Altcoin

Ethereum’s supply crisis: is this a possible trigger for a new rally?

Credit : ambcrypto.com

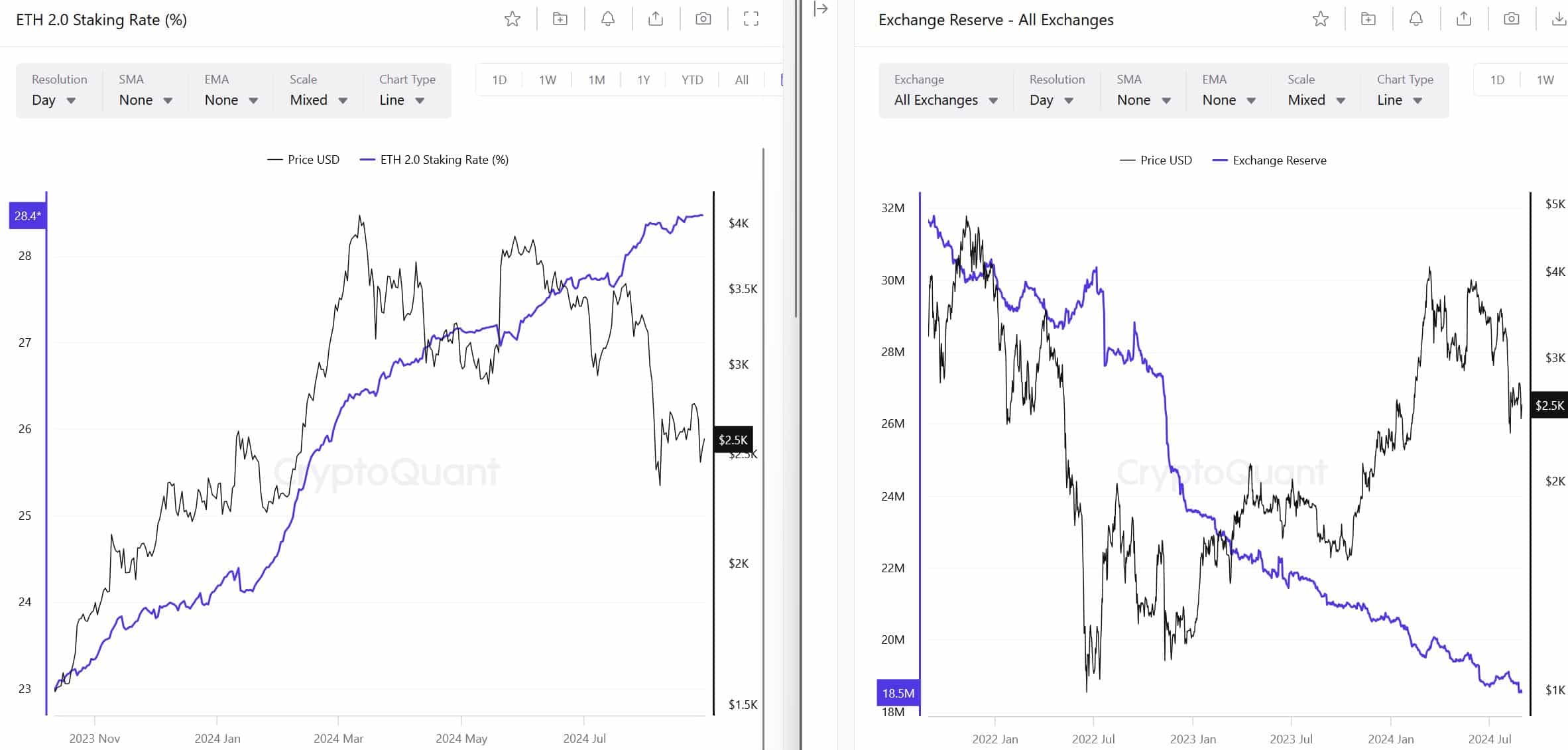

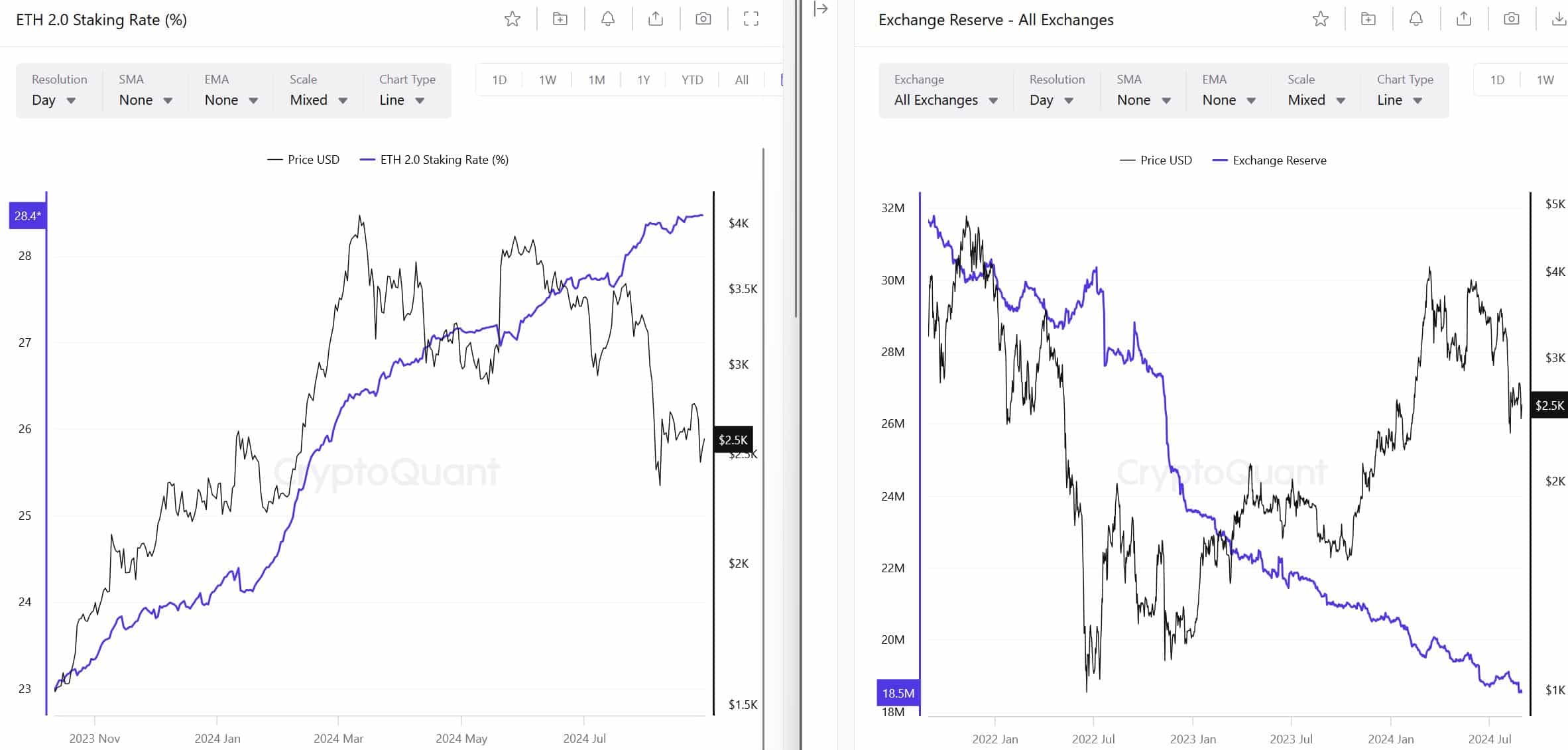

- ETH’s provide disaster intensified as staking demand elevated and international change reserves fell

- ETH fundamentals remained sturdy regardless of weak market sentiment

Ethereum[ETH]The provision crunch within the US continues to accentuate and may very well be a harbinger of a attainable sturdy restoration for the world’s largest altcoin.

In accordance with on-chain analyst Leon Waidmann, ETH’s provide disaster has been even worsened by dwindling international change reserves and rising investor curiosity in staking ETH. He projected that ETH may ‘fly’ amid the availability disaster.

“The #ETHEREUM SUPPLY CRISIS is getting MORE SEVERE by the day. With betting charges rising and foreign money reserves plummeting, #ETH will fly as soon as sellers are exhausted and demand will increase!📈”

Supply: CryptoQuant

Right here it’s value declaring that ETH change reserves have hit a brand new low of 18.5 million previously 24 hours. That is down from a peak of 35 million recorded in 2020.

ETH fundamentals have been sturdy, however…

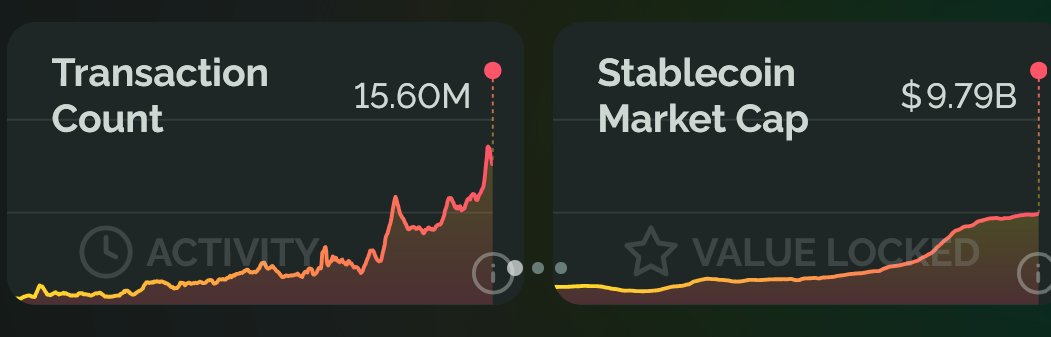

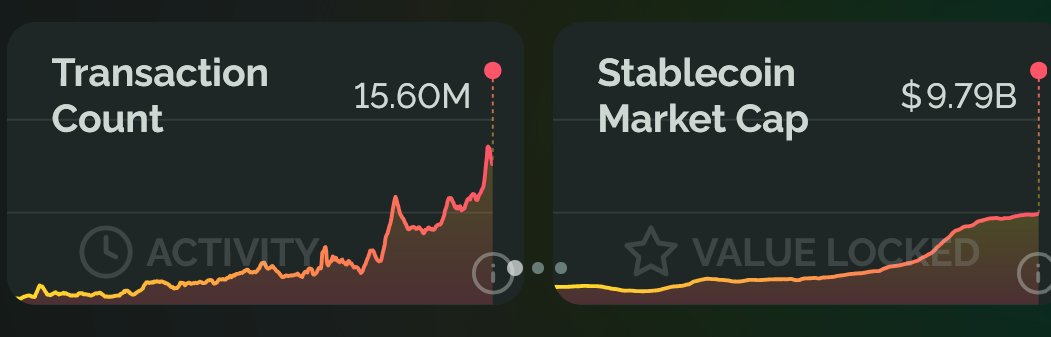

As well as, the analyst marked the sturdy fundamentals of the ETH ecosystem, citing report excessive stablecoin and transaction numbers.

“Variety of transactions: ALL-TIME HIGH at 15.60 million. Stablecoin market cap: ALL-TIME HIGH at $9.79 billion. The foundations are stronger than ever!”

Supply: Growthepie

This can be a signal of sturdy community development for ETH, which underneath regular circumstances may very well be a constructive catalyst for a rebound.

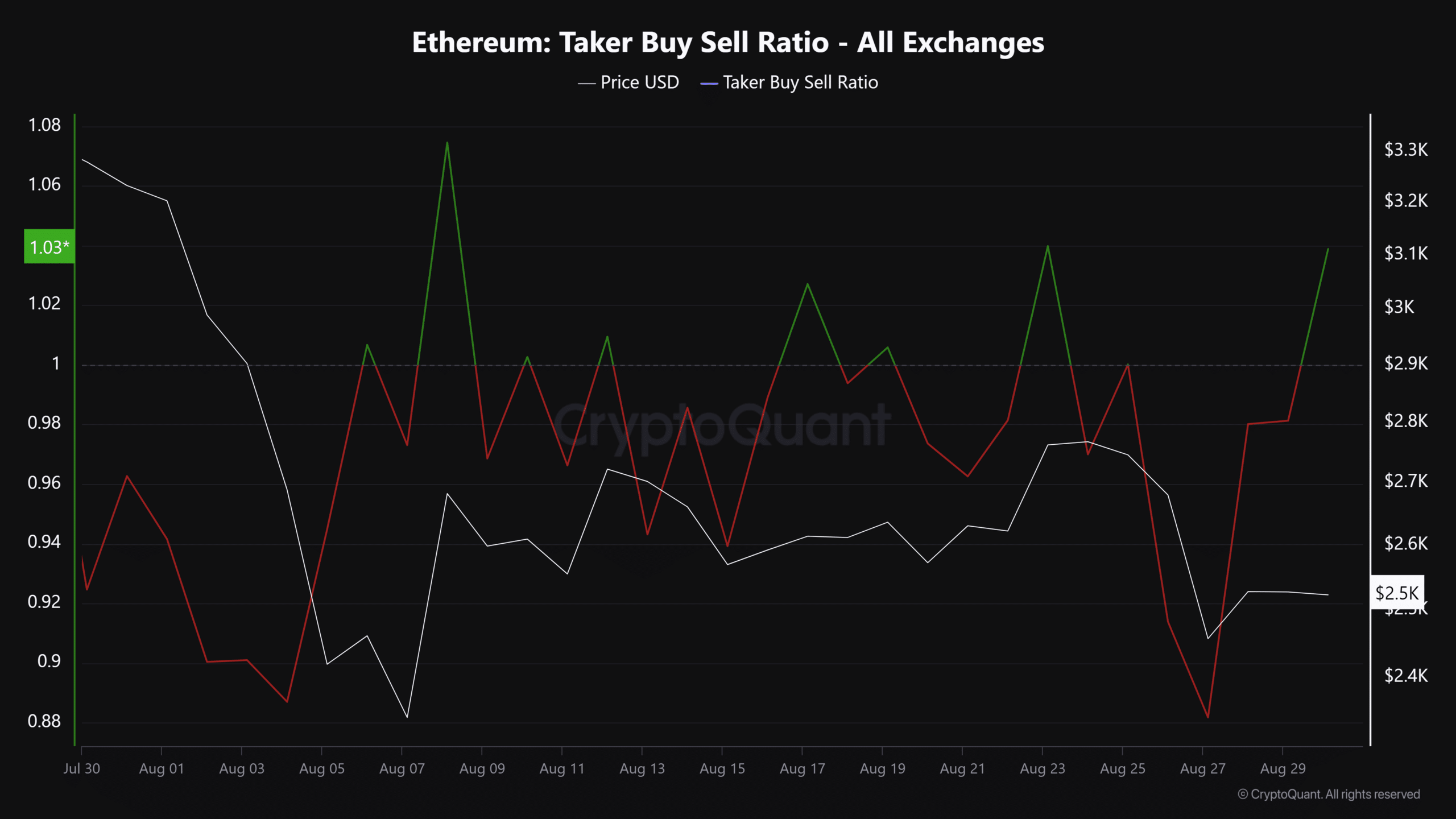

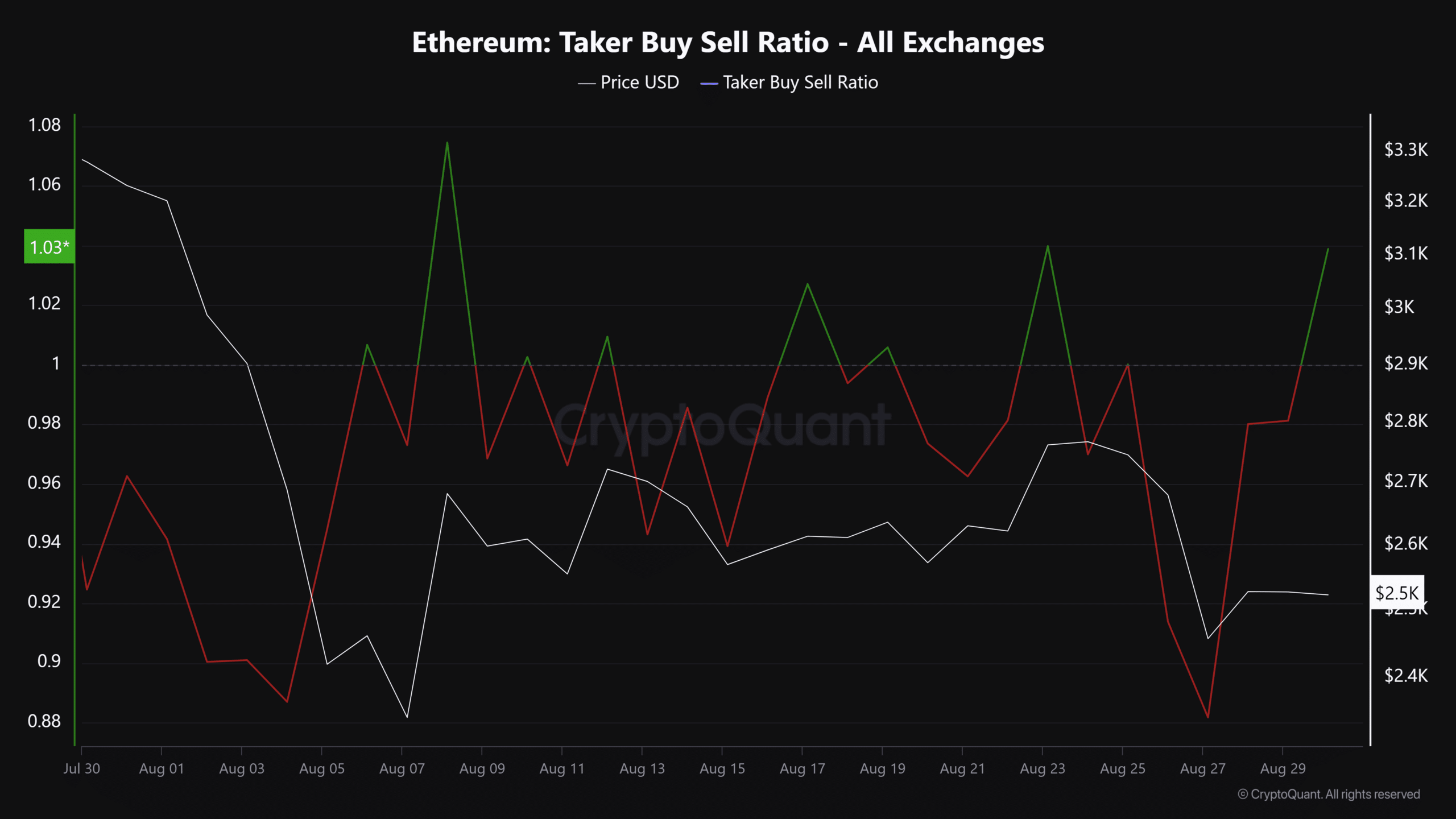

Nevertheless, the altcoin was tormented by adverse market sentiment for many of August, as mirrored in its Taker Purchaser Promote ratio. This metric tracks the shopping for versus promoting quantity of the altcoin within the derivatives market.

The overwhelmingly adverse numbers in August indicated that sellers have been dominating the market. The adverse sentiment on this entrance could partially clarify the altcoin’s muted value motion on the charts.

Supply: CryptoQuant

So was among the adverse sentiment driven because of perceived low charges and inflation points within the ecosystem. Particularly for the reason that introduction of blobs, which made chain transaction prices cheaper.

In accordance with Ethereum neighborhood member Ryan Berckmans statement, Revenues for the chain will enhance as blob utilization will increase.

“The long run seems to be extraordinarily vibrant for Ethereum L1 revenues.”

He is not alone both, with one other analyst echo the outlook and expects ETH to succeed in $10,000 simply from utilizing the blob area.

On the time of writing, ETH was buying and selling at $2.5k, down virtually 5% on the weekly charts from a current excessive of $2.8k final weekend.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024