Analysis

Crypto Market Flashing Signal That Suggests Bottom Is Forming, Says Real Vision Analyst – Here’s His Outlook

Credit : dailyhodl.com

A very powerful digital property analyst Jamie Coutts from Actual Imaginative and prescient says {that a} backside on the cryptomarkt can type after weeks.

Couts tells Are 33,800 followers on the social media platform X that, based mostly on a metrician follows of the efficiency of Crypto property for 12 months that the market is making ready for a bullish reversal.

“This month’s crypto-flush resulted within the highest 365-day new low (NL) lecture since mid-2024. Though it isn’t a definitive soil sign, this means {that a} soil varieties. Deal with property that surpassed final yr and through this current pullback. Their energy refers to what comes within the subsequent stage of this cyclical bull market. “

He additionally shares the overall 2 -graph – the market capitalization of all crypto -activa excluding Bitcoin (BTC) and Stablecoins – that exhibits a attainable reversal that’s fashioned within the day by day interval after a falling development.

Total2 is appreciated at $ 1.24 trillion on the time of writing.

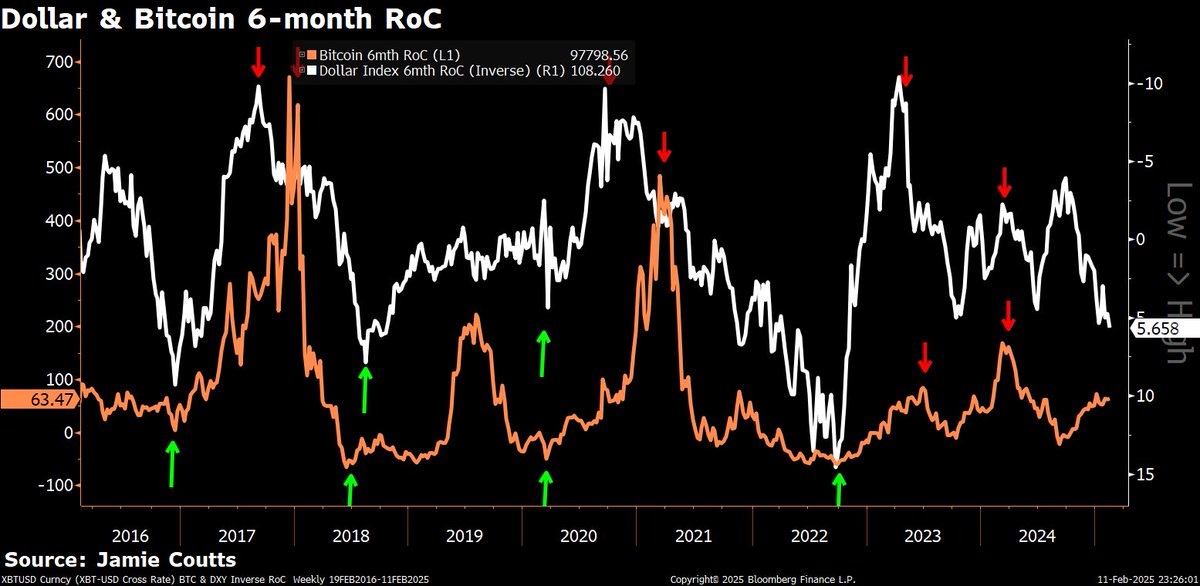

Subsequent, coutts out Bitcoin can break his traditionally reverse correlation with the US Greenback Index (DXY), which travels the USD towards a basket with different massive foreign currency, as a result of extra traders can deal with the flagship Crypto Asset as a secure port property corresponding to gold.

“Bitcoin’s reverse correlation with the damaged greenback? For the reason that September low, BTC has risen from $ 70,000 to $ 110,000 whereas the DXY climbed from 104 to 110. Is it ETFs (exhibition -related funds), MSTR (MicroSstrategy), Sovereigns? Arduous to say. Maybe Bitcoin is lastly acknowledged because the Secure Harbor Asset that was meant. “

He too out That the acceptance of blockchain expertise rises based mostly on the metric of day by day lively addresses (DAAS) on sensible contract platforms (SCPs).

“Liquidity all the time stimulates exercise on the chain. However since 2022 that relationship has been weakened. Blockchain adoption is extra resilient and fewer tied to liquidity cycles. Lively addresses have tripled previously yr, whereas markets stay their traditional schizophrenic themselves and debate the place the liquidity goes. However right here is the factor: the expertise is the contact of escape velocity. Zoom out. Each liquidity and blockchain use are in long-term uptrends. The one query that issues – they are going to be larger in a single, three or 5 years. “

Lastly, he to predict That 2025 will see an explosion of the acceptance of blockchain expertise in numerous sectors.

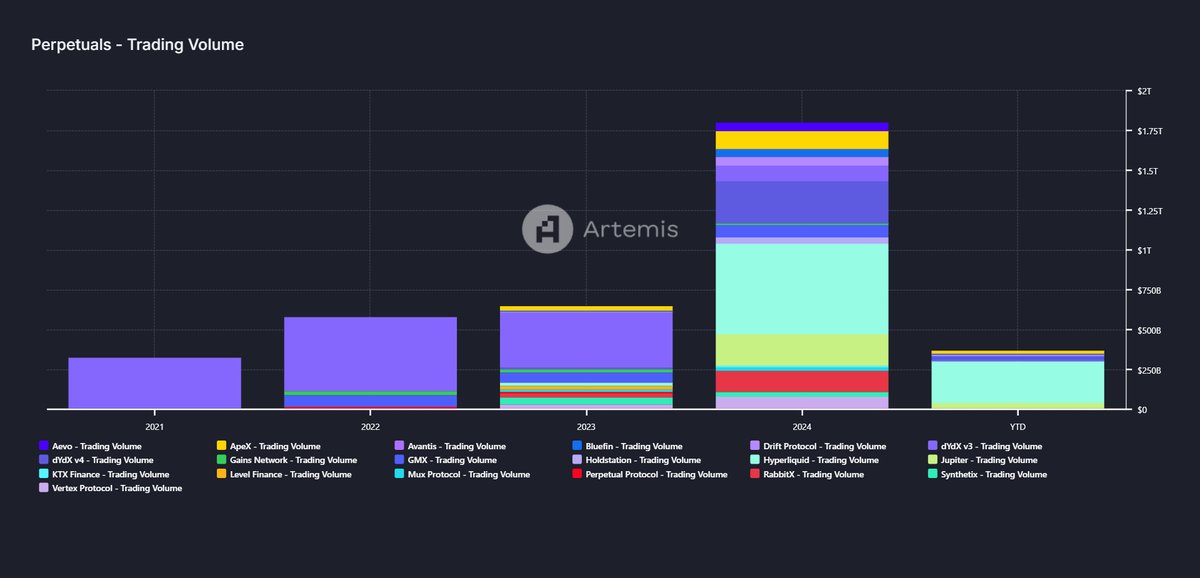

“In 2025 we’ll most likely see Perps volumes of the chain of greater than $ 4 trillion. What till RWAS (Actual-World property) large land, shares, uncooked supplies, bonds and KYC (know your buyer) options in order that settings can take part. Which chains and protocols do you assume will profit essentially the most from what is going to occur? “

Do not miss a beat – Subscribe to get e -mail notifications on to your inbox

Verify worth promotion

Observe us on X” Facebook And Telegram

Surf the Day by day Hodl -Combine

Generated picture: midjourney

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024