Policy & Regulation

‘Trust Me It’s Going to Happen’

Credit : cryptonews.net

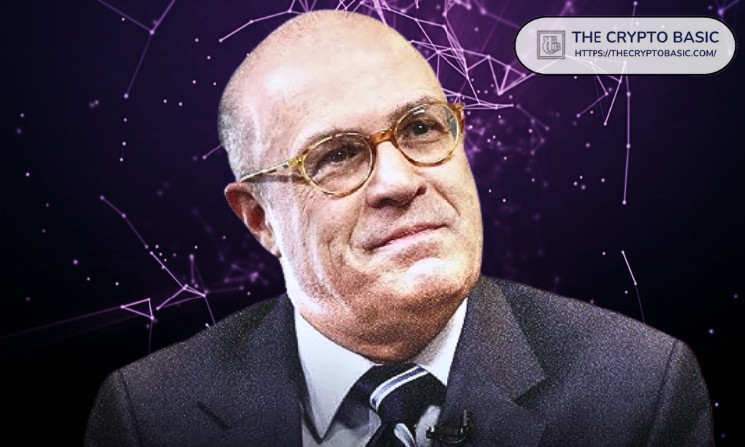

Former CFTC Chairman Chris Giancarlo claims regulators will permit US banks to make use of crypto for funds.

The fortunes of the crypto business seem like altering quickly. Just some weeks in the past, the trending subject within the house was “debanking”, a time period describing claims that market contributors misplaced entry to banking providers on account of regulatory stress.

Now, only a few days into President Donald Trump‘s inauguration, and one of many leaders of America’s high banks is already speaking about embracing the funds asset class, with a former high regulator claiming regulatory strikes to greenlight it are imminent.

American banks will embrace crypto?

Former CFTC Chairman Chris Giancarlo has argued that regulators will permit US banks to make use of crypto for funds.

“Imagine me, it can occur” Giancarlo claimed on TuesdayJanuary 21, in response to an X-post from Fred Thiel, chairman of MARA Holdings.

Within the submit, Thiel highlighted statements from Financial institution of America CEO Brian Moynihan stating that the banking business was able to undertake crypto for funds if regulators allowed it.

Moynihan introduced this in a dialog with CNBCAndrew Sorkin on the World Financial Discussion board in Davos. The financial institution supervisor emphasised that banks already had a number of blockchain patents and data of the right way to enter the house.

Unsurprisingly, Giancarlo’s declare that the inexperienced mild for such a transfer is on the horizon has brought about nice pleasure amongst crypto market contributors, as US banks supporting and maybe encouraging crypto funds might usher in an enormous wave of adoption.

Nonetheless, it stays unclear if and when this regulatory readability will come. Nonetheless, the crypto business stays optimistic amid Trump’s pro-crypto picks for a number of high regulatory positions, together with the Federal Deposit Insurance coverage Company. the Securities and Change Fee, and the Treasury.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now