Bitcoin

ETH/BTC ratio nears THIS critical level: Here’s what it means

Credit : ambcrypto.com

- ETH/BTC ratio is approaching the crucial 0.05 BTC degree, which makes probably losses directions as key help fail.

- Institutional desire for Bitcoin and the dearth of catalysts from Ethereum contributes to the lengthy -term underperformance of ETH.

The Ethereum[ETH]-To-bitcoin[BTC] (ETH/BTC) Ratio has needed to cope with ongoing battle, with at least 77% of the commerce days which might be unprofitable for ETH holders in opposition to BTC.

The current market turbulence has exacerbated these situations, as based on information on chains and value efficiency. However what does this imply for merchants and buyers?

Perception into the ETH/BTC profitable graphic

The graph illustrates ETH/BTCs profitability over time By marking worthwhile and unprofitable buying and selling days. Inexperienced means days that ETH carried out higher than BTC, whereas Rod emphasizes underperformance intervals.

The Orange Ding space on the backside represents the rising proportion of unprofitable days in time.

Supply: Checkonchain

Evaluation exhibits that for the reason that starting of 2022 ETH has constantly subtracted Bitcoin, with only some quick intervals of profitability.

The final decline within the early 2025 has strengthened this Bearish pattern, with the relative weak point of ETH that pushes the unprofitable buying and selling days than 77% – a traditionally important threshold.

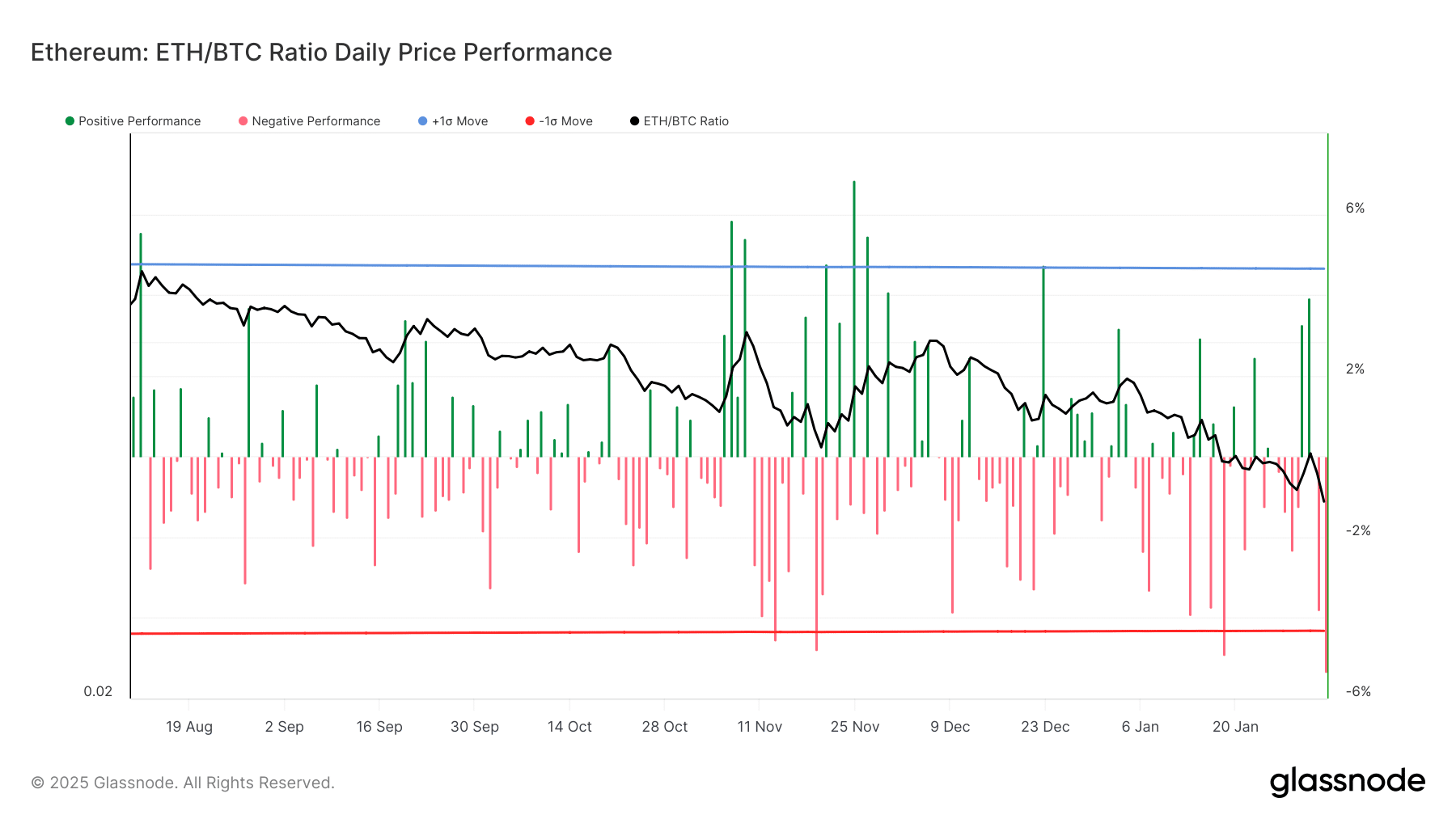

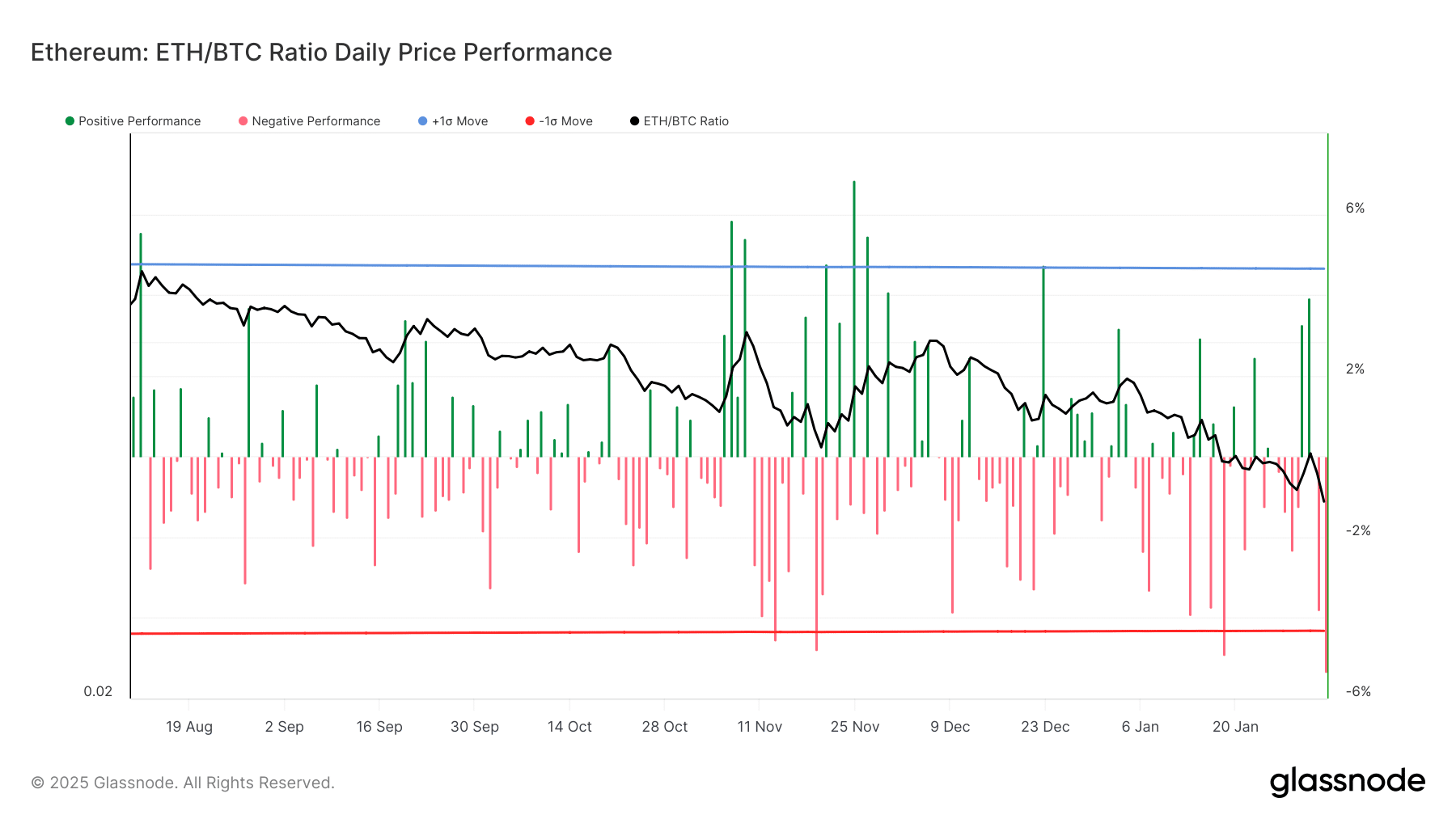

Eth/BTC Value promotion: a brutal wick

Evaluation of the ratio graph exhibits the day by day value efficiency of ETH/BTC and emphasizes excessive volatility.

The final value promotion included a brutal wick, which underlined a pointy rejection of resistance ranges and heavy gross sales stress.

Every day detrimental efficiency bars exceed constructive, which signifies a persistent bearish pattern.

Supply: Glassnode

From mid -2024, ETH has bother sustaining an upward momentum in opposition to BTC, creating a gradual pattern. Each try at restoration has been obtained with gross sales stress, which pushes the ETH/BTC ratio decrease.

The most recent lower noticed the worth of ETH in comparison with BTC-Gaststeen to a multi-year low, with the ETH/BTC ratio across the 0.05-level-level psychological and technical help zone.

Why is ETH struggling in opposition to BTC?

Bitcoin stays the go-to belongings for institutional adoption, particularly after the approvals of Bitcoin ETF initially of 2024. Capital continues to circulation to BTC as a substitute of altcoins, together with ETH.

Whereas Ethereum stays a big blockchain, BTC buyers desire a safer wager.

In distinction to Bitcoin, who advantages from macro -economic tales and institutional acceptance, Ethereum misses quick, robust catalysts.

Regardless of the ETH ETF approval, the impression has not been important, as seen by the present in comparison with the BTC ETF -Stroom.

-Eleeum (ETH) Value forecast 2025-26

What’s the subsequent step for ETH/BTC?

With ETH/BTC that approaches traditionally important help ranges, merchants should maintain an in depth eye on 0.05 BTC degree. If ETH/BTC breaks beneath this degree, the ratio can fall additional to 0.045 and even decrease.

This might trigger a wave of liquidations and panic gross sales. Though the Development Beerarish stays, a rebound of necessary help ranges is feasible, particularly if Ethereum sees an institutional curiosity.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024