NFT

OpenSea NFT volumes have given way to Solana and Bitcoin platforms

Credit : cryptonews.net

NFTs are securities – so it seems the SEC is getting ready to take it to court docket, with OpenSea as a possible defendant.

Whatever the deserves (or lack thereof) of a case in opposition to the corporate, most NFT exercise as of late takes place elsewhere.

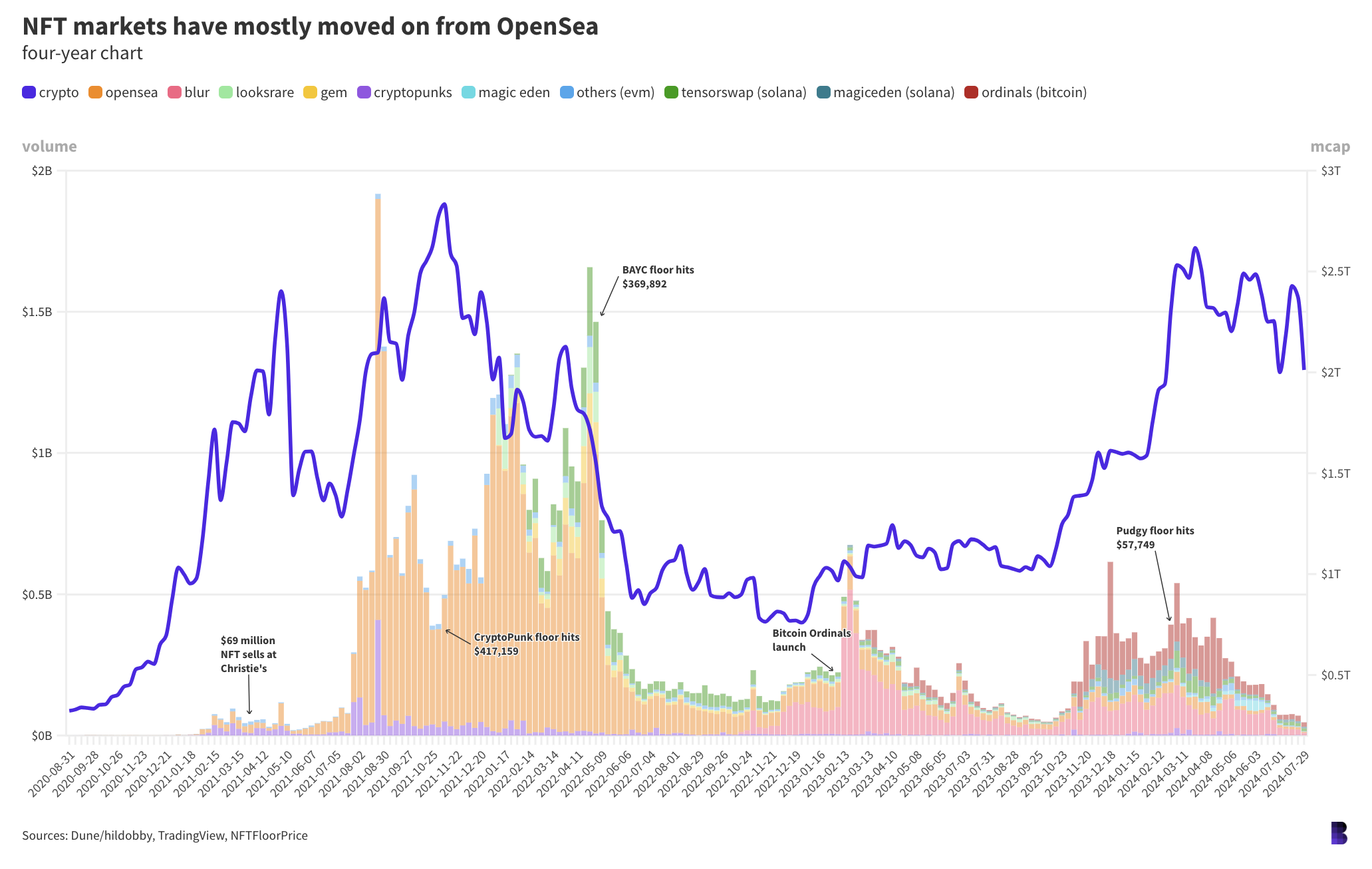

The chart beneath reveals US dollar-denominated buying and selling volumes for NFT marketplaces on EVM chains, represented by the colourful columns within the background. Crypto’s whole market capitalization is in any other case mirrored by the blue line.

It consists of NFT transactions on Ethereum, Base, Blast, Solana and Bitcoin over the previous 4 years.

The information factors to over $62.75 billion in NFT buying and selling volumes since August 2020, with OpenSea facilitating practically 58% of that.

A take a look at the previous 12 months alone reveals a complete of $11.37 billion in NFT buying and selling quantity. OpenSea, primarily based in New York, contributed solely 10% of those transactions.

Blur alone processed $3.75 billion, a few third of the full, whereas Solana marketplaces Tensorswap and MagicEden accounted for six.6% and eight% respectively.

If we bundle all Ordinals buying and selling below one umbrella, $3.8 billion price of Bitcoin-native collectibles had been traded final 12 months (via early August), making up nearly 34% of annual quantity. Ordinal volumes are proven in the dead of night pink columns on the map.

(EVM knowledge got here from this Dune dashboard by consumer @hildobby, and from right here for Solana quantity. Bitcoin knowledge got here from CryptoSlam.)

(Each Hildobby and CryptoSlam knowledge filter out volumes suspected of being the results of wash buying and selling, so precise onchain volumes are larger, however this could mirror natural buying and selling exercise for many of the NFT market .)

NFTs Go Their Personal Approach (NGTOW)

Granted, a loss for OpenSea would seemingly bode ailing for different NFT marketplaces.

So there’s nonetheless room for the SEC to “defend traders,” because the company sees it, even when that has grow to be a meme within the crypto house.

It has not been confirmed whether or not a securities ruling would finish NFTs as a helpful idea in crypto. It will seemingly solely encourage artists, publishers, and different creatives to distance themselves from their work and thus keep away from the Howey Check.

Maybe at worst, there can be much less incentive for enterprise capitalists to delve into numerous NFT ecosystems – particularly if the promise of future income from the efforts of others was actually now not a part of the attraction. And there’s extra to crypto than enterprise capital, even when it generally would not appear that method.

Be that as it might, NFTs have lengthy been a straightforward goal for haters. Past the extra ridiculous use instances — from burning artistic endeavors to tokenizing farts in jars — even the most well-liked NFT markets are usually far much less liquid than prime fungible cryptocurrencies, to not point out a lot smaller ones.

This often makes them rather more prone to mini-bubbles and different varieties of manias. That draws a variety of consideration, each optimistic and unfavourable.

It might be that NFT markets comply with their very own cycle schedules, probably separate from the remainder of the crypto market.

NFTs have solely been traded with any actual dimension for 3 years, with the biggest cycle to this point often occurring inside the first.

Blur (in coral pink on the chart above) reignited a few of the hearth when it launched in late 2022. Bitcoin did it once more by way of Ordinals. And whereas these volumes have dried up not too long ago, crazier issues have occurred in crypto than NFTs discovering continued curiosity from the market.

Until the SEC ruins everybody’s enjoyable with its potential OpenSea case.

If solely it had rained just a little earlier on the parades of Sam Bankman-Fried, Alex Mashinsky, Su Zhu, Kyle Davies and Do Kwon. Maybe we’d nonetheless be within the grip of NFT mania.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September