Bitcoin

BTC decouples from S&P —Here’s why it’s important for investors

Credit : ambcrypto.com

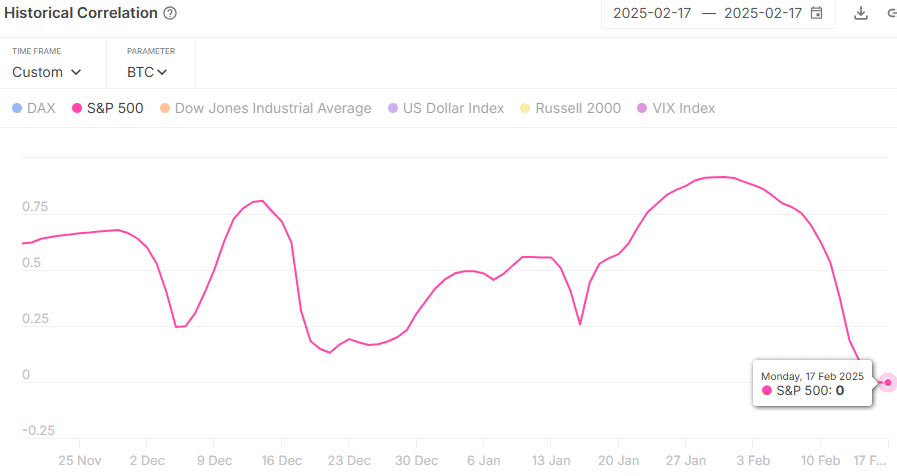

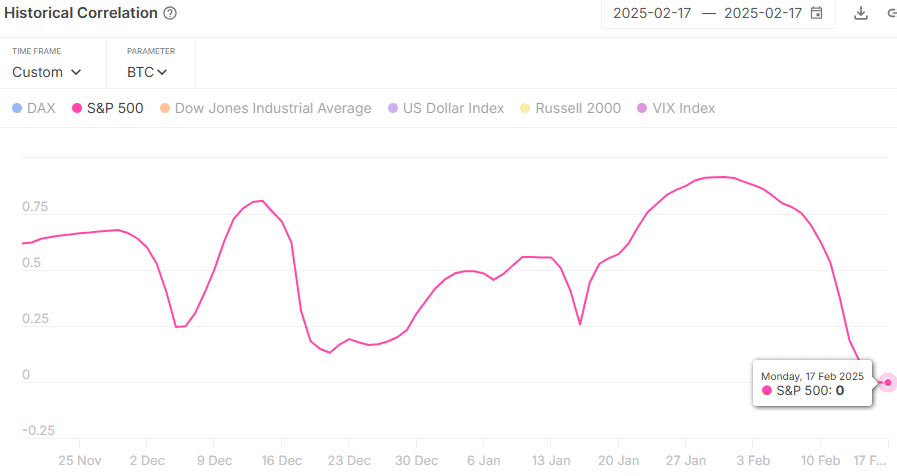

- BTC S&P correlation touches zero and alerts the complete disconnection of Bitcoin of conventional markets.

- Hypothesis about whether or not the independence of Bitcoin of shares might trigger a significant value improve are widespread.

Bitcoin [BTC] has lengthy been seen as a danger -active, associated to shares in instances of market uncertainty. However a brand new shift is on the rise.

The correlation between Bitcoin and the S&P 500 has fallen at zeroSignaling a whole disconnection of conventional markets.

This break comes after months of optimistic correlation and displays falls in instances the place Bitcoin rose after comparable variations.

Whereas market guards assess what this implies for the cryptomarket, individuals are questioning: is Bitcoin about to a different large rally?

Perception into the correlation within the monetary markets

Correlation measures how the value actions of two belongings relate to one another. A correlation close to 1 signifies that they’re going synchronously, whereas -1 suggests an inverted relationship.

A zero correlation, as seen now, signifies that there is no such thing as a connection between Bitcoin and the S&P 500, which signifies a shift out there conduct of Bitcoin.

Traditionally, the correlation of Bitcoin with conventional belongings is fluctuating. Intervals of excessive correlation correspond to broader financial uncertainty.

Nevertheless, a correlation lower as much as zero has usually indicated a shift in Bitcoin’s value course of.

The shift in correlation

In January, Bitcoin and the S&P 500 confirmed an virtually excellent correlation, which for the primary time transferring in latest reminiscence together.

This was exceptional as a result of Bitcoin is normally thought-about a separate activa class, not carefully linked to conventional monetary markets.

The coordination of Bitcoin with the S&P 500 instructed {that a} wider sentiment for inventory market influenced the value.

Supply: Intotheblock

This correlation has fallen sharply for the reason that starting of February, so zero is reached. This dramatic shift signifies that Bitcoin’s value actions are not carefully linked to developments on the inventory market.

The decoupling of Bitcoin of the S&P 500 can imply a brand new part for the cryptocurrency, extra pushed by its distinctive components than exterior market influences.

Graphic evaluation of the correlation pattern additional confirms this sharp lower.

Traditionally, such decoupling has usually preceded vital value actions for Bitcoin, indicating that it might quickly be making ready for exceptional volatility.

BTC S&P: Historic context

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September