Ethereum

Ethereum faces key $2.8K resistance – Can ETH bulls push through?

Credit : ambcrypto.com

- Ethereum maintained its Bearish market construction.

- Liquidation ranges indicated {that a} potential value bounced as much as $ 2,880.

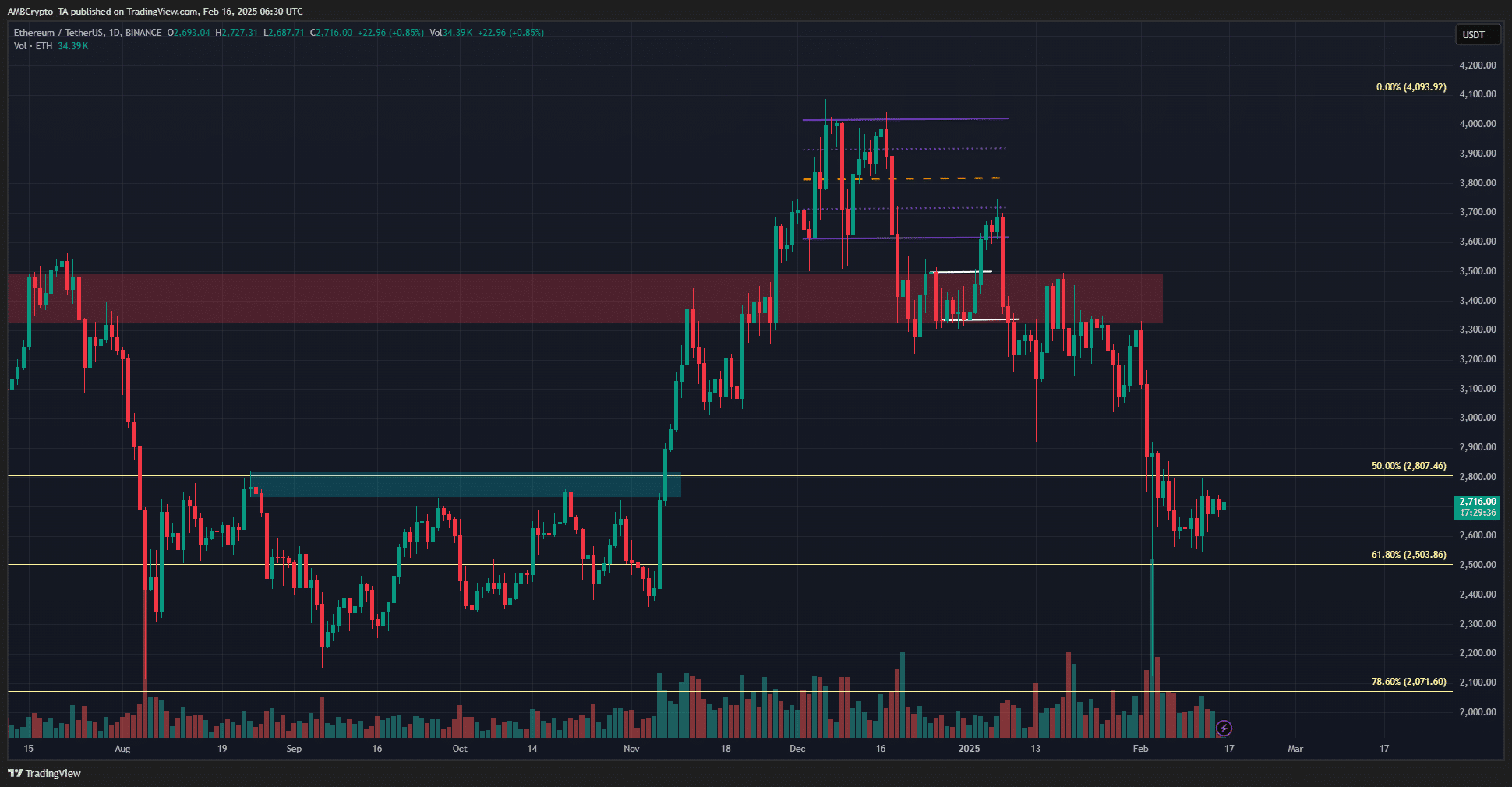

Ethereum [ETH] Has fallen underneath $ 2.8k zone, which had been succeeded as a strict resistance from August to November 2024.

It was discouraging for traders to see ETH, and many of the Altcoin market misplaced most of their revenue in November.

Supply: ETH/USDT on TradingView

Technically, the 61.8% and 78.6% Fibonacci retracement ranges continued to behave as assist. However, the each day market construction Beerarish and the buying stress was stopped.

A mix of statistics and the liquidation warmth map gave directions in regards to the following motion.

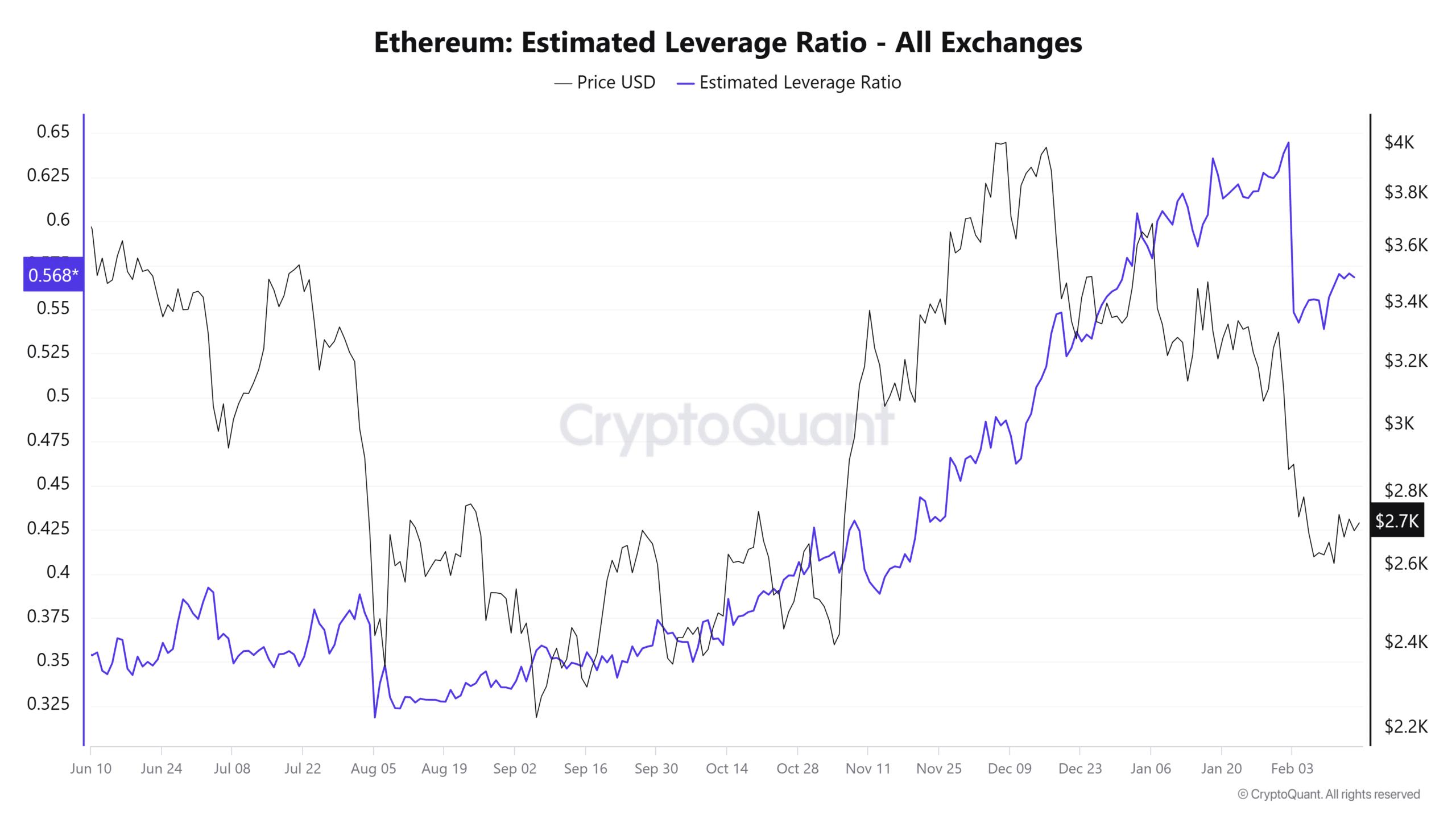

The estimated lever ratio and a possible ETH -LIGHIDITY yacht

The estimated lever ratio (ELR) is calculated by sharing the open curiosity of the alternate by sharing his muntres reserve.

The ELR can be a measure of speculative sentiment- a better ELR implies that contributors are prepared to take extra dangers and customarily signifies bullish circumstances or expectations.

The fast value drop from the start of February stopped the upward pattern of the ELR, however the metric has since bounced larger.

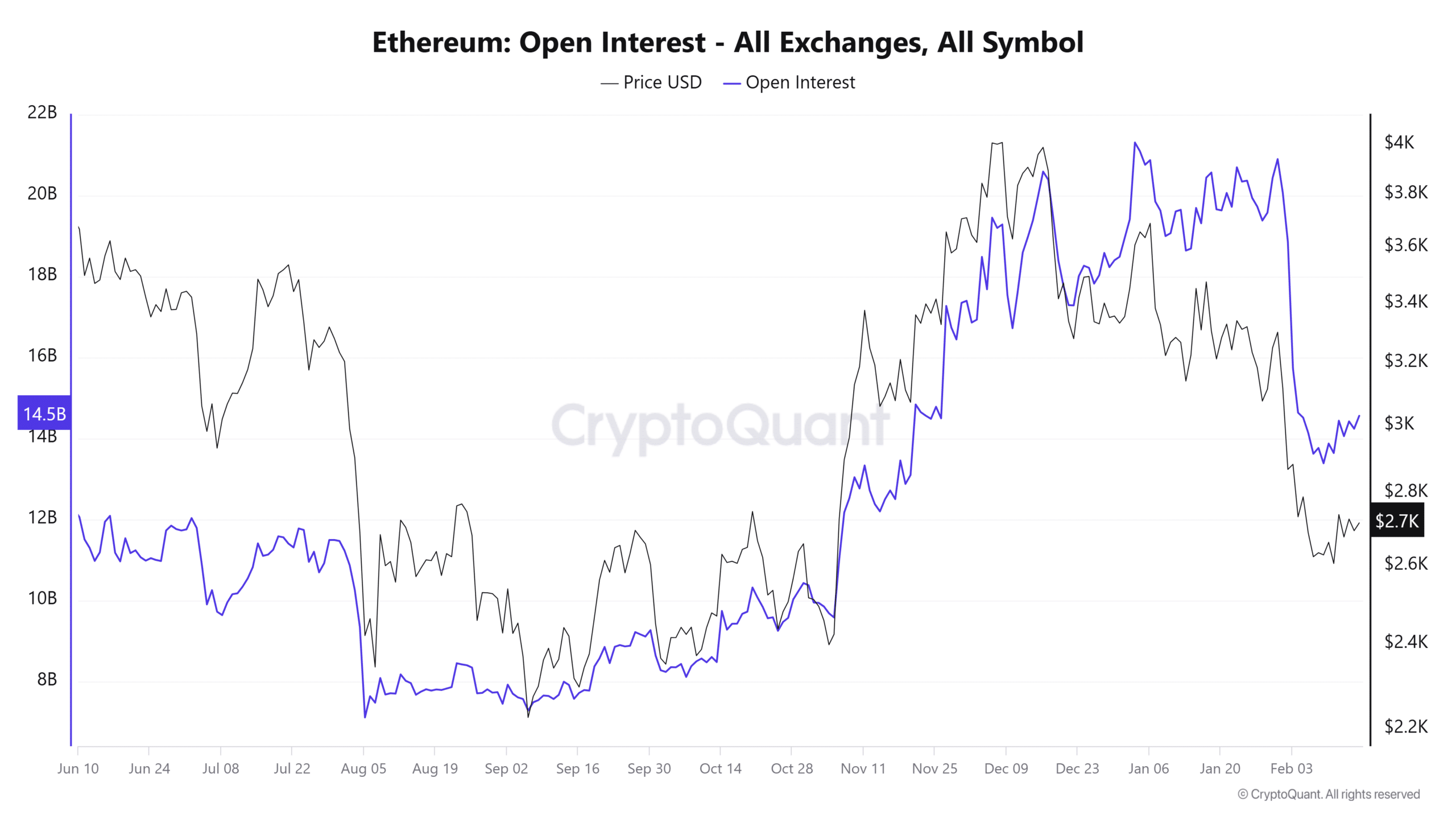

In the previous couple of days, open curiosity additionally noticed a rise, from $ 13.3 billion to $ 14.2 billion. This got here alongside a value board from $ 2.5k to $ 2.7k.

The previous two weeks additionally noticed a big flurry of ETH motion from gala’s. It is a bullish signal and customarily exhibits accumulation, however doesn’t assure value tendencies in itself.

It should be reminded that Elr is split by the reserve- an elevated OI and diminished cash reserve will push the ELR larger.

Subsequently, the conclusion of the ELR with regard to speculative expectations should be tempered. It doesn’t deny the conclusion of Bullish expectations within the brief time period based mostly on each the OI and the ELR.

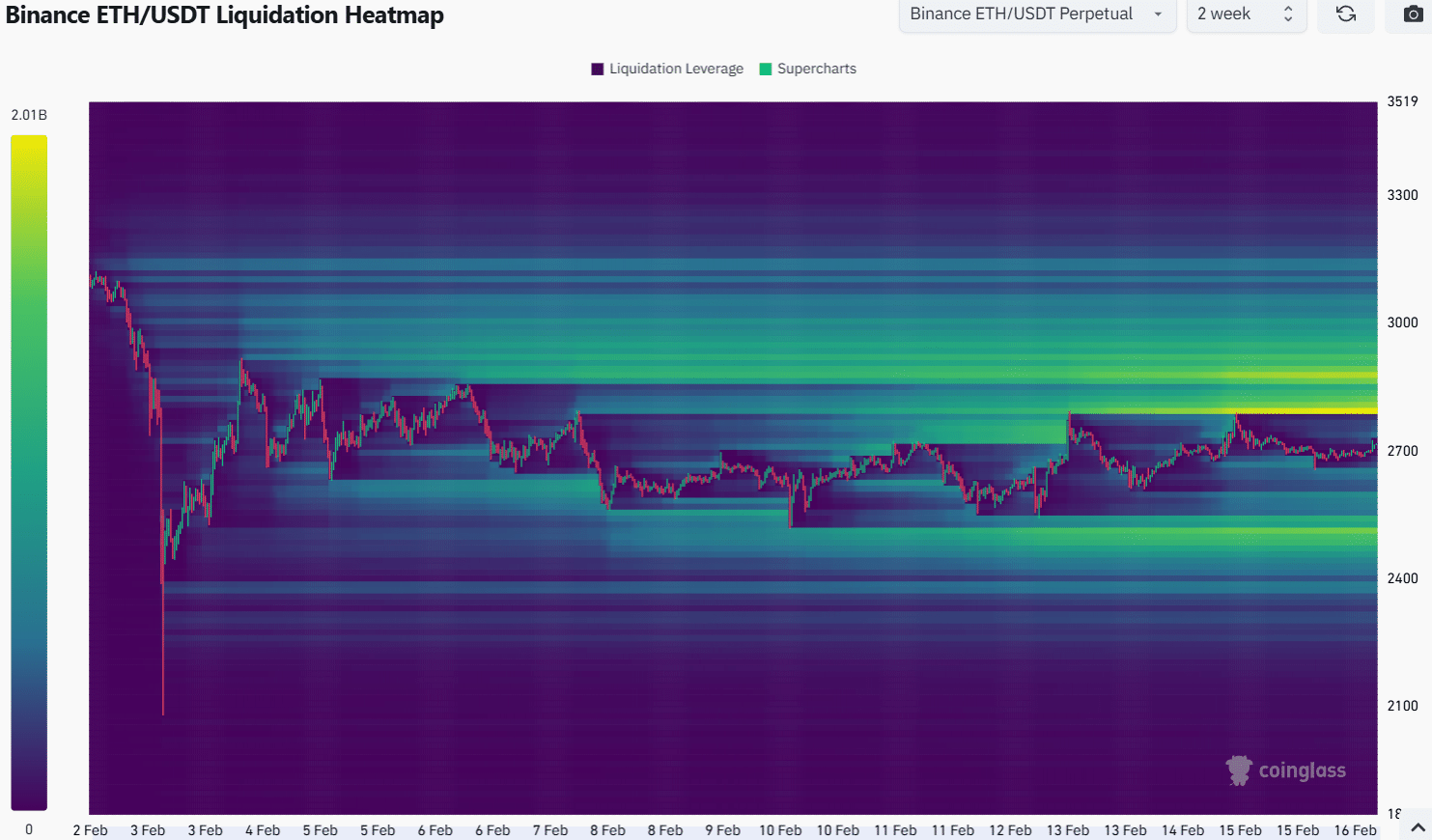

With this in thoughts, the liquidation Heatmap supplied one other indication. There was a big bag of liquidity across the $ 2.8k degree. It prolonged from $ 2,800 to $ 2,880, which marked it as an essential magnetic zone within the brief time period.

Moreover, the $ 3.5k was the subsequent goal, which was a lot additional away.

That’s the reason market contributors should be cautious of a fast value that’s larger.

The outbreak of Ethereum past $ 2.8k, as a result of it was a serious resistance prior to now, would most likely trigger enthusiasm and elevated leverage, however a transfer to $ 2,880 might show to be a bullfall earlier than a bearish reversing.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024