Policy & Regulation

US regulators should prioritize crypto clarity like MiCA, Bitstamp US CEO says

Credit : cryptonews.net

In an unique interview with crypto.information, Bitstamp US Chief Government shares his opinion about how Mica might pave the best way for related regulatory frameworks within the US

The historic regulation of the European Union for the ever-controversial crypto sector got here into pressure on the finish of December 2024. .

For instance, it requires that crypto corporations obtain licenses to function all through the EU, set guidelines to guard shoppers and decide how stablecoins must be spent. Mica additionally presents necessities for capital, anti-wue wages and transparency. Briefly: crypto corporations should now meet requirements which can be akin to these of conventional monetary establishments.

The concept is to carry extra authorized readability and shopper safety and on the identical time promote innovation within the crypto area. Nevertheless, some are nervous that the regulation causes extra issues than good. For context, Tether chief Government Paolo Ardoinino beforehand alerted that Mica’s Regulatory Transfer Financial institution methods and the usage of stablecoins place within the European Bloc with a “systemic danger” as a result of the legislation now requires the spending of Stablecoin in Europe to no less than 60% of their hold reserves to maintain no less than 60% of their reserves on financial institution accounts established in Europe.

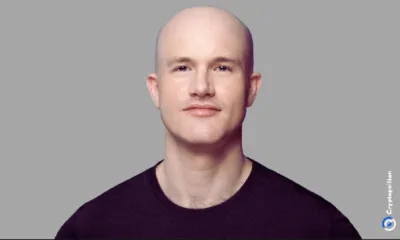

Crypto.information sat down with Bitstamp US CEO Bobby Zagotta to debate the implications of the principles for the Crypto business, how it will affect the exchanges resembling Bitstamp and whether or not the Regulation might push extra retail traders to decentralized monetary platforms.

CN: Some stablecoin giants are nervous that mica brings extra issues than good. Tether’s (USDT) and PayPal’s (Pyusd) will now not be out there for the European clients of Bitstamp. Do you not assume that these restrictions can push retail traders to Defi, the place the investigation investigation isn’t that tight?

BZ: No, we welcome mica and the readability it should carry to the market. Bitstamp presents Stablecoins in Europe with which non-public traders may be carried out, in order that clients can transfer funds rapidly and at low prices. We even have USD Coin (USDC), Euro Coin (EURC) and EUR Coinvertible (EURCV), to call just a few mica-compliant stablecoins.

Bitstamp presents retail traders belongings of the longest working, most trusted and controlled change on the planet. Mica presents readability for the exchanges and traders themselves, in order that the market can work extra effectively and we’ll proceed to work with European supervisors proactively.

CN: Do you count on the US to comply with Europe with a mica-like framework, or do you see the American market following a unique method?

BZ: My hope is that the present American administration provides this subject precedence to offer the American cryptomarkt the identical, a lot wanted, regulatory readability as in EU mica can serve for example of how and why cryptocurrency corporations want regulatory frameworks to successfully And work effectively.

There are indicators and up to date govt orders that point out that the present administration will certainly provide that readability. I’m optimistic for the long run.

Possibly you additionally prefer it: Robinhood to amass bitstamp for $ 200 million: ‘Large step in rising our crypto -business’

CN: Some declare that Mica provides a bonus to banks and conventional monetary establishments in comparison with crypto-native corporations. Do you assume these laws ship the enjoying discipline on the enjoying discipline or make it tougher for exchanges resembling Bitstamp?

BZ: Whereas rising tides enhance all boats, Bitstamp has taken a proactive angle in compliance for years and has invested closely, with virtually 30% of our workforce that performs compliance, laws, danger administration, safety and inside audit features – operations and selections correspond to regulatory requirements.

Many corporations which can be akin to Bitstamp within the crypto-room can and might nonetheless spend money on a compliance ahead method.

We take into account the introduction of the markets in crypto-assets directions as a constructive step for the cryptocurrency market. These laws provide the a lot wanted readability and set up a degree enjoying discipline for all individuals within the crypto room.

By making certain that each one entities adhere to the identical guidelines, Mica promotes a extra clear and protected setting. This elevated transparency and security are anticipated to advertise belief and belief in each establishments and particular person customers, which is essential for the approval and progress of the long-term of the cryptocurrency market.

Learn extra: Bitstamp secures MiFID MTF license from the European Regulator

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024