Ethereum

Whales Are Manipulating ETH Price

Credit : www.newsbtc.com

Este Artículo También Está Disponible and Español.

Giant fluctuations on the Ethereum (ETH) market yesterday activated a wave of reactions on social media, whereby one Ethereum co-founder claimed that sure massive holders or whales “pushed down the value of the belongings.

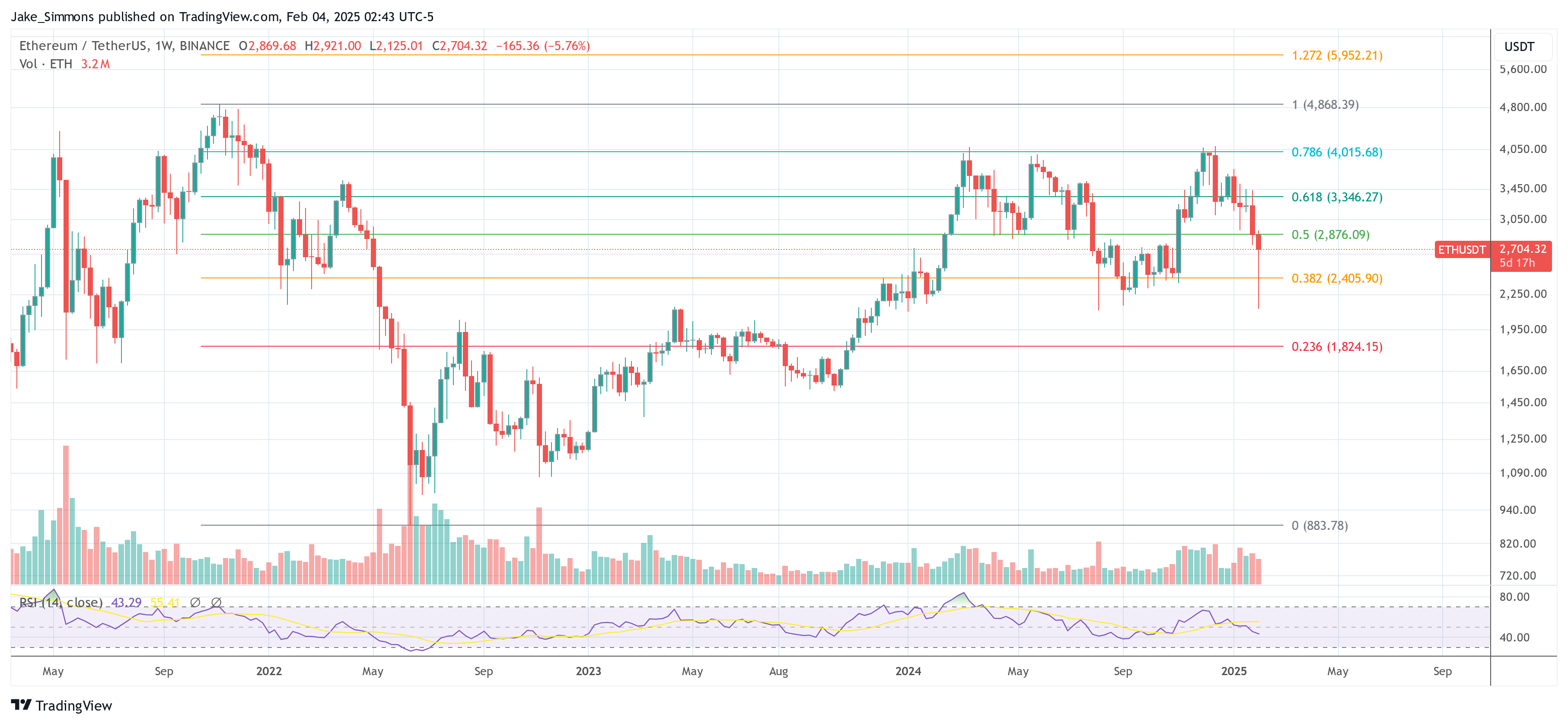

The exercise reached a feverpitch on Monday 4 February, when the ETH value gained from round $ 2,900 to solely $ 2,120 earlier than it bounced again sharply. Regardless of the intraday dipper, Ether lastly closed the day with a inexperienced wick of 26% – an uncommon value that displays in such a brief window.

Ethereum -Worth manipulated by whales?

Analysts attributed the dramatic motion to exterior macro -economic forces, specifically the American commerce battle underneath President Donald Trump. After having imposed the charges on Mexico and Canada early within the day, the president later saved an association that stimulated a fast restoration on the world markets, together with cryptocurrency.

Associated lecture

The turbulence led an observer, simply recognized as “trainee” (@intern), the director of Progress at Monad, to submit a grim sentiment on X: “ETH dies proper for us. To be trustworthy, by no means thought this might occur. ‘

In answerEthereum co-founder and CEO of the Consensys Joseph Lubin supplied a composite prospect, which underlines that any such value fluctuations are usually not uncommon for the digital belongings: “It occurs often. Then it stands out. What we see is whales that profit from financial unrest and destructive sentiment to shake out weak fingers, stroll stops after which purchase again after they can carry out the identical playbook in reverse means. “

Lubin’s rationalization gives a cyclical understanding of crypto volatility, which suggests that bigger gamers profit from market nervousness – typically aggravated by macro developments – to place strain on much less resilient traders to promote.

Varied distinguished crypto-traders additionally commented on the occasions, specifically accusations of manipulation guided by whale.

A nicely -known determine, Hsaka (@hsakatrades), suggested newcomers to not assume that the decline of ETH was pure pushed by natural market sentiment: “Expensive Noobs, Ethereum doesn’t naturally go down. It’s pushed down via whales with Spoofy gross sales orders at commerce gala’s to make Noobs and promote danger managers to ‘purchase again’. They steal your baggage and allow you to purchase again at a better value. “

Associated lecture

The concept of a joint “spoofing” technique – the place massive gross sales orders are positioned after which canceled or solely partially stuffed – has lengthy circulated in crypto communities. The tactic is alleged to be aimed toward activating panic, in order that so -called whales can acquire positions at extra favorable value ranges.

Distinguished dealer Pentoshi (@Pentosh1) supplied a brief however focused response, wherein it was emphasised how EHH is present process up to now three years in comparison with Bitcoin (BTC): “Shaking out for 3 years up to now. I hope you might be proper. “

The query why specifically ether would select was known as by group member Evmaverick392.eth (@evmaverick392): “Possibly I sound naive, however why do whales carry out this maneuver solely on Ether?”

Lubin reacted by drawing a parallel to traditional financial institution robberies and suggesting that the latest wave of unrest across the Ethereum ecosystem of the Lively has made an necessary goal: “Why robbing financial institution robbers banks – or used to it? The (unjustified) FUD to the Ethereum ecosystem is at the moment essentially the most pronounced. “

On the time of the press, ETH traded at $ 2,704.

Featured picture made with dall.e, graph of tradingview.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024