Ethereum

Will Ethereum staking in ETFs propel ETH’s price to new heights?

Credit : ambcrypto.com

- The institutional property of Ethereum ETF rose from 4.5% to 14.5% in This autumn of 2024

- Grayscale has searched the SECs noden for his ETH ETF strike -function

Institutional acceptance of Ethereum ETFs elevated in This autumn of 2024, in distinction to the Bearish sentiment beneath the retail commerce. The truth is ACcording to Juan Leon, Senior Funding Strategist at Bitwise, Reden Institutional Property of ETFs by roughly 10% from 4.8% to 14.5%.

She noted”

“Institutional possession of ETH ETFs rose from 4.8% in Q3 to 14.5% in This autumn. The settings come for ETH. “

An enormous adoption -uptick

Right here one other exceptional development is the comparatively larger acceptance share of ETFs, in comparison with BTC ETFs, in the identical interval. This, even supposing Bitcoin maintains total dominance in all sectors of the market.

In line with Leon, the institutional adoption for Bitcoin ETFs was 21.5% in This autumn 2024, in comparison with 22.3% in Q3.

The report got here from the final 13F archives on the SEC, that are made quarter and supply a take a look at bids by prime managers with greater than $ 100 million in AUM (property beneath administration).

Particularly Fintel facts It revealed that BlackRock’s Eth Belief, Ethha, was dominated by Goldman Sachs, Millennium Administration and Brevan Howard Capital. The highest three firms had $ 235 million, $ 105 million and $ 94 million in ETHA shares.

Leon added that a rise in institutional possession marks the subsequent part in adoption.

“I feel this means the introduction of the subsequent part of institutional accumulation: massive establishments comparable to sovereign energy funds and pension funds.”

One other potential bullish replace for the merchandise is the urge to ETF deployment. The Crypto Process Drive lately met Jito Labs and Crypto VC Multicoin Capital on the problem. The transfer is usually thought of to be optimistic for possible ETF strike traits. Grayscale has in reality submitted a latest sec application For an ETF strike perform for its US spot ETF product.

Reply to the developments, Nate Geraci of the ETF retailer stated That ETF transfer is a ‘matter of time’.

“As an alternative of simply saying” no “, SEC truly takes on constructive conversations. Encouraging. Imo, deploying in ETH ETFs is only a matter of time.”

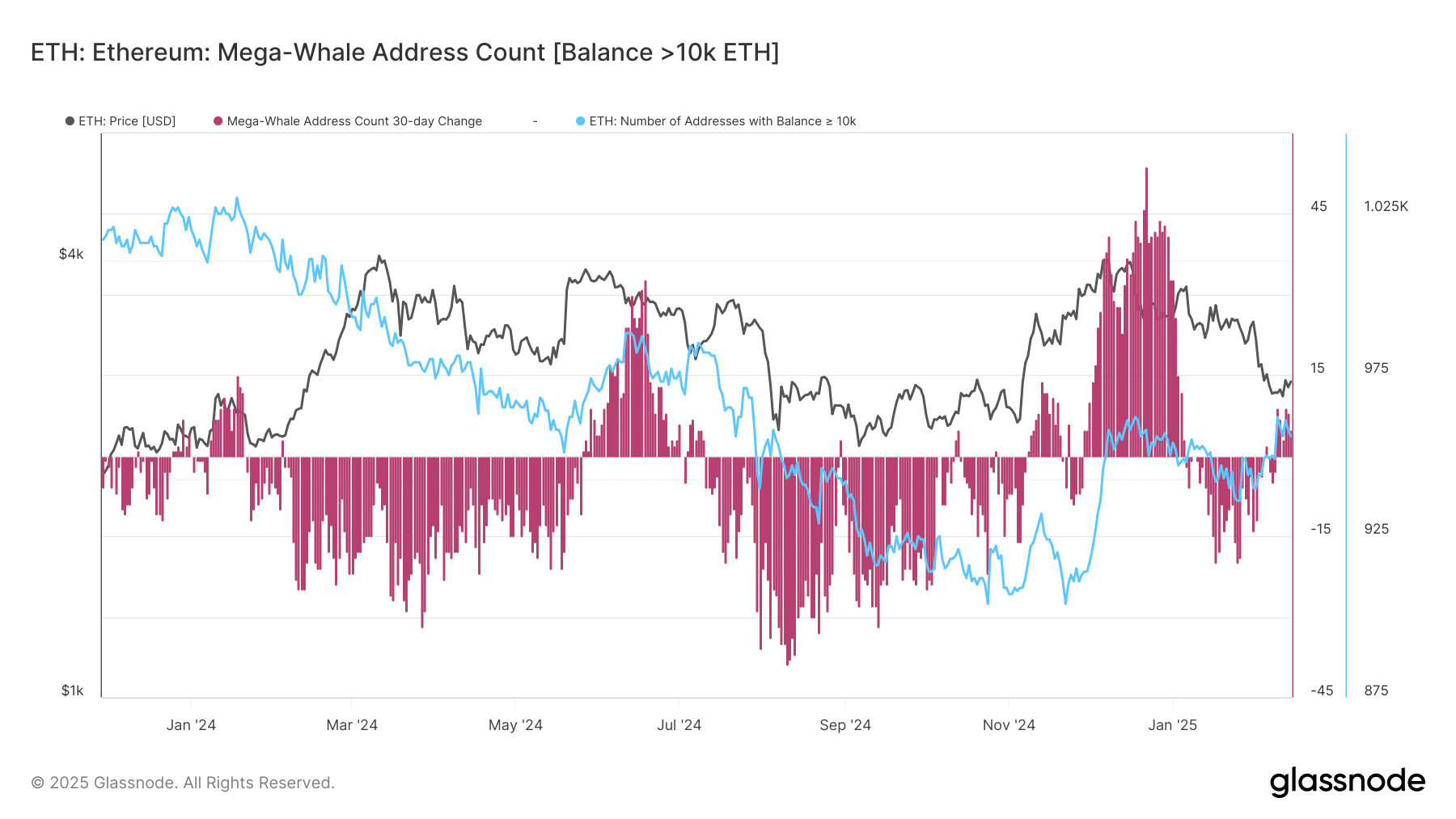

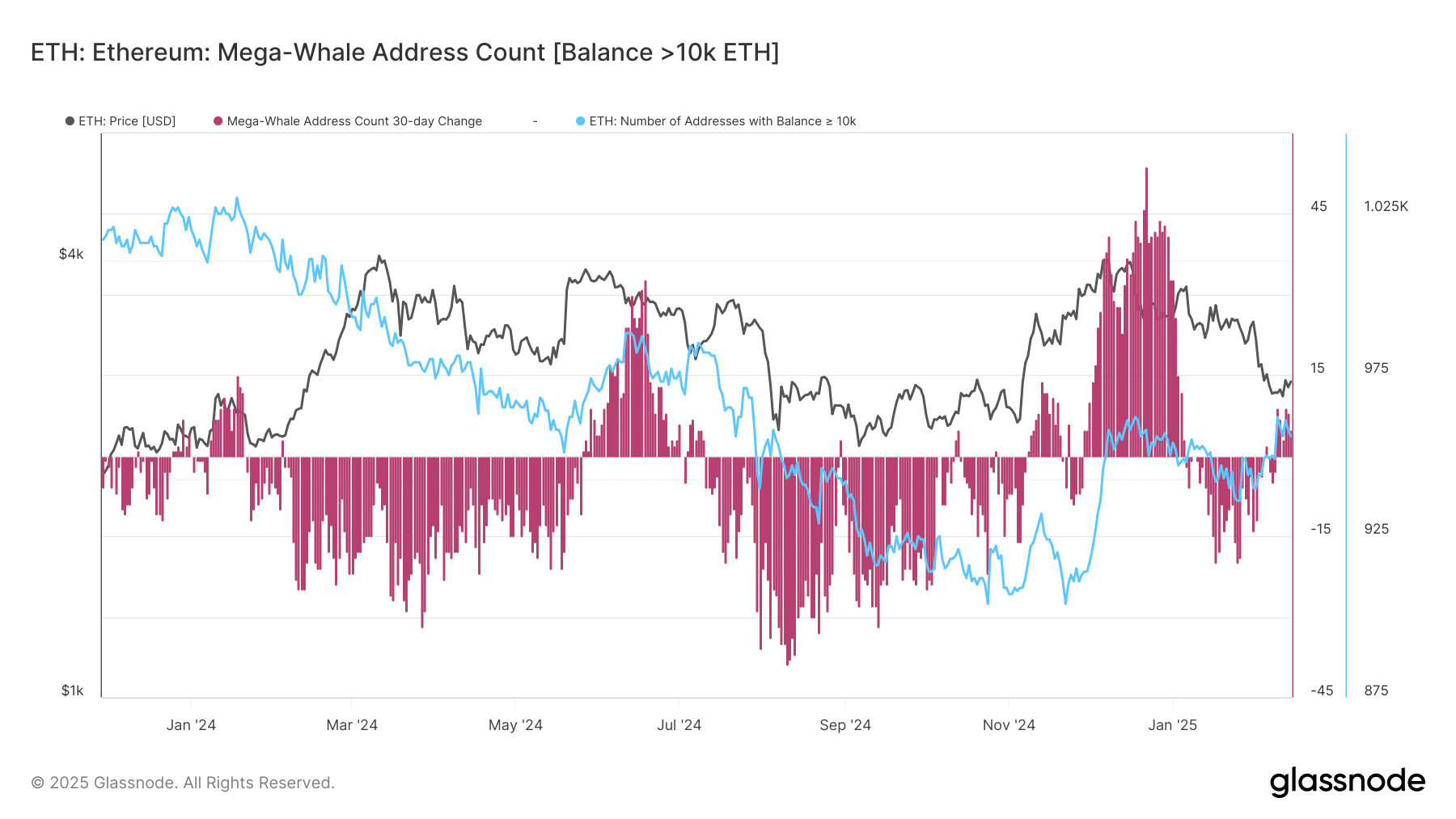

That stated, the 30-day Mega-Wal handle outcomes (with greater than 10k ETH) grew to become optimistic once more in February. The variety of addresses with greater than 10k ETH has additionally risen to 956 from 936 to this point.

Supply: Glassnode

Quite the opposite, the value of ETH has remained damped regardless of the institutional adoption circulate. On the time of writing, the Altcoin was appreciated at $ 2.7k and 34% was in comparison with its peak of $ 4.1k.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024