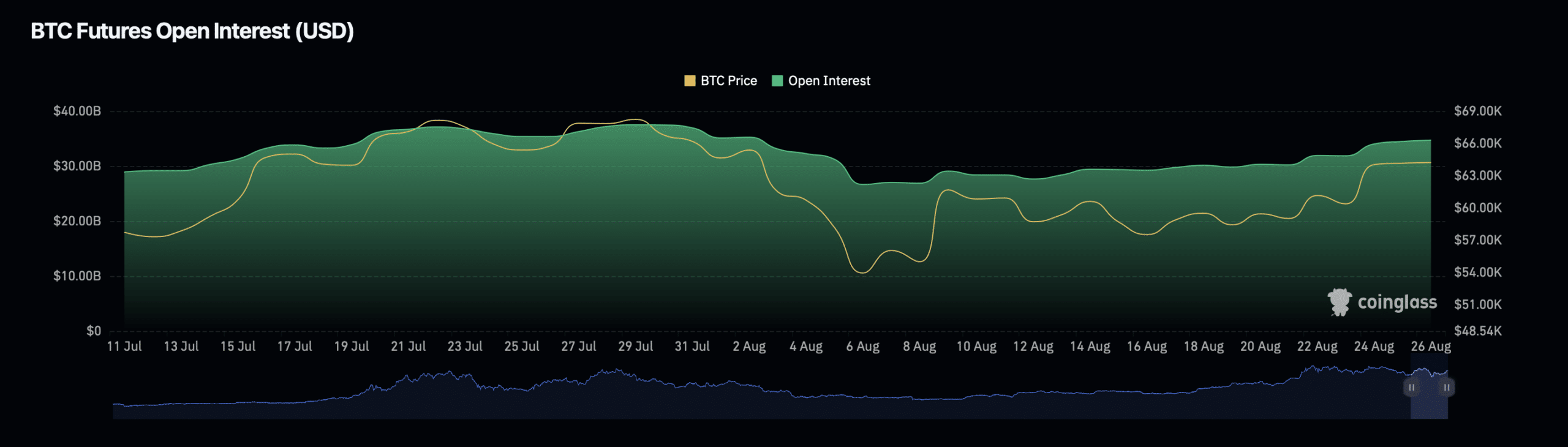

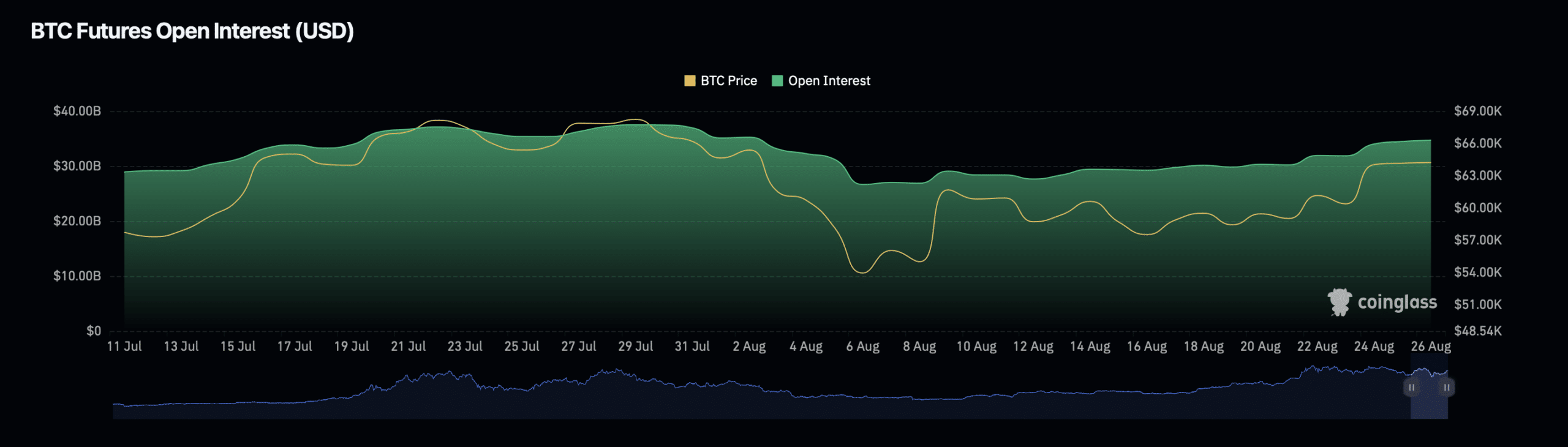

To grasp Bitcoin’s potential for continued upside, it is value analyzing the asset’s underlying fundamentals. In line with facts from Coinglass, Bitcoin open curiosity has seen a slight decline of 1% over the previous day, bringing its present valuation to $34.39 billion.

Open curiosity refers back to the whole variety of excellent spinoff contracts, corresponding to futures and choices, that haven’t but been settled.

Supply: Coinglass

A drop in open curiosity may point out a discount in market exercise or a shift in merchants’ sentiment.

Regardless of this decline, Bitcoin’s open curiosity quantity, which measures the whole worth of those contracts, elevated 1.84% to $39.06 billion over the identical interval.

This improve means that whereas the variety of contracts has decreased, the worth of the remaining contracts has elevated, probably indicating larger confidence amongst merchants about Bitcoin’s near-term prospects.

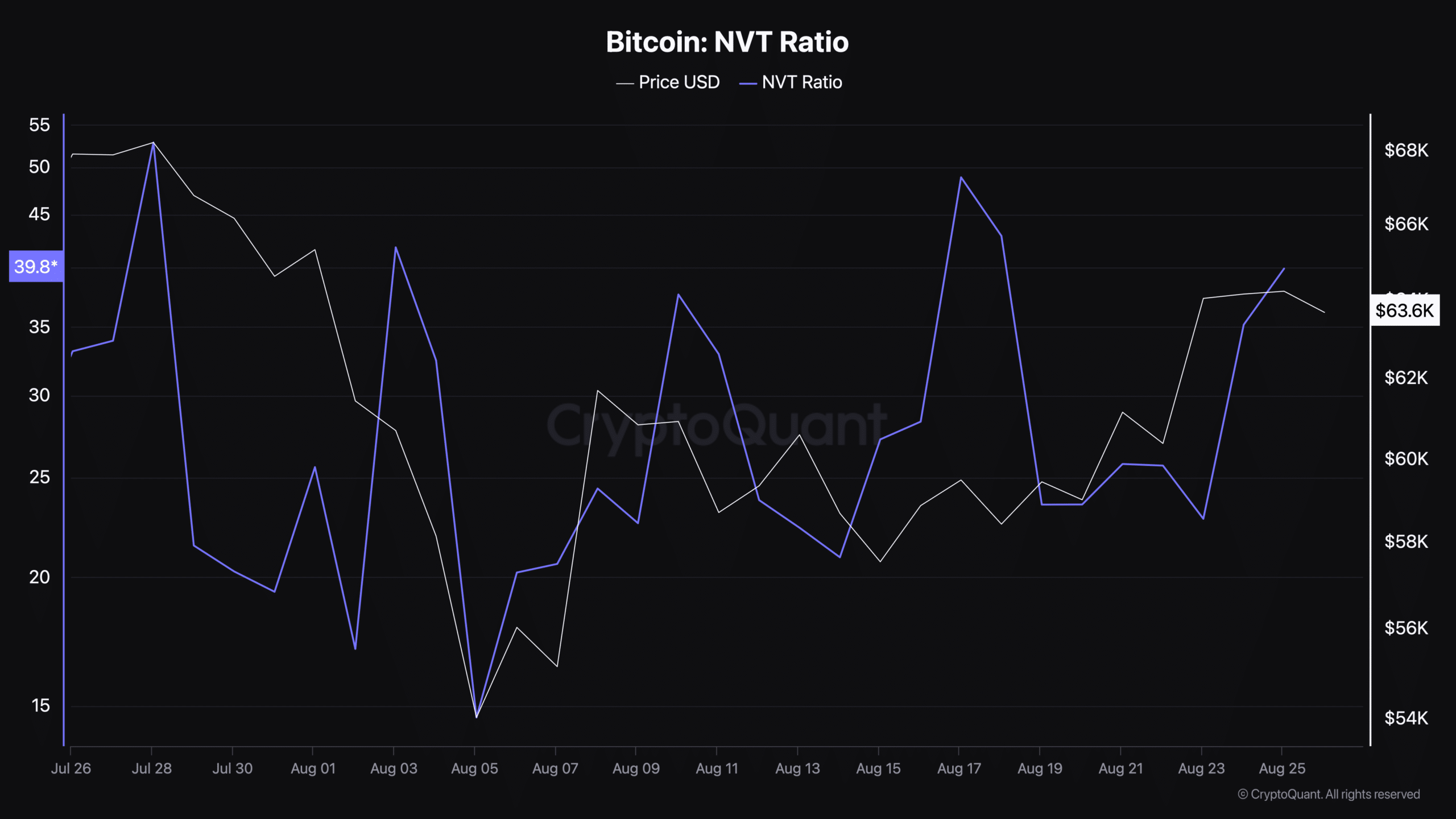

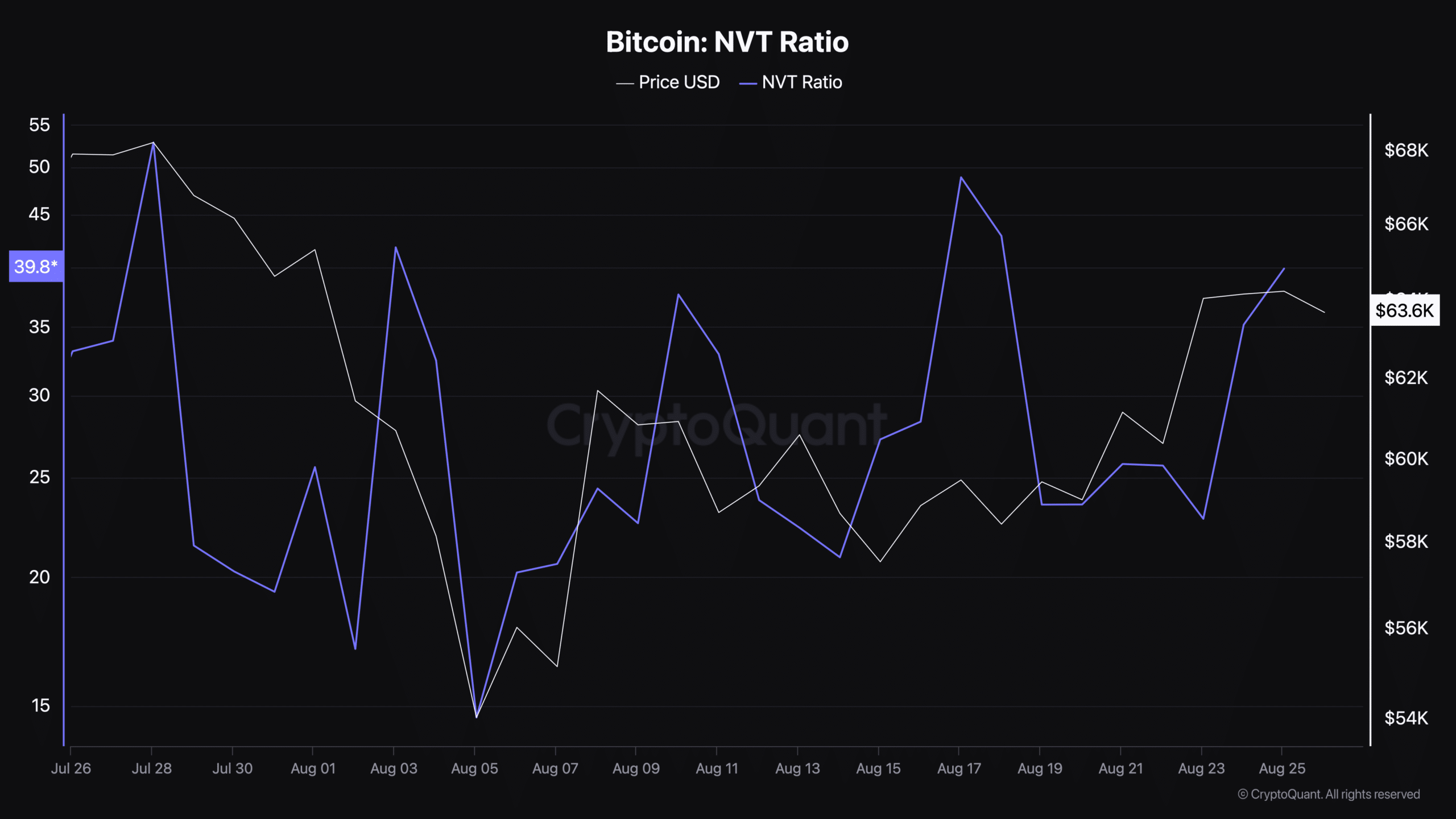

One other vital metric to think about is Bitcoin’s Community Worth to Transactions (NVT) ratio, which is at present on the rise and is reported to be 39.8. facts from CryptoQuant.

The NVT ratio is a valuation metric that compares Bitcoin’s market capitalization to the variety of transactions on its community.

Supply: CryptoQuant

A better NVT ratio could point out that Bitcoin is overvalued relative to transaction quantity, probably indicating warning.

Learn Bitcoin’s [BTC] Value forecast 2024-25

Nevertheless, it may additionally point out that the market expects future development in transaction quantity, which might justify the present valuation.

Within the case of Bitcoin, the rising NVT ratio may suggest that buyers are anticipating a continued worth improve, supported by the broader market development.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024