Bitcoin

Why Not Strategic Beef Reserve?

Credit : bitcoinmagazine.com

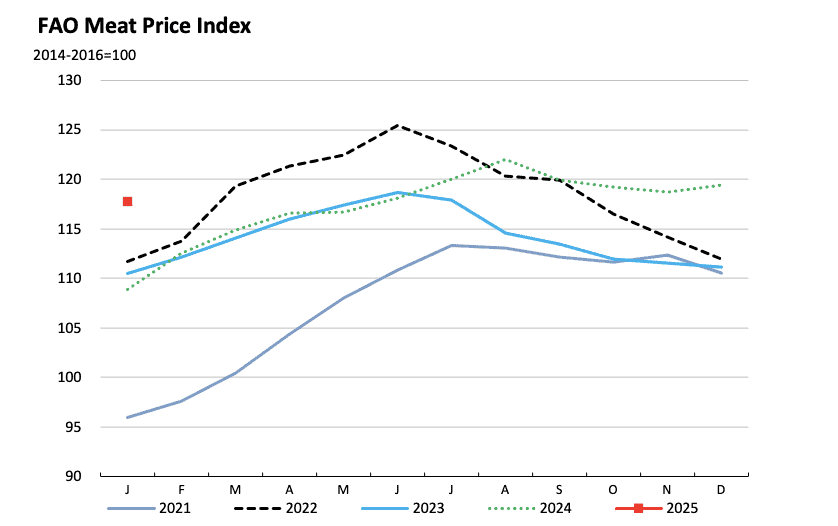

South Africa Reserve Financial institution (SARB) Governor query, “Why not strategic beef reserve?” On the World Financial Discussion board 2025 in Davos, maybe rhetorical, however the apparently sarcastic remark from Lesetja Kganyago about ‘strategic Bitcoin reserves’ unintentionally underlined the necessity for Africa to rethink its financial methods within the mild of worldwide monetary shifts. In a world that’s more and more outlined by digital transformation, the idea of cash and worth storage rapidly evolves. Africa isn’t any stranger to economies -based economies. From oil to gold, beef to cocoa, the continent has lengthy been conversant in pure sources for financial meals. Nevertheless, these uncooked supplies are loaded with challenges. Worldwide uncooked materials costs are very delicate to market fluctuations, geopolitical tensions and local weather change. For instance, the value of beef can swing dramatically on account of outbreaks of illnesses or business restrictions, precisely as the worth of Fiat’s currencies waves and stays unpredictable when it’s traded towards digital belongings akin to Bitcoin on account of regional monetary coverage and devaluation of forex. In line with the Food and Agricultural Organization (FAO)” The costs of beef have skilled the volatility of a most of 30% on an annual foundation on account of elements akin to foot and claw illness and export bans.

Picture supply: FAO

Though Brian Armstrong, CEO of Coinbase, answered Kganyago’s query with a compulsory argument: Bitcoin just isn’t solely a greater type of cash than gold, it’s also extra moveable, divisible and utilities. Up to now decade, Bitcoin has carried out higher than any massive asset class, which confirms its place as a superior worth of worth. For Africa, a continent has usually been marginalized within the world monetary system, a strategic bitcoin reserve may very well be the important thing to unlock financial independence, promote innovation and defend long-term prosperity. How?

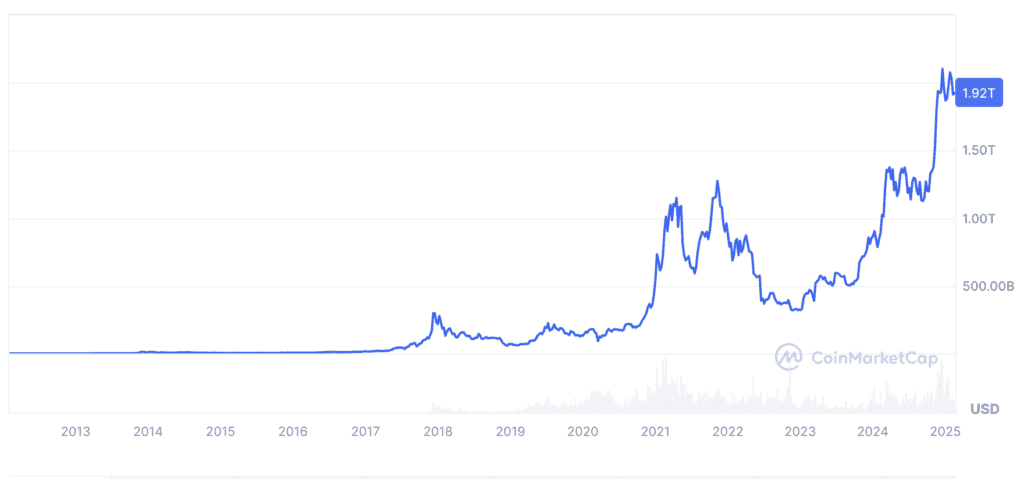

It’s time to be truly and lifelike in our comparability. Bitcoin exists digitally and doesn’t require bodily storage, uncooked supplies akin to beef and sheep meat are perishable and costly to keep up. The World Financial institution estimates that losses are $ 48 billion yearly after the harvest for agricultural merchandise in Africa, which emphasizes the inefficiencies of reserves -based reserves. Though uncooked supplies have intrinsic worth, their usefulness is proscribed to particular industries. Bitcoin, then again, is a worldwide, limitless belongings with purposes in finance, know-how after which, whereas the distinctive properties make it a super candidate for a strategic reserve resistant. With a lined inventory of 21 million cash, Bitcoin is inherently deflationary, in distinction to Fiat -currencies that may be printed indefinitely or beef with limitless reproductive mechanisms. According to Coinmarketcap, the market capitalization of Bitcoin has grown from less than 1 billion in 2013 to more than 1 trillion in 2025, Offering the fast acceptance and worth valuation.

Picture supply: Mint market cap

Why Bitcoin about beef?

Bitcoin may be transferred throughout borders inside a couple of minutes and are divided into smaller models (Satoshis), making it extra sensible than gold or beef. Up to now decade, Bitcoin has delivered a mean annual return of greater than 200%, which performs higher than gold, shares and actual property. A research by Fidelity Investments showed that the risk-corrected return of Bitcoin is superior to traditional assets, Making it a horny possibility for lengthy -term retention. Worldwide nations are beginning to acknowledge the potential of Bitcoin as a reserve stroll. El Salvador wrote Historical past in 2021 by hiring Bitcoin as authorized tender, whereas nations akin to Switzerland and Singapore Bitcoin have built-in into their monetary programs. That is 2025 and the “Strategic Bitcoin Reserve” legislation of the US is already within the pipeline. In line with a report of 2023 by Chainalysis, Africa is among the quickest rising cryptocurrency markets, through which Nigeria, Kenya and South Africa lead in adoption.

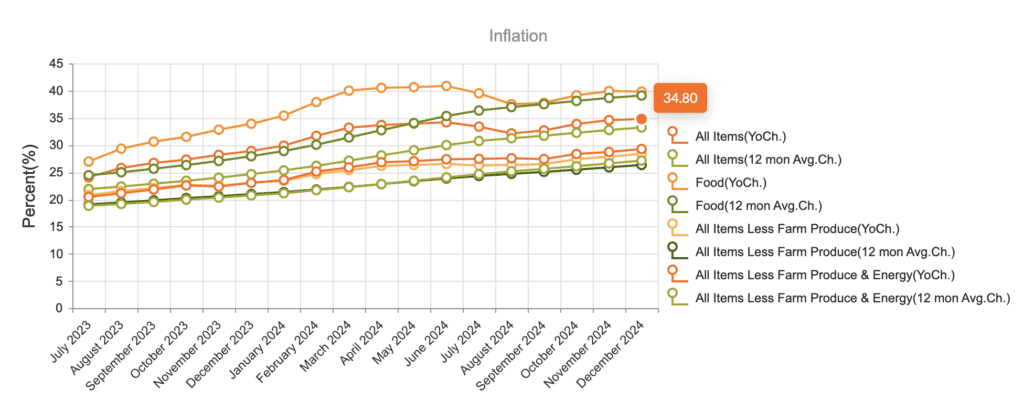

The deflatory nature of Bitcoin makes it an efficient cowl towards inflation, which has plagued many African economies. For example, Nigeria’s inflation percentage reached 34.80% in 2024, Hollen the worth of the Naira. A Bitcoin reserve may defend the nationwide wealth towards such devaluation. By allocating Bitcoin just one% of its reserves, Africa can unlock billions of worth. For instance, if the mixed overseas reserves of the continent of 500 billion 5 billion in Bitcoin embody, a 10x appreciation within the worth of Bitcoin $ 50 billion within the return would yield. In distinction to the manufacturing of beef, which contributes to deforestation and emissions of greenhouse gases, Bitcoin -mining may be pushed by renewable vitality. In line with the Cambridge Bitcoin Electrical energy Consumption Index, 58.5% of the worldwide Bitcoin -mining is powered by renewable vitality from 2021. The big photo voltaic and hydro -electric potential of Africa makes it a super location for sustainable Bitcoin -my -building actions. Saving and managing Bitcoin reserves is rather more cost-effective than sustaining uncooked materials reserves. There are not any storage prices, no threat of spoilage and no want for advanced logistics.

Picture supply: Central bank of Nigeria.

The approval of El Salvador from Bitcoin as a authorized tender gives priceless insights for Africa. Regardless of the primary skepticism, Bitcoin has stimulated tourism and overseas investments in El Salvador. In line with the Central Reserve Financial institution of El Salvador, vacationer earnings rose by 30% within the first 12 months after Bitcoin’s adoption. Greater than 70% of Salvadorans didn’t have entry to financial institution providers earlier than. Bitcoin has enabled tens of millions to take part on this planet financial system. By lowering the dependence on the US greenback, El Salvador has taken a daring step within the route of economic independence. Many African nations are extremely depending on the US greenback for commerce and reserves, making them susceptible to exterior financial coverage. Bitcoin gives a decentralized different, lowering dependence on conventional monetary programs.

By establishing a strategic Bitcoin reserve, Africa can safe its financial future, defend its wealth towards inflation and place itself as a world chief within the digital financial system. The time has come when Africa goes past outdated financial fashions and embraces the way forward for cash. As Brian Armstrong declared acceptable, Bitcoin just isn’t solely a greater type of cash; It’s the foundation of a brand new monetary paradigm. For Africa the selection is evident: Bitcoin, no beef, is the trail to prosperity. Bitcoin represents a reworking activa class that provides unparalleled advantages in comparison with conventional uncooked supplies akin to beef or sheep meat.

This can be a visitor put up from Heritage Falodun. The expression of opinions are utterly their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024