Bitcoin

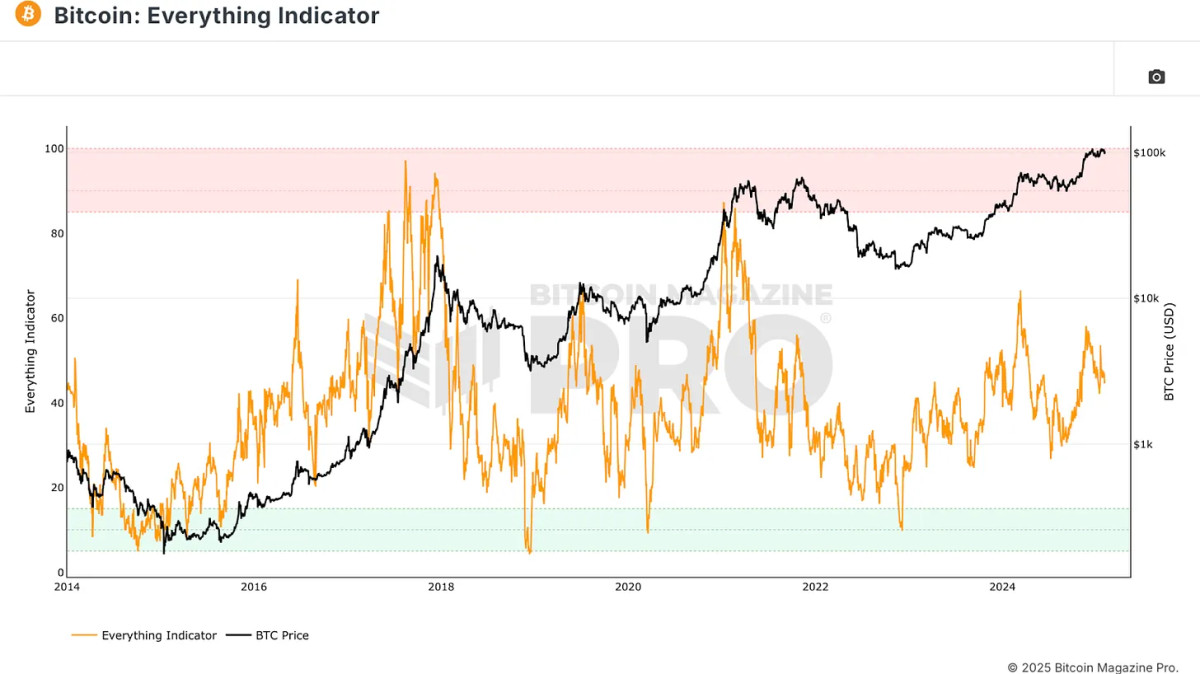

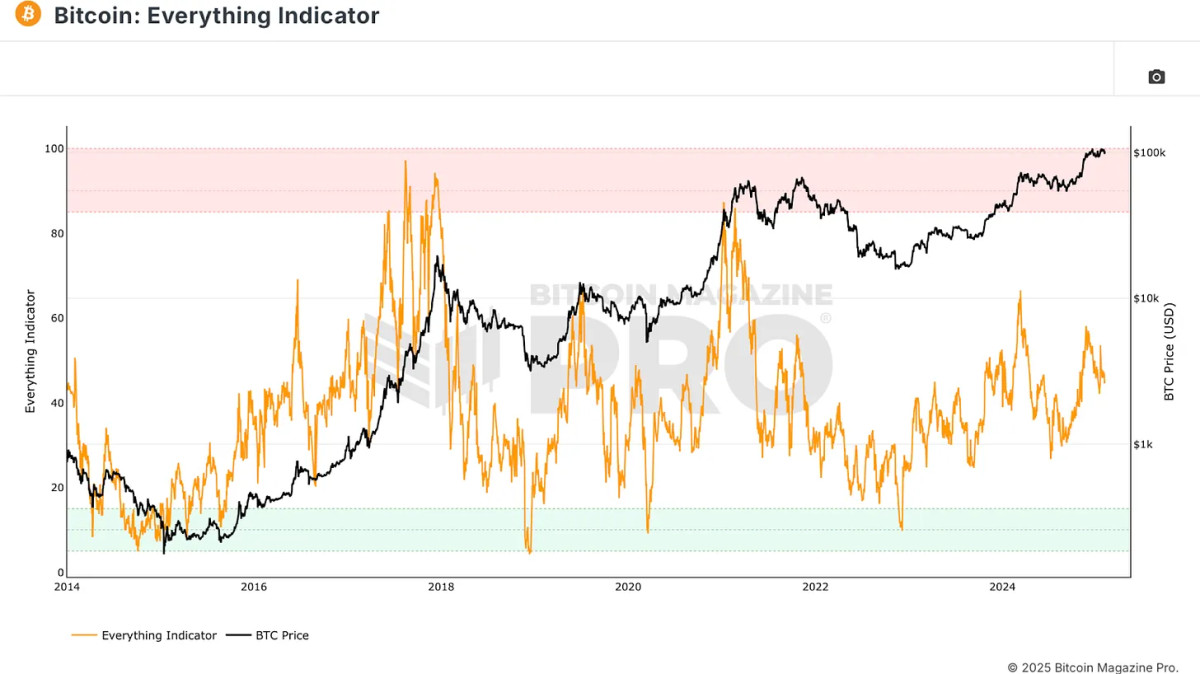

Introducing the Bitcoin Everything Indicator

Credit : bitcoinmagazine.com

Would not or not it’s nice if we had one all-embracing metric to information our Bitcoin funding choices? That’s precisely what has been made, the Bitcoin All the things indicator. Just lately added to Bitcoin Journal Professional, this indicator is meant to consolidate a number of statistics in a single framework, in order that Bitcoin evaluation and the decision-making of investments are streamlined.

View a latest YouTube video right here for a extra in-depth view of this topic: The official Bitcoin all -indicator

Why we want an in depth indicator

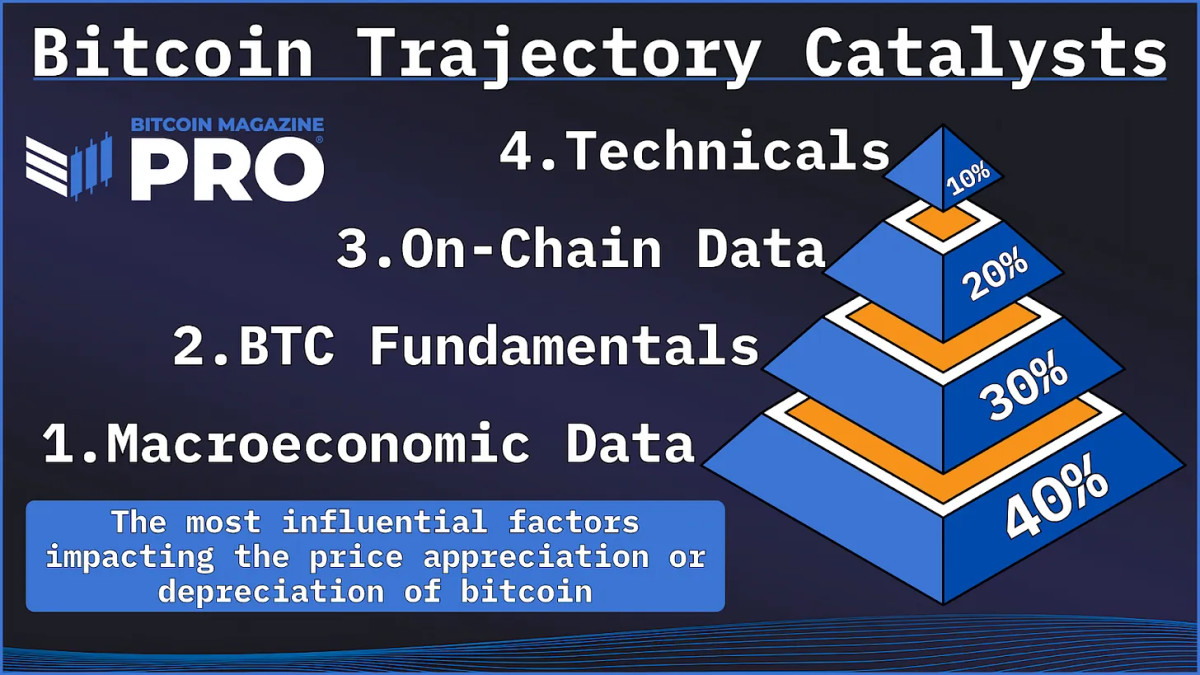

Buyers and analysts often rely upon completely different statistics, comparable to information on chains, technical evaluation and spinoff playing cards. Nonetheless, specializing in one facet can result in an incomplete understanding of Bitcoin’s value actions. The Bitcoin Everything Indicator Makes an attempt to resolve this by integrating essential parts into one clear statistics.

The core parts of the Bitcoin All -Dicator

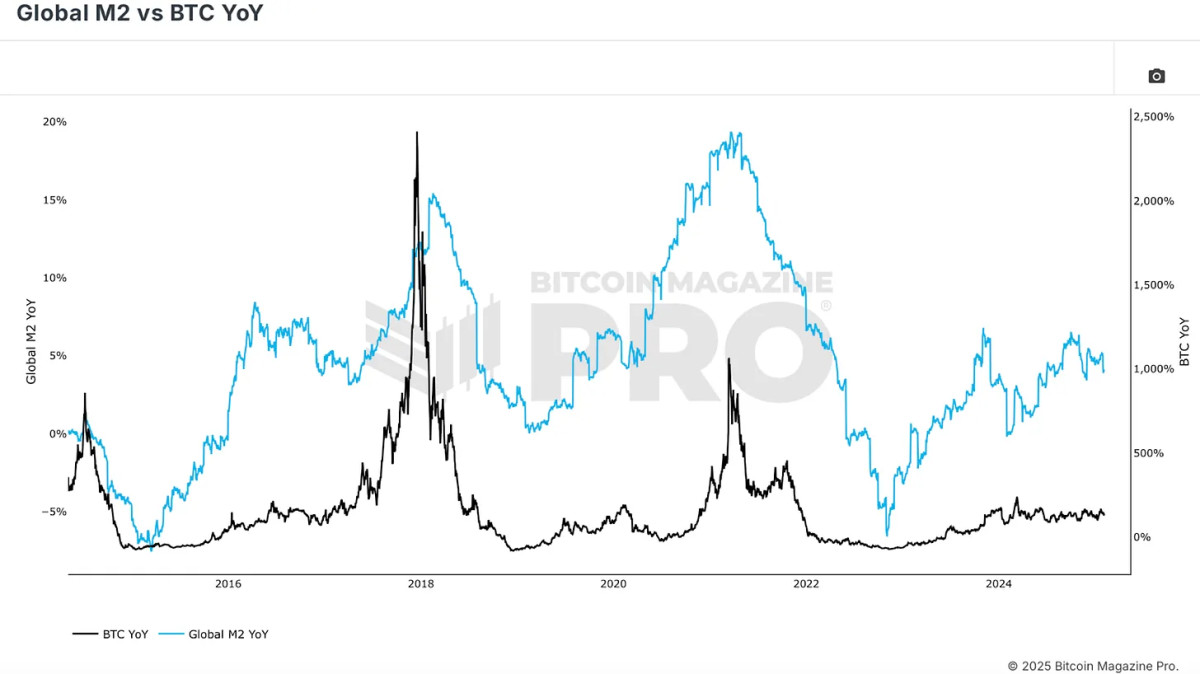

The worth motion of Bitcoin is deeply influenced by international liquidity cycles, making macro -economic situations a elementary pillar of this indicator. The correlation between Bitcoin and wider monetary markets, particularly by way of Global M2 money supplyIs evident. When the liquidity expands, Bitcoin often appreciates.

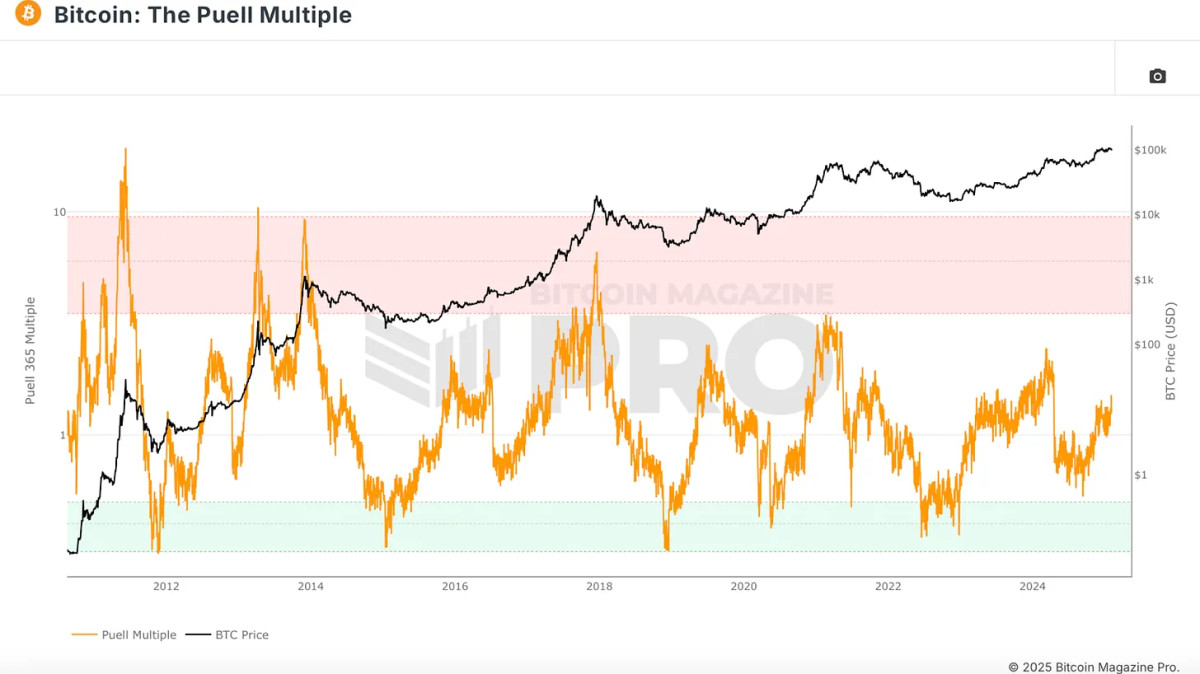

Elementary components such because the Haltecycli from Bitcoin and my work energy play a vital position in its appreciation. Whereas Halvens is decreasing the brand new Bitcoin provide, their influence on value score has decreased as a result of greater than 94% of the whole vary of Bitcoin is already in circulation. Nonetheless, the profitability of miners stays essential. The Puell -A number of, which measures the revenue of the mine in relation to historic averages, gives perception into market cycles. Traditionally, Bitcoin, when the profitability of the miner is powerful, is in a good place.

Indicators on the chain assist to evaluate Bitcoin’s provide and provide dynamics. The MVRV Z-scoreFor instance, compares the market capitalization of Bitcoin with the realized cap (common buy value of all cash). This metric identifies accumulation and distribution zones and emphasizes when Bitcoin is overvalued or undervalued.

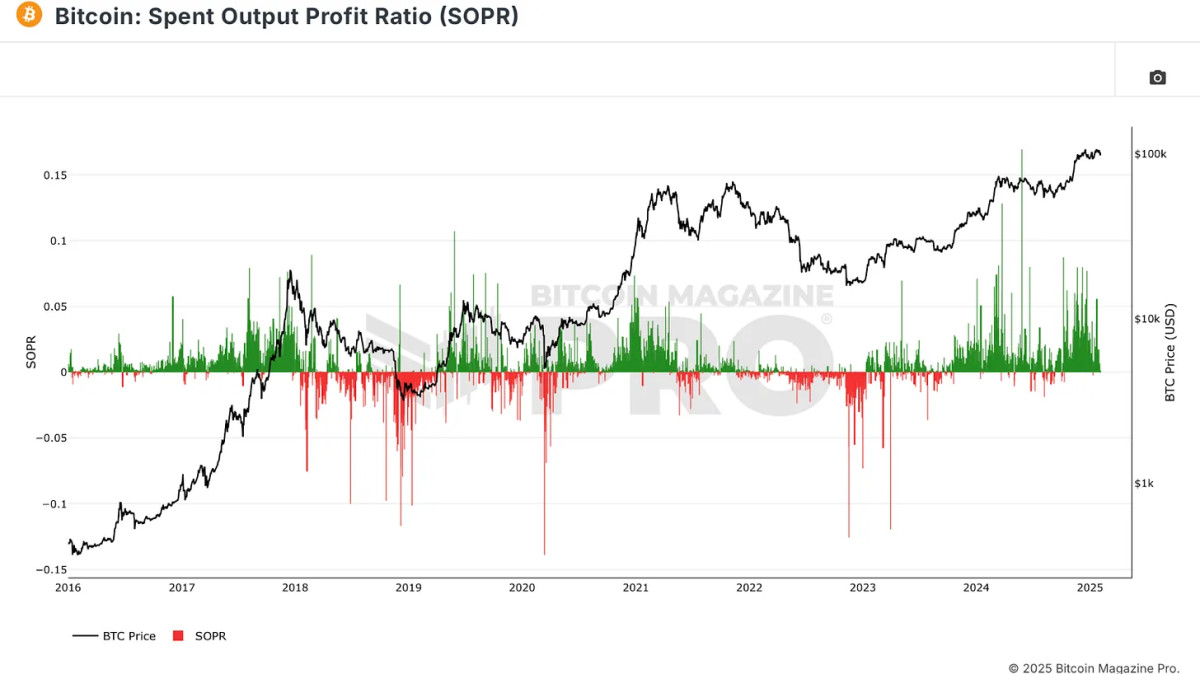

One other essential on-chain statistics is the Best output profit ratio (sopr)who investigates the profitability of cash that’s spent. When Bitcoin holders understand large revenue, this typically signifies a market peak, whereas excessive losses point out a market base.

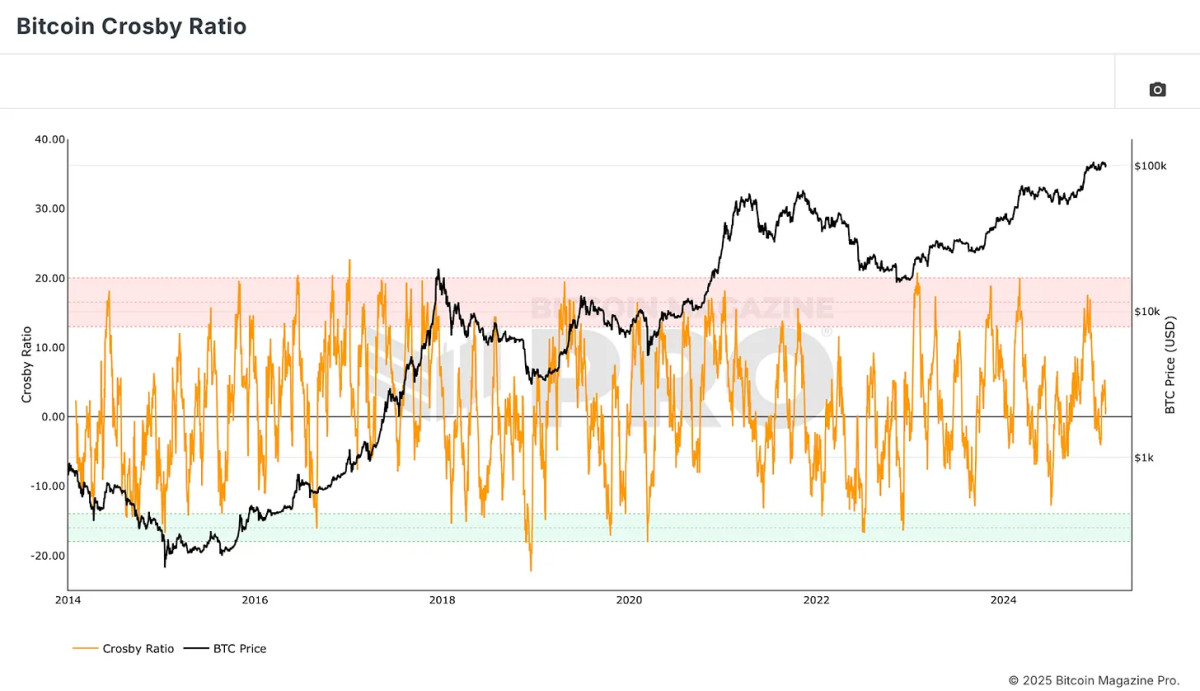

The Bitcoin Crosby ratio is a technical statistics that assess the overburdened or discounted situations of Bitcoin purely on the idea of value motion. This ensures that market sentiment and momentum are additionally justified within the Bitcoin All the things indicator.

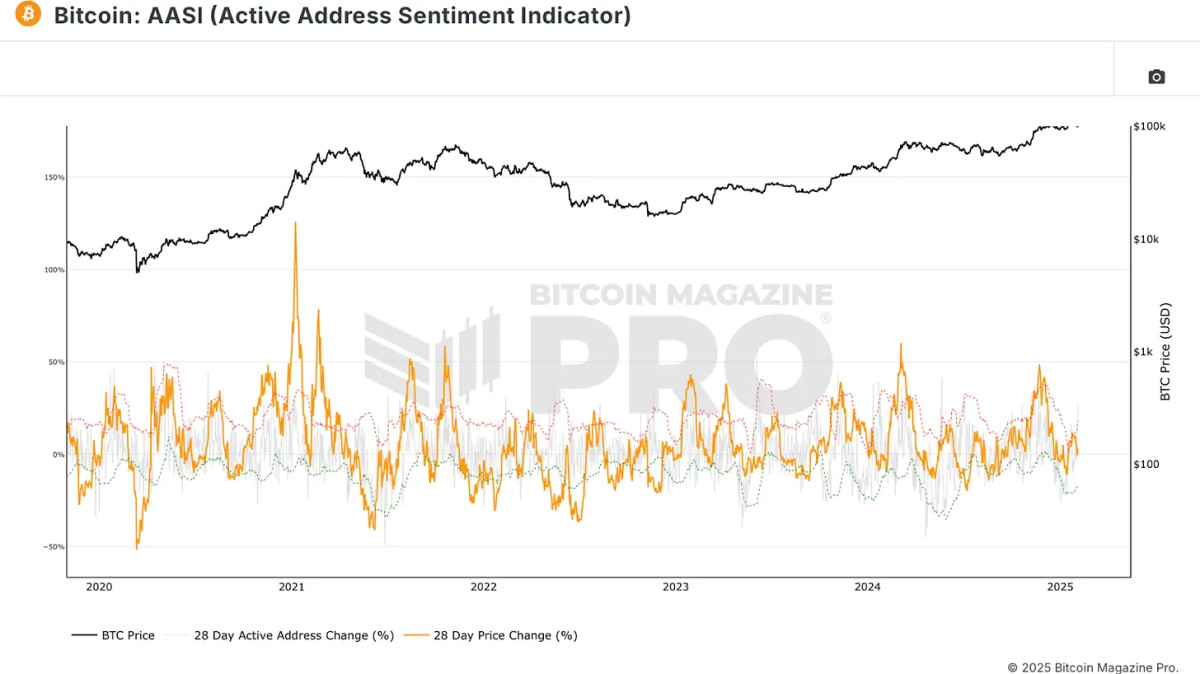

Community use can provide important directions concerning the energy of Bitcoin. The Active address sentiment indicator Measure the proportion change in energetic addresses for 28 days. A rise in energetic addresses usually confirms a bullish development, whereas stagnation or decline can sign the worth of the worth.

How the bitcoin works every thing -indicator

By combining these completely different statistics, the Bitcoin all -indicator ensures that no issue is given pointless weight. In distinction to fashions which are too strongly depending on particular alerts, such because the MVRV Z-score or the Pi-Cyclustop, this indicator distributes affect on a number of classes. This prevents overfitting and allows the mannequin to adapt to altering market situations.

Historic efficiency versus buy-and-hold technique

One of the putting findings is that the Bitcoin all-indicator has surpassed a easy buy-and-hold technique, as a result of Bitcoin was appreciated at lower than $ 6. Utilizing a method to gather Bitcoin throughout sold-up situations and steadily promoting in Overboughtzones, traders who use this mannequin would have significantly elevated the efficiency of their portfolio with decrease drawings.

This mannequin, for instance, maintains a lower of 20% in comparison with the lower of 60-90% that’s often seen within the historical past of Bitcoin. This means {that a} effectively -balanced, information -driven strategy can assist traders to make higher knowledgeable choices with a decreased downward threat.

Conclusion

The Bitcoin all -indicates investing investing by combining essentially the most essential points that affect the worth motion of Bitcoin in a single metric. It has carried out traditionally higher than buy-and-hold methods, whereas the danger is mitigated, making it a precious instrument for each retail and institutional traders.

Be careful for extra detailed Bitcoin evaluation and for superior features comparable to dwell graphs, personalised indicator warnings and in-depth industrial stories Bitcoin Magazine Pro.

Safeguard: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. All the time do your personal analysis earlier than you make funding choices.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024