Bitcoin

Amboss CEO Talks Growth Of The Bitcoin Lightning Network, Tether (USDT) On Lightning

Credit : bitcoinmagazine.com

Founder: Jesse Shrader and Anthony Potdevin

Date based: March 2021

Location of the pinnacle workplace: Nashville, TN

Variety of workers: 10

Web site: https://amboss.tech/

Public or personal? Non-public

Jesse Shrader thinks this can be an necessary yr for the lightning community.

With the value of Bitcoin within the rise and Tether (USDT) that involves lightning, Shrader states that increasingly corporations and establishments will see lightning for funds within the coming yr.

And his firm, Amboss, is able to assist notice this imaginative and prescient.

“We need to develop Bitcoin as a fee system and use Lightning to do this,” Shrader informed Bitcoin Journal. “We need to make lightning a excessive environment friendly, excessive -quality system.

By a collection of instruments and companies that Shrader and the staff of Amboss have developed, they’re prepared to board the subsequent wave of institutional customers on board the most important permission -free fee community on the planet – particularly now that USDT is operating on lightning.

What Amboss does

Amboss primarily provides clever fee infrastructure for digital funds utilizing the lightning community.

“We give individuals insights with regard to what they need to do to extend the effectivity of funds on the community,” mentioned Shrader.

To realize this, they provide quite a few services.

One of the putting of those is Ambussion spaceWhat a Lightning Community Explorer is that machine studying makes use of to assist customers choose up info or hook up with a node on the community.

Along with their evaluation software program, Amboss additionally provides its clients aids and companies to enhance the liquidity situations on lightning.

Such a service is Magma -MarketplaatsWith which customers can purchase and promote liquidity on the lightning community. With the assistance of magma, customers can provide liquidity – with out giving up custody about their bitcoin – for a yield.

One other is HydroAn extension of magma. The software program allows customers to automate their liquidity purchases to raised assure the success of funds.

(And Amboss additionally provides ReflexA compliance suite for enterprise clients with AML (anti-Wilwas) reporting obligations.)

The evaluation software program and instruments from Amboss are constructed for transactions with a big quantity which can be simpler to make on lightning.

“We measure the power of corporations to make funds with simulations,” Shrader defined. “We are going to assist corporations to see how a lot of the community they will really attain after they strive a fee.”

The state of lightning

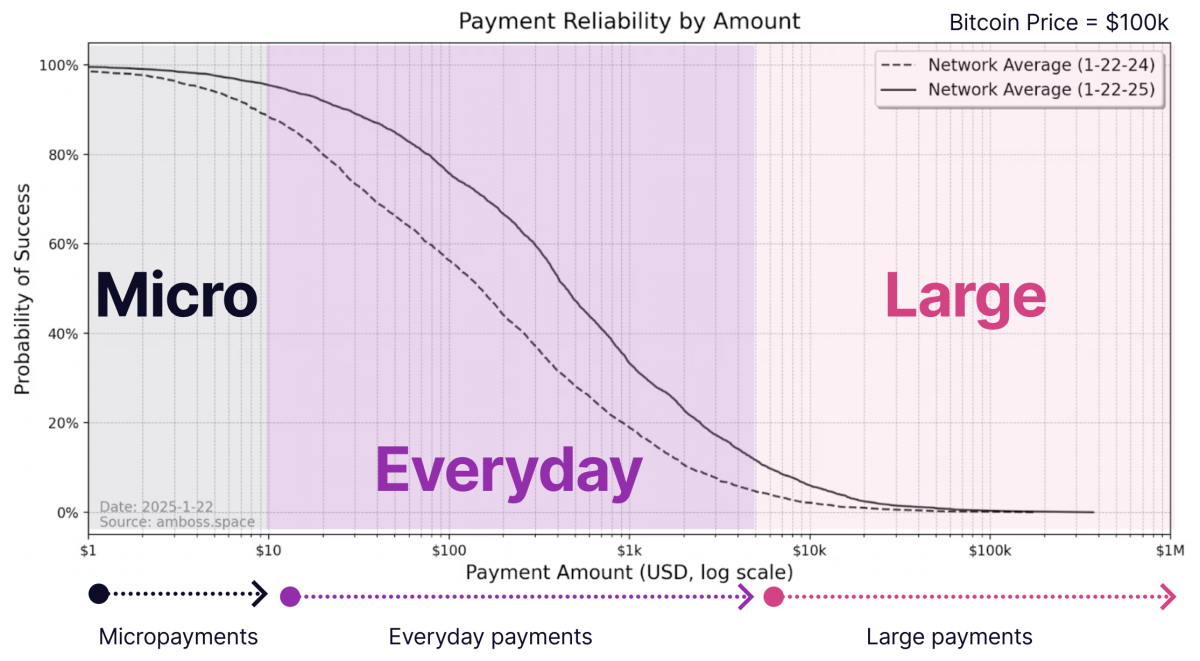

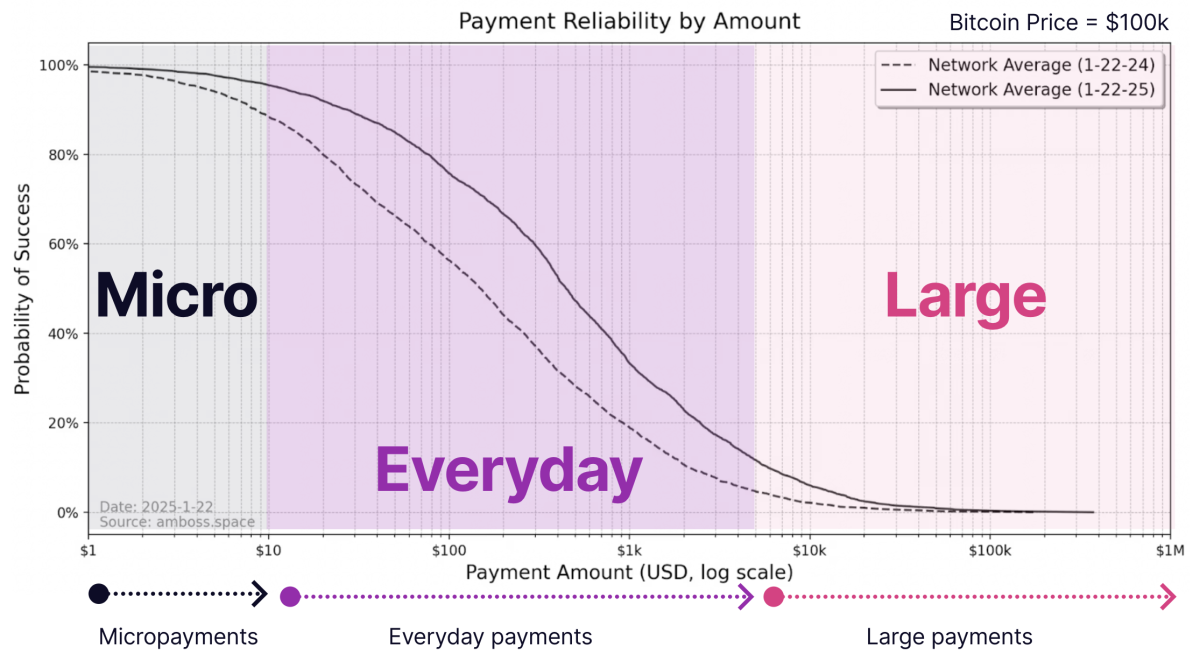

Shrader is optimistic relating to the expansion of lightning. With on daily basis that passes, customers belief the community to ship extra than simply micropayments.

“We’ve efficiently processing each day funds on lightning, which I outline as between $ 10 and $ 4,000 funds,” mentioned Shrader. “We’re engaged on additional enhancing the probabilities of the community, with a deal with decentralization.”

Funds bigger than $ 4,000 are nonetheless troublesome to course of. Shrader defined that extra capital is required to assist the processing obtain bigger funds.

Nevertheless, he additionally famous that the latest enhance within the worth of Bitcoin has helped bigger funds to be processed extra simply.

“What we lately noticed is that the Bitcoin worth has risen, which has elevated the opportunity of settlement in all lightning channels,” mentioned Shrader. “As a result of the Bitcoin channels are expressed, it’s as if we acquired larger pipes.”

And though Shrader is optimistic about these bigger pipes that make extra transit attainable, he additionally believes that the arrival of Tether (USDT) will appeal to much more liquidity to the community.

Tether (USDT) on lightning

On the finish of final month, Lightning Labs announced That the USDT brings to Bitcoin and the lightning community through the Taproot Property protocol.

This improve allows Bitcoin service suppliers to extra simply combine and settle for USDT, which, in line with Shrader, can be a blessing for lightning.

“One factor that may be very clear is that Tether has the product market match,” mentioned Shrader.

“Final yr the $ 10 trillion of funds, which exceeds Visa and Mastercard,” he added.

“It is rather clear that the world desires us {dollars}.”

Shrader, a pragmatist, acknowledged the truth that many hardline bitcoiners have issues with USDT that runs on Bitcoin and lightning, and he sympathizes with them as a result of he appreciates the nice cash qualities of Bitcoin.

On the similar time, he thinks that the advantages of Lightning clearly outweigh the disadvantages, as a result of many nonetheless don’t perceive what Bitcoin is, nor are they prepared to tolerate its volatility.

“Many haven’t but taken the Oranje Tablet and can perceive the advantages of Bitcoin,” he defined.

“I feel Bitcoin is an unbelievable instrument and I need to carry that to as many individuals as attainable. That mentioned, there are lots of issues with conventional funds, and Bitcoin has this very protected, auditable system, one thing that I need to carry to the world, “he added.

“Though the Bitcoin worth motion is nice for me, many individuals are afraid of volatility. In case you have a possession with very low volatility reminiscent of USDT, now for very protected, confidential rails, that may be a enormous victory. “

The issue that USDT solves on lightning

Shrader defined what the primary Bitcoin-related convention Microstrategy was organized, it was really known as ‘Lightning for Companies’. Through the convention, corporations had been inspired to pay workers in Bitcoin about lightning – with out absolutely realizing the issues that this could trigger at the moment.

“What employers realized was that every one 1099s who needed to be submitted to workers had been a trouble,” mentioned Shrader. “And there was a complete collection of regulatory overhead that additionally they needed to cope with.”

Shrader identified that not solely the fee of workers in USDT about lightning can cut back accounting and authorized headache, nevertheless it additionally reduces a part of the counterparty threat associated to using banks – a actuality with which Shrader is kind of acquainted.

“Our payroll all the time went by Silicon Valley Financial institution,” mentioned Shrader.

“And at a sure level the pay body contacted me to re -ship my payroll from the center of the month after I had tried to pay the employees. I misplaced the runway of half a month. This was all as a result of Silicon Valley Financial institution was bancrupt, “he added.

“So, if I can keep away from the counterparty threat within the monetary system by transferring to Bitcoin and Lightning, it signifies that I’m in a significantly better place.”

[Author’s note: Some counterparty risk still exists when using USDT, as you have to trust that Tether holds actual U.S. dollars to back the tokenized ones it issues.]

Dangers

Shrader observed a part of the dangers of USDT on Bitcoin and Lightning, however didn’t appear an excessive amount of frightened about them.

“There are one Along Dangers when you’ve got different property than the indigenous lively of a blockchain that’s traded on the chain, “mentioned Shrader.” However Bitcoin already has ordinal inscriptions that create different property, in order that that drawback already exists. “

He additionally didn’t appear confused after I introduced the danger {that a} Bitcoin fork will consequence within the USDT on one of many chains that grew to become nugatory, nor did he assume there’s a outstanding threat of bigger financial junctions within the Bitcoin community, reminiscent of Coinbase, which custodes the bitcoin for the American place Bitcoin ETFs and chooses to be a “tether fork” from Bitcoin Help, which may additionally embody different upgrades that may hurt Bitcoin within the lung run.

“Bitcoin -consensus isn’t decided by custody of Bitcoin, so though an necessary firm reminiscent of Coinbase can assist varied adjustments or initiatives, it doesn’t assure that protocol adjustments could be carried out,” Stated Shrader.

As a substitute of concentrating on the dangers associated to USDT on Bitcoin, Shrader makes the other.

“What’s extra attention-grabbing are in all probability the alternatives that unlocks the place you will have an precise arbitration capability on Bitcoin itself,” mentioned Shrader.

“As a result of each node is in a position to have the ability to trade each USDT and Bitcoin to additionally allow native lightning, you possibly can ship Bitcoin from one lightning channel and obtain USDT in one other of your lightning channels,” added he’s prepared.

“That may be so simple as producing a USDT bill and paying with BTC, instantly re -balancing holdings.”

2025: The yr of lightning

Within the final ideas of Shrader from my interview with him, he shared two final necessary explanation why 2025 would be the yr of lightning.

The primary is that holding Bitcoin is now not essential to make use of lightning.

“Till this yr, if individuals or corporations wished to change to lightning, they first needed to have Bitcoin – and that may be a enormous barrier,” Shrader defined. (Shrader added in a solution to a observe -up query that’s comparatively easy and customary outdoors the US to realize entry to USDT.)

“The Bitcoin-Alleen marketplace for fee processing is small. However this yr we eliminated that barrier, and pays shoppers with one other lively – USDT. There may be already a big marketplace for that, “he added.

(Shrader additionally famous that though USDT is operating on lightning rails, Bitcoin nonetheless advantages, as a result of the USDT is transformed into Bitcoin whereas he travels over lightning. He added that “all that bitcoin lies round at lightning makes it extra dangling to 1 Lighting a lightning button to run a lightning button.

Furthermore, Shrader famous that lightning customers will solely pay a small group of what they’d paid for transaction prices utilizing conventional monetary rails.

“We ship liquidity to lower than 0.5%,” mentioned Shrader.

“As a person of Massive Cost Card Networks I pay 4% for all that fee processing, and the cash doesn’t seem days to weeks after fee has been made,” he added.

“With lightning, your fee processing prices lower with virtually 10x.”

Given the factors of Shrader, it’s troublesome to think about that 2025 is not going to be a big yr for lightning.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024