Ethereum

Ethereum forms first bullish divergence in 2 years: Major rally ahead?

Credit : ambcrypto.com

- Ethereum reveals potential for a bullish reversal, with a uncommon each day bullish divergence and narrowing Bollinger Bands.

- Macroeconomic shifts and on-chain information may push Ethereum’s worth greater regardless of current bearish momentum.

Ethereum [ETH] was displaying indicators of a worth reversal at press time, with a bullish divergence rising on the each day time-frame. This marks the primary bullish divergence for ETH in over two years.

Michaël van de Poppe, crypto analyst, lately noted,

“These are nice alerts within the markets as $ETH has made its first bullish divergence in each day time in over two years.”

Nonetheless, he additionally requested the important query:

“Will this be the precise reversal sign?”

Supply:

Technical indicators sign potential worth actions

Ethereum was buying and selling at $2,514.53 on the time of writing, reflecting a decline of 0.89% prior to now 24 hours and a decline of 4.94% prior to now week. Regardless of this current downturn, technical indicators level to a potential shift.

The Bollinger Bands are narrowing, which regularly signifies that there might be vital worth motion on the horizon.

ETH was buying and selling under the center Bollinger Band on the time of writing, indicating the asset remains to be experiencing bearish momentum.

The Transferring Common Convergence Divergence (MACD) indicator confirmed the MACD line staying under the sign line, with each traits in detrimental territory.

Whereas this recommended continued bearish strain, the histogram confirmed slight weakening, which may point out the early phases of a potential reversal or consolidation.

Supply: TradingView

On the time of writing, the Relative Power Index (RSI) stood at 39.7, placing it in oversold territory.

So so long as promoting strain stays, there could also be a chance for consumers to re-enter the market, probably resulting in a near-term rebound.

Macroeconomic influences

Macroeconomic components may additionally play a vital position in Ethereum’s potential worth appreciation.

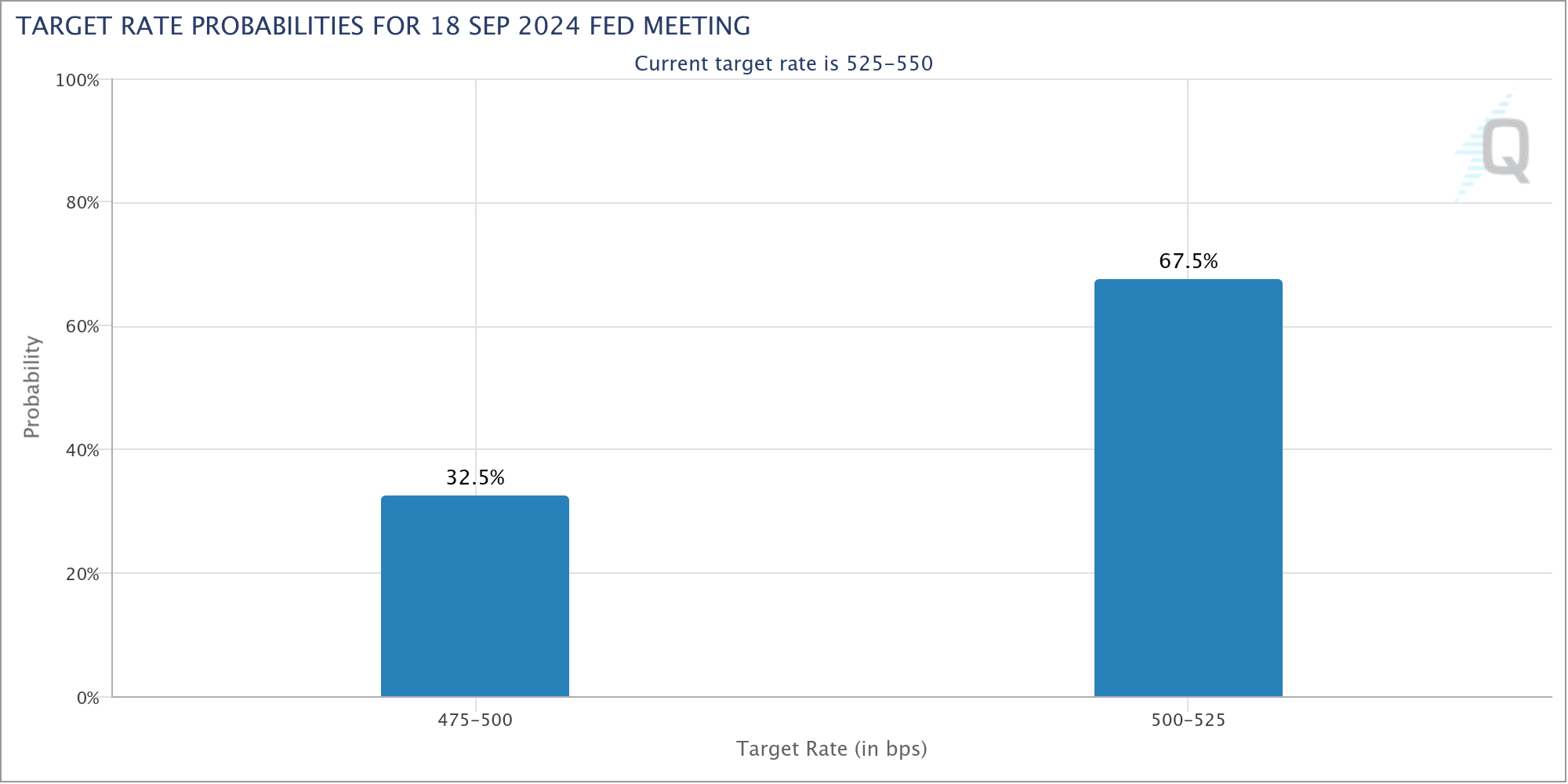

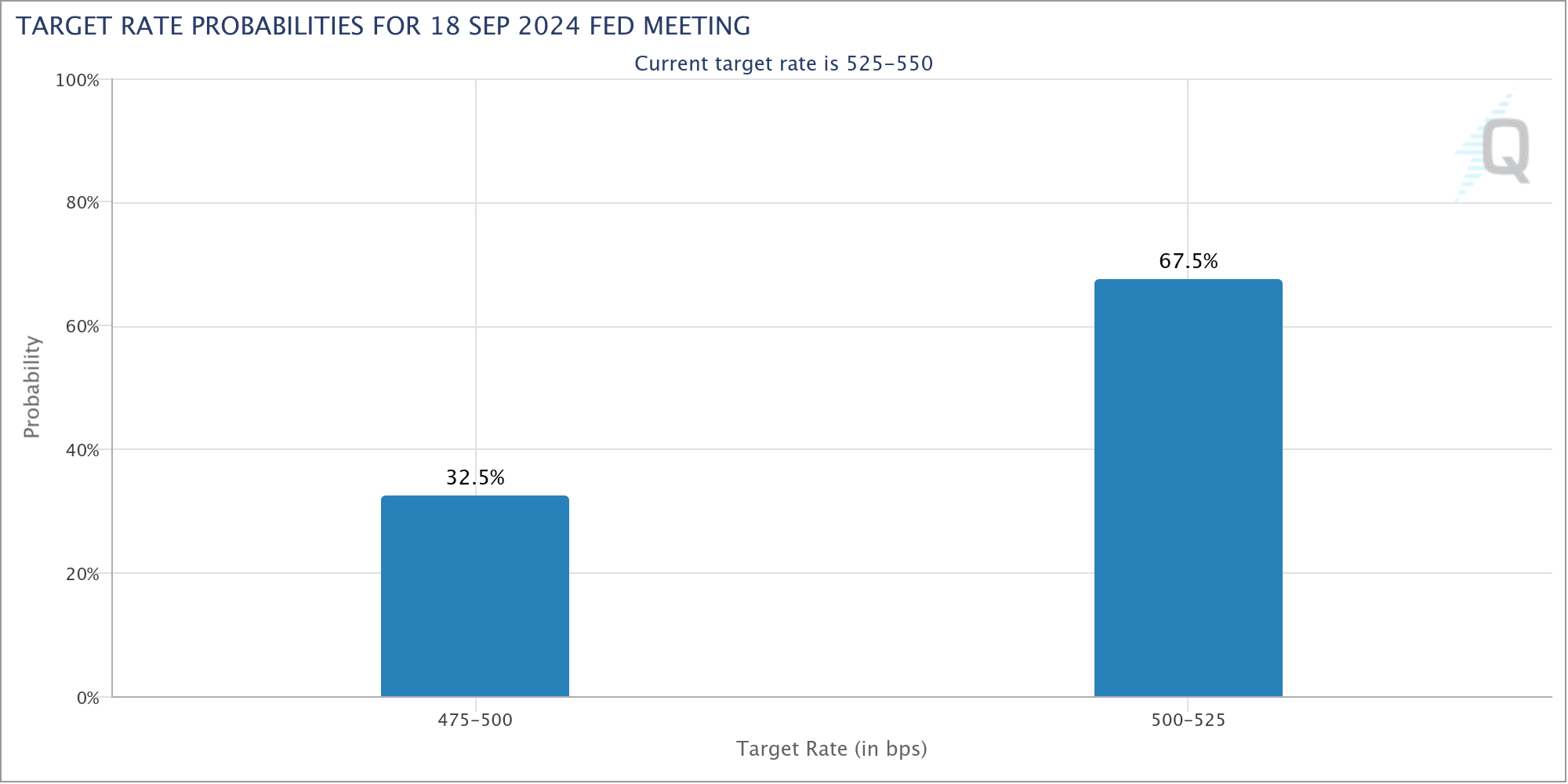

The Federal Reserve is predicted to chop charges in September and should proceed with additional cuts, pushed by slowing inflation and financial uncertainty.

A discount in rates of interest tends to make riskier property comparable to cryptocurrencies extra engaging, because the attraction of protected havens such because the US greenback diminishes.

Supply: CME

Traditionally, rate of interest cuts have led to higher capital inflows into the crypto market as traders search greater returns in various property.

Given Ethereum’s established ecosystem and its rising adoption, the crypto might be one of many major beneficiaries of this shift in investor sentiment.

A dovish stance from the Federal Reserve may weaken the US greenback, which may put additional upward strain on the worth of ETH.

Ethereum’s development prospects

On-chain information additionally supported a constructive outlook for Ethereum. Based on DefiLlamaThe Whole Worth Locked (TVL) in Ethereum-based decentralized finance (DeFi) protocols stood at $46.966 billion on the time of writing.

Moreover, the community noticed a 24-hour transaction quantity of $1.13 billion, with inflows of $2.44 million.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

The variety of lively addresses within the final 24 hours reached 390,291, along with 64,793 new addresses, highlighting continued consumer engagement and community exercise.

So there’s continued curiosity within the Ethereum community, which may help the asset’s worth within the coming months.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024