Altcoin

Crypto Liquidations Hit $300 Million in 24 Hours: What’s Behind the Crash?

Credit : ambcrypto.com

- Greater than $300 million was liquidated from the crypto market as costs retreated from the weekend rally.

- Bitcoin fell from $62,000 to under $59,000 earlier than staging a slight restoration.

The cryptocurrency market bled as we speak, with derivatives merchants taking a giant hit. Per Mint glassOn the time of writing, the futures market noticed $320 million in liquidations. Merchants with lengthy positions suffered essentially the most losses, with $285 million liquidated.

This comes amid a drastic worth drop that noticed the whole cryptocurrency market capitalization fall by 6.7%. All prime 50 cryptos by market cap had been additionally within the purple.

Bitcoin [BTC)] fell 6%, hitting a weekly low of round $58,000. The value has recovered considerably and stands at $59,430 on the time of writing.

Ethereum [ETH] had a steeper decline of seven.8%, in the meantime buying and selling at $2,430 Solana [SOL] fell 6.8% to $148. XRP and Dogecoin [DOGE] additionally recorded declines of three.7% and 6% respectively.

What brought on the liquidations?

On-chain analytics platform Santiment attributed the liquidations to market greed after longs added to their positions following the August 25 restoration. This brought on an enormous spike in financing charges, which had been doomed to liquidation.

Supply:

Macro components will also be behind the volatility. Nvidia is about to launch what’s colloquially referred to as “key tech earnings.” Per CNBCNvidia’s outcomes will “set the tone” for the markets forward of the discharge of different key financial knowledge subsequent month.

Nvidia’s earnings are likely to drive market volatility. If the chipmaker beats expectations on second-quarter earnings, it may gasoline a rally within the crypto market. Nonetheless, if the corporate falls quick, it may trigger additional declines.

Will BTC Worth Get better?

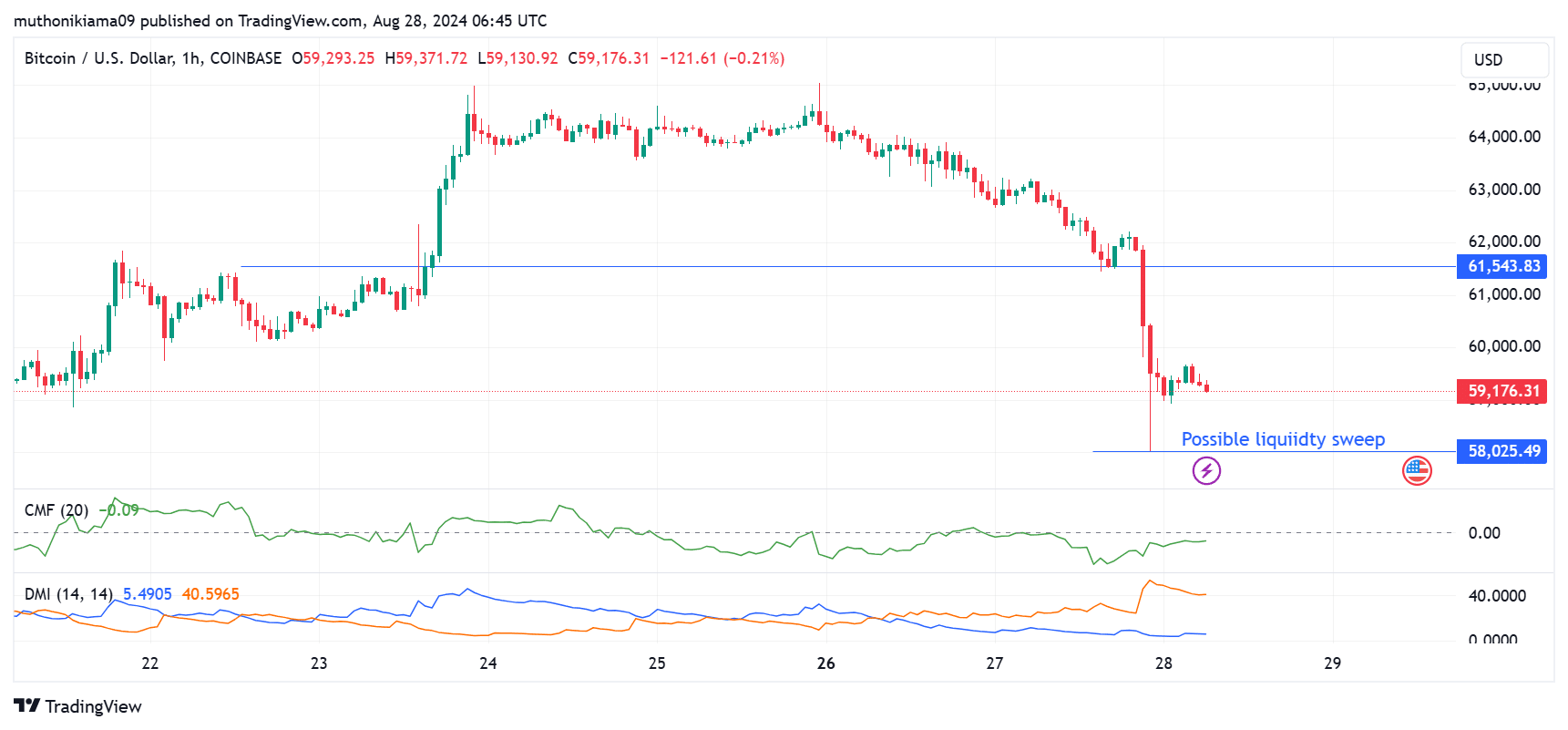

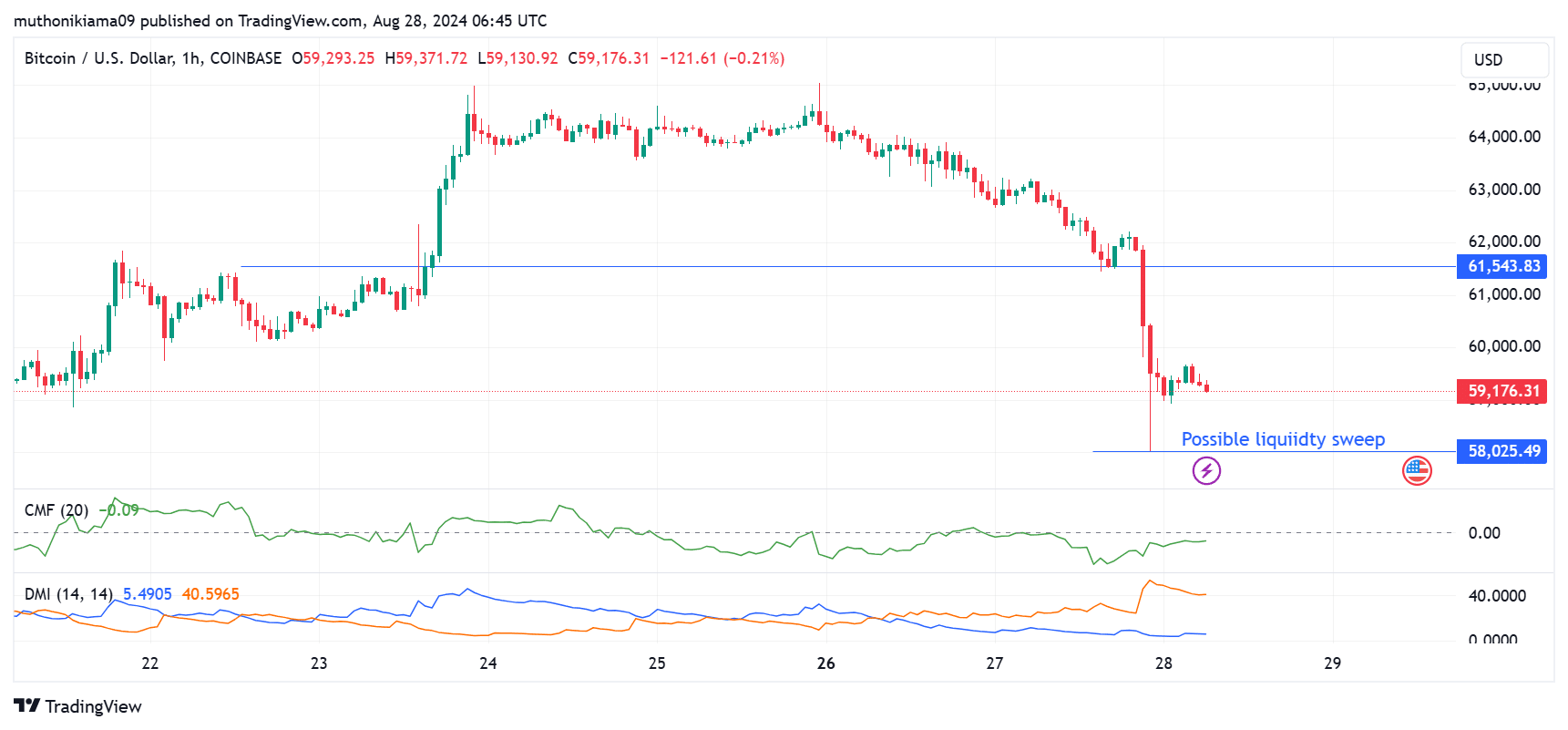

Bitcoin worth failed to carry a assist degree above $61,500, inflicting a pointy worth drop. Since August 23, BTC has been buying and selling above this degree, and holding the assist supported the uptrend.

Chaikin money circulation was adverse on the time of writing, indicating promoting strain. The CMF confirmed shopping for strain beginning to ease after the weekend rally. Subsequently, there haven’t been sufficient consumers to drive the value motion.

Supply: Tradingview

The bearish thesis is additional confirmed by the Directional Motion Indicators (DMI). The optimistic DI is properly under the adverse DI, exhibiting that the bearish development is stronger than the bullish development.

Merchants also needs to watch out for a doable liquidity surge on the $58K degree.

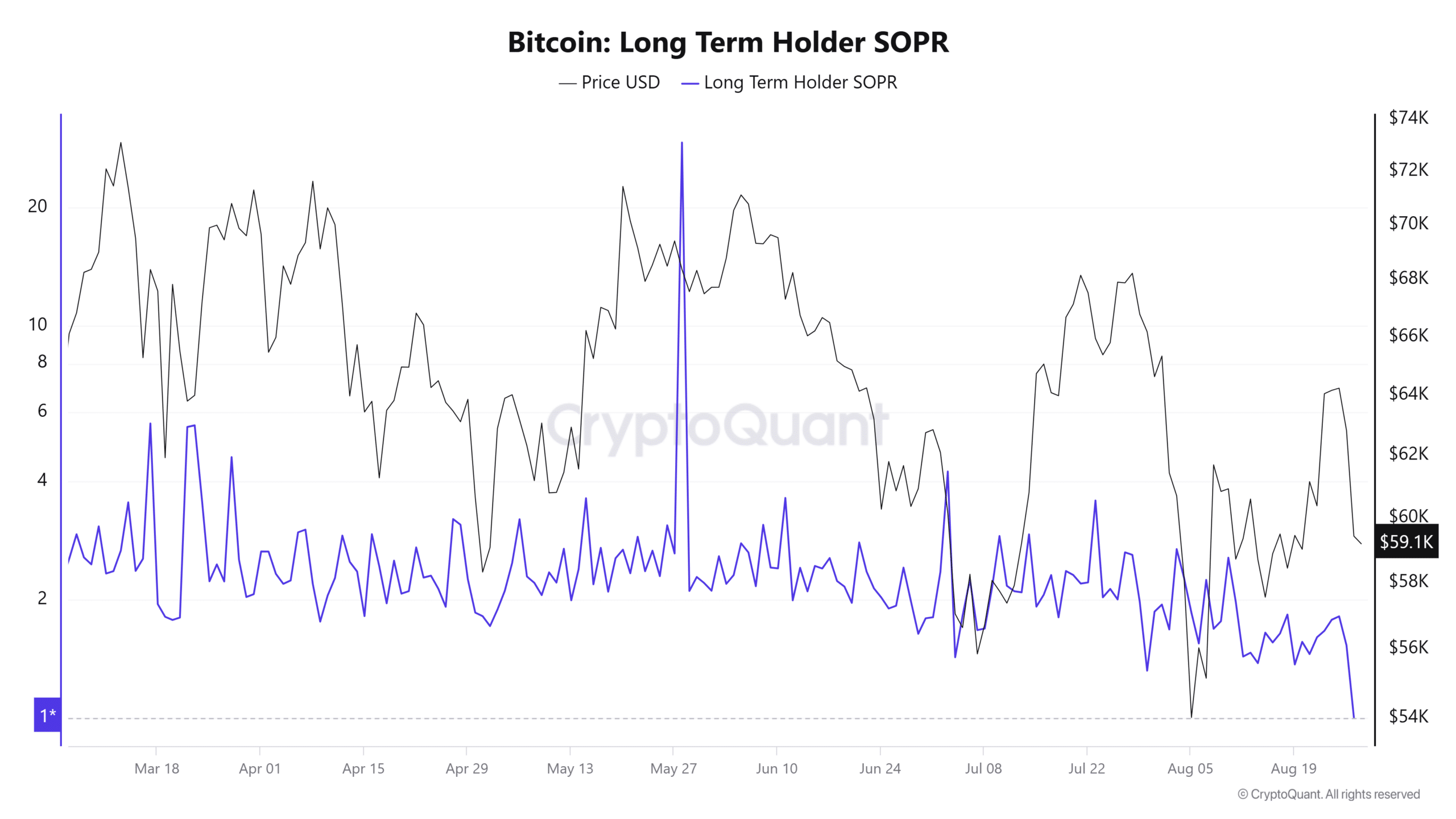

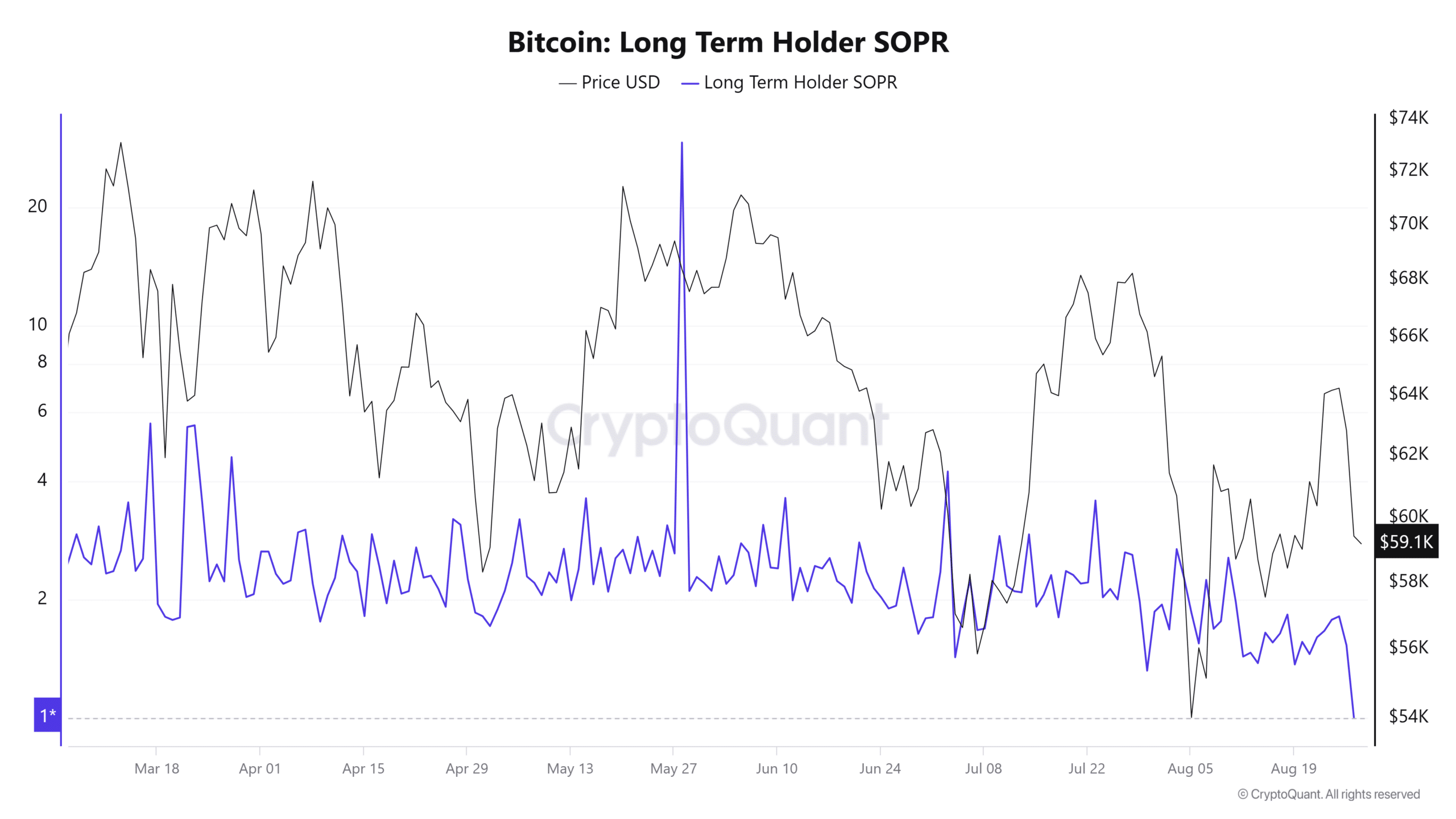

On-chain indicators present that the latest decline has pushed long-term bonds to a breakeven level. The final time this cohort was at this level was on August 5, after which the value made a robust optimistic correction.

This measure may point out that the latest decline marked an area low, indicating that the value may rise.

Supply: CryptoQuant

Information from InTheBlok confirmed that greater than $3 million addresses purchased BTC for between $58,000 and $62,000. Subsequently, $62,355 may act as an important resistance degree if BTC resumes the uptrend.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024