Policy & Regulation

Trump’s Digital Assets Executive Order May Not Last — Senator Lummis is Doing it Right

Credit : cryptonews.net

Final night time, President Trump signed the “Digital Belongings” Government Order (EO), and for example that bitcoiners really feel … bitter. Initially, rumors had been held that this might be the lengthy -awaited strategic Bitcoin reserve (SBR) laws. However no – not even shut. Bitcoin Reserve acquired no point out.

As a substitute, the EO mentioned:

“The working group will consider the potential creation and upkeep of a nationwide digital property inventory and suggest standards for establishing such a inventory, presumably derived from cryptocurrencies seized by the federal authorities by its regulation enforcement efforts.”

Translation: This EO appears like a obscure “Let’s research Shitcoins” roadmap as an alternative of a daring step within the course of a strategic Bitcoin reserve. Should you hoped for a nationwide state of the Orange Pil Second, this isn’t.

However earlier than you rage tweet, you’re taking a deep breath. There’s a silver lining. The EO prohibits CBDCS and an enormous victory for freedom cash and a extra Bitcoin-released future.

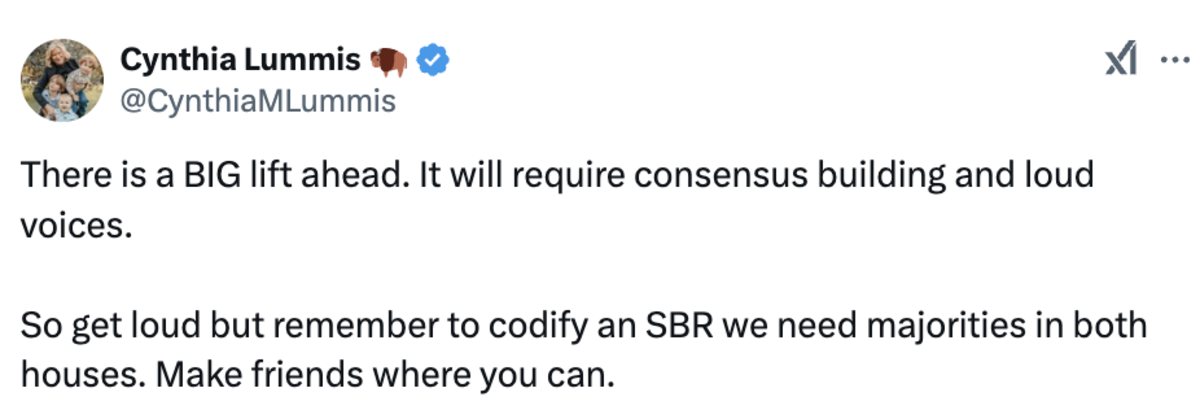

And, as Senator Cynthia Lummis remembered us yesterday, is her strategic Bitcoin Reserve Invoice “”A giant elevate“

Why is that this excellent news? Let’s break it down:

- Government orders are susceptible: EOS will be carried out shortly, however can simply be reversed by the subsequent administration. They’re political post-it notes, no everlasting options.

- Laws is sustainable: legal guidelines adopted by each homes of the congress are far more troublesome to withdraw. The lengthy -term technique of Lummis is geared toward generations of the position of Bitcoin within the US economic system, not simply the subsequent election cycle. She takes the low time most popular route and I greet her for that.

Senator Lummis mentioned it in an X DM that she allowed me to share:

“Even when the EO had been an outright strategic Bitcoin reserve, the subsequent administration (after Trump) may undo this (which has carried out administratively, can typically be undone administratively). So, with the intention to get the 20-year-old minimal HODL, which calls on my invoice, and to make use of America’s fault, we’ve got to undergo the legislative course of (passage by way of each the home and the senate) to the workplace of the President to get a signature.

It’s actually vital that we’ve got momentum for a marathon, not a dash. I do not need individuals to be discouraged. The method is to the moon, however we’ve got to remain on it and work the method. So much to do, however the EO was a terrific start line to get us there. “

So sure, the EO appears like a fast victory for crypto -sexecs who want to pump their baggage. However the actual battle for the way forward for Bitcoin has simply begun.

A congress accepted SBR is best than an SBR through government order. Level!

Bitcoin has at all times thrive in adversity. Whether or not it’s prohibition, limitations or the “Nationwide Digital Asset Stockpile” sentence, the resilience of Bitcoin is unparalleled. Whereas Senator Lummis works to push the strategic Bitcoin Reserve Invoice by way of the congress, particular person states already lead the management. States introduce Bitcoin -specific reserve laws, not obscure “digital property” plans.

Within the meantime, the worldwide momentum is constructing. Putin didn’t say: “No one can management digital property,” he mentioned “no one can examine Bitcoin “. Nation states are usually not about to FOMO in $ Trump or Fartcoin. They appear, study and get nearer to Bitcoin.

Bitcoin wins as a result of it’s superior cash. Each information, even setbacks, is finally bullish for Bitcoin as a result of it uncovers weaknesses in Fiat and reinforces the story of Bitcoin. So keep affected person. The sluggish combustion shall be value it.

See you in Vegas – and keep in mind: the most effective cash wins.

This text is one To take. The expression of opinions are utterly the creator and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024