Ethereum

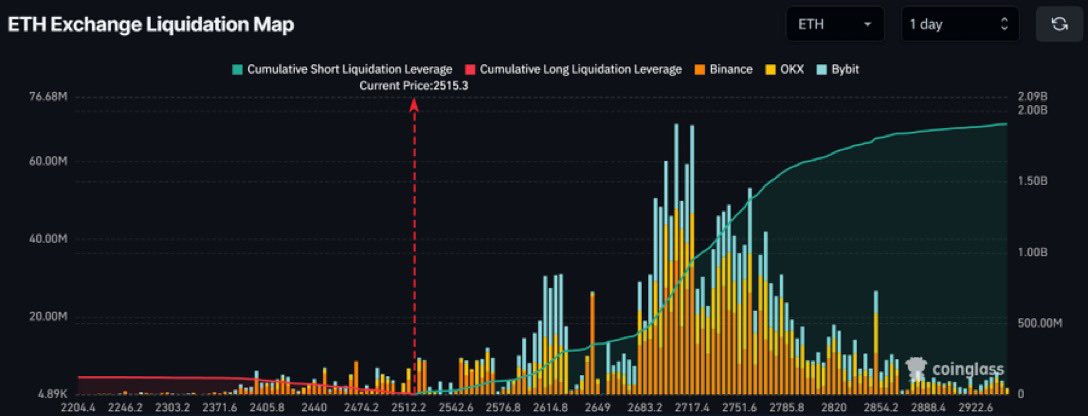

Ethereum’s $2B liquidation risk: Will a short squeeze send ETH soaring?

Credit : ambcrypto.com

- Greater than $ 2 billion ETH shorts are liquidated if the Ethereum value value pumps to $ 3,000.

- Ethereum is days away from printing the same BTC -monthly hammer candle that preceded a parabolic rally.

Ethereum’s [ETH] Change -Liquidatiekaart indicated large accumulation of brief positions, with potential liquidations that method $ 2 billion as the worth of ETH $ 3,000.

From the time of the press, $ 2,479.30 was traded. The rise within the cumulative brief liquidation lever instructed a excessive bearish hypothesis inside this value vary.

If the worth rises from ETH to $ 3,000, the liquidation of those brief positions could cause a brief squeeze. This might propel the worth even increased, since brief sellers cowl their positions.

This will appeal to extra bullish sentiment and purchase exercise, which pushes the worth from ETH to new resistance ranges.

Supply: Coinglass

Instead, if Ethereum doesn’t attain this set off level, the bearish sentiment might proceed. This will result in value stabilization or additional fall as bearish market circumstances.

Lengthy place defications can worsen this if costs fall, as indicated by the smaller peaks in lengthy liquidation.

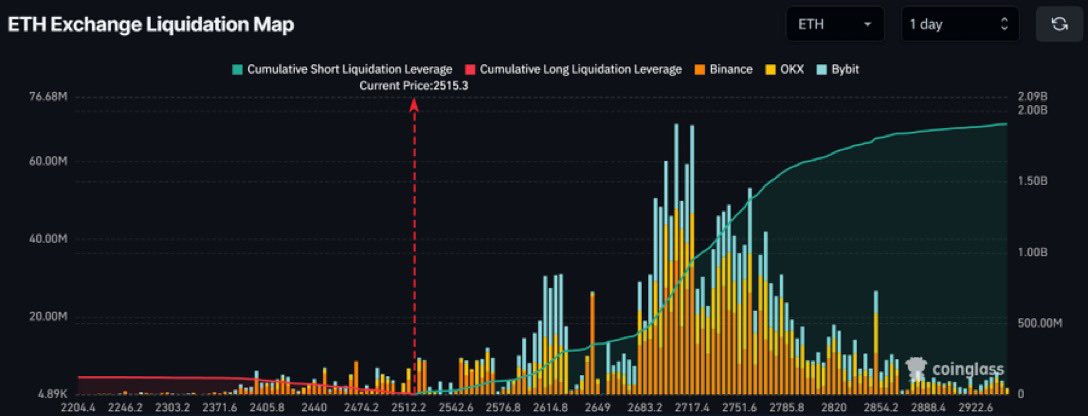

Which potential month-to-month hammer candle means?

A comparative evaluation between Bitcoin’s 2021 value motion and the present actions of Ethereum reveals that ETH is about to type a month-to-month hammer candlestick. This sample displays the sample of Bitcoin earlier than the 2021 rally.

If Ethereum completes this sample, this means a doubtlessly bullish momentum akin to Bitcoin’s climb from round $ 10,000 to virtually $ 66,000.

Presently, the worth of Ethereum might observe the same course of for $ 2,479.76, which presumably aimed the extent of $ 4,800, characterised by earlier resistance factors in 2021 earlier than he went to $ 16,000.

Supply: TradingView

Conversely, if the sample doesn’t fill and the candle turns into destructive, Ethereum might see assist of decrease limits close to $ 2,150, tailor-made to the previous assist ranges.

This sample suggests an imminent choice level for ETH. The formation of a hammer candle might catalyze a rally, a mirrored image of historic patterns which can be seen in BTC.

The subsequent few commerce classes will likely be essential. They’ll verify whether or not ETCs will emulate explosive efficiency from the previous or will differ on a bearish path.

Ethereum ICO WHALE CASHING OUT OUT OUT

Regardless of the potential rally, an Ethereum ICO walvis from the ICO period of 2015 has BIG resistance. The whale collapsed 3,046 ETH value $ 8.16 million in cracking. This follows a 6,046 ETH value $ 16.34 million sale within the final day, in keeping with Eyelashing.

With a wide ranging price foundation of $ 0.31 per ETH, this worthwhile spree leaves him with just one,024 ETH. Whereas Crypto marks these wrestling with widespread falls and capitulation, this step can strengthen the bearish sentiment.

Massive-scale liquidations of Early Adopters usually create traders, making ETH costs decrease within the midst of weak market confidence. Which means that the next actions of Ethereum are within the steadiness.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024