Ethereum

Ethereum’s Q1 2025 outlook – Is ETH at the risk of being left behind now?

Credit : ambcrypto.com

- Ethereum has traditionally soared within the first quarter, usually doubling returns

- Nevertheless, with development slowing, the stakes are actually larger

Do you bear in mind election night time final yr? Properly, Ethereum recorded its longest inexperienced candlestick in three months on the time, rising 12% in sooner or later to shut at $2,721. Quick ahead to January 19 and now it’s down 20% from the $4,015 peak from that rally.

With a lot happening proper now, the approaching week will put ETH’s historical past of bullish Q1 to the take a look at: will it repay?

Historical past issues in crypto

Ethereum has traditionally finished nicely within the first quarter, usually doubling and even tripling returns over the previous 4 years. In 2023, ETH rose 54%, reaching $1,800 by the top of the quarter. Nevertheless, 2021 stays the excessive level, with ETH surging 160% to $1,920 in simply three months.

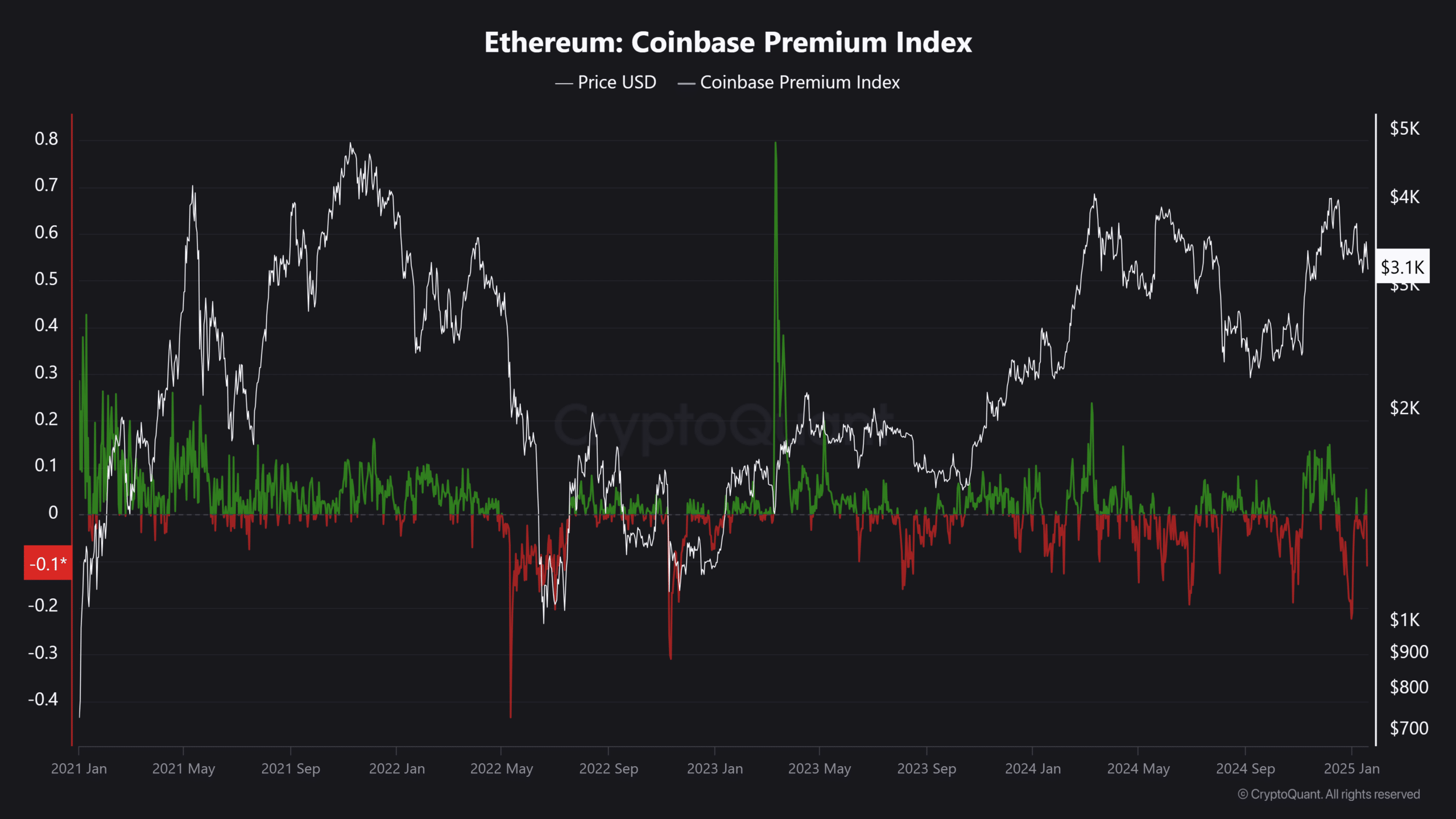

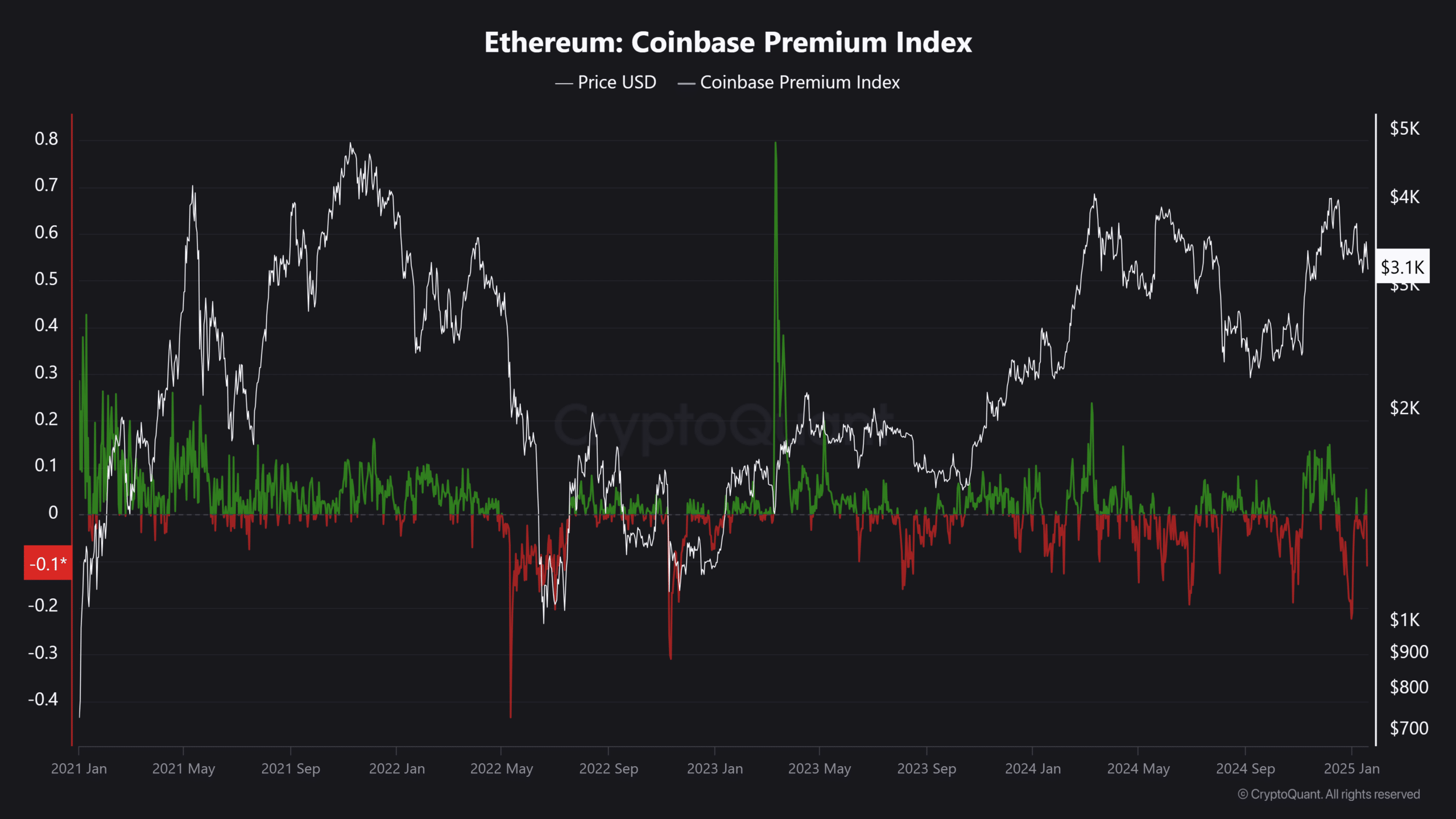

Clearly, development has slowed since then and annualized returns are additionally declining, making a dilemma for HODLers. This shift in sentiment is seen within the Coinbase Premium Index (CPI), which underlined a cooling of shopping for momentum.

Even because the crypto market cap reached an all-time excessive of $3.70 trillion throughout final yr’s post-election rally, the ETH shopping for frenzy amongst US buyers barely moved the CPI. This indicated declining enthusiasm throughout the board.

Supply: CryptoQuant

4 years in the past, Ethereum’s market capitalization even reached $500 billion, whereas its value rose to $4.76k. Quick ahead to right now, it’s down 22% and buying and selling at $3.2k on the time of writing. With quarterly returns cooling, HODLers’ endurance is now being examined as ETH struggles to maneuver previous its key psychological ranges.

Regardless of the market-wide restoration, ETH’s lack of ability to interrupt $4k stands in stark distinction to XRP, which is already up 53% within the first quarter. Buyers are clearly in search of larger returns, and different high-caps are doing their finest to make this occur.

Ethereum is at risk of being left behind

Zooming in, XRP’s market cap has risen to a brand new all-time excessive of $180 billion, now half that of Ethereum. In the meantime, ETH is down 3% for the reason that begin of the yr. At this price, XRP may quickly overtake Ethereum – quicker than anybody expects.

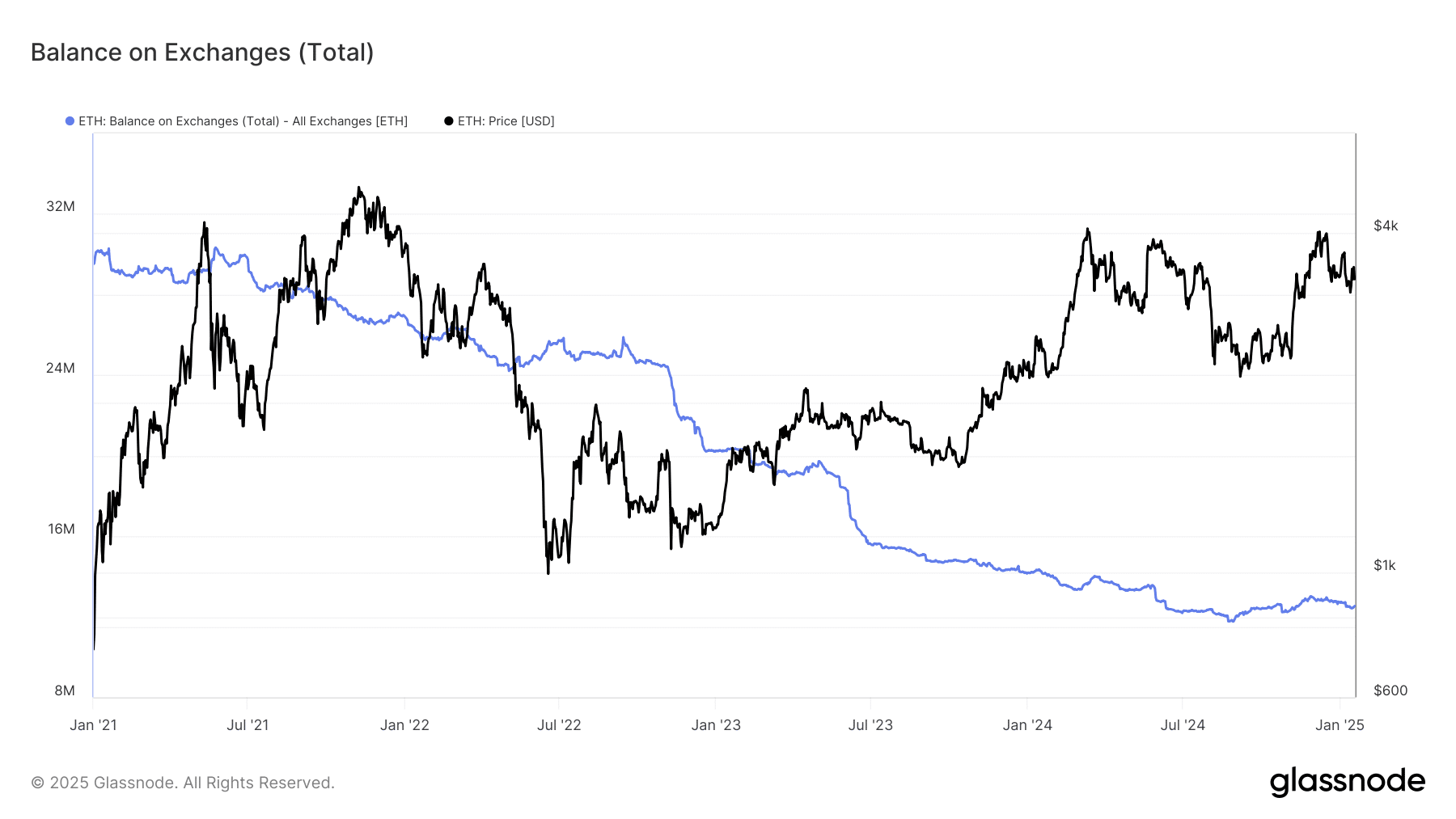

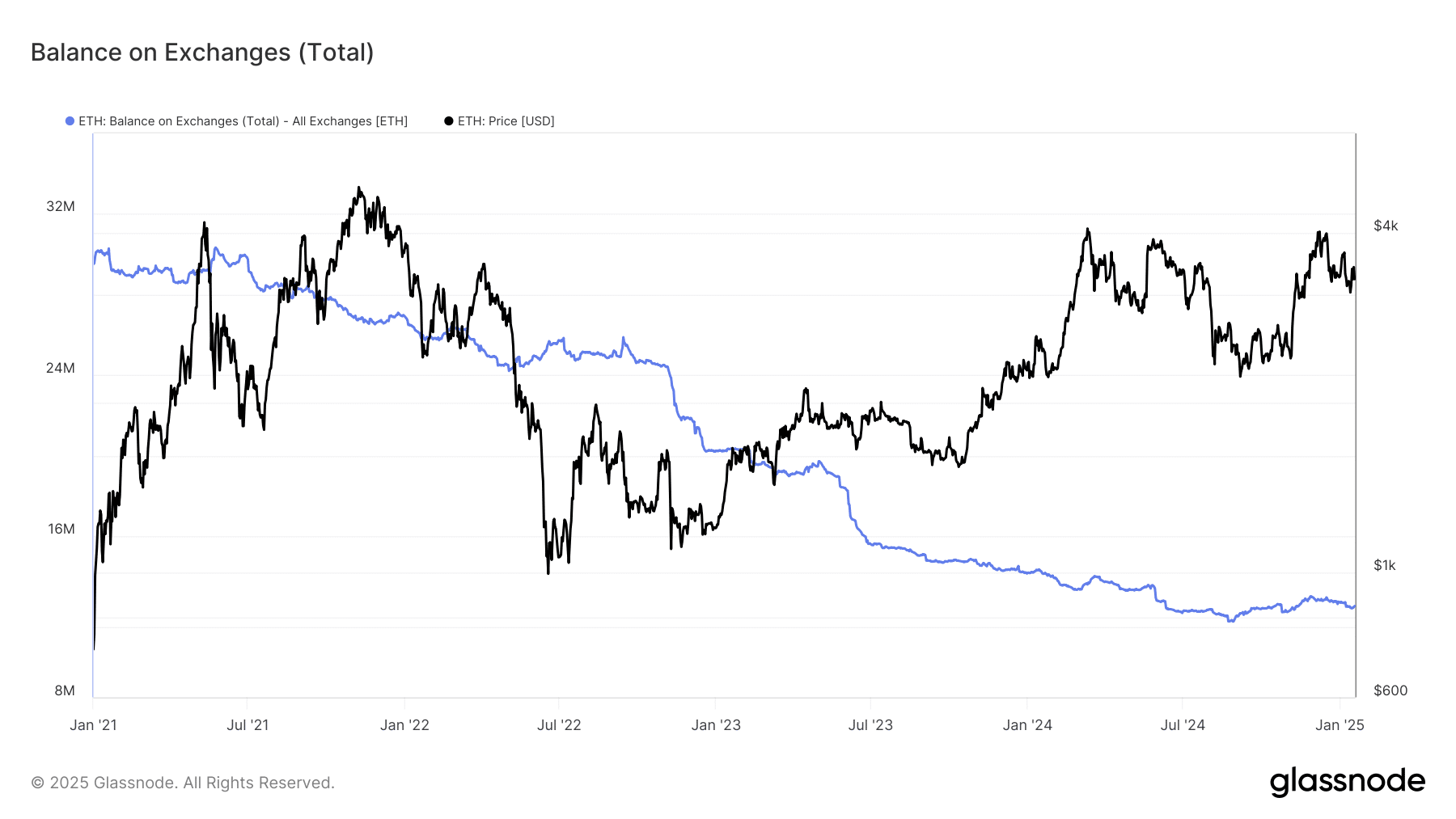

Although there may be 540k ETH withdrawn and $1.84 billion in contemporary capital flowing into the market, Ethereum has nonetheless seen a 2% decline over the previous month. In reality, the inventory market steadiness additionally reached a brand new low. Right here, the The shortage of bullish motion can be evident, placing Ethereum’s long-term prospects in danger.

Supply: Glassnode

Learn Ethereum’s [ETH] Worth forecast 2025–2026

What’s extra worrying? Lengthy-term holders (LTHs) have elevated their holdings by 75% up to now yr.

Nevertheless, with yields falling brief, these LTHs may disappear quickly, making the $4k stage a important take a look at for ETH within the coming days.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September