Analysis

Whales Invest $20M in Chainlink (LINK) Following Trump’s Inauguration

Credit : coinpedia.org

LINK, Chainlink’s native token, is receiving plenty of consideration from crypto fans following Donald Trump’s latest funding of $4.7 million. This substantial funding has attracted large-scale traders who’ve additionally invested in LINK tokens.

Crypto Whales Purchase 770K LINK

At the moment, January 21, 2024, a outstanding crypto skilled shared a put up on Nevertheless, this substantial accumulation didn’t have any impression on the LINK worth.

On the time of writing, LINK is buying and selling round $25.70 and has skilled a 2.50% decline within the final 24 hours. Throughout the identical interval, intraday buying and selling quantity fell 44%, indicating decrease dealer participation, probably on account of revenue reserving because the market reacted forward of Trump’s inauguration.

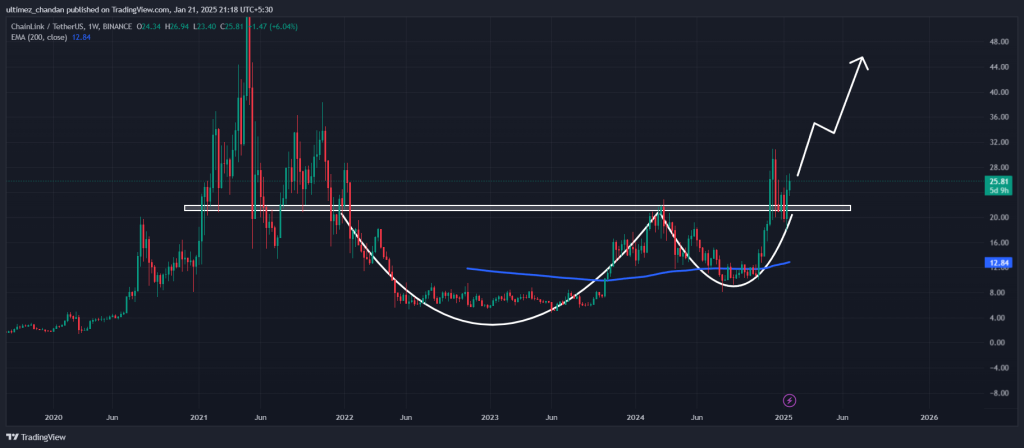

Chainlink (LINK) Technical Evaluation and Upcoming Ranges

In line with skilled technical evaluation, LINK seems bullish because it has efficiently retested the bullish Cup and Deal with worth motion sample on the weekly timeframe and is poised for a major upward rally. In the meantime, the altcoin presently seems to be consolidating inside a good vary on account of prevailing market sentiment.

Primarily based on the historic worth momentum, if LINK crosses the higher certain of the consolidation and closes a every day candle above the $26.40 degree, there’s a robust chance that it might rise by 50% to hit the $38.50 degree within the coming days reaches.

Moreover, LINK’s Relative Power Index (RSI) stands at 52, indicating a possible worth reversal and indicating that the asset has loads of room to rise considerably within the coming days.

Bearish outlook for merchants

As a result of ongoing consolidation, merchants buying and selling LINK seem bearish, as evidenced by Coinglass knowledge. Presently, LINK’s Lengthy/Quick ratio stands at 0.92, indicating bearish sentiment amongst merchants. The information additional reveals that within the final 24 hours, round 48.65% of prime merchants positioned bets on lengthy positions, whereas 51.35% most well-liked quick positions.

Wanting on the present market sentiment, it seems that traders are taking benefit of the present worth and appear to be accumulating, whereas merchants appear to be buying and selling based mostly available on the market sentiment.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September