Bitcoin

Bitcoin’s September predictions – Will 2024 be any different?

Credit : ambcrypto.com

- Bitcoin is displaying indicators of weakening demand as September, a month typically related to falling costs, approaches

- Potential US rate of interest cuts and different bullish catalysts may gasoline volatility

August was a unstable month Bitcoins (BTC) value. BTC began buying and selling on August 1 at round $63,000, and only a week later the crypto’s value dropped to round $49,000. Whereas the value later recovered to $65,000 on the finish of August, it has since fallen to $59,190 on the time of writing.

Regardless of Bitcoin falling practically 8% over the previous month, merchants count on additional declines in September because the coin follows earlier value motion. Even based on fashionable analysts Ali Martinez,

“In the event you suppose August was robust for Bitcoin, take into account that September typically produces damaging returns as nicely.”

For instance, in September 2023, the value of crypto fluctuated between $24,000 and $27,000, with out making vital beneficial properties. There was additionally a pointy value drop of 17% in September 2021.

Will historical past repeat itself or will Bitcoin break this sample?

A take a look at the important thing statistics

A number of key figures already present bears taking management and positioning themselves for a doable September decline.

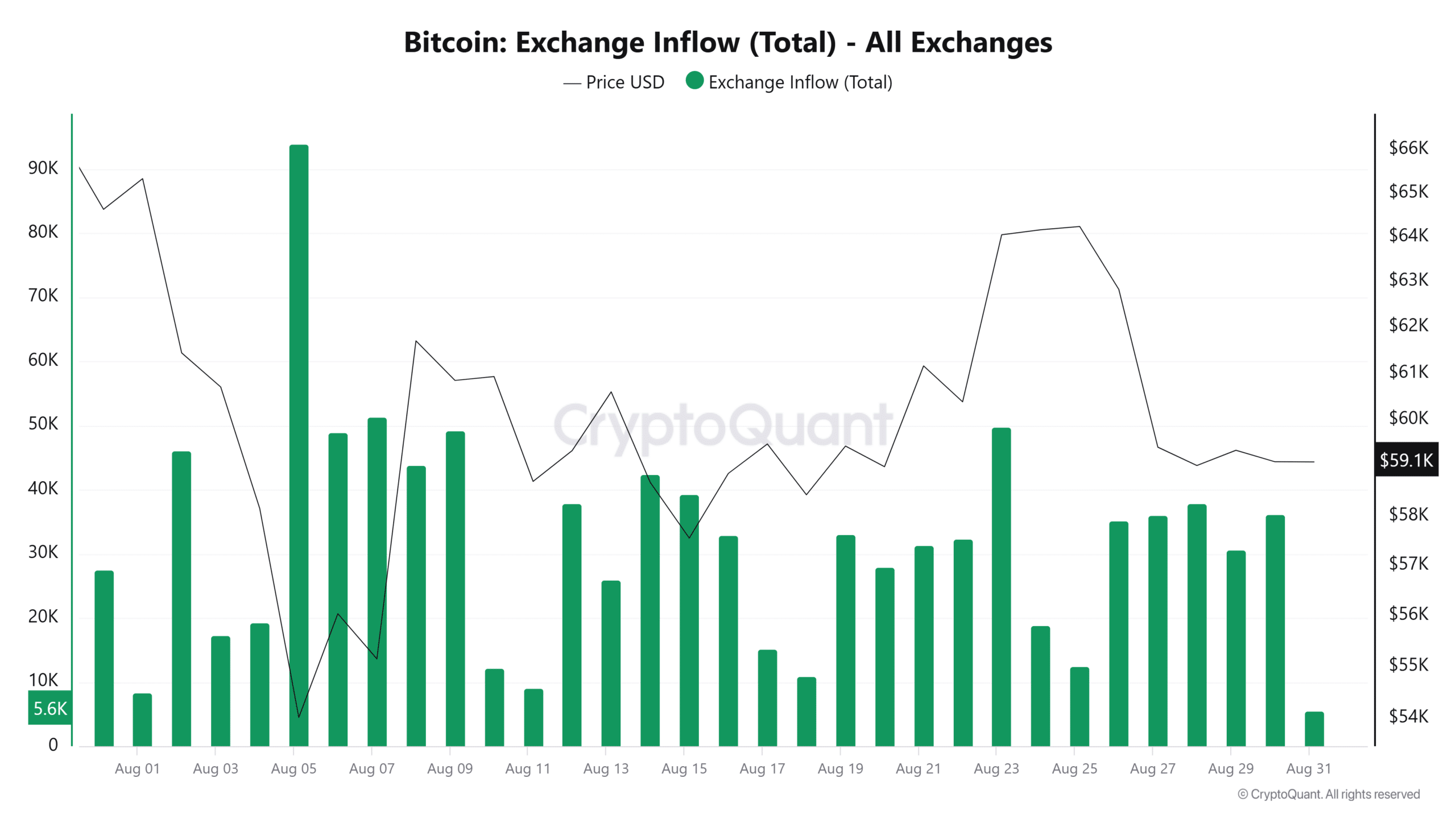

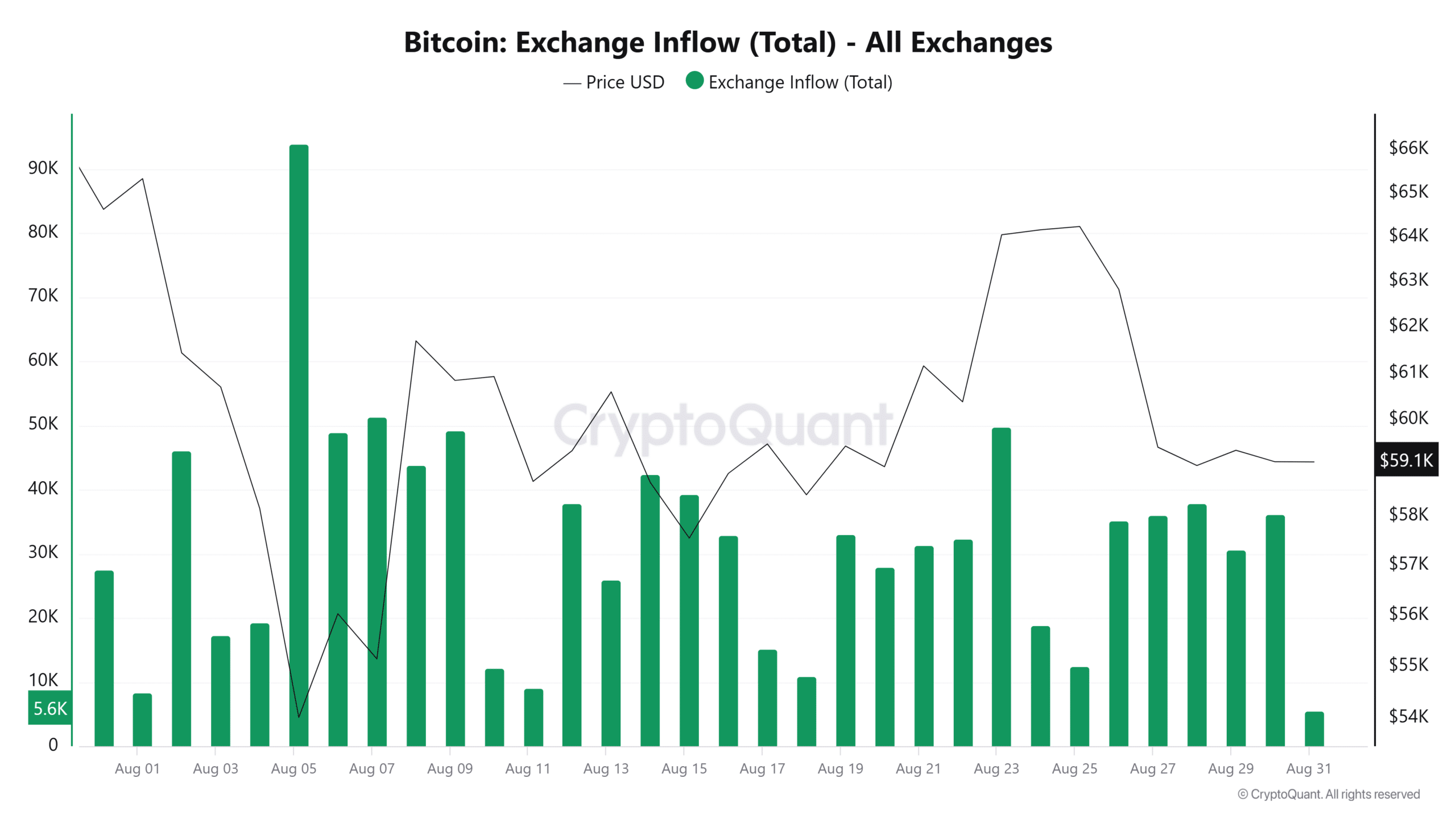

For instance, information from CryptoQuant reveals that foreign money inflows have elevated considerably since late August. The influx got here shortly after the value of BTC rose above $64,000.

(Supply: CryptoQuant)

This indicator may imply that after the latest restoration in costs, a big variety of merchants have chosen to promote and decrease dangers in case of additional declines forward.

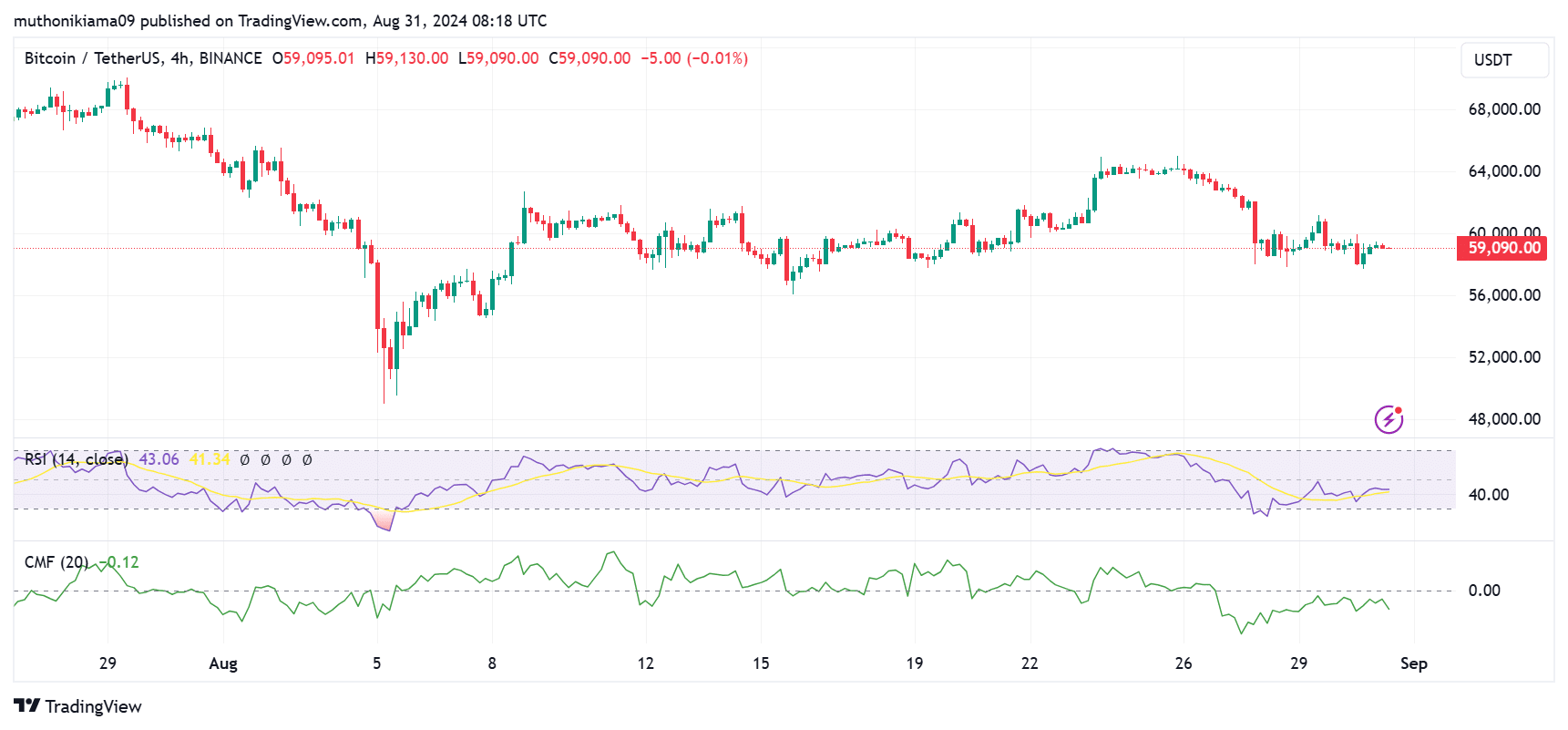

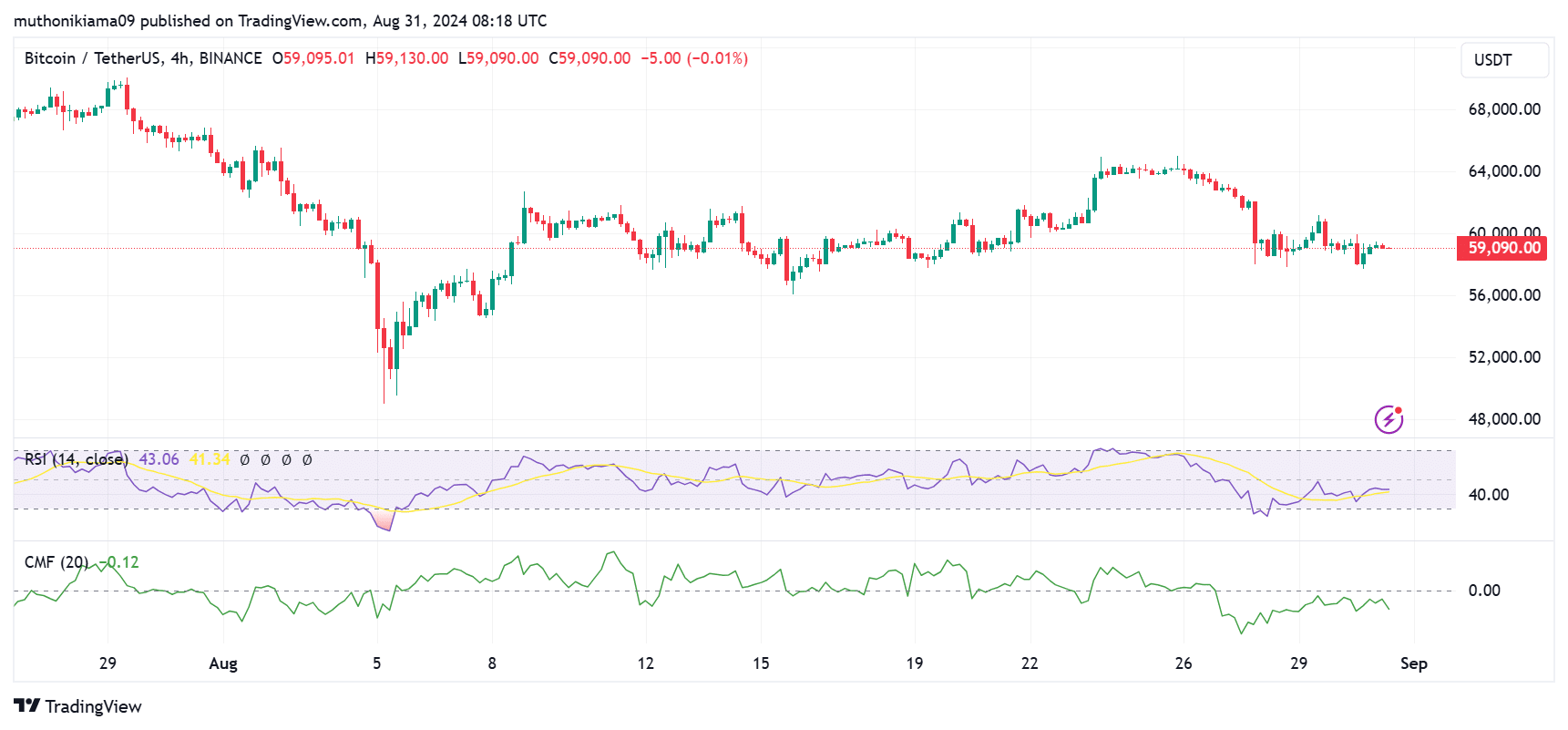

Consumers are additionally displaying hesitation to get again into the market. A number of key indicators, the Relative Power Index (RSI) and the Chaikin Cash Circulation (CMF), confirmed declining purchaser curiosity on the time of writing.

The RSI at 43 prompt that sellers are nonetheless in management, and patrons are unwilling to enter at prevailing costs. The CMF has additionally been hovering within the damaging area since August 26 – an indication of bearish dominance.

(Supply: Handelsview)

On August 30, the US introduced that the primary PCE value index for July was 2.6% annualized. This was decrease than the anticipated 2.70%.

Such constructive macro elements normally result in a rise within the value of Bitcoin. Nonetheless, that did not work yesterday.

Based on QCPWith the latest macro information barely having any impact on crypto costs, BTC will proceed to commerce inside a $58k-$65k vary within the close to time period.

Furthermore, inflows into Bitcoin Trade Traded Funds (ETFs) have weakened. For instance, over the previous 4 consecutive days, BTC has seen constant outflows SoSoValue information.

Will September 2024 be completely different?

Declining demand for Bitcoin seems to be making merchants hesitant to enter the market if September seems to be one other gloomy month.

Nonetheless, a number of bullish elements may gasoline a rally in September. The constructive information on the US financial system has fueled hypothesis that the US will lower rates of interest on the subsequent assembly of the Federal Open Market Committee (FOMC).

Information from the CME FedWatch tool confirmed {that a} majority of traders count on the Fed to chorus from tightening financial coverage for the primary time since March 2020. If that occurs, it should gasoline a rally in dangerous belongings like Bitcoin.

One other bullish catalyst is the discharge of former Binance CEO Changpeng Zhao from jail. Its launch date is ready for September 29, and a few already anticipate it may set off a bull run.

Lastly, former US President Donald Trump will debate US Vice President Kamala Harris in September. If cryptocurrency is concerned, this will enhance volatility.

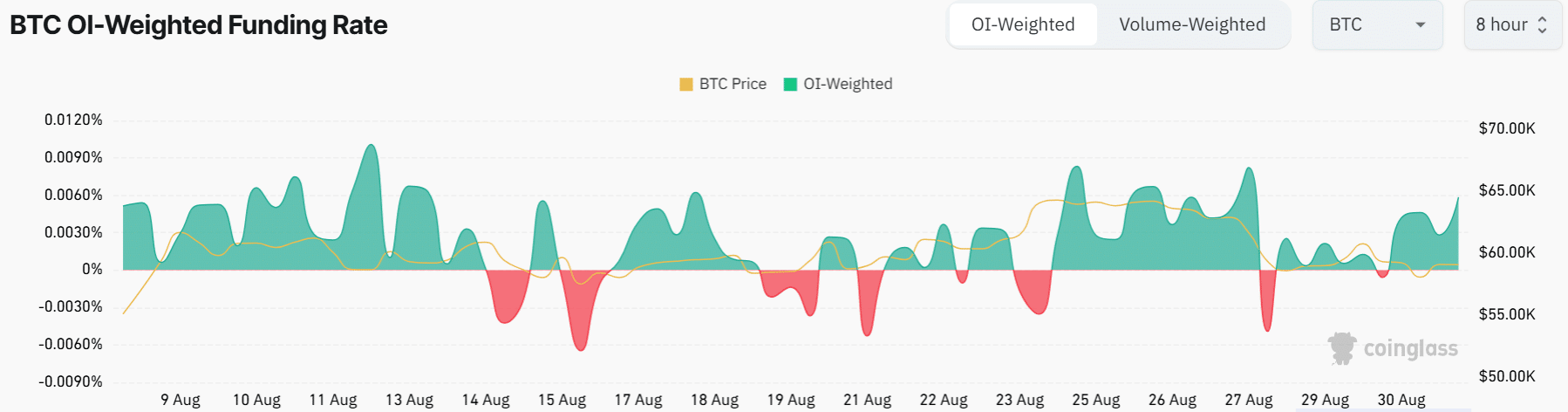

Bitcoin funding charges have additionally turned constructive and elevated considerably in latest days. This means a rise within the variety of lengthy positions – a bullish sign as merchants anticipate future income.

(Supply: Mint Glass)

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024