Bitcoin

US Interest Rate Decision, FOMC Meeting to Decide Crypto Trends

Credit : coinpedia.org

The Cryptocurrency market noticed a big improve and a whole lot of shopping for exercise after Donald Trump returned to the White Home. As a result of Trump indicators numerous govt orders that help the cryptocurrency market, extra individuals are interested by commerce. The next week is vital for the market as a result of the Federal Open Market Committee (FOMC) assembly and choices about rates of interest, along with different main financial information, will in all probability affect future tendencies out there.

Markets stay steady and bullish underneath Trump’s new coverage

This week everybody centered on the coverage of US President Trump after he took workplace, and plainly the markets have been dealing with it moderately effectively to date. As a substitute of worrying, his bulletins individuals really make bullisher. He has mentioned massive investments in synthetic intelligence (AI), which makes important modifications to the crypto coverage, maintain the rates of interest low and checking inflation by lowering oil costs. This has inspired buyers to take extra dangers, in order that the S&P 500 has reached a brand new file excessive.

Learn additionally: Bitcoin Value Prediction 2025: Will BTC break $ 109k and hit a brand new all time?

As we begin a brand new week, numerous vital occasions can type the long run tendencies of the cryptocurrency market.

US 4Q WIND Season

Subsequent week massive know-how firms reminiscent of Microsoft, Meta Platforms, Tesla and Apple will report their revenue. Analysts predict that these massive gamers, along with three different massive firms, will see their revenue develop by greater than 17% in comparison with the next yr, which is nearly double the 9% progress anticipated from the opposite 493 firms.

As a result of these firms are so extremely appreciated, buyers will in all probability look extra than simply the standard revenue and turnover figures.

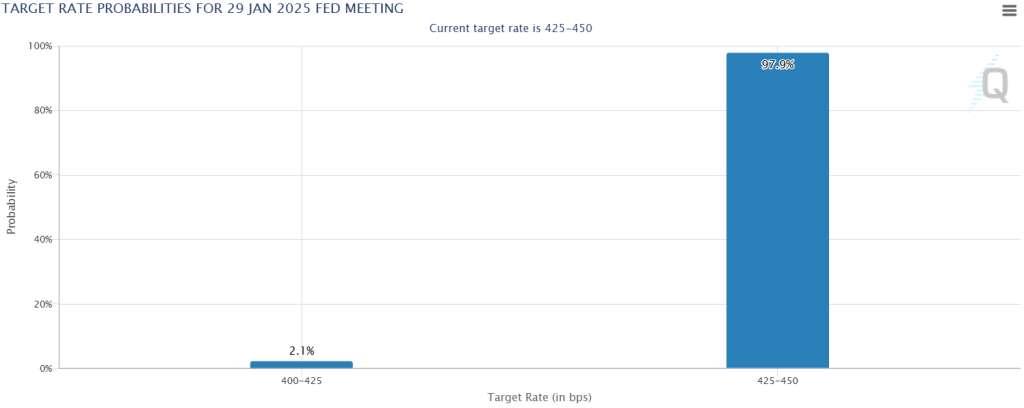

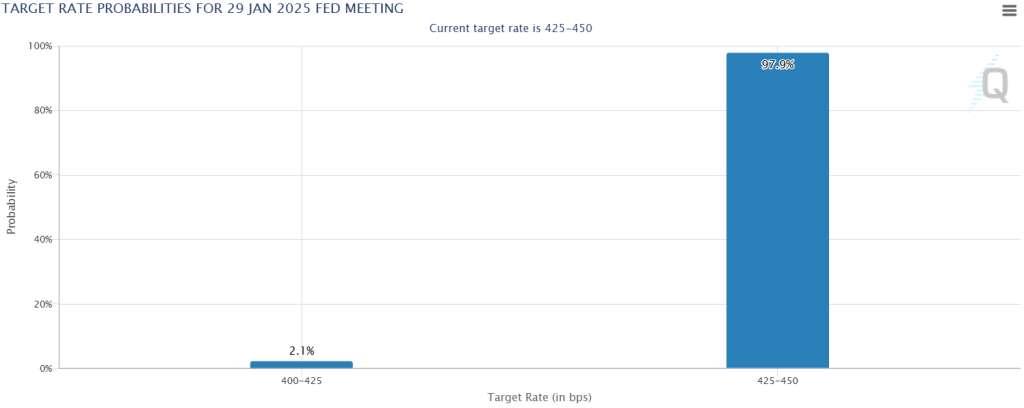

American FOMC assembly

It’s typically anticipated that the Federal Reserve will maintain its most vital rate of interest unchanged this Wednesday whereas ready for extra info that reveals that inflation is reducing.

On the World Financial Discussion board in Davos, Switzerland, Trump stated he would insist on instant cuts on rates of interest worldwide, and would once more go to his frequent however ineffective stress on the FED throughout his first time period. Early in his second time period, Trump has already tightened immigration and introduced plans to levy import tax from 1 February.

This creates uncertainty for the FED, making it tough to plan financial coverage. The FED meets rapidly and is predicted to take care of the present rate of interest between 4.25% and 4.50%, as a result of latest knowledge help a gradual method to attain their 2% inflation goal.

FED chairman Jerome Powell and his staff are confronted with the problem of balancing present financial coverage with uncertainties concerning the future and to determine how a lot to disclose concerning the prospects of the FED.

US Core Private Consumption Expenditures (PCE) Value index

In November the whole PCE costs within the US elevated by 2.4% in comparison with final yr, which is a rise in comparison with the three-year low of two.1% that was seen in September. The core -pce value index, which makes use of the FED to gauge underlying inflation, rose solely by 0.1% -the smallest improve in six months. This stored the annual Core PCE fee steady at 2.8% in December, which was decrease than the anticipated 2.9%.

Trying forward, the whole PCE is predicted to rise to 2.6% on an annual foundation, which can be introduced on Friday. The core -PCE inflation proportion can also be anticipated to stay steady at 2.8%.

European Central Financial institution (ECB) curiosity determination

The ECB is predicted to scale back rates of interest by 0.25% through the subsequent assembly on January 30, which ends up in the speed to 2.75%. This might be the fifth charges since June 2024, aimed toward supporting financial progress.

Conclusion

With the Fed in all probability on a break, the ECB is able to decrease the charges, and Trump’s pro-crypto alerts nonetheless recent, the cryptomarkt appears to be positioned for a typically bullish week forward. Nevertheless, merchants should be ready for volatility across the FOMC announcement and vital releases for enterprise income.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024