Layer 2

Ethereum lags even as traders bet big, rally to $4,500?

Credit : crypto.news

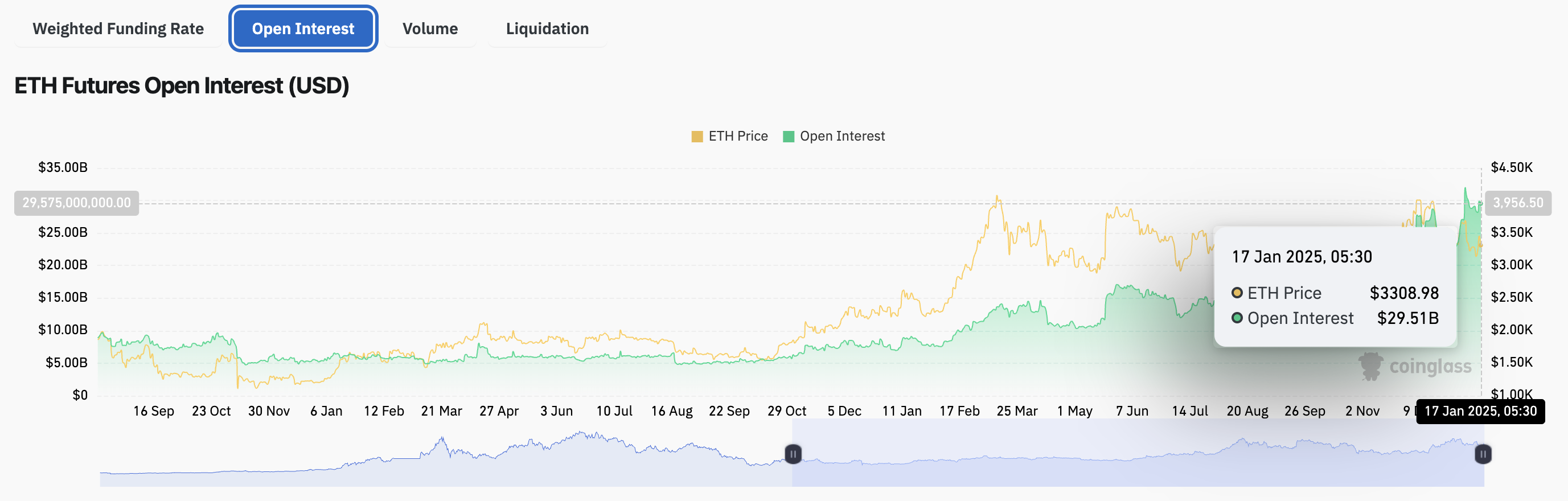

Ethereum stays regular above $3,300 as crypto merchants put together for the inauguration of newly elected President Donald Trump. Derivatives merchants are bullish on Ethereum, with open curiosity in Ether derivatives contracts surpassing $30 billion on Friday.

Ethereum’s main pockets buyers proceed to build up the token regardless of its lackluster worth efficiency by 2024. The altcoin has a excessive correlation with Bitcoin, and up to date market strikes are conducive to good points in Ether.

Ethereum is seeing large bets from derivatives merchants

Ethereum derivatives information on Coinglass reveals a virtually 47% improve in choices buying and selling quantity over the previous 24 hours as derivatives open curiosity hovers round $30 billion. Choices quantity exceeded $1 billion in a 24-hour interval.

The lengthy/quick ratio, which is used to find out whether or not derivatives merchants are bullish or bearish on a token, is larger than one on Binance and OKX. Derivatives merchants are optimistic a few rise within the Ethereum worth.

The chart beneath reveals the rise in open curiosity in Ethereum because the final US presidential election. Open curiosity is beneath the height of $31.99 billion noticed on January 7, 2025.

Ethereum on-chain evaluation

Derivatives merchants’ prospects are thought of a benchmark for what merchants can count on within the spot markets. Mixed with bullish on-chain metrics, derivatives merchants’ prospects help a thesis of good points within the Ethereum worth.

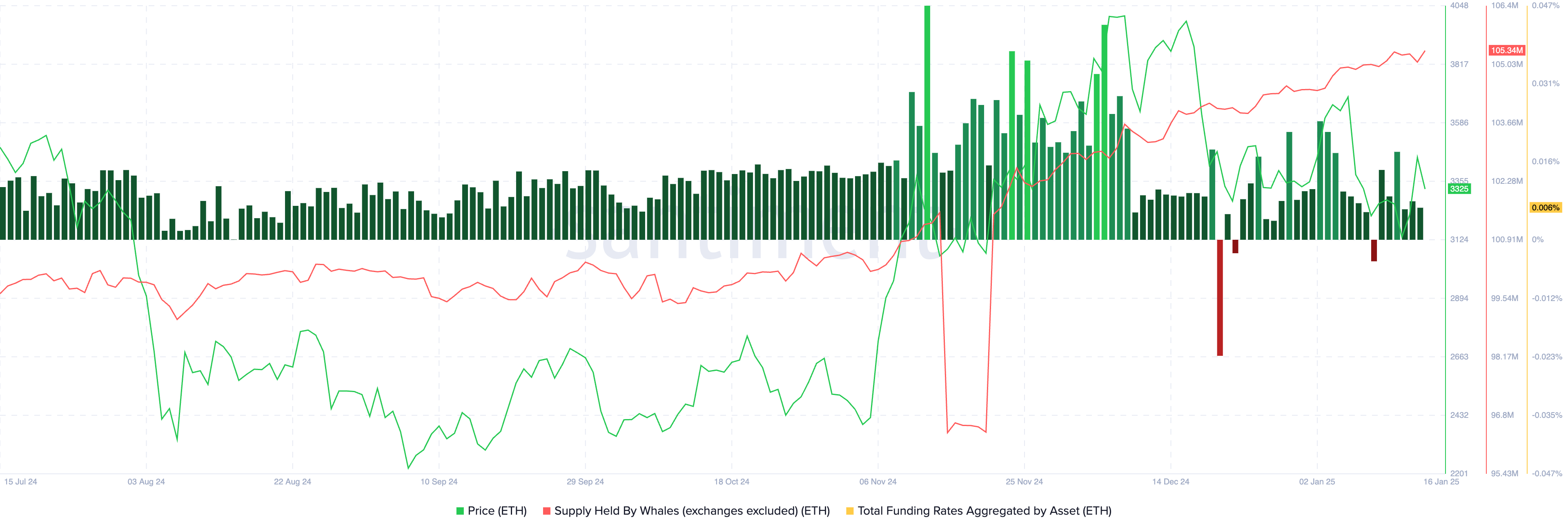

Santiment information reveals that the availability of Ether tokens within the fingers of main pockets buyers has been steadily rising, which means that even because the ETH worth fell, merchants continued to build up. This can be a constructive signal for Ethereum.

The whole funding price collected by Ethereum is generally constructive in January 2025. This represents optimism and hope for worth good points amongst merchants.

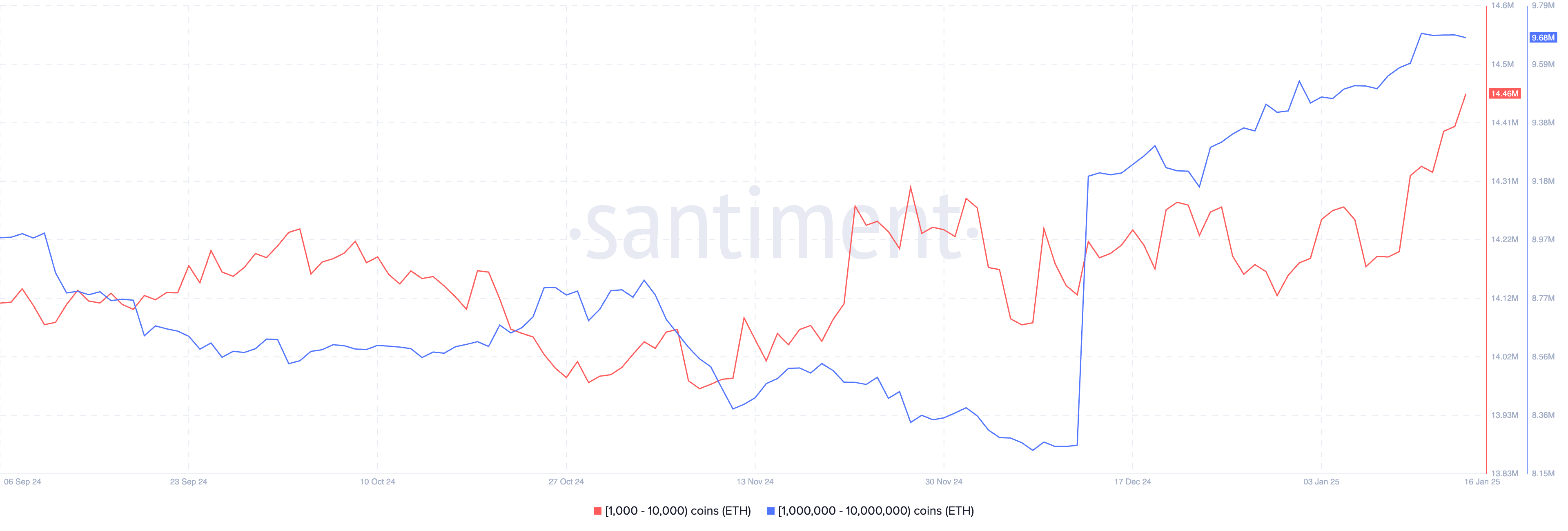

Ethereum within the fingers of merchants with 1,000 to 10,000 ETH of their wallets has risen over the previous week. Equally, holders with 1 million to 10 million Ether added to their ETH holdings between the final two weeks of 2024 and January 17, 2025.

Ethereum market actions

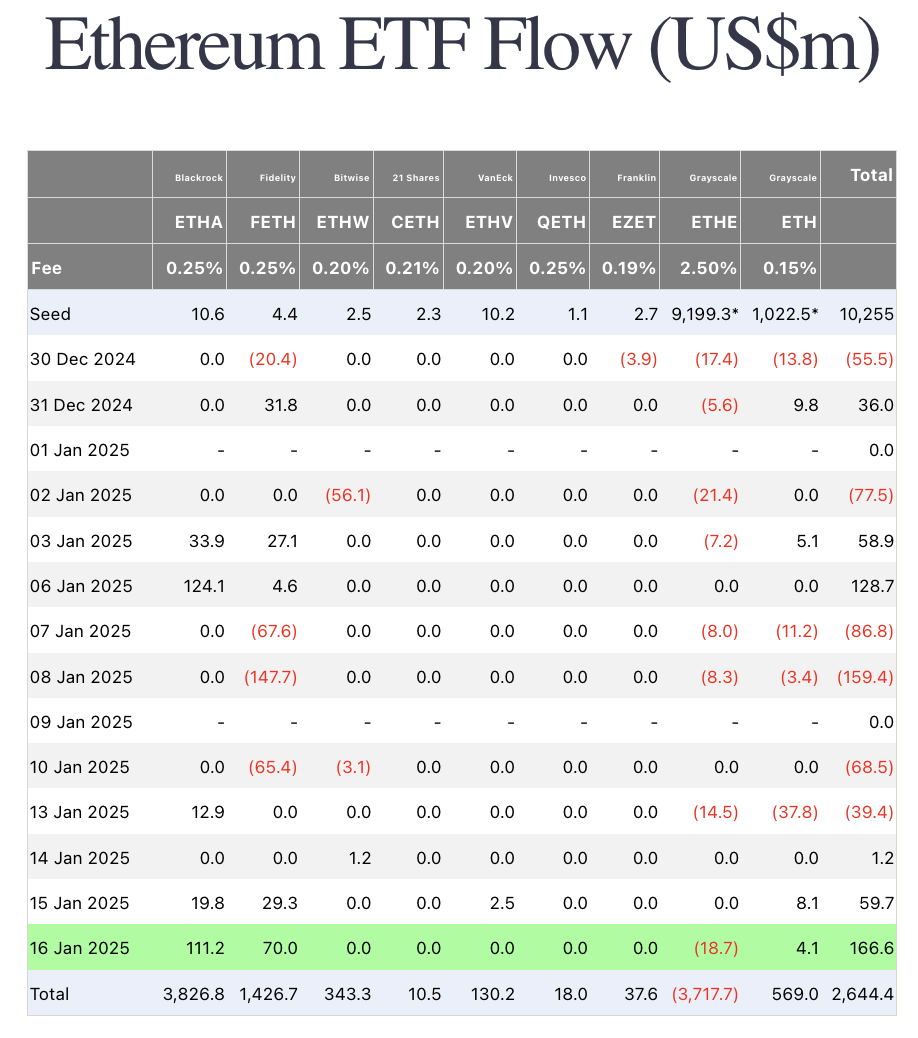

Knowledge from Farside Buyers reveals that institutional capital inflows into Ether almost doubled on Thursday. ETH Spot ETFs recorded inflows of $166.6 million on January 16, up from 59.7 million the day earlier than.

Usually, rising institutional curiosity is bullish for Ether.

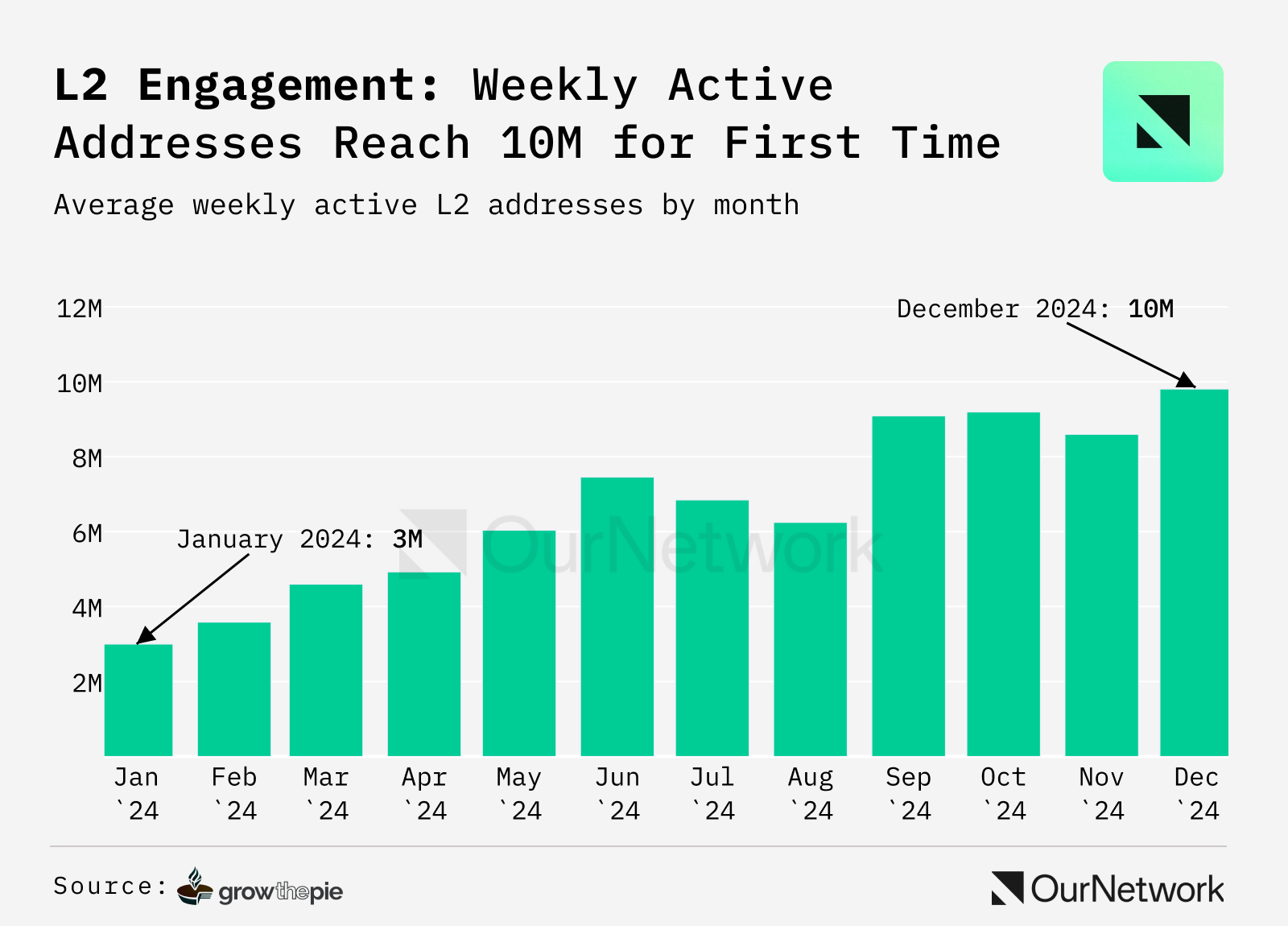

One other essential market motion is the rising exercise within the chain on account of Layer 2 protocols. Knowledge from GrowThePie reveals that Ethereum Layer 2 chains have skilled speedy development in energetic addresses, rising greater than 300% in a 12 months and exceeding 10 million per week. Energetic wallets on a number of Layer 2s are comparatively low, lower than 5%.

The rising adoption and value of Layer 2 contributes to income for the underlying chain, supporting a development thesis for Ether.

Technical evaluation and ETH worth prediction

The weekly ETH/USDT worth chart reveals Ether hovering across the $3,360 degree early on Friday. The altcoin is 22% beneath its 2024 peak of $4,107. Two technical indicators, the relative power index and the transferring common convergence divergence, help a bullish thesis for Ethereum.

The RSI is trending increased and studying 53, MACD is flashing consecutive inexperienced histogram bars, supporting a bullish thesis for Ethereum on the weekly time-frame.

If Ethereum ends its consolidation and breaks above the December 2024 peak, the altcoin may goal the $4,578 degree and rise to the earlier all-time excessive at $4,878, as seen within the weekly ETH/USDT chart beneath .

Vitalik Buterin’s tackle Ethereum Layer 2 and the way forward for Ether

Buterin lately commented on Soneium from Sony Block Resolution Labs. Buterin stated the undertaking reveals how Ethereum Layer 2 is “nice for companies and customers” in a tweet on X.

Buterin believes that the creation of a free market on the Layer 2 degree makes it extra accessible and helpful for companies and customers, supporting the expansion of the Ethereum ecosystem. The thought is to consider Layer 2 rollups as ventures in-built cities throughout the ‘Ethereum mainnet’ state.

The controversy surrounding Soneium involved the steps taken to guard mental property by imposing restrictions on some contracts throughout the protocol. Whereas it looks like meme coin merchants have been shut down, customers can proceed their transactions on the Ethereum mainnet with a delay of some hours.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September