Altcoin

Near’s Rally in question If sentiment remains mixed – what is the next step?

Credit : ambcrypto.com

- Close by was in a essential place on the graph when it tried to reclaim a degree of assist that might decide the assembly.

- On-chain statistics advised blended market indicators, which place near a intersection with regard to the following step.

Close to the protocol [NEAR] has fallen 3.80% within the final 24 hours, with the valuation of the time time at $ 3.38.

This bearish motion set the downward development close to the previous month, with a lower of 36.94%.

Evaluation confirmed blended indicators about a number of market statistics, which may delay a doable rally or trigger additional market drops.

Nearly makes an attempt to reclaim increased ranges

After buying and selling for an extended month inside a consolidation channel-where the worth oscillated between a assist at $ 3.50 and a resistance degree of $ 8.30-this assist degree just lately broke and decrease.

Nevertheless, it was actively making an attempt to reclaim this assist on the time of writing, act again throughout the consolidation channel and to kind a brand new excessive.

Supply: TradingView

One other risk is that this small pullback is nearly a decrease excessive earlier than it continues his downward development.

Ambcrypto analyzed further elements that may affect the worth development – upwards or down – and located a blended sentiment available on the market.

Blended market sentiment creates uncertainty

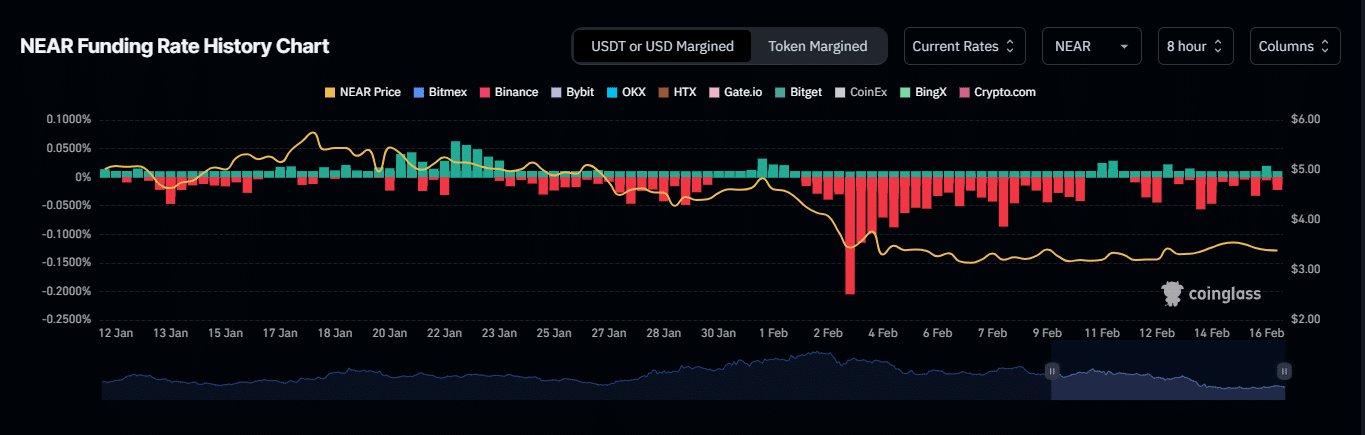

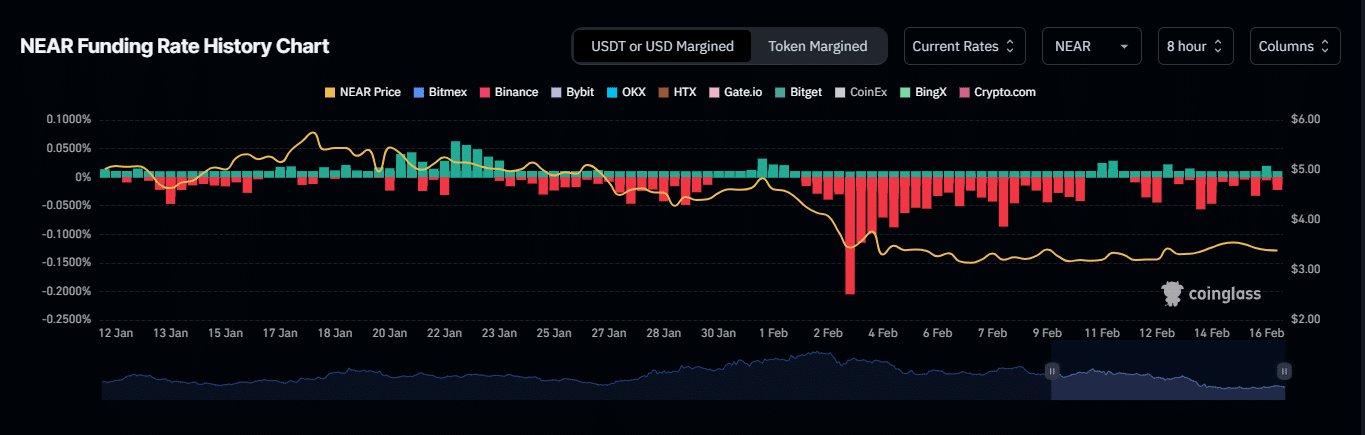

Numerous market indicators counsel blended sentiment. On the time of writing, the financing proportion confirmed that sellers financed the market.

That is based mostly on the detrimental financing velocity of -0.0170. A detrimental studying signifies that sellers are strongly satisfied that the Close to value will fall quickly.

Supply: Coinglass

Likewise there have been extra lengthy liquidations available in the market in all time frames. Within the final 24 hours alone, a complete of $ 137,140 in lengthy contracts was strongly concluded, in comparison with $ 24,170 briefly liquidations.

This excessive inequality means that the bears of Close to have management, which will increase the prospect of additional value decreases.

The Purchase-Promote ratio of Taker, nonetheless, signifies that bulls stay lively, as a result of shopping for quantity has surpassed the gross sales quantity over the previous 24 hours.

This ratio is measured on a scale during which 1 represents a impartial zone. A lecture above 1 means that consumers are extra lively, whereas a lecture beneath 1 signifies the dominance of the vendor.

The present Purchase-Promote ratio of the Close by Taker was 1.004, which signifies that the market has been considerably bullish for the previous 24 hours.

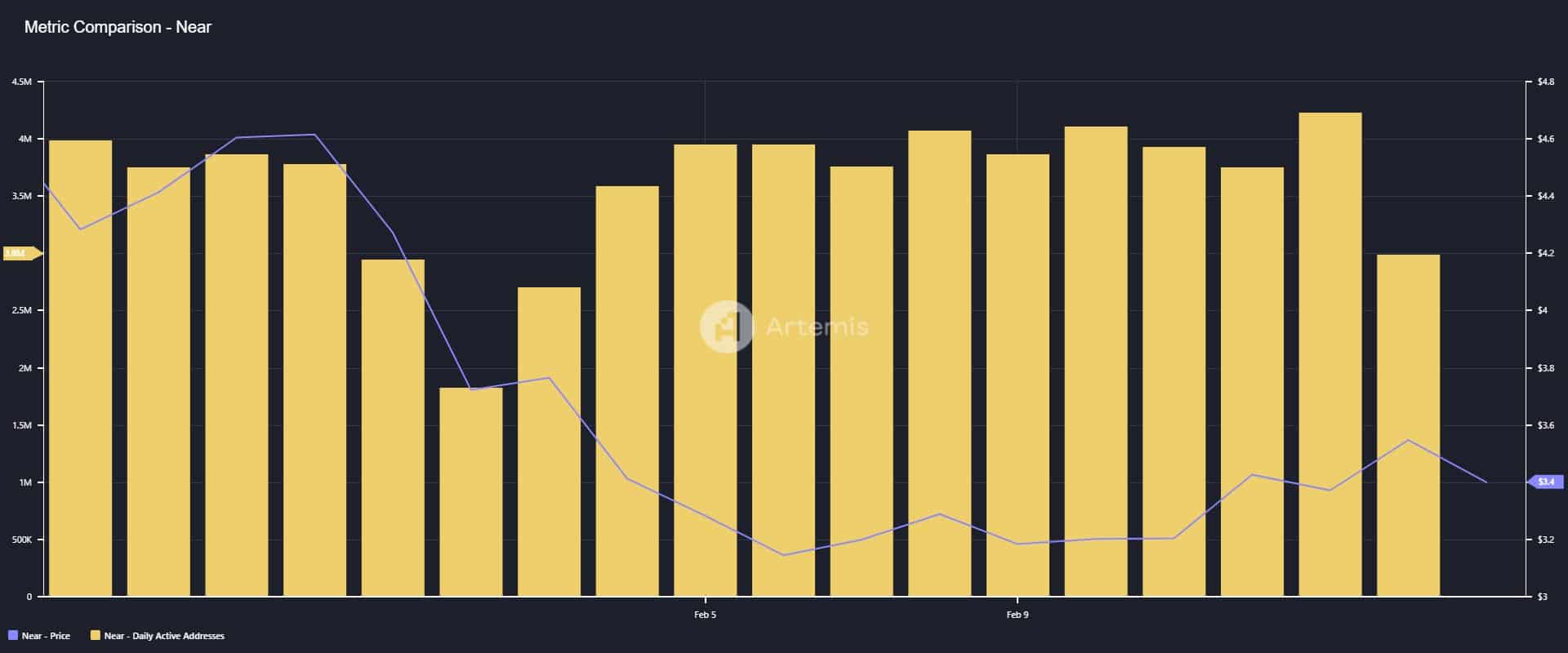

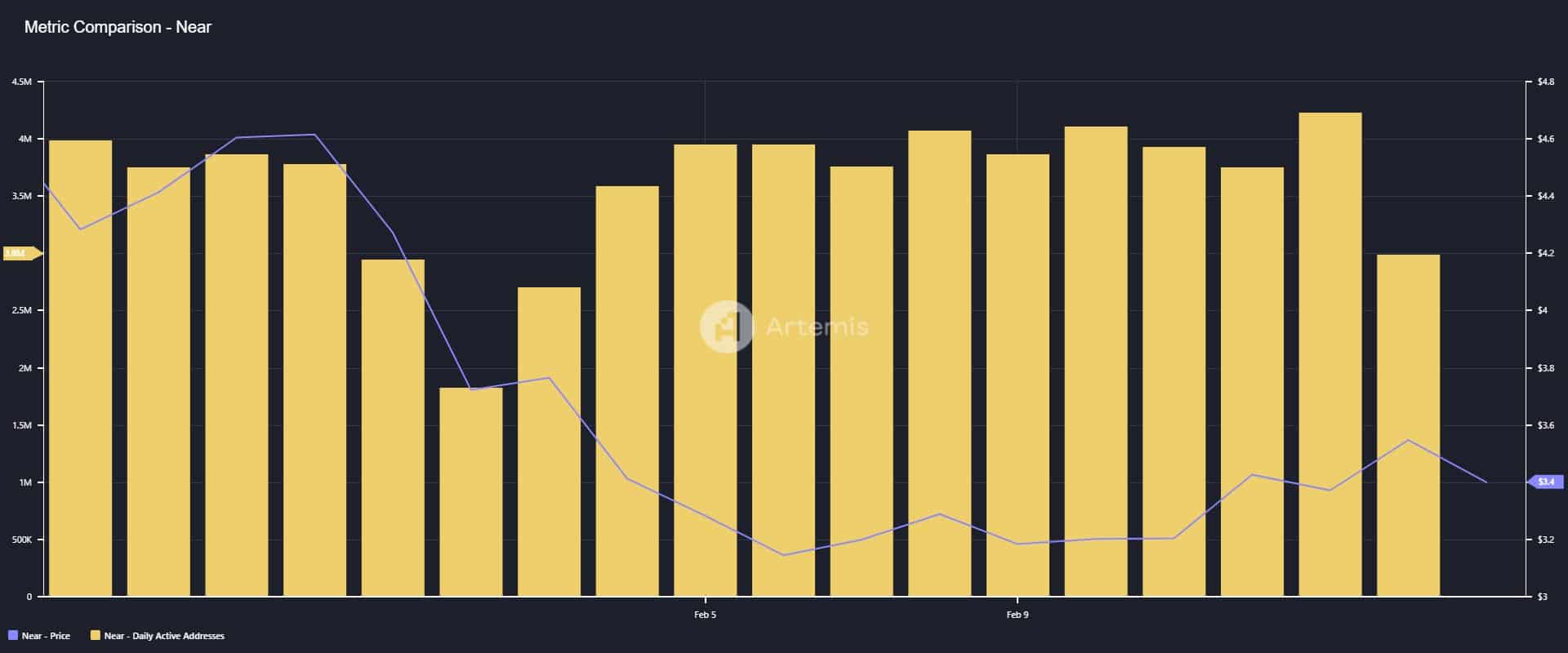

Lower in lively addresses contributes to printing

The variety of every day lively addresses on the close by chain is a major lower within the variety of every day lively addresses.

A lower in lively addresses, particularly when the worth of the asset drops, suggests a lowered community exercise, as a result of merchants most likely depart their positions.

Based on Artemis, lively addresses fell by 1.2 million between 13 February and the final knowledge on the time of the press – from 4.2 million to three.0 million.

This means {that a} outstanding a part of this decline comes from sellers who depart the market.

Supply: Artemis

If lively addresses proceed to fall, this could add extra downward strain on actively as extra sellers enter the market.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024